Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

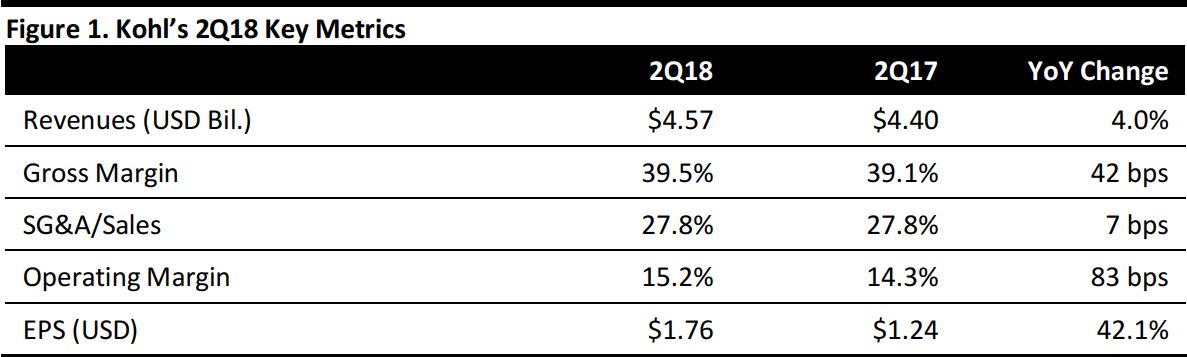

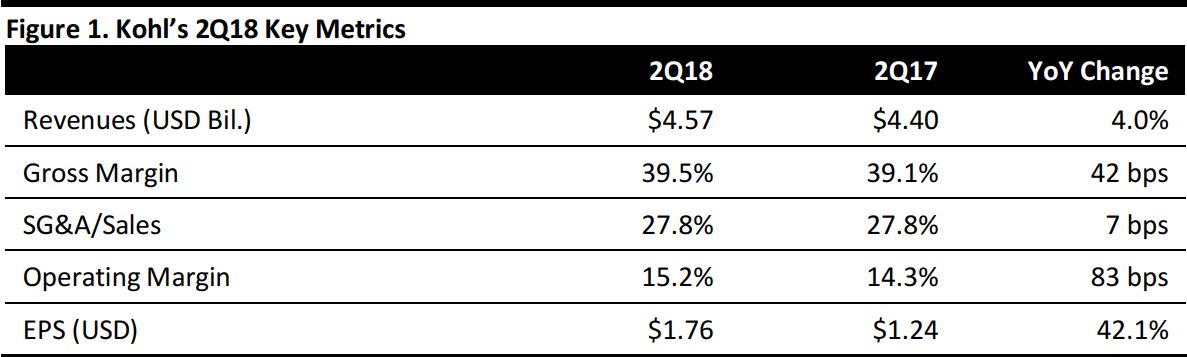

2Q18 Results

Kohl’s reported 2Q18 revenues of $4.57 billion, up 4.0% year over year and beating the consensus estimate of $4.27 billion.

Comps were 3.1%, beating the consensus estimate of 2.6%.

EPS was $1.76, beating consensus of $1.64 and up 42.1% year over year.

Management commented that comps in the quarter represented the fourth consecutive quarter of positive comparable sales. The company experienced strength across both store and digital channels, in all regions of the country, and for both proprietary and national brands. The men’s and women’s apparel businesses led the growth, followed closely by footwear. In addition, gross margins increased, due to ongoing inventory management.

Details from the Quarter

- Comps increased in both stores and the digital channel. Digital reported a mid-teen increase.

- Comp sales continued to be driven by an increase in average transaction value.

- Men’s, women’s and footwear were the strongest performers in the quarter.

- Children’s and accessories also reported comp sales increases.

- After reporting strong comps in the first quarter, comps for Home were slightly negative in the second quarter.

- All regions reported positive comps, and the Midwest, South Central and mid-Atlantic outperformed.

- The 42-basis-point gross margin improvement was a result of an ongoing focus on inventory management, which contributed to cleaner inventory and fewer permanent and promotional markdowns.

- Margins also benefited from the effect of the company’s operational excellence initiative on shipping costs.

- Four key management initiatives driving improved inventory performance are:

- The standard-to-small initiative continues to drive lower inventory levels and higher profitability, and Kohl’s expanded its program to another 200 stores in 2018.

- Localization has enabled the company to have the right product, in the right store, at the right time.

- The speed initiative has positively impacted the company’s proprietary portfolio by enabling it to flow receipts better to match customer demand.

- Finally, the company has strategically reduced customer choice while increasing depth in key items, which has also served to improve inventory metrics.

- Inventory per store decreased 8%, the 10th consecutive quarter of inventory reductions. Inventory is turning faster, clearance levels continue to be well managed and aged inventory is decreasing.

- SG&A increased 4%, owing to all major lines of business reporting expense leverage, except IT, in which the company is making investments in the cloud and other initiatives to drive future efficiencies and growth.

- National brand sales increased 4%, driven by strength in apparel and footwear.

- Nike, the company’s largest national brand, continues to outperform through core and new offerings, which included launching Golf in the quarter. Under Armour delivered very strong growth in its second year and its sales performance accelerated from the first quarter. The performance of Adidas was characterized as having an outstanding quarter, as customers continued to react favorably to an expanded and elevated assortment.

- As part of the company’s efforts to invest in active and wellness initiatives, Kohl’s recently launched an active expansion test in 30 stores earlier this month. The expansion increases square footage for the active business by approximately 40% and aims to provide customers with almost 50% more choices, including unique items.

- The company’s proprietary brand portfolio had its best performance in over five years due to an intense focus on improving the performance of proprietary brands, while also editing the overall portfolio, reducing inventory and narrowing customer choice.

- In 2019, the company plans to launch the Nine West brand, which elevates its overall fashion offering for women and millennial customers.

Outlook

Management raised guidance as follows:

- GAAP EPS of $4.96–$5.36, up from $4.86–$5.31 previously.

- Adjusted EPS of $5.15–$5.55, up from $5.05–$5.50 previously.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research