Source: Company reports/FGRT

2Q17 Results

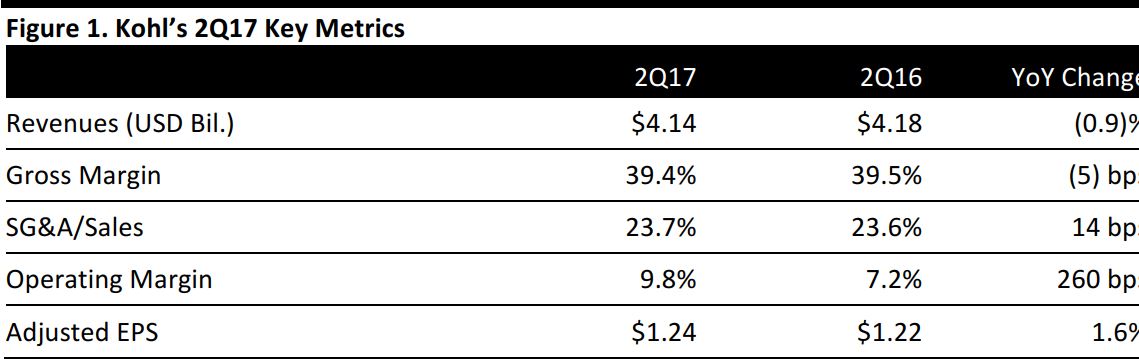

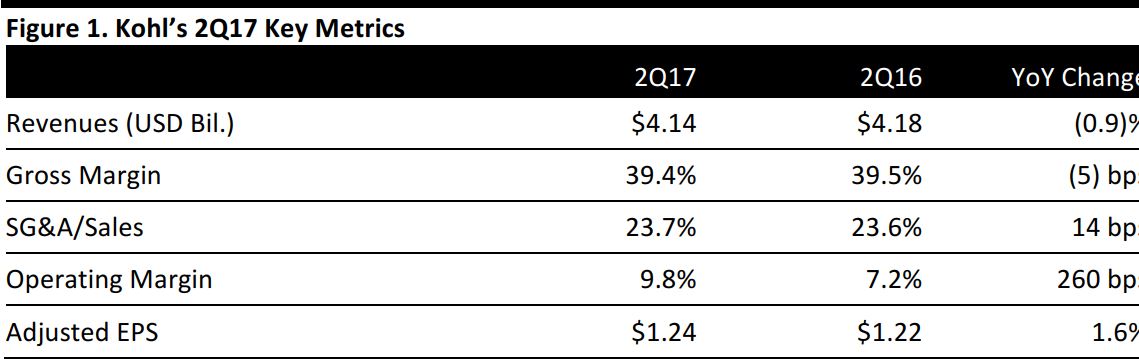

Kohl’s reported 2Q17 adjusted EPS of $1.24, ahead of the $1.19 consensus estimate and up 1.6% from the year-ago period. Total revenues were $4.14 billion, down 0.9% year over year but beating the $4.13 billion consensus estimate.

Comparable-store sales were down 0.4%, which was better than the 1.5% decline analysts had expected and the prior-year quarter’s 1.8% decline. While store traffic remained slightly negative in the quarter, it improved in the combined March and April period and turned flat in the month of July.

The average transaction value increased in the quarter, driven by a continued increase in average unit retail that was partially offset by a decrease in units per transaction. The number of transactions was down, yet it improved throughout the quarter and the July figure represented an increase in monthly transactions year over year.

Online fulfilled sales grew by 19%, and Kohl’s stores fulfilled 31% of the total units, a significant increase from the year-ago period and up from 24% in the first quarter. Demand for buy-online, pick-up-in-store service contributed to the positive result.

Mobile accounted for 66% of total digital traffic and for 42% of digital sales. Both smartphone and smartphone app conversion increased at a double-digit rate.

Performance by Category

The activewear business posted a mid-teen comp increase year over year across both footwear and apparel, driven by the addition of an Under Armour merchandise offering and sales increases for both Nike and Adidas. Positive comps in footwear were driven by athletic footwear. Home and menswear posted positive comps, while childrenswear and accessories underperformed. Although accessories improved during the quarter, comps still remained slightly negative.

Kohl’s private-label brands improved sequentially from the first quarter, with the company’s two largest exclusive brands—Simply Vera Vera Wang and LC Lauren Conrad—posting double-digit sales increases.

Performance by Region

Geographically, performance was generally consistent across all regions. The West and Southeast were the strongest regions, while the Midwest was consistent with the company average. The Mid-Atlantic, Northeast and South Central regions were modestly below the company average.

Outlook

Management did not update its FY17 EPS guidance of $3.50–$3.80, which is based on the following assumptions:

- Revenue growth of (1.3)%–0.7%, which includes sales of approximately $160 million in the 53rd week.

- Comps of (2)%–0%.

- A gross margin increase of 10–15 basis points.

- An increase of 0.5%–2% in SG&A dollars. Excluding the 53rd week, the company expects SG&A dollars to increase by 0%–1.5%. SG&A dollars in the 53rd week are expected to total about $25 million.

The company is continuing its store optimization strategy, which involves remerchandising and refixturing full-sized, lower-volume stores. This has brought an improvement in both profitability and customer experience, management said.