Source: Company reports/Fung Global Retail & Technology

1Q17 Results

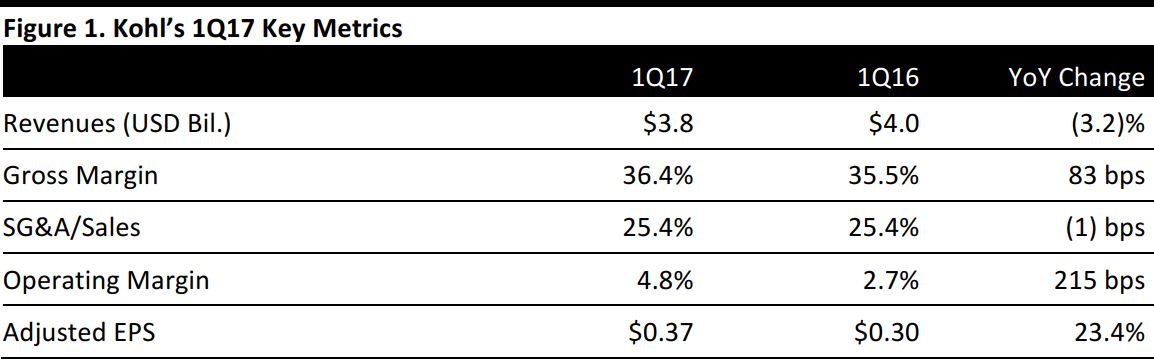

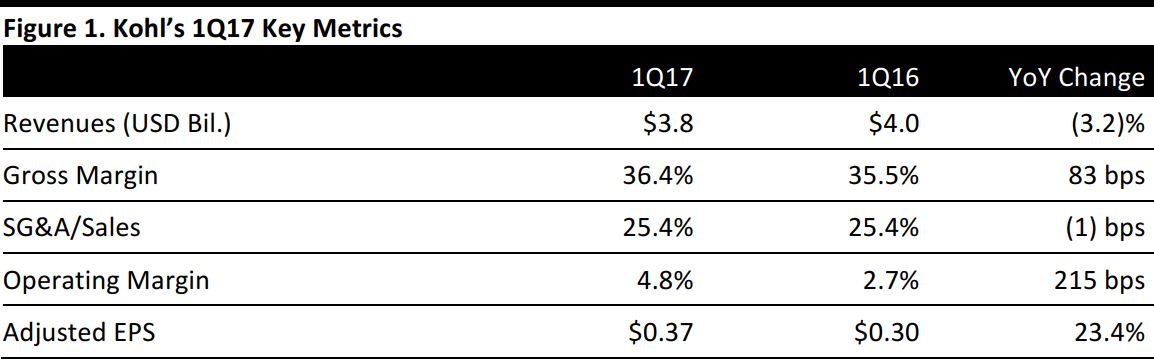

Kohl’s reported 1Q17 revenues of $3.84 billion, down 3.2% year over year and slightly below the $3.91 billion consensus estimate.

Adjusted EPS was $0.37, up 23.4% year over year and beating the consensus estimate of $0.29.

Management commented that strong inventory management led to an increase of 83 basis points in the gross margin.

The company ended the quarter with 1,154 Kohl’s stores, 12 FILA Outlet stores and three Off/Aisle clearance centers in 49 states. The company operated 1,167 Kohl’s stores in the year-ago quarter.

Details from the Quarter

Comparable-store sales were (2.7)%, below the (1.2)% consensus estimate. Following a weak February, sales and traffic improved in March and April. Sales were down 1% in those two months.

The average transaction value increased in the quarter, driven by a continued increase in average unit retail, which was partially offset by a decrease in units per transaction. The number of transactions was down, yet it improved significantly throughout the quarter; the figure for March and April was nearly 600 basis points higher than February’s figure.

Online fulfilled sales grew by 13%, and Kohl’s stores fulfilled 24% of the total units, a significant increase from the year-ago period. Demand for buy-online, pick-up-in-store service reached 13% of all digital orders, up from 8% in the year-ago quarter.

Mobile accounted for 66% of total digital traffic and for almost 40% of digital sales. Smartphone and smartphone app conversion both increased substantially.

Chief Marketing Officer Greg Revelle joined the company in April, bringing a background in analytics, personalization and marketing. He is charged with improving performance in the company’s $1 billion-plus in marketing spend.

Performance by Category

Activewear sales grew at a mid-teens rate, compared with a mid-single-digit rate in the year-ago quarter. Nike sales grew at a high-single-digit rate in the quarter. Strength was largely due to the launch of Under Armour, which exceeded expectations. While home and men’s outperformed, the women’s and accessories businesses remained challenging.

Home and

footwear both had positive comp sales for the quarter. Home was strong across the board, while footwear was driven by athletic footwear.

Menswear outperformed the corporate growth rate.

Childrenswear,

womenswear and

accessories underperformed the corporate growth rate. Heavy carryover inventories from last year notably impacted the performance of childrenswear and womenswear in the month of February.

Private brands and the

speed initiative outperformed the total growth rate, with speed brands reaching 40% of total private brand receipts.

Performance by Region

The warm weather regions, the Southeast, South Central region and the West, outperformed the cold weather regions in the quarter, and California was relatively strong.

Outlook

Management did not update its FY17 EPS guidance of $3.50–$3.80, which is based on the following assumptions:

- A change in revenues of (1.3)%–0.7%, which includes sales of approximately $160 million in the 53rd week.

- Comps of (2)%–0%.

- A gross margin increase of 10–15 basis points.

- An increase of 0.5%–2% in SG&A dollars. Excluding the 53rd week, SG&A dollars should increase by 0%–1.5%. SG&A dollars in the 53rd week are expected to total about $25 million.

The company is continuing its store optimization strategy, which involves remerchandising and refixturing full-sized, lower-volume stores. This has brought an improvement in both profitability and customer experience, and has been rolled out to 200 stores as of the end of the first quarter. The company’s goal is to have optimized more than 300 stores by the end of the second quarter.