Source: Company reports

1Q16 RESULTS

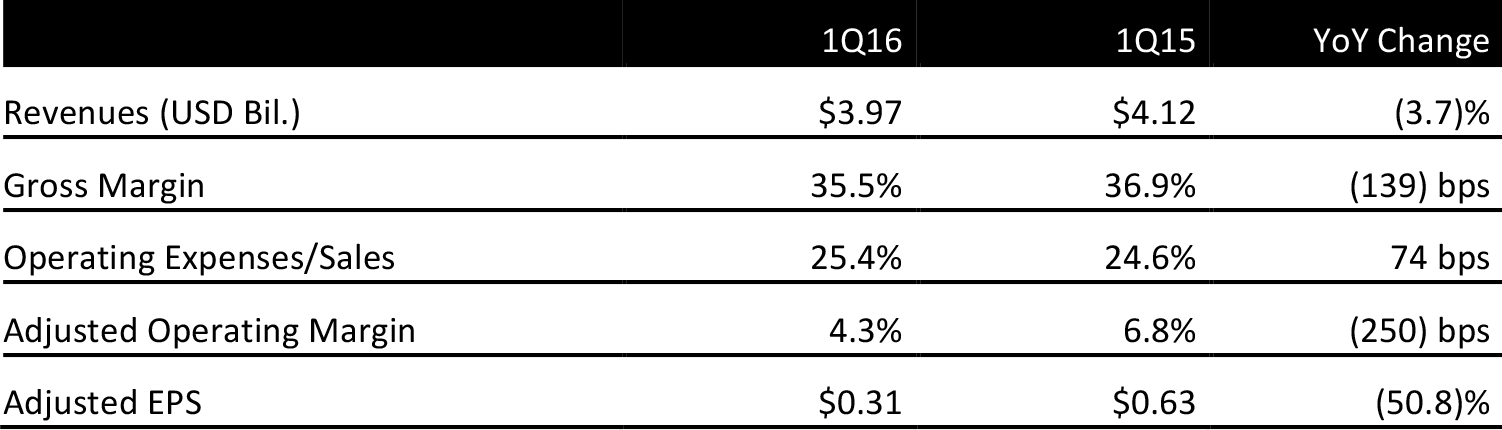

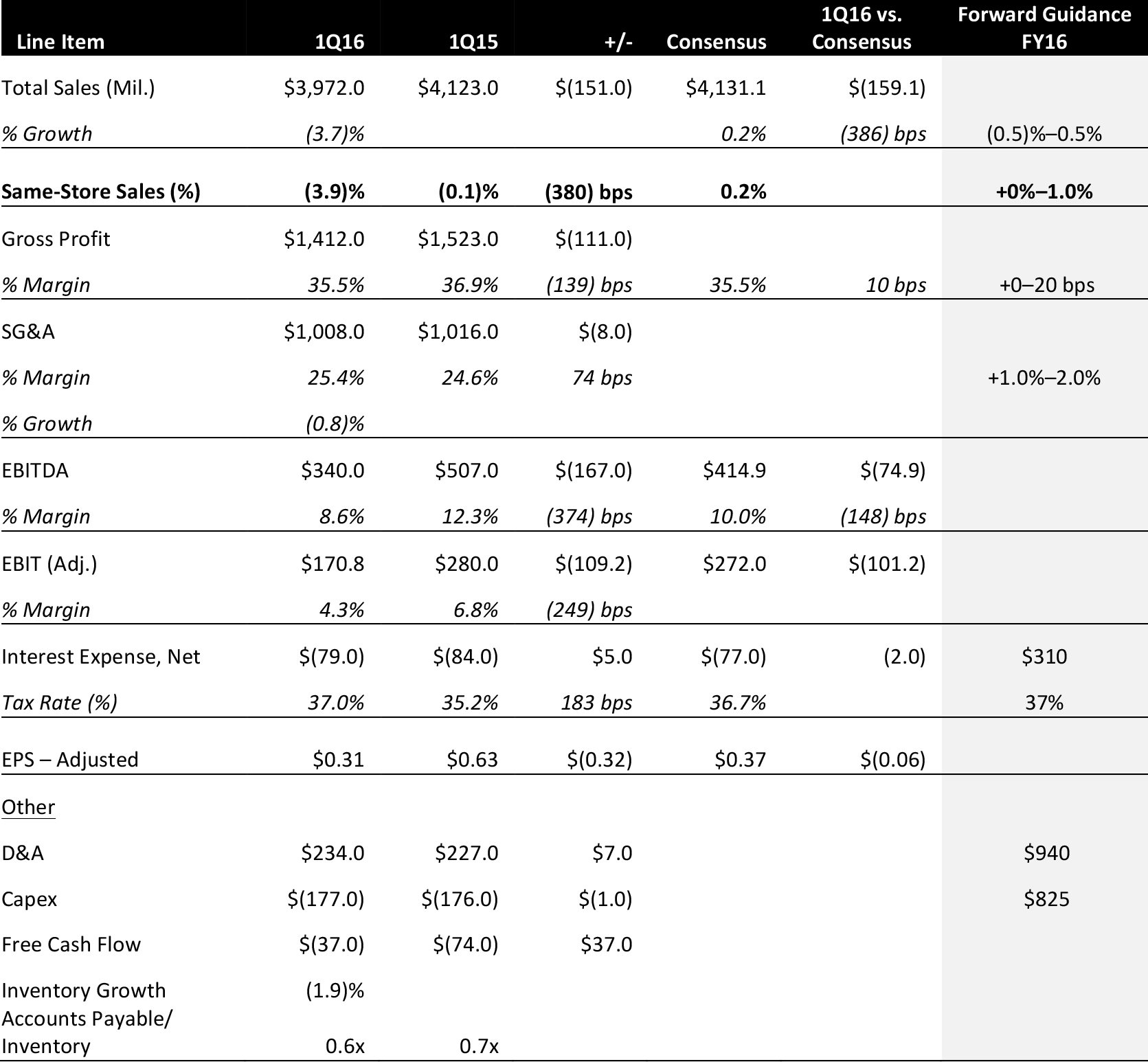

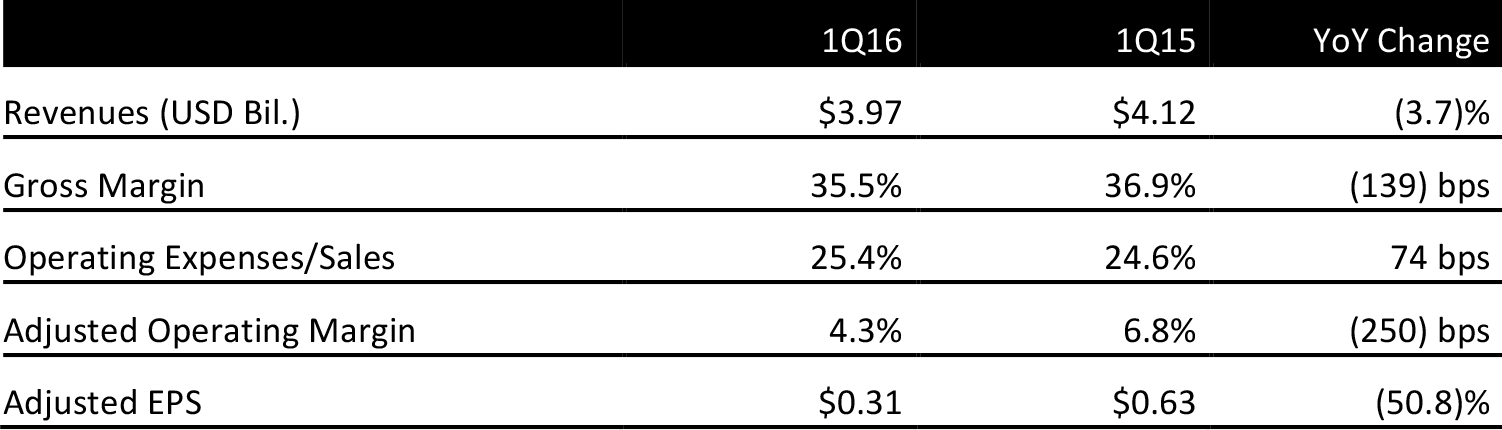

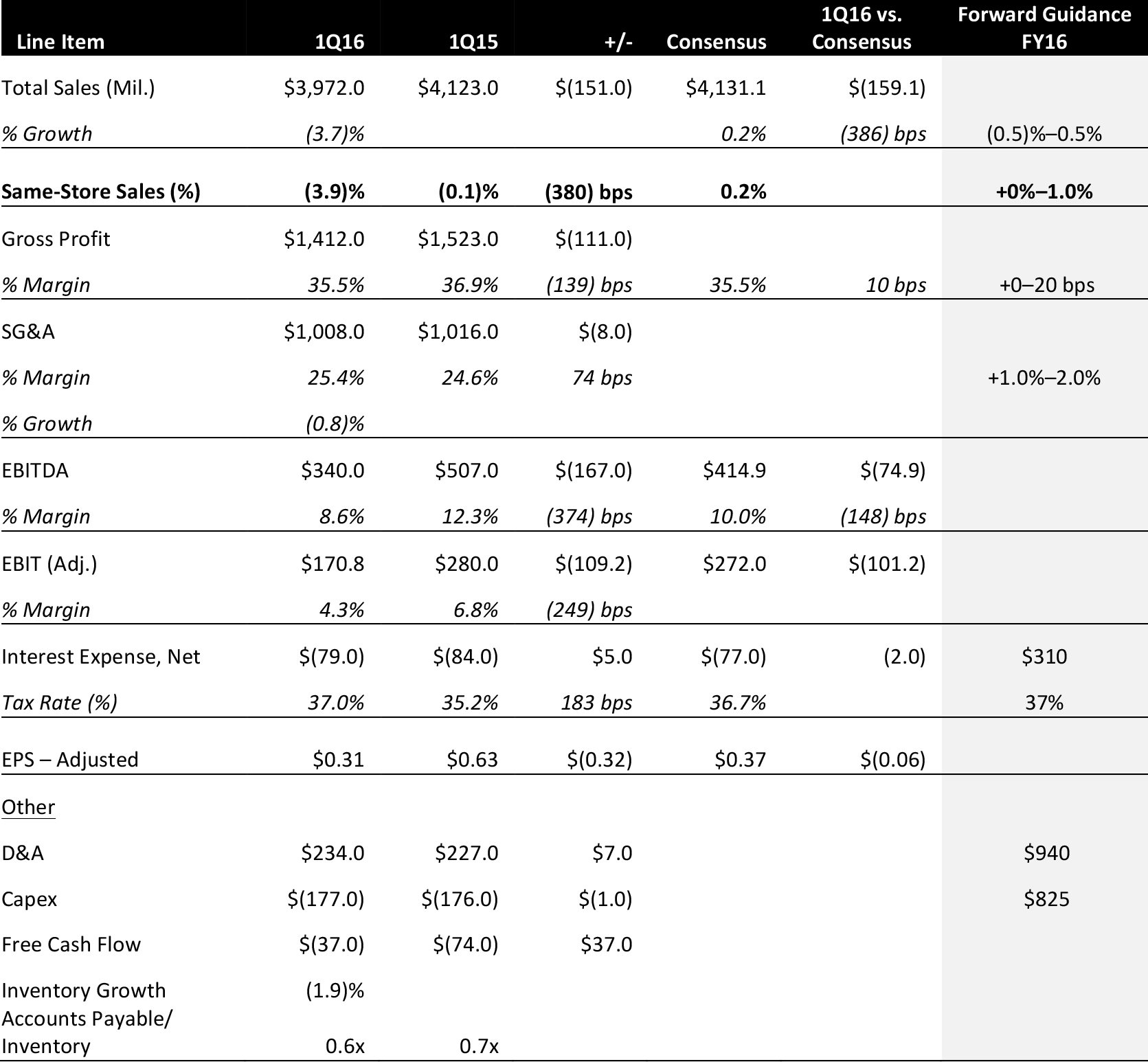

Kohl’s reported adjusted 1Q16 EPS of $0.31 versus the consensus estimate of $0.37.

Total revenues were $3.97 billion, below consensus of $4.13 billion. Comps declined by 3.9%, below consensus of a 0.2% increase. Management noted that sales in the quarter were challenging.

Transactions per store, a proxy for traffic, were down 4.1% in the period. Management also commented that apparel is an area of weakness, as consumers are “not buying apparel.”

Inventory was $4.08 billion at the end of the quarter, down 1.9% year over year and versus a sales decline of 3.7% during the quarter.

FY16 OUTLOOK

While management did not update its full-year guidance, it commented that it plans to focus on same-store sales and SG&A.

Although management is making contingency plans, management still feels good about the prospects for improved sales trends in 2Q16. Full-year guidance calls for comps of flat to up 1%, however management now expects comps to be closer to the low end or slightly below the range.

Management also noted that SG&A expense is likely to be lower than 1% growth in SG&A dollars and could be closer to flat to up 1% for the year, following a 0.8% decline during 1Q16; initial guidance for the year was for an increase of 1%–2%.

Source: Company reports