Source: Company reports/FGRT

3Q17 Results

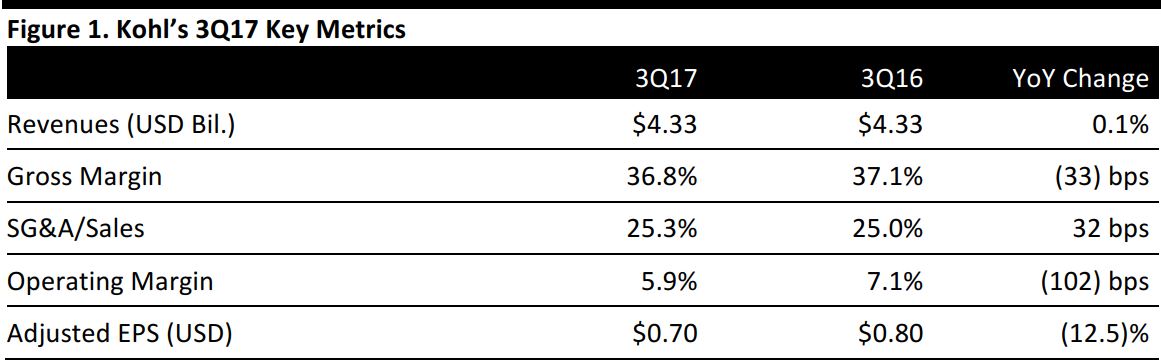

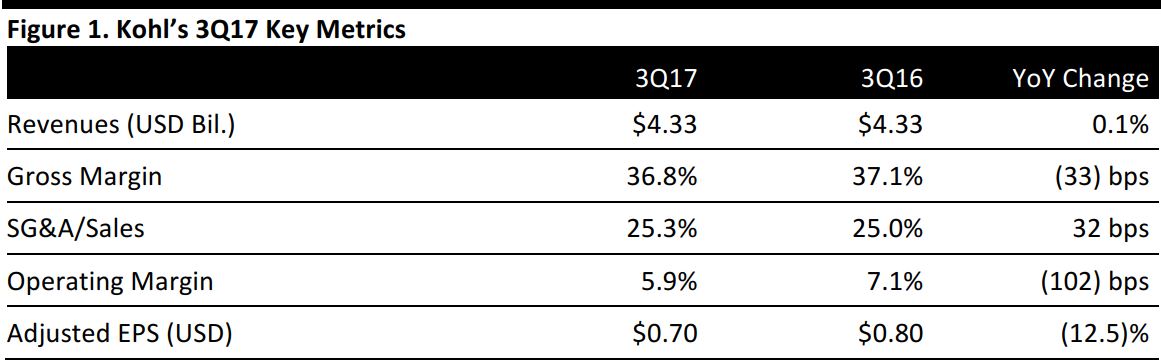

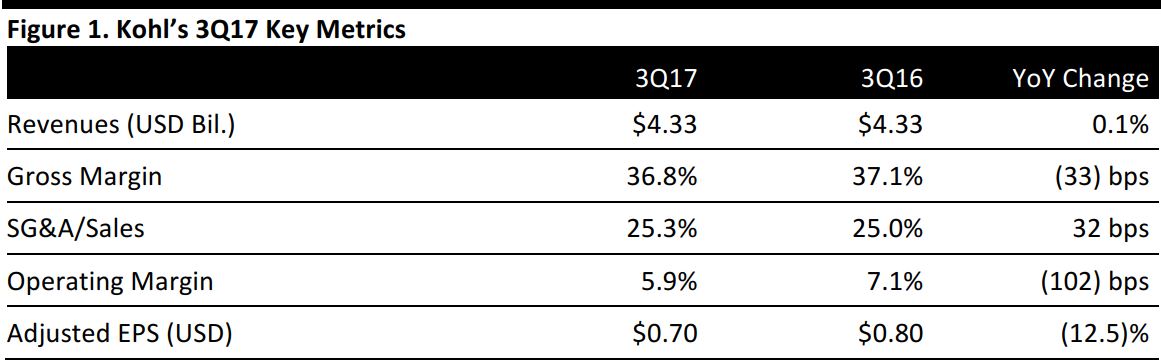

Kohl’s reported 3Q17 adjusted EPS of $0.70, below the $0.72 consensus estimate and down 12.5% from the year-ago period. Total revenues were $4.33 billion, up 0.1% year over year and beating the $4.30 billion consensus estimate. Management noted a strong back-to-school selling season, with sales from August through Labor Day up by low single digits, driven by strong performance in kids’ and footwear product categories.

Comparable-store sales were up 0.1% year over year, ahead of the 0.7% decline analysts had expected and the prior-year quarter’s 1.7% decline. Comps benefited from higher average transaction value, driven by an increase in average unit retail that was partially offset by a decrease in units per transaction. While traffic remained negative for the quarter, there was sequential improvement, which was a positive driver of the improved sales performance.

Comps were negatively affected by the recent hurricanes, which led to the temporary closure of more than 100 Kohl’s stores. This resulted in a negative impact of $15 million, or 35 basis points, on sales.

Online sales grew by 15%, and Kohl’s stores fulfilled 30% of total online order units. Demand for buy-online, pick-up-in-store and ship-from-store services contributed to the positive result. Mobile accounted for 67% of total digital traffic and smartphone app conversion increased at a low-double-digit rate.

In October, Kohl’s expanded its partnership with Amazon, announcing that Kohl’s will sell devices such as the Amazon Echo and Fire tablets at 10 of its stores. Kohl’s also said that it will accept Amazon returns in 82 of its stores.

The company’s gross margin decreased by 33 basis points during the quarter. The positive impact of fewer clearance markdown levels was more than offset by higher shipping costs and higher reserves, such as loyalty rewards and sales return adjustments.

Performance by Category

By product category, the footwear, home, men’s and children’s businesses reported positive comps, which were partially offset by negative comps in the accessories and women’s businesses. Positive comps in footwear and apparel were driven by growth in the active category, specifically by brands such as Nike, Adidas and Under Armour.

National brand penetration rose by 57% (or 300 basis points) in the quarter, driven by growth in the active category along with growth in national brands such as Levi’s, Carter’s, Van Heusen, Haggar, Columbia and Fitbit. The company’s private-label brands improved sequentially from the second quarter, and two of its largest exclusive brands—Simply Vera Vera Wang and LC Lauren Conrad—posted double-digit sales increases year over year.

Outlook

Kohl’s narrowed its FY17 adjusted EPS guidance range upward and now expects adjusted EPS of $3.60–$3.80 versus $3.50–$3.80 previously and the $3.76 consensus estimate. Management did not comment on revenue guidance.

Kohl’s is continuing its store optimization strategy, which involves remerchandising and refixturing full-sized, lower-volume stores. This has brought an improvement in both profitability and customer experience, management said.

The company expects a very strong holiday performance in the active apparel and footwear categories.