Source: Company reports/Coresight Research

1Q18 Results

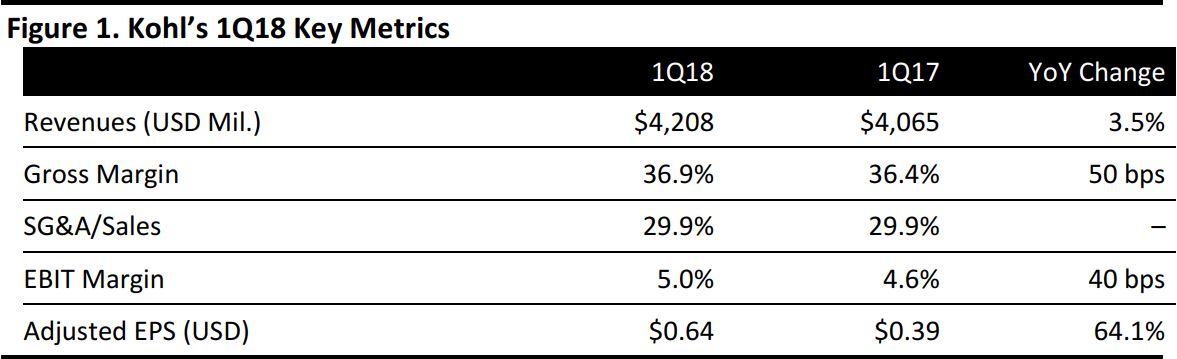

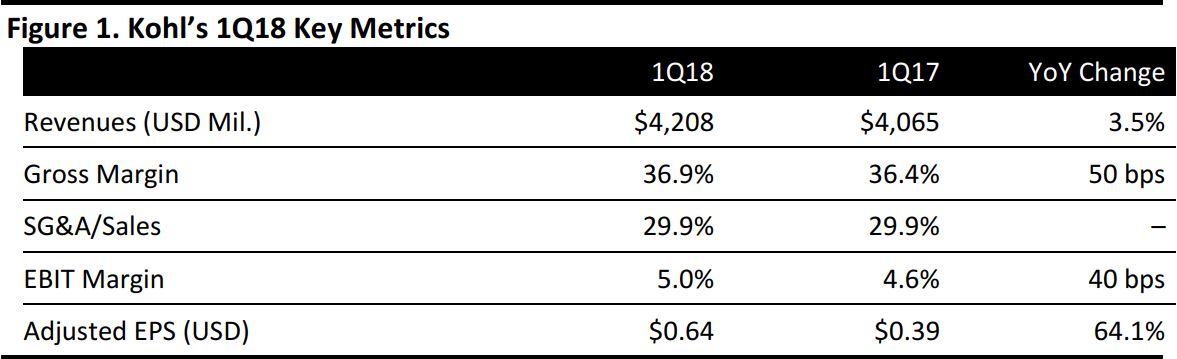

Kohl’s reported 1Q18 total revenues of $4.21 billion, up 3.5% year over year. Net sales were $3.95 billion, slightly below the $3.96 billion consensus estimate. Adjusted EPS was $0.64, beating the $0.50 consensus estimate and up from $0.39 in the year-ago quarter.

The company’s gross margin increased by 50 basis points year over year, with reported EBIT of $210.0 million exceeding the consensus estimate of $178.9 million. Margin performance was driven by a clean inventory position, localization of inventory management and speed initiatives that resulted in improved operational agility and a decrease in permanent and promotional markdowns.

Comp sales were up 3.6% year over year, compared with the prior-year quarter’s 2.7% decline. Comps were driven by an increase in average transaction value and benefited from the timing of promotional events leading into Mother’s Day. The company estimates that this calendar shift positively affected comps by approximately 320 basis points, while unfavorable weather negatively affected quarterly comps by about 100 basis points.

Quarterly digital sales grew by almost 20%, with mobile representing more than 70% of digital traffic and almost half of all digital sales.

Home, footwear and menswear were the strongest-performing categories during the quarter, while childrenswear was the most challenged. Activewear sales increased by 10% in 1Q18, driven by Nike, Under Armour and Adidas. The company’s proprietary brands experienced flat comps in the quarter.

Outlook

Management updated its guidance and now expects full-year adjusted EPS of $5.05–$5.50, up from $4.95–$5.45 previously. Including a loss due to extinguishment of debt, full-year adjusted EPS is expected to be $4.86–$5.31.