Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

3Q18 Results

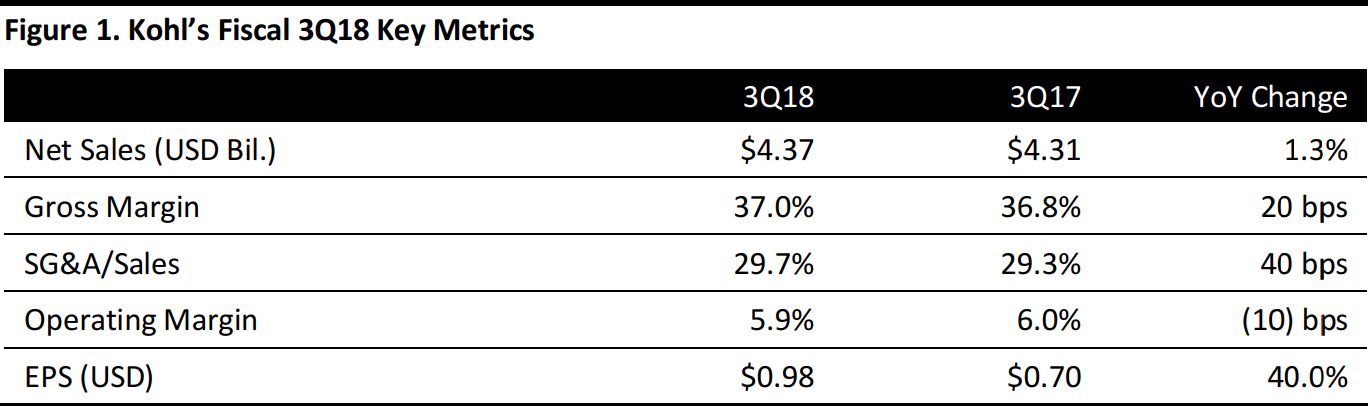

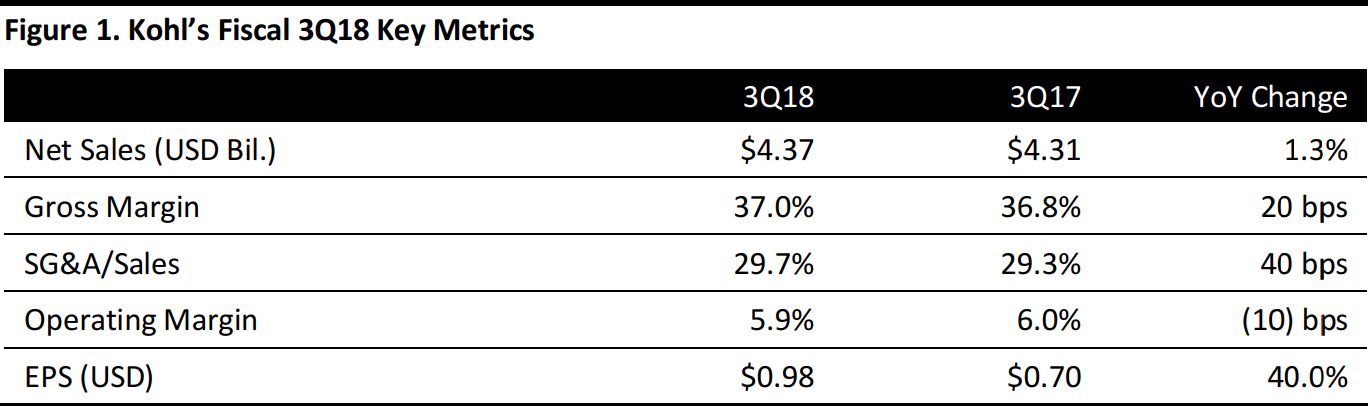

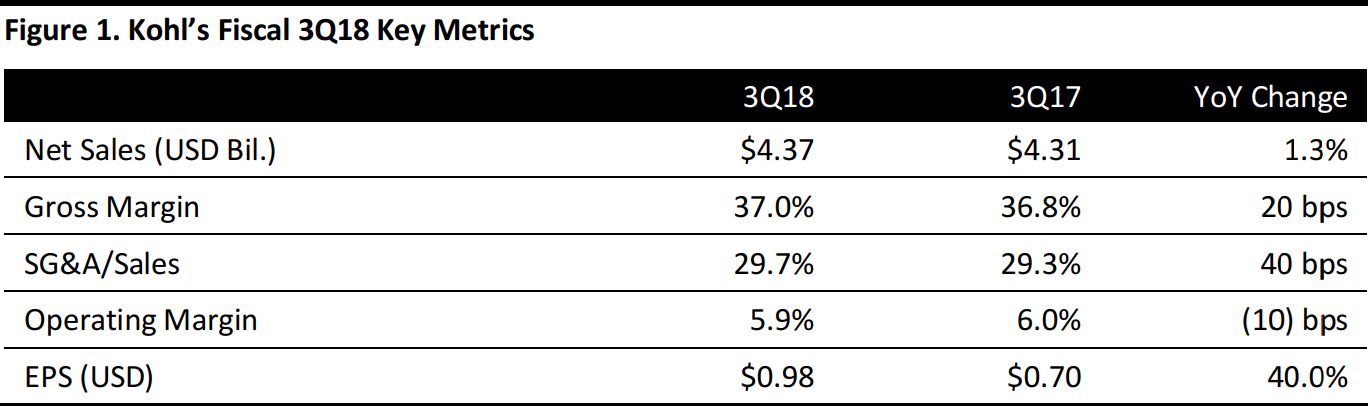

Kohl’s reported 3Q18 net sales of $4.37 billion, up 1.3% year over year and in line with the $4.37 billion consensus estimate. Adjusted EPS was $0.98, beating the $0.95 consensus estimate and up from $0.70 in the year-ago quarter.

Comparable sales were up 2.5% year over year, beating the consensus estimate of 2.4%. The company reported its fifth consecutive quarter of positive growth. All lines of business reported positive comps, except for the accessories business, which was essentially flat. All regions reported positive comps, with the Midwest, Mid-Atlantic, and Northeast regions being the strongest.

Kohl’s reported growth in its national and proprietary brands, led by strong performance of apparel in its men and children’s businesses. Kohl’s men’s business grew private brands including SONOMA, Croft & Barrow and national brands such as Haggar and Columbia. Its active business was driven by active categories and brands in golf and big and tall. In its children’s business, Kohl’s reported that its proprietary brand, Jumping Beans, posted a mid-teens comp while its Carter's business boosted its kids’ active business.

The company commented that its positive 3Q18 sales results were amplified by competitor store closures, with approximately one-third of its store base favorably affect by department store closings compared to one-fourth that benefitted last year. The company reported that it expects the Bon-Ton closures to be an opportunity to capture market share given the overlap of the store’s customer base and the markets where they compete.

Kohl’s attributed its 40% EPS growth to the traction it is gaining in product, marketing, and digital store initiatives. The company also stated that more than 25 million customers have downloaded the Kohl’s app to date and approximately 5 million customers are actively engaging with the app on a monthly basis. Customers use the app to either make purchases or to use functionality in-store like the wallet, which puts all of the customers' offers in Kohl's Cash in one place. Kohl’s reported that its app represents a significant part of traffic and sales, and management is encouraged by how conversion growth outperforms all other digital channels and how it drives customer loyalty.

Kohl’s is also accepting Amazon returns in about 100 stores and has tripled the number of Amazon shops inside Kohl's stores from 10 to 30. For the holiday season, Kohl’s will sell Amazon-branded products across all stores for the holiday season, including Black Friday favorites such as the Amazon Echo and the Echo Dot.

Outlook

Kohl’s raised its full-year earnings guidance per share and now expects full-year EPS to be $5.35–$5.55 compared to prior guidance of $5.15–$5.55, in line with the consensus estimate of $5.49. This excludes the one-time debt extinguishment charge of $42 million or $0.19 per share taken in the first quarter. For the full year, the company expects comparable sales to increase 1%–2%.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research