Source: Company reports/Fung Global Retail & Technology

4Q16 Results

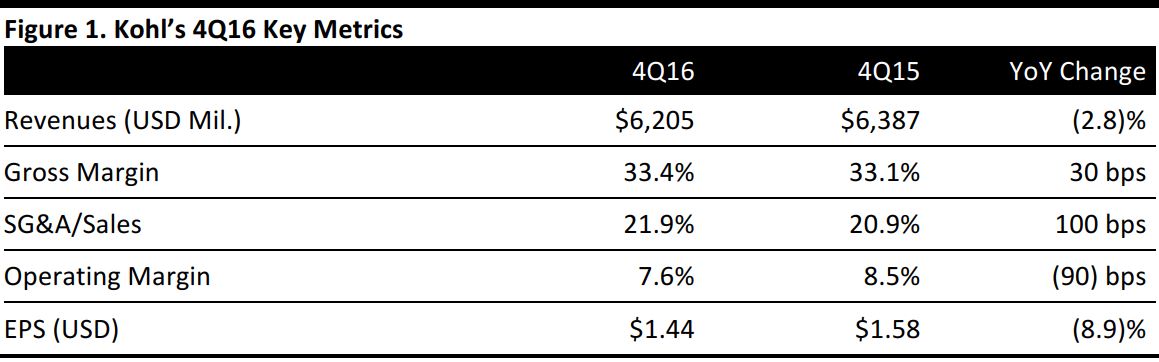

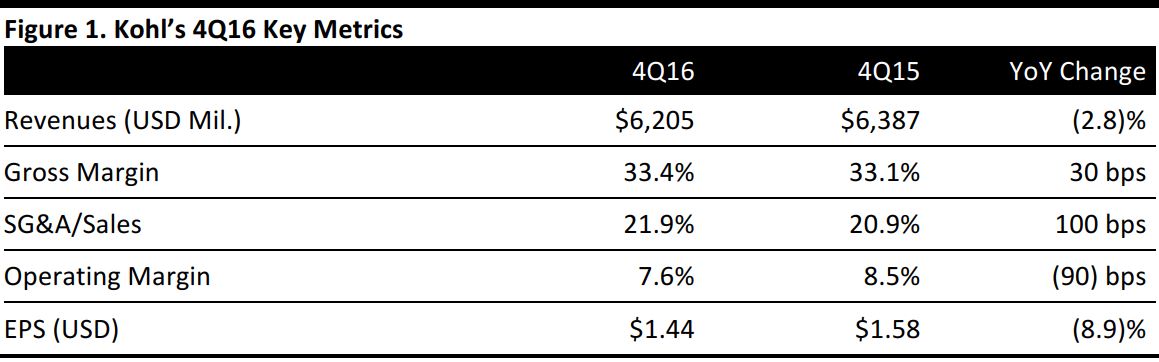

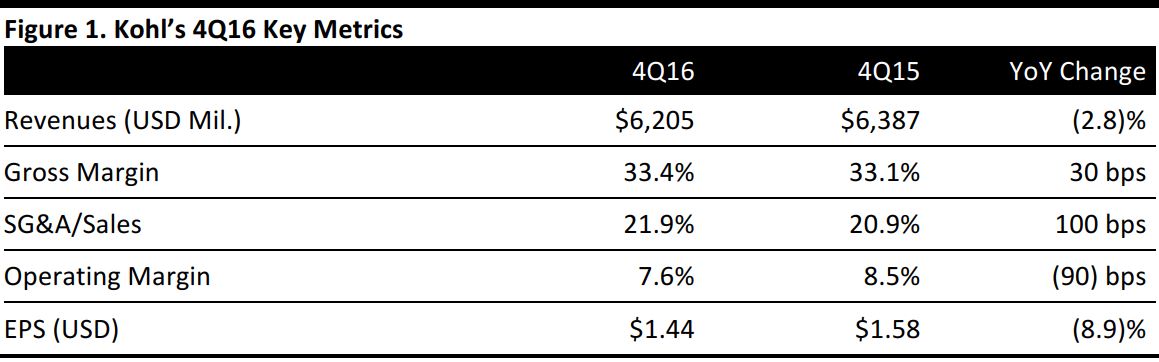

Kohl’s reported 4Q16 revenues of $6.2 billion, down 2.8% from $6.4 billion in the year-ago quarter and in line with the consensus estimate. Reported EPS was $1.44, beating the consensus estimate of $1.33 and down 9% from $1.58 in the year-ago quarter.

Total comps for the quarter were down 2.2%, missing the consensus estimate of a 2.1% decline. Holiday comps declined by 2.1%. Average transaction value increased by 3.8% and average unit retail increased by 3.7%. Transactions per store declined by 6% for the quarter.

Gross margin was 33.4% for the quarter, beating the consensus estimate of 32.8% and showing improvement versus the year-ago quarter’s 33.1%. Gross margin has improved as the company has recovered from significant markdowns. Merchandise inventory for the quarter was $3.8 billion, down 6% year over year. Inventory declined at a faster rate than sales did; sales declined by 2.8% in the quarter. Inventory per store declined by 5% as a result of the company’s effort to decrease inventory.

Management was disappointed with the quarter’s weak sales, which were driven by in-store traffic declines that were partially offset by strong online sales. The company has been focusing on becoming the top destination for active and wellness lifestyles. Management highlighted its upcoming March partnership with Under Armour. The company also said it is focusing on speed to market for its private label brands in apparel and home categories.

On a regional basis, the Southeast was the strongest performer for the company during the quarter, while the South Central region was the most challenging.

FY16 Results

For the full year, adjusted EPS was $3.76, compared with $4.01 for the previous year. Net sales were $18.7 billion, down 4% from the previous year’s $19.2 billion. Total comps for the year declined by 2.4%. Transactions per store declined by 5% for the year.

E-commerce continued to be a growth driver. Online sales were up by a low-teens percentage for both the quarter and full year, and 30% of online sales came from mobile devices. Mobile traffic accounted for 50% of total online traffic for the company.

FY17 Outlook

The company expects FY17 adjusted EPS of $3.50–$3.80, versus consensus of $3.73. The guidance is based on an expected total sales decline of 0.7%–1.3%. Total comps are expected to be (2)%–flat for the period. Capital expenditure of $700 million is planned for the year.

Management is pleased with its inventory reduction initiatives and plans to lower inventory per store by about 3% in each of the next three years.