Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

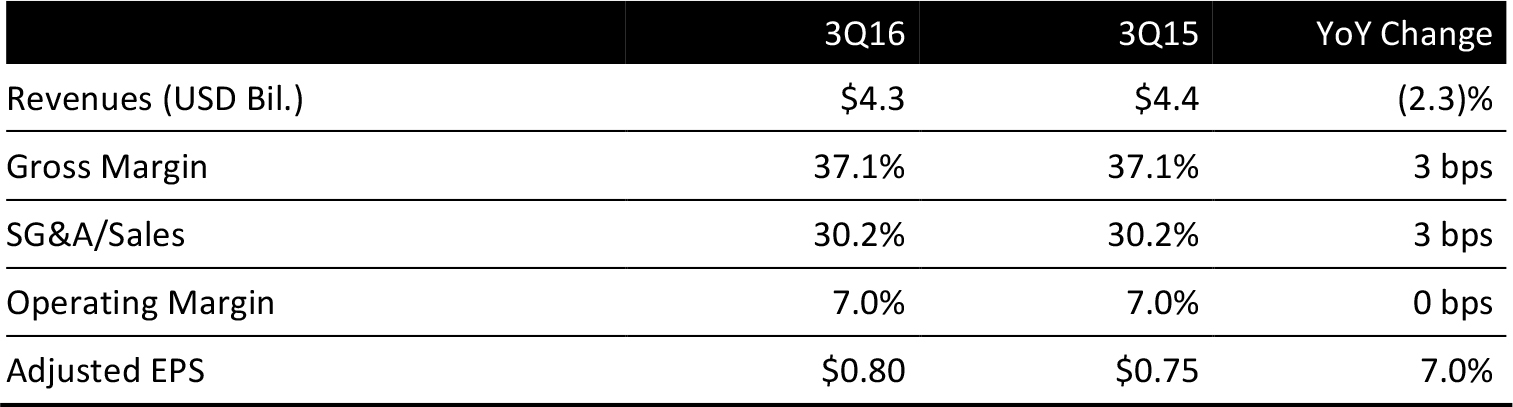

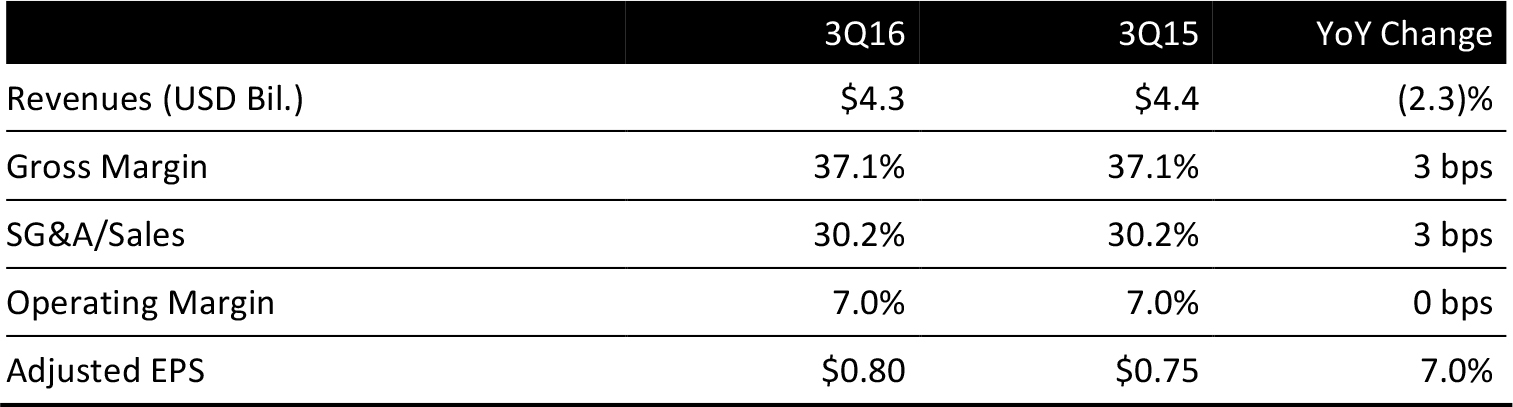

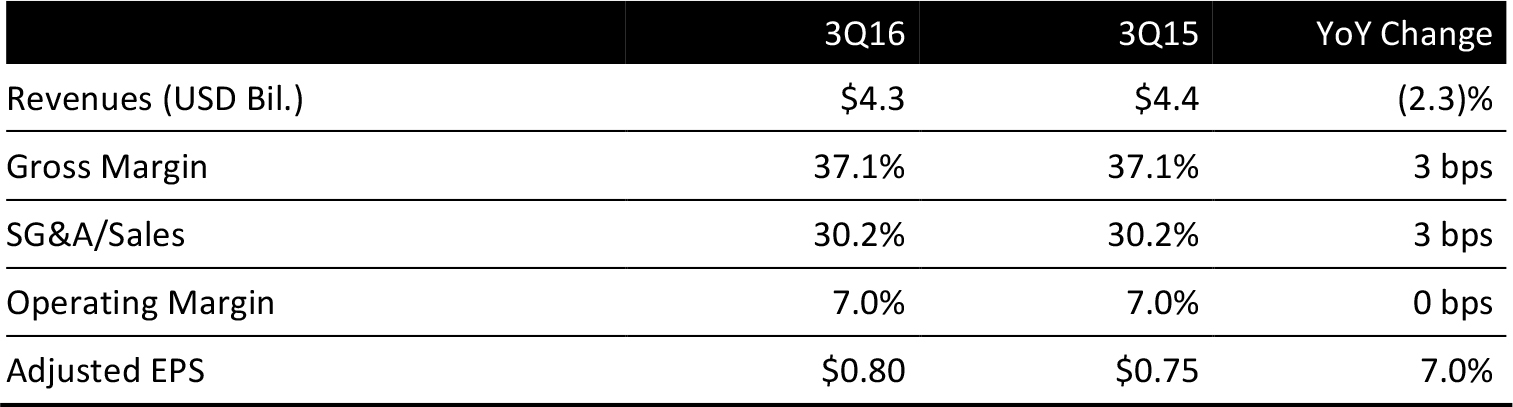

Kohl’s reported 3Q16 revenues of $4.3 billion, down 2.3% year over year and in line with the consensus estimate.

Adjusted EPS was $0.80, up 7.0% year over year, beating the consensus estimate by $0.10. GAAP EPS was $0.82, compared with $0.63 in the year-ago quarter.

The company ended the quarter with 1,155 Kohl’s stores, 12 FILA Outlet stores and three Off/Aisle clearance centers, compared with 1,166 Kohl’s stores a year ago. During the quarter, the company opened six Kohl’s stores, all of which are in the new mall store format, and also closed one store.

Kohl’s is in year one of a three-year inventory-reduction initiative, and management commented that it is managing inventory well across all areas of its business. Although sales were down 2% in the quarter, the company exited the quarter with 9% less inventory, which significantly improved sell-through.

DETAILS FROM THE QUARTER

Comparable-store sales declined by 1.7%, in line with estimates. The company experienced a modest improvement in year-to-date comp sales trends in the third quarter, including a strong back-to-school selling season, with sales up 5% in key back-to-school categories. However, this was followed by a weak September selling period.

The number of transactions per store decreased by 5.7% in the quarter, but the average transaction value increased by 400 basis points, comprising an increase of 210 basis points in the number of units per transaction and an increase of 190 basis points in average unit retail.

PERFORMANCE BY CATEGORY

Menswear was the strongest category for the third consecutive quarter, due to strength in active and tailored dress clothing.

Footwear also performed above the company average, due to strength in athleticwear.

Home was in line with the company average, but the segment reported the most significant improvement of any business over the spring trend, which management considers a positive sign, as the category becomes much more important for overall sales in the holiday season.

Womenswear performed slightly below the company average, but experienced continued strength in juniors, driven by the company’s speed initiative as well as by Sonoma and other key brands.

Childrenswear continues to be challenging; strength in the Carter’s brand was offset by declines in the Jumping Beans brand.

Accessories underperformed the company average.

Bath and beauty and fine jewelry experienced double-digit increases, which were more than offset by declines in other categories.

The

active and wellness category remains strong, and the company has expanded assortments and introduced key suppliers such as Nike, New Balance and Fitbit, which are continuing to drive sales. Kohl’s plans to launch Under Armour next spring, which will be the largest launch in the company’s history. This holiday, the company plans to offer the American Girl doll of the year and Koolaburra by UGGs, and it recently announced that it plans to carry the Apple Watch.

PERFORMANCE BY REGION

The West was the strongest region, with a low single-digit increase in comp store sales; the South Central region also outperformed the company average. The Mid-Atlantic and Northeast regions were characterized as the most challenging.

CFO TO RETIRE AS PLANNED

Separately, the company announced on November 9 that its CFO, Wesley S. McDonald, would retire in spring 2017 as planned after 14 years of service and that a comprehensive search would be conducted over the next few months to find a replacement.

OUTLOOK

Kohl’s ended strongly in October and saw a progressive sequential improvement in business throughout the month, with October ending basically flat year over year, which management characterized as encouraging entering the holiday season.

For the upcoming holiday season, the company plans changes to its Kohl’s Cash and Yes2You Rewards programs to heighten and strengthen their effectiveness and improve their value proposition.

The company reaffirmed its guidance for fiscal 2016 GAAP EPS of $3.12–$3.22 and adjusted EPS of $3.80–$4.00. The current consensus estimate is $3.88.

Consensus estimates for the fourth quarter call for revenues of $6.35 billion and EPS of $1.66.