DIpil Das

[caption id="attachment_88820" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

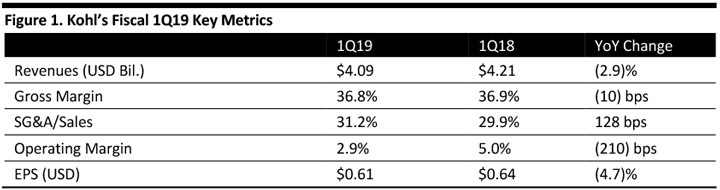

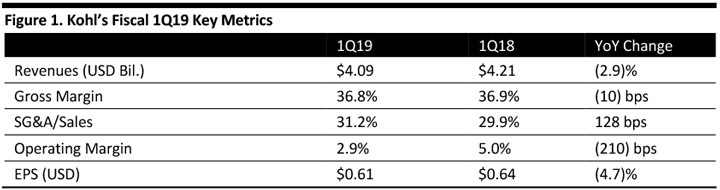

Kohl’s reported fiscal 1Q19 revenues of $4.09 billion, beating the consensus estimate of $3.95 billion, and down 2.9% year over year. The company reported 1Q19 EPS of $0.61, lower than the consensus estimate of $0.68, and down 4.7% from the year ago period.

Comparable sales decreased 3.4% for the quarter compared to the consensus estimate of (0.1)%. The company attributed the 3.4% comparable sales decline to unfavorable weather, soft home category sales and less productive key promotional events.

Children's, men's and women's segments outperformed the company overall, while home and footwear performed below the company average. Management said the “active” category is a growth driver for the company and achieved positive growth from Nike, Under Armour and Adidas – with Adidas sales growing in particular. Management said that its active category offers growth opportunity, and in 2019, the company will allocate additional space to the category in 160 of its highest performing active stores.

In children’s, the brands that performed well included Jumping Beans and Carter's. The company’s toys business was driven by LEGO. Kohl’s men's segment outperformed the company overall, led national brands including IZOD, Lee and Columbia. The women's category saw strength in active and brands including Apartment 9 and Levi's.

Geographically, the Midwest and mid-Atlantic regions were the strongest, followed by the northeast. Management attributed strength in the Midwest to competitor store closures.

Digital sales grew in high single digits, following a mid-teens percentage increase in the prior year. Mobile represented the majority of digital traffic growth at over 75% of traffic and more than half of digital sales. Management said the company saw higher adoption of both buy online, pickup in store (BOPIS) and buy online and ship to store (BOSS) in the quarter.

The company reported it expects softness to continue into Q2, followed by a return to growth in the second half of the year. The company will roll out an Amazon returns program nationwide in July 2019, under which all Kohl’s stores will accept Amazon returns. The program has been tested for the past 18 months in Chicago and Los Angeles and more recently in southeast Wisconsin. Management reported the program created a convenient and easy experience for both Kohl's and Amazon customers. Management said the tests showed the program drives engagement with existing customers and attracts new and younger customers.

Management also announced brand launches and program expansions. One is the launch of EVRI, a new private-label plus-size brand. Management said the plus-size women's category represents a significant long-term opportunity for Kohl's and added that Kohl’s also expanded its plus-size offerings with Nike in the spring. The company announced that for the winter holiday season, it will be introducing a capsule collection designed by fashion designer Jason Wu.

The company ended the quarter with 1,155 Kohl's stores. Kohl’s closed four stores in the quarter and plans on opening four smaller-format stores later in the year.

Outlook

For fiscal FY19, the company lowered guidance for earnings per diluted share from $5.80-6.15 to $5.15-5.45, compared to the consensus estimate of $6.03.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Kohl’s reported fiscal 1Q19 revenues of $4.09 billion, beating the consensus estimate of $3.95 billion, and down 2.9% year over year. The company reported 1Q19 EPS of $0.61, lower than the consensus estimate of $0.68, and down 4.7% from the year ago period.

Comparable sales decreased 3.4% for the quarter compared to the consensus estimate of (0.1)%. The company attributed the 3.4% comparable sales decline to unfavorable weather, soft home category sales and less productive key promotional events.

Children's, men's and women's segments outperformed the company overall, while home and footwear performed below the company average. Management said the “active” category is a growth driver for the company and achieved positive growth from Nike, Under Armour and Adidas – with Adidas sales growing in particular. Management said that its active category offers growth opportunity, and in 2019, the company will allocate additional space to the category in 160 of its highest performing active stores.

In children’s, the brands that performed well included Jumping Beans and Carter's. The company’s toys business was driven by LEGO. Kohl’s men's segment outperformed the company overall, led national brands including IZOD, Lee and Columbia. The women's category saw strength in active and brands including Apartment 9 and Levi's.

Geographically, the Midwest and mid-Atlantic regions were the strongest, followed by the northeast. Management attributed strength in the Midwest to competitor store closures.

Digital sales grew in high single digits, following a mid-teens percentage increase in the prior year. Mobile represented the majority of digital traffic growth at over 75% of traffic and more than half of digital sales. Management said the company saw higher adoption of both buy online, pickup in store (BOPIS) and buy online and ship to store (BOSS) in the quarter.

The company reported it expects softness to continue into Q2, followed by a return to growth in the second half of the year. The company will roll out an Amazon returns program nationwide in July 2019, under which all Kohl’s stores will accept Amazon returns. The program has been tested for the past 18 months in Chicago and Los Angeles and more recently in southeast Wisconsin. Management reported the program created a convenient and easy experience for both Kohl's and Amazon customers. Management said the tests showed the program drives engagement with existing customers and attracts new and younger customers.

Management also announced brand launches and program expansions. One is the launch of EVRI, a new private-label plus-size brand. Management said the plus-size women's category represents a significant long-term opportunity for Kohl's and added that Kohl’s also expanded its plus-size offerings with Nike in the spring. The company announced that for the winter holiday season, it will be introducing a capsule collection designed by fashion designer Jason Wu.

The company ended the quarter with 1,155 Kohl's stores. Kohl’s closed four stores in the quarter and plans on opening four smaller-format stores later in the year.

Outlook

For fiscal FY19, the company lowered guidance for earnings per diluted share from $5.80-6.15 to $5.15-5.45, compared to the consensus estimate of $6.03.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Kohl’s reported fiscal 1Q19 revenues of $4.09 billion, beating the consensus estimate of $3.95 billion, and down 2.9% year over year. The company reported 1Q19 EPS of $0.61, lower than the consensus estimate of $0.68, and down 4.7% from the year ago period.

Comparable sales decreased 3.4% for the quarter compared to the consensus estimate of (0.1)%. The company attributed the 3.4% comparable sales decline to unfavorable weather, soft home category sales and less productive key promotional events.

Children's, men's and women's segments outperformed the company overall, while home and footwear performed below the company average. Management said the “active” category is a growth driver for the company and achieved positive growth from Nike, Under Armour and Adidas – with Adidas sales growing in particular. Management said that its active category offers growth opportunity, and in 2019, the company will allocate additional space to the category in 160 of its highest performing active stores.

In children’s, the brands that performed well included Jumping Beans and Carter's. The company’s toys business was driven by LEGO. Kohl’s men's segment outperformed the company overall, led national brands including IZOD, Lee and Columbia. The women's category saw strength in active and brands including Apartment 9 and Levi's.

Geographically, the Midwest and mid-Atlantic regions were the strongest, followed by the northeast. Management attributed strength in the Midwest to competitor store closures.

Digital sales grew in high single digits, following a mid-teens percentage increase in the prior year. Mobile represented the majority of digital traffic growth at over 75% of traffic and more than half of digital sales. Management said the company saw higher adoption of both buy online, pickup in store (BOPIS) and buy online and ship to store (BOSS) in the quarter.

The company reported it expects softness to continue into Q2, followed by a return to growth in the second half of the year. The company will roll out an Amazon returns program nationwide in July 2019, under which all Kohl’s stores will accept Amazon returns. The program has been tested for the past 18 months in Chicago and Los Angeles and more recently in southeast Wisconsin. Management reported the program created a convenient and easy experience for both Kohl's and Amazon customers. Management said the tests showed the program drives engagement with existing customers and attracts new and younger customers.

Management also announced brand launches and program expansions. One is the launch of EVRI, a new private-label plus-size brand. Management said the plus-size women's category represents a significant long-term opportunity for Kohl's and added that Kohl’s also expanded its plus-size offerings with Nike in the spring. The company announced that for the winter holiday season, it will be introducing a capsule collection designed by fashion designer Jason Wu.

The company ended the quarter with 1,155 Kohl's stores. Kohl’s closed four stores in the quarter and plans on opening four smaller-format stores later in the year.

Outlook

For fiscal FY19, the company lowered guidance for earnings per diluted share from $5.80-6.15 to $5.15-5.45, compared to the consensus estimate of $6.03.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Kohl’s reported fiscal 1Q19 revenues of $4.09 billion, beating the consensus estimate of $3.95 billion, and down 2.9% year over year. The company reported 1Q19 EPS of $0.61, lower than the consensus estimate of $0.68, and down 4.7% from the year ago period.

Comparable sales decreased 3.4% for the quarter compared to the consensus estimate of (0.1)%. The company attributed the 3.4% comparable sales decline to unfavorable weather, soft home category sales and less productive key promotional events.

Children's, men's and women's segments outperformed the company overall, while home and footwear performed below the company average. Management said the “active” category is a growth driver for the company and achieved positive growth from Nike, Under Armour and Adidas – with Adidas sales growing in particular. Management said that its active category offers growth opportunity, and in 2019, the company will allocate additional space to the category in 160 of its highest performing active stores.

In children’s, the brands that performed well included Jumping Beans and Carter's. The company’s toys business was driven by LEGO. Kohl’s men's segment outperformed the company overall, led national brands including IZOD, Lee and Columbia. The women's category saw strength in active and brands including Apartment 9 and Levi's.

Geographically, the Midwest and mid-Atlantic regions were the strongest, followed by the northeast. Management attributed strength in the Midwest to competitor store closures.

Digital sales grew in high single digits, following a mid-teens percentage increase in the prior year. Mobile represented the majority of digital traffic growth at over 75% of traffic and more than half of digital sales. Management said the company saw higher adoption of both buy online, pickup in store (BOPIS) and buy online and ship to store (BOSS) in the quarter.

The company reported it expects softness to continue into Q2, followed by a return to growth in the second half of the year. The company will roll out an Amazon returns program nationwide in July 2019, under which all Kohl’s stores will accept Amazon returns. The program has been tested for the past 18 months in Chicago and Los Angeles and more recently in southeast Wisconsin. Management reported the program created a convenient and easy experience for both Kohl's and Amazon customers. Management said the tests showed the program drives engagement with existing customers and attracts new and younger customers.

Management also announced brand launches and program expansions. One is the launch of EVRI, a new private-label plus-size brand. Management said the plus-size women's category represents a significant long-term opportunity for Kohl's and added that Kohl’s also expanded its plus-size offerings with Nike in the spring. The company announced that for the winter holiday season, it will be introducing a capsule collection designed by fashion designer Jason Wu.

The company ended the quarter with 1,155 Kohl's stores. Kohl’s closed four stores in the quarter and plans on opening four smaller-format stores later in the year.

Outlook

For fiscal FY19, the company lowered guidance for earnings per diluted share from $5.80-6.15 to $5.15-5.45, compared to the consensus estimate of $6.03.