DIpil Das

Kohl’s Investor Day 2022: Coresight Research Insights

Kohl’s Investor Day featured management presentations by Michelle Gass, CEO; Doug Howe, Chief Merchandising Officer; Paul Gaffney, Chef Technology and Supply Chain Officer; and Jill Timm, Chief Financial Officer. Gass kicked off the day highlighting that Kohl’s has over 60 years of experience, and the retailer is now evolving from a department store to a lifestyle concept centered around active and casual, to serve the next generation of customers. The retailer has over 65 million customers nationwide, employs over 100,000 associates and operates more than 1,150 stores. [caption id="attachment_143065" align="aligncenter" width="700"] Source: Company reports [/caption]

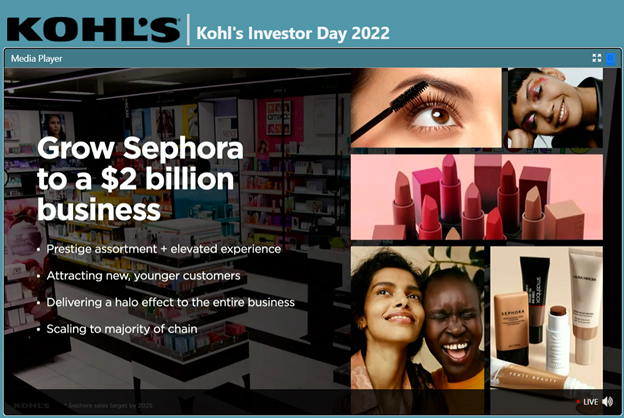

Kohl’s Expects To Grow Its Sephora Business to $2 Billion

Management highlighted the strength of its Sephora shop-in-shop business, which Kohl’s launched with 200 shops in 2021 and expects to grow to be a $2 billion business. Kohl’s plans to add 400 Sephora shop-in-shops in 2022 and 250 in the spring of 2023, totaling 850 locations.

While Kohl’s did not provide specifics of the breakdown of the $2 billion in revenue, the retailer provided the following metrics on the Sephora shop-in-shops:

Source: Company reports [/caption]

Kohl’s Expects To Grow Its Sephora Business to $2 Billion

Management highlighted the strength of its Sephora shop-in-shop business, which Kohl’s launched with 200 shops in 2021 and expects to grow to be a $2 billion business. Kohl’s plans to add 400 Sephora shop-in-shops in 2022 and 250 in the spring of 2023, totaling 850 locations.

While Kohl’s did not provide specifics of the breakdown of the $2 billion in revenue, the retailer provided the following metrics on the Sephora shop-in-shops:

- The stores with Sephora shop-in-shops have seen a mid-single-digit sales lift, in percentage terms (as compared to non-Sephora stores).

- 25% of customers shopping Sephora are new to Kohl’s.

- 50% of customers are adding at least one other category to their cart.

Source: Company reports [/caption]

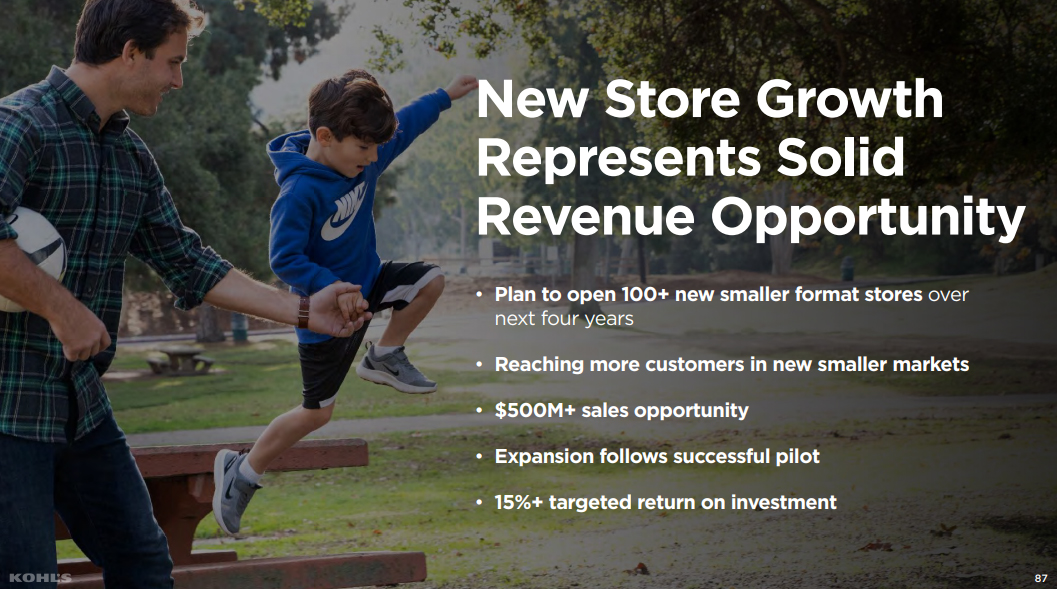

Kohl’s Plans To Expand Its Portfolio by 100 Small-Format Hyper-Localized Stores

Kohl’s plans to open 100 small-format stores, averaging 35,000 square feet, over the next four years. The smaller format provides real estate flexibility, allowing the retailer to enter markets and neighborhoods that cannot support a full-size store. The retailer has been testing this smaller format in various markets over the past few years, and it is expanding the pilot based on its success.

Using data science, the small-format stores are hyper-localized—developed based upon the local customer and competitive market. For example, the first small-format store is set to open in Seattle and will include an expanded outdoor footprint, based on the retailer’s analysis of the market.

Kohl’s projects over $500 million in sales, which is accretive, from its small-format stores. The retailer reported that it is targeting a 15% return on investment.

[caption id="attachment_143067" align="aligncenter" width="700"]

Source: Company reports [/caption]

Kohl’s Plans To Expand Its Portfolio by 100 Small-Format Hyper-Localized Stores

Kohl’s plans to open 100 small-format stores, averaging 35,000 square feet, over the next four years. The smaller format provides real estate flexibility, allowing the retailer to enter markets and neighborhoods that cannot support a full-size store. The retailer has been testing this smaller format in various markets over the past few years, and it is expanding the pilot based on its success.

Using data science, the small-format stores are hyper-localized—developed based upon the local customer and competitive market. For example, the first small-format store is set to open in Seattle and will include an expanded outdoor footprint, based on the retailer’s analysis of the market.

Kohl’s projects over $500 million in sales, which is accretive, from its small-format stores. The retailer reported that it is targeting a 15% return on investment.

[caption id="attachment_143067" align="aligncenter" width="700"] Source: Company reports [/caption]

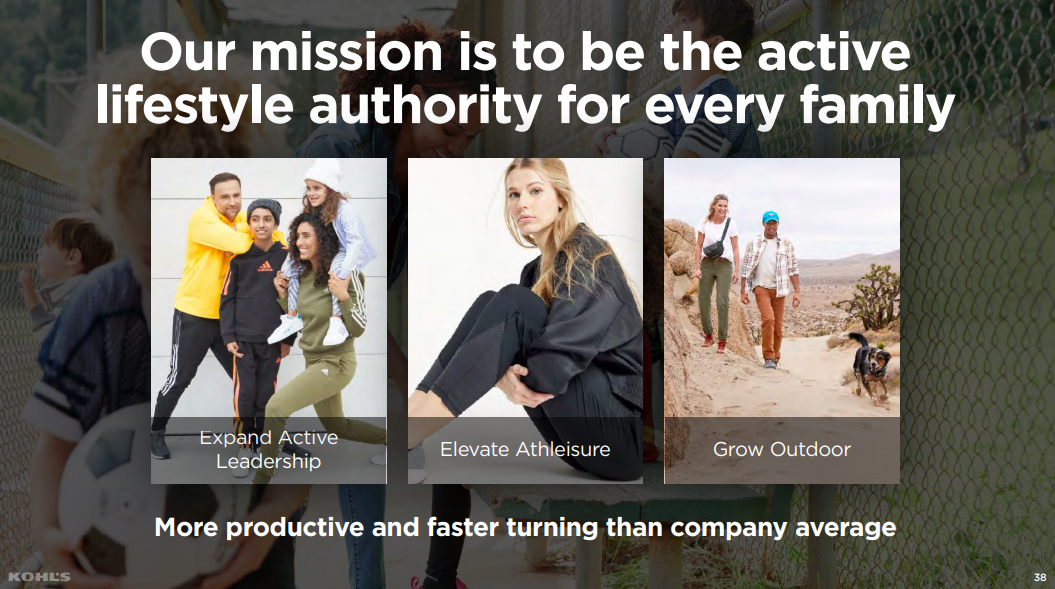

Kohl’s Aims To Be an Active Lifestyle Destination for the Entire Family

The retailer is continuing to invest in the strategic goal it set in October 2020 to become an active/casual destination for the entire family. The company’s active business grew by 40% in fiscal 2021, with sales totaling $4.4 billion—24% of total sales—Kohl’s reported.

Kohl’s emphasized that the combination of national and private brands is a differentiator in the active, athleisure and outdoor categories. The retailer added national brands Calvin Klein, Eddie Bauer and Tommy Hilfiger in 2021, supplementing its active brand portfolio (which includes Adidas, Champion, NIKE and Under Armour) and outdoor national brand portfolio (Columbia and Land’s End). The company’s private labels, Flex and Tek Gear, offer consumers differentiated, quality products at opening price points, management highlighted.

[caption id="attachment_143068" align="aligncenter" width="700"]

Source: Company reports [/caption]

Kohl’s Aims To Be an Active Lifestyle Destination for the Entire Family

The retailer is continuing to invest in the strategic goal it set in October 2020 to become an active/casual destination for the entire family. The company’s active business grew by 40% in fiscal 2021, with sales totaling $4.4 billion—24% of total sales—Kohl’s reported.

Kohl’s emphasized that the combination of national and private brands is a differentiator in the active, athleisure and outdoor categories. The retailer added national brands Calvin Klein, Eddie Bauer and Tommy Hilfiger in 2021, supplementing its active brand portfolio (which includes Adidas, Champion, NIKE and Under Armour) and outdoor national brand portfolio (Columbia and Land’s End). The company’s private labels, Flex and Tek Gear, offer consumers differentiated, quality products at opening price points, management highlighted.

[caption id="attachment_143068" align="aligncenter" width="700"] Source: Company reports [/caption]

Kohl’s Plans To Reignite Growth of Its Women’s Apparel Business

As part of the company’s plan to become an active destination for the entire family, Kohl’s aims to revitalize its women’s business through four initiatives:

Source: Company reports [/caption]

Kohl’s Plans To Reignite Growth of Its Women’s Apparel Business

As part of the company’s plan to become an active destination for the entire family, Kohl’s aims to revitalize its women’s business through four initiatives:

1. Become a leader in women’s casual apparel.

The company stated that a major growth driver for its women’s casual business will be denim, where it reported it holds the number-three market position—and it is the number-one retailer of Levi’s. In fiscal 2022, Kohl’s will enter the premium denim category with Buffalo Jeans and an exclusive offering from Levi’s Silver Tab. Kohl’s is also leveraging its private brand Sonoma as a growth driver; Sonoma is a $1 billion-plus brand, and women's represents half of that volume. Kohl’s is amplifying its brand offerings and repositioning Sonoma as its flagship brand. Moving forward, all Sonoma products will be 100% sustainably sourced. Management sees the opportunity to drive growth from Sonoma in bottoms and dresses.2. Grow dress business.

Kohl’s is seeing strong customer interest in dresses, as “dresses” ranked as one of the top search terms on its digital platform. However, the retailer is underrepresented in the market in the dress category. Therefore, starting in spring 2022, Kohl’s is increasing its dress footprint in stores by 75% and creating “dress destinations.” The retailer is also expanding its dress offerings across the Sonoma private label and national brands Lauren Conrad, Nine West and Simply Vera Vera Wang. Dresses will represent nearly half of the product portfolio from the Draper James RSVP line, according to Kohl’s.3. Expand outerwear and swimwear.

Kohl’s said it can “own the seasons” by focusing on outerwear in the fall and swimwear in the spring. The company plans to focus its outerwear growth on relevant brands including Columbia, Land’s End and Eddie Bauer, and curating in-store experiences and online assortments. Kohl’s added three exclusive swimwear brands that focus on a classic, contemporary or junior customer. The retailer will maintain swim shops in its southern stores all year round.4. Amplify inclusivity.

Kohl’s said that while it has a well-established and trending business in plus-size apparel today, the retailer has an opportunity to expand its offerings across its private brands. Its teams are also focusing on diversity, equity and inclusion. Kohl’s is launching an exclusive brand, Tempo, focused on a younger, diverse consumer. [caption id="attachment_143069" align="aligncenter" width="700"] Source: Company reports[/caption]

Kohl’s Is Investing in Technology, with Digital Growth Set To Reach $8 Billion

Kohl’s management highlighted that the retailer has a strong omnichannel foundation, with customers shopping across both its stores and digital channels. Customers who shop across channels are four times more productive than store-only shoppers, and they are six times more productive than digital-only shoppers, the company said. As more consumers are shopping both channels, the retailer is using technology to enhance the experience for its customers and store associates.

Stores fulfill approximately 40% of digital sales, including via BOPIS (buy online, pick up in store), drive up and ship-from-store. The company invested in better handheld devices for its store associates, which helps to make store-based fulfillment easier and more efficient for customers. Kohl’s is offering more customer convenience through self-service, including self-pickup of an order at a store, self-returns and self-checkout. The retailer has been testing self-service in 2021 with over one-quarter of its stores equipped with some form of self-service.

Source: Company reports[/caption]

Kohl’s Is Investing in Technology, with Digital Growth Set To Reach $8 Billion

Kohl’s management highlighted that the retailer has a strong omnichannel foundation, with customers shopping across both its stores and digital channels. Customers who shop across channels are four times more productive than store-only shoppers, and they are six times more productive than digital-only shoppers, the company said. As more consumers are shopping both channels, the retailer is using technology to enhance the experience for its customers and store associates.

Stores fulfill approximately 40% of digital sales, including via BOPIS (buy online, pick up in store), drive up and ship-from-store. The company invested in better handheld devices for its store associates, which helps to make store-based fulfillment easier and more efficient for customers. Kohl’s is offering more customer convenience through self-service, including self-pickup of an order at a store, self-returns and self-checkout. The retailer has been testing self-service in 2021 with over one-quarter of its stores equipped with some form of self-service.

- By the end of 2022, all stores will have self-service pickup.

- Self-returns are currently available in over 100 stores. Kohl’s will continue to roll out this service to more stores over the next 18 months. Consumers scan the item, drop it into a bag and leave it in a designated box at a Kohl’s store.

- Kohl’s is testing self-service checkout.

Source: Company reports[/caption]

Kohl’s Enhances Loyalty Rewards Program and Launches Co-Branded Card in 2022

Kohl’s has 65 million customers, and 30 million customers belong to its rewards program, which provides cashback. Rewards members spend twice what base customers spend, and customers using a Kohl’s credit card spend six times as much, according to the company.

This spring, the company is launching enhanced rewards for customers that use its Kohl’s card; customers will earn 7.5% back. Kohl’s reported that approximately 19 million rewards members use its credit card. When the retailer tested its 7.5% Kohl's rewards card in 2021, it saw a 1% sales lift in test markets.

The retailer plans to launch a co-branded Kohl’s card, which will expand its reach.

[caption id="attachment_143071" align="aligncenter" width="700"]

Source: Company reports[/caption]

Kohl’s Enhances Loyalty Rewards Program and Launches Co-Branded Card in 2022

Kohl’s has 65 million customers, and 30 million customers belong to its rewards program, which provides cashback. Rewards members spend twice what base customers spend, and customers using a Kohl’s credit card spend six times as much, according to the company.

This spring, the company is launching enhanced rewards for customers that use its Kohl’s card; customers will earn 7.5% back. Kohl’s reported that approximately 19 million rewards members use its credit card. When the retailer tested its 7.5% Kohl's rewards card in 2021, it saw a 1% sales lift in test markets.

The retailer plans to launch a co-branded Kohl’s card, which will expand its reach.

[caption id="attachment_143071" align="aligncenter" width="700"] Source: Company reports [/caption]

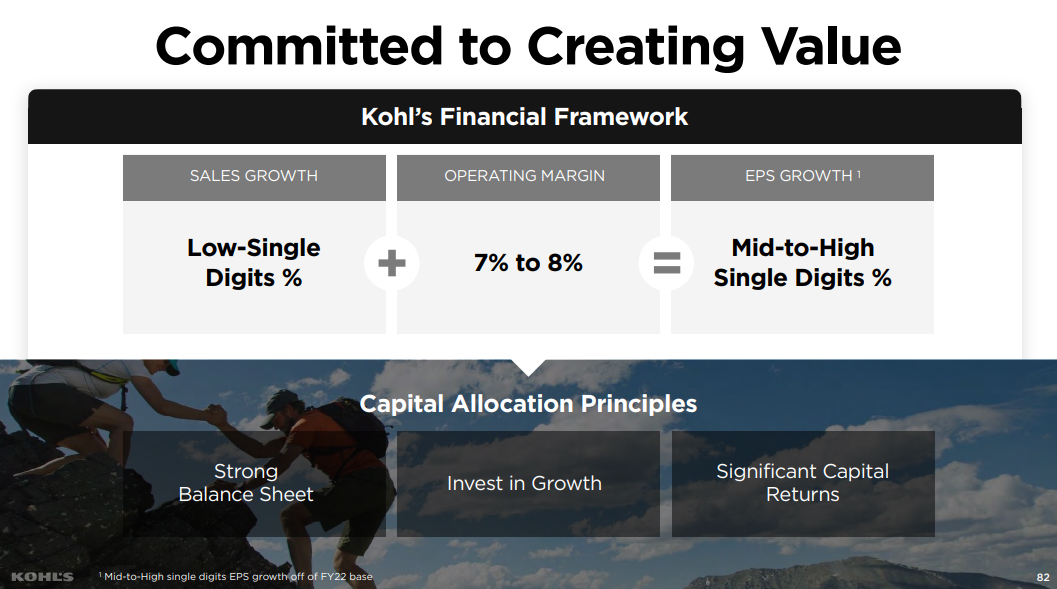

Financial Outlook

Kohl’s projects sales growth of low single digits, in percentage terms, to $19.6–19.8 billion in fiscal 2022, compared to 21.8% year-over-year growth in fiscal 2021. The retailer expects an operating margin of 7%–8% (compared to 8.6% in fiscal 2021) and gross margin of 36%–37% (compared to 38.1% in fiscal 2021).

Positive drivers for its operating margin include a projected inventory turnover of at least 4X in 2022; Kohl’s achieved this in fiscal 2021 and will continue to use dynamic inventory allocation to achieve this inventory turnover rate. The company is simplifying its pricing and promotion strategies, continuing to reduce its marketing, and driving productivity in stores and fulfillment centers by leveraging technology and self-service. Pressures on operating margin include inflation, wage investments and digital penetration.

Kohl’s plans to spend approximately $2.5 billion in capital expenditures. Management said that 65% of the spending will be across its stores and approximately 15% will be in omnichannel. The remainder will support technology including the Kohl's media network, hyper-localization and increased automation in stores. The company said that it is committed to returning capital to shareholders.

[caption id="attachment_143072" align="aligncenter" width="700"]

Source: Company reports [/caption]

Financial Outlook

Kohl’s projects sales growth of low single digits, in percentage terms, to $19.6–19.8 billion in fiscal 2022, compared to 21.8% year-over-year growth in fiscal 2021. The retailer expects an operating margin of 7%–8% (compared to 8.6% in fiscal 2021) and gross margin of 36%–37% (compared to 38.1% in fiscal 2021).

Positive drivers for its operating margin include a projected inventory turnover of at least 4X in 2022; Kohl’s achieved this in fiscal 2021 and will continue to use dynamic inventory allocation to achieve this inventory turnover rate. The company is simplifying its pricing and promotion strategies, continuing to reduce its marketing, and driving productivity in stores and fulfillment centers by leveraging technology and self-service. Pressures on operating margin include inflation, wage investments and digital penetration.

Kohl’s plans to spend approximately $2.5 billion in capital expenditures. Management said that 65% of the spending will be across its stores and approximately 15% will be in omnichannel. The remainder will support technology including the Kohl's media network, hyper-localization and increased automation in stores. The company said that it is committed to returning capital to shareholders.

[caption id="attachment_143072" align="aligncenter" width="700"] Source: Company reports [/caption]

Source: Company reports [/caption]