Source: Company reports

4Q15 RESULTS

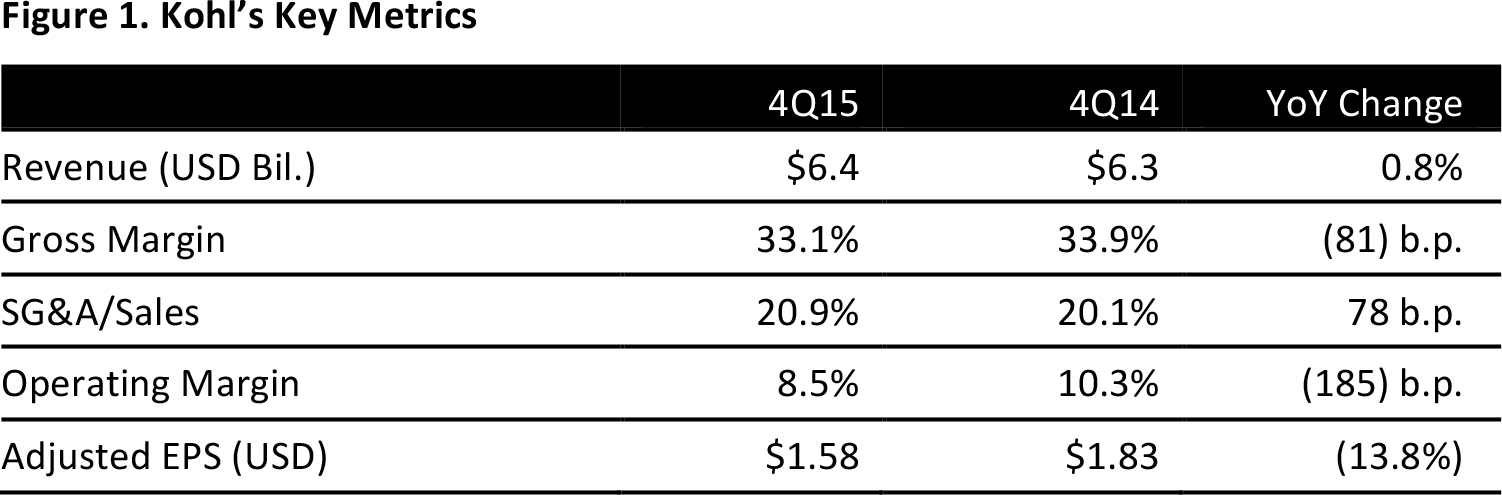

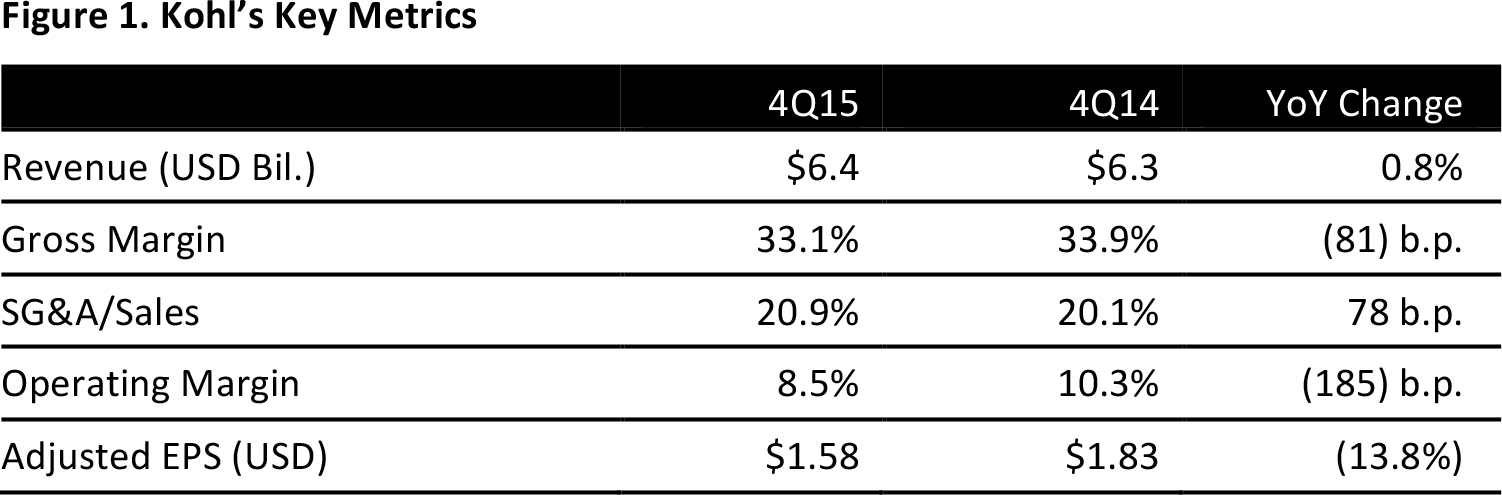

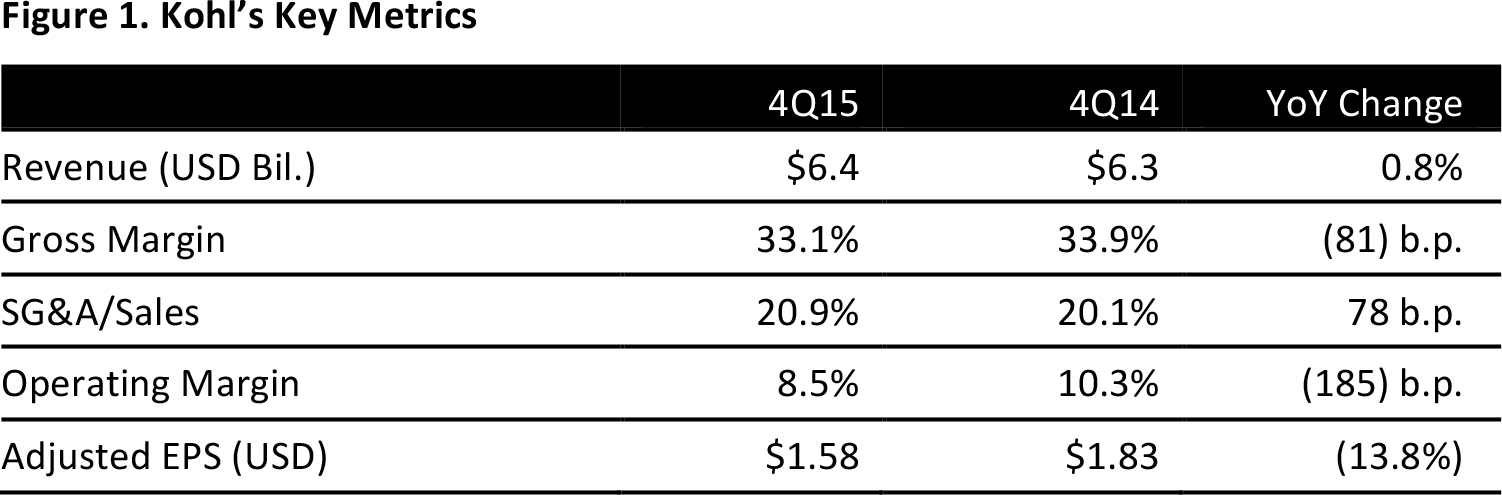

Kohl’s reported 4Q15 revenues of $6.4 billion, up 0.8% from $6.3 billion in the year-ago period and slightly above the consensus estimate.

The company reported quarterly comps of 0.4%, which represented the fifth consecutive quarter of positive comps. However, the comp growth was below management’s expectation, and encouraging 4% comps between Thanksgiving and Christmas were substantially offset by soft sales in November and unfavorable weather in January.

For the quarter, net income was $296 million and diluted EPS was $1.58, down 14% year over year, versus consensus of $1.56.

The company’s management shared its plans to pilot seven small-format stores in the US, add two Off-Aisle stores in Wisconsin and open 12 Fila outlet stores. The Fila outlet stores represent the company’s first entry into the outlet space.

Kohl’s will close 16 underperforming stores in 2016, which will save about $45 million in SG&A and $10 million in depreciation. The 16 stores account for less than 1% of the company’s total sales.

2015 RESULTS

Revenues for 2015 were $19.2 billion, up from $19.0 billion in 2014 and slightly above consensus. Comp sales increased by 0.7% for the year, as decreased transactions per store were offset by increased average transaction value. Net income was $781 million and adjusted diluted EPS was $4.01.

Footwear and home were the top-performing categories for the quarter and the year, whereas accessories was the weakest category for both periods. Regionally, the West performed best for both the quarter and year, while the Mid-Atlantic and South Central regions underperformed. As a result of heavy investment in omni-channel capabilities, online-generated demand grew by 25% for the year and by 30% for the quarter.

GUIDANCE

Kohl’s provided guidance for diluted EPS of $4.05–$4.25 for 2016, assuming flat–1% comps and total sales growth of (0.5)%–0.5%. Management expects significant gross margin pressure of 150 basis points for the first quarter as stores clear excess inventory.

Consensus estimates for 2016 are revenues of $19.3 billion and EPS of $4.01.

�