Source: Company reports/Coresight Research

4Q17 Results

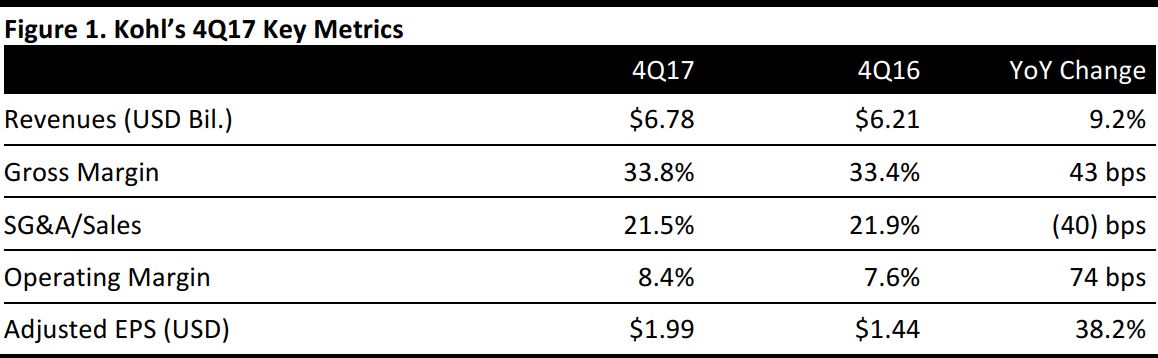

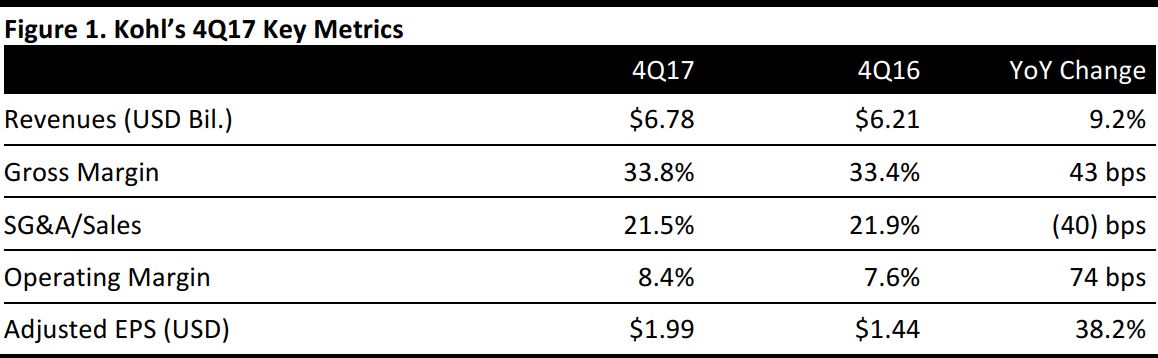

Kohl’s reported 4Q17 revenues of $6.78 billion, up 9.2% year over year and above the $6.74 billion consensus estimate. Adjusted EPS was $1.99, beating the $1.77 consensus estimate and up from $1.44 in the year-ago quarter.

Comp sales were up 6.3% from the year-ago quarter, below the 6.5% consensus estimate and compared with the prior-year quarter’s 2.2% decline. Comps were driven by a 6.9% increase from the combined November and December holiday period. Comps benefited from higher average transaction value (both in stores and online), driven by an increase in average unit retail.

Management noted that traffic was positive both in-store and online and that it was, in both cases, “well above” the prior year-to-date trends.

Online sales grew by 26%, and Kohl’s stores fulfilled 36% of total online order units. Demand for buy-online, pick-up-in-store and ship-from-store services contributed to the positive result.

The company’s gross margin increased by 43 basis points during the quarter. The positive impact of fewer clearance markdown levels and strong inventory management was more than offset by higher shipping costs.

Results by Category

Footwear reported a double-digit comp increase for the quarter. Home and men’s both outperformed, with comps up by high single digits. Positive comps in footwear and apparel were driven by growth in the active category, specifically by brands such as Nike, Adidas and Under Armour.

National brand sales rose by 11% year over year, with national brand penetration reaching 62% of total sales (compared with 57% in 3Q17). National brands such as LC Lauren Conrad and Simply Vera Vera Wang drove strong results.

FY17 Results

Kohl’s reported full-year revenues of $19.10 billion, up 2.2% year over year. Adjusted EPS was $4.19, versus $3.76 in the previous year.

Outlook

Management provided the following guidance:

- FY18 adjusted EPS of $95–$5.45, versus the consensus estimate of $4.72.

- FY18 revenue growth of (1)%–1%, implying revenues of $18.90–$19.29 billion, compared with the consensus of $19.07 billion, or 0.1% growth.

The company expects capital expenditures of roughly $700 million in 2018, of which approximately $350 million will be for IT spending and the remainder split between store strategy and fulfillment centers. Other key areas of investment for Kohl’s include its mobile app, the Kohl’s Cash rewards program and its private-label apparel lines, including Sonoma and Tek Gear.

In October, Kohl’s expanded its partnership with Amazon, announcing that Kohl’s will sell devices such as the Amazon Echo and Fire tablets at 10 of its stores. Kohl’s also said that it will accept Amazon returns in 82 of its stores.