Nitheesh NH

Kohl’s Corporation

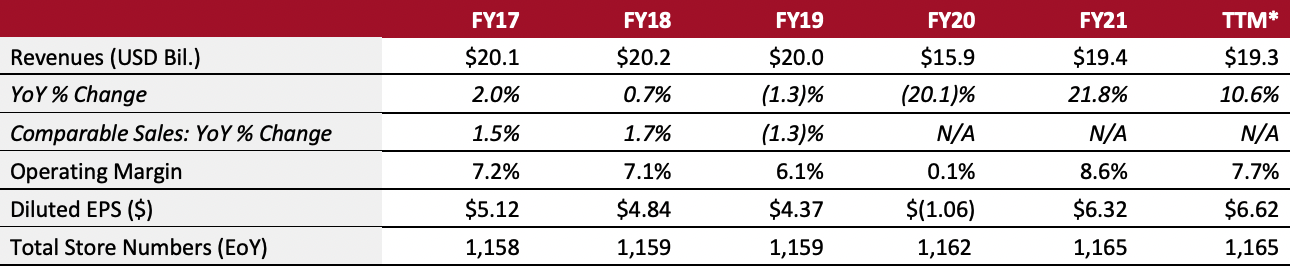

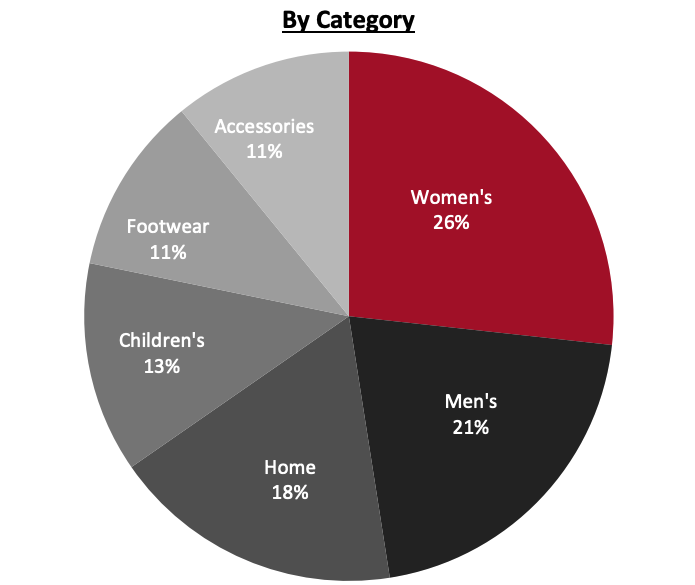

Sector: Department stores Country of operation: US Key product categories: Accessories, apparel, beauty, footwear and home Annual Metrics [caption id="attachment_151810" align="aligncenter" width="700"] Fiscal year ends on January 31 of the following calendar year

Fiscal year ends on January 31 of the following calendar year*TTM is calculated based on the month ending April 30, 2022[/caption] Summary Kohl’s is a US-based department store that sells moderately priced proprietary and national brand accessories, apparel, beauty, footwear and home products. Kohl’s was founded in 1962 and is headquartered in Menomonee Falls, Wisconsin. The operating segments of Kohl’s include accessories, children’s, footwear, home, men’s and women’s. At the Kohl’s Investor Day on March 7, 2022, the company reported it operates 1,165 stores in 49 states, with approximately 80% of Americans living within 15 miles of a Kohl’s store. The company operates an e-commerce site (www.kohls.com) and 12 FILA outlets. The company reported in its annual 10-K report for the fiscal year ending January 30, 2022, that during 2020, the company employs approximately 99,000 associates. Company Analysis Coresight Research Insight: The company identified a path to driving category growth in four main areas: beauty, active and casual, women’s and new hyper-localized stores. The company is focusing on its brand portfolio for the company’s current consumer. One of its biggest initiatives is in beauty, the company launched a partnership with Sephora, bringing 200 Sephora Beauty shop-in-shop locations inside Kohl’s department stores and online in its third quarter of fiscal 2021 (ended October 30, 2021). The company reported at its Investor Day that the partnership is helping to bring in new customers, as 25% of its Sephora shop-in-shops customers are new to Kohl’s, as well as driving business. Its stores with Sephora shop-in-shops are more productive, outperforming the balance of the chain with an incremental to mid-single-digit sales lift to overall store sales in the locations where they have launched. 50% of customers are adding new other items to their carts. Therefore, Kohl’s aims to grow its beauty business to $2 billion as it scales beauty to 850 shop-in-shops by 2023, and we expect its Sephora partnership to be one of its biggest growth drivers. Additionally, the company’s investments in its activewear are paying off—including the launch of its private-label FLX brand, and the allocation of more store space to the category. In fiscal year 2021, active sales grew by 40%, increasing penetration to 24%. The company reported it is aiming to refocus its women’s brand, by (1) becoming a leader in women’s casual by focusing on its private label brand, (2) focusing on dresses; (3) expanding swimwear and outerwear; and (4) expanding inclusivity. We expect this to be Kohl’s most challenging strategic initiative, as women’s apparel (particularly at value price points) is one of the most competitive categories including fast fashion, online retailers and mass merchants Target and Walmart. Finally, Kohl’s plans to open 100 small-format stores, averaging 35,000 square feet, over the next four years. The smaller format provides real estate flexibility, allowing the retailer to enter markets and neighborhoods that cannot support a full-size store. The retailer has been testing this smaller format in various markets over the past few years, and it is expanding the pilot based on its success. These are positive strategic goals in repositioning the product portfolio and initial consumer indicators are optimistic. Coresight Research expects that Kohl’s expansion of its partnership with Sephora to over 850 shop-in-shops by the spring of 2023, combined with its 100 small-format, hyper-localized store expansion over the next four years, will be the biggest growth drivers for the company in terms of new customers and projected revenues.

| Tailwinds | Headwinds |

|

|

- Initiatives include building a sizable beauty business with Sephora, driving continued growth in active and outdoor business, reigniting growth in the women’s business, enhancing brand portfolio, opening new stores, leading with loyalty and value, and further growing digital.

- The company reported it has taken steps in many of these areas, such as launching its strategic partnership with Sephora in 2021 by opening the first 200 shop-in-shops and offering a comprehensive digital experience, driving sales growth of more than 40% in our active and outdoor business, and introducing new brands including Tommy Hilfiger, Calvin Klein and Eddie Bauer.

- Deliver an operating margin of 7% to 8%.

- Gross margin initiatives include disciplined inventory management and increased inventory turn, efficient sourcing, and optimized pricing and promotion strategies.

- Initiatives to drive selling, general, and administrative expense efficiency are focused on labor productivity across stores and fulfillment centers, marketing, and technology expenses.

- Maintain a strong balance sheet

- Long-term objective of sustaining Kohl’s Investment Grade credit rating. Focus on gash flow generation, investing in the business, and returning significant capital to shareholders—all of which will remain important in the future.

- Foster a diverse, equitable and inclusive environment for Kohl’s associates, customers, and suppliers.

- Kohl’s has a diversity and inclusion framework that includes key initiatives across three pillars: Our People, Our Customers, and Our Communities.

- The company is building on its commitment to Environmental, Social, and Corporate Governance (“ESG”) and 2025 goals related to climate change, waste and recycling and sustainable sourcing.

Source: Company reports[/caption]

Company Developments

Source: Company reports[/caption]

Company Developments

| Date | Development |

| July 28, 2022 | Kohl’s announces it has partnered with Levi’s to reintroduce the 1990’s Levi’s SilverTab collection. Kohl’s is the exclusive wholesale partner of Levi’s SilverTab. |

| July 21, 2022 | Kohl’s announces the expansion of Kohl’s Media Network (KMN), the company’s in-house retail media agency, to further the company’s advertising opportunities and provide brands, vendors and partners an extensive portfolio of omnichannel media services. |

| July 18, 2022 | Kohl’s announces a $2 million commitment to eight nonprofit hometown partners to strengthen its support of the Milwaukee community. |

| July 11, 2022 | Kohl’s announces the launch of “Discover @ Kohl’s,” a new feature that curates dozens of emerging, established and diverse-owned brands that are new to Kohl’s, into different seasonal areas throughout the store in 600 locations and highlighted online on Kohls.com. Kohl’s announces the introduction of new brands and gender-neutral assortments to drive inclusivity and representation. |

| July 1, 2022 | Kohl’s announces that following the exclusive negotiation period with Franchise Group (“FRG”), the Kohl’s Board of Directors (the “Board”) unanimously determined to conclude its strategic review process. The current financing and retail environment was reflected in the price and terms of FRG’s most recent proposal, which was not fully executable or complete. |

| June 6, 2022 | Kohl’s announces it entered it into exclusive negotiations with Franchise Group, Inc. (“FRG”), a holding company, for a period of three weeks in relation to FRG’s proposal to acquire the company for $60.00 per share. The purpose of the exclusive period is to allow FRG and its financing partners to finalize due diligence and financing arrangements and for the parties to complete the negotiation of binding documentation. |

| May 25, 2022 | Kohl’s announces it is committed to driving growth by investing in its stores. By 2023, Sephora at Kohl’s will enter 850 doors. Kohl’s plans to open 100 new, small format stores over the next four years, reaching new customers in untapped markets. The new store growth represents a sales opportunity of more than $500 million. |

| May 11, 2022 | Kohl’s announces that based on the preliminary vote count provided by its proxy solicitor following the company’s 2022 Annual Meeting of Shareholders, Kohl’s shareholders have voted to re-elect all thirteen of its director nominees – Michael J. Bender, Peter Boneparth, Yael Cosset, Christine Day, Chuck Floyd, Michelle Gass, Margaret Jenkins, Thomas Kingsbury, Robbin Mitchell, Jonas O. Prising, John E. Schlifske, Adrianne T. Shapira, and Stephanie Streeter – to the company’s Board of Directors. |

| May 2, 2022 | Kohl’s announces the nationwide rollout of its new Kohl’s Rewards program enhancement offering all Rewards members that use their Kohl’s Card an elevated earn rate of 7.5% Kohl’s Rewards on every purchase. |

| April 29, 2022 | Kohl’s comments on the Institutional Shareholder Services (“ISS”) recommendation. Kohl’s reported it is pleased that ISS agreed that a change in Board control is unwarranted. ISS noted: “Within the context of a rapidly changing retail environment, which forced bankruptcies and liquidations of many of KSS' competitors before and during the pandemic, KSS has been able to maintain steady margins and a strong balance sheet and has generated healthy cash flow, allowing it to pay dividends and execute share repurchases. These operating results do not paint a picture of a broken company that requires sweeping changes at the top to execute a turnaround.” |

| April 21, 2022 | Kohl’s releases a presentation detailing progress on its strategy and initiatives to maximize shareholder value. This provided an overview of Kohl’s Board of Directors while evaluating the ongoing review of expressions of interest to buy the company. The company asserts that by comparison, the proposed slate nominated by Macellum Advisors GP is unqualified and inexperienced. |

| April 11, 2022 | Kohl’s mails a letter to shareholders detailing their position that their qualified Board of Directors that has the necessary skills to oversee Kohl’s evolving strategy. |

| March 31, 2022 | Kohl’s mails a letter to shareholders detailing the steps the Board has taken to maximize shareholder value, including the robust and intentional process to evaluate potential bids. |

| March 21, 2022 | Kohl’s provides an updated review of ongoing expressions of interest. The company authorized Goldman Sachs to coordinate with select bidders who have submitted indications of interest to assist with further due diligence so that they have the opportunity to refine and improve their proposals and include committed financing and binding documentation. |

| March 7, 2022 | Kohl’s holds a virtual Investor Day meeting and provides updates on its strategic growth initiatives and financial plan. |

| February 2022 | Kohl’s announces it will open 400 Sephora shop-in-shops in 2022 and 250 shop-in-shops in 2023; the company announced Sephora at Kohl’s is adding six prestige beauty brands to its assortment this spring. Murad, Clarins, Jack Black, Living Proof, Versace and Voluspa. |

| February 2022 | Kohln’s issues the following statement regarding Macellum Advisors’ announcement of its nomination of directors for election to the Kohl’s Board of Directors at the Company’s 2022 Annual Meeting of Shareholders: Kohl’s believes Macellum’s effort to take control of the Board is unjustified and counterproductive. Kohl’s appointed two of Macellum’s designees, along with an additional mutually agreed upon designee, to its Board pursuant to the 2021 settlement agreement with Macellum and certain other shareholders. All members of the Kohl’s Board, other than its CEO, are independent. Kohl’s reaffirms its commitment to maximize value for shareholders. |

| January 2022 | Kohl’s comments on Macellum’s statement and reaffirms strategic progress: The Board of Directors recently refreshed with three independent directors as part of settlement with investor group, which included Macellum, in April 2021; the company plans to share updated financial framework and capital allocation strategy at Investor Day on March 7, 2022, and Board of Management refuse to be distracted and remains focused on executing strategy to drive sustained shareholder value. |

| November 2021 | Kohl’s donates $8 million to more than 150 nonprofit organizations across the country for the holiday season. |

| October 2021 | Kohl’s announces enhancements for the holiday season including increasing the number of designated drive-up parking spots for buy online, pick up in-store and piloting self-pick up and self-return options in select stores . |

| October 2021 | Kohl’s donates $2 million to the National Alliance on Mental Illness (NAMI) to help improve and expand support services for individuals and families impacted by mental illness. |

| September 2021 | Kohl’s donates $500,000 in grants to nonprofit organizations serving the Milwaukee community. |

| July 2021 | Kohl’s announces a donation of $5 million, over three years, in support of the company’s national nonprofit partner, Alliance for a Healthier Generation, to expand and scale its family health and wellness initiative, Kohl’s Healthy at Home; the initiative, which launched in 2019, is rooted in health equity and works closely with schools and community partners to inspire families to prioritize a healthy lifestyle. |

| April 2021 | Kohl’s publishes 2020 Environmental, Social, and Governance Report. |

| April 2021 | Kohl’s partners with Tommy Hilfiger to debut in more than 600 Kohl’s stores with an expanded assortment on Kohls.com beginning fall 2021; the assortment will feature signature Tommy Hilfiger men’s sportswear styles. |

| April 2021 | Kohl’s announces the opening of its sixth e-commerce fulfillment center in Etna, Ohio to support the company’s continued online demand and digital sales acceleration; the 1.2 million square-foot facility is Kohl’s largest, most efficient fulfillment center and will be dedicated to processing, filling and shipping Kohls.com orders. |

| March 2021 | Kohl’s Cole Haan Footwear brand for women and men is available at 200 Kohl’s stores and online at Kohls.com. |

| March 2021 | Kohl’s private label, specialty athleisure brand, FLX, is available; the collection features size-inclusive assortment of modern, sustainably-focused athleisure apparel made with high-quality performance fabrics and functional details. |

| March 2021 | Kohl’s releases an updated investor presentation detailing progress on its strategy and initiatives to drive continued momentum. Kohl’s introduced a strategic framework in October 2020 focused on creating long-term shareholder value. The strategy focused on driving top-line growth and expanding operating margin to 7% to 8%. Kohl’s reports it is making significant progress, with the announcements of key strategic partnerships and recent results exceeding expectations. The Company’s partnership with Sephora is expected to drive beauty sales and new customer acquisition. |

| March 2021 | Kohl’s announces a one-year donation to the Milwaukee Public Museum, of $250,000 to support the extension of Kohl’s Thank You Thursdays, offering free museum access on the first Thursday of every month to all visitors |

| February 2021 | Kohl’s donates $400,000 to Boys & Girls Clubs of Greater Milwaukee. |

| February 2021 | Kohl’s announces a partnership to bring Eddie Bauer outdoor performance outerwear and apparel to select Kohl’s stores and on Kohl’s.com in the fall of 2021; the Kohl’s assortment will feature size-inclusive women’s, men’s and kids apparel with functional, premium quality performance features for any season and outdoors. |

| December 2020 | Kohl’s announces a partnership to bring 200 Sephora Beauty shop-in-shop locations inside of Kohl’s department store beginning in 2021 and online, with an expected total of 850 physical locations by 2023 |

| November 2020 | Kohl’s digital sales represent 32% of total sales in the third quarter of 2021, an increase of 25%; stores fulfilled nearly 40% of digital sales. |

| November 2020 | Kohl’s is named in the 2020 Dow Jones Sustainability Index (DJSI) North America by S&P Global for its sustainability performance and environmental, social and governance (ESG) commitments. |

| October 2020 | Kohl’s announces FLX, a new private-label specialty athleisure brand, which will launch in select stores and online at Kohls.com beginning March 2021. |

| October 2020 | Kohl’s partners with footwear and lifestyle brand Cole Haan, which will be available in stores in spring 2021. |

| September 2020 | Kohl’s launches Lauren Conrad Beauty, a skincare and cosmetics line featuring certified-clean, vegan and cruelty-free products. |

| September 2020 | Kohl’s launches a new loyalty program nationwide, named Kohl’s Rewards; offers a free, tender-agnostic loyalty program where consumers can earn 5% Kohl’s Cash on purchases as well as access personalized deals and a special birthday gift. |

| May 2020 | Kohl’s begins reopening stores on May 4, 2020 following temporary closures related to Covid-19. |

| March 2020 | Kohl’s closes its physical stores nationwide due to Covid-19. |

| March 2020 | With Lands’ End, Kohl’s announces a partnership to offer the retailer’s entire assortment of women’s, men’s, kids, and home merchandise on Kohls.com, which will be directly fulfilled and shipped by Lands’ End, beginning fall 2020. Kohl’s will bring Lands’ End merchandise, with a particular focus on seasonal goods for the family, including outerwear in fall/winter and swimwear in spring/summer, to 150 stores beginning fall 2020. |

| December 2019 | Kohl’s offers a two-hour window for free in-store pick up on Kohls.com orders through Christmas Eve, with most orders ready within one hour. |

| October 2019 | Kohl’s launches various brands for the holiday season, such as Nine West, Caliville, Fanatics and Cara Santana x Apt.9, among others. |

| October 2019 | Bruce Besanko retires as CFO and Jill Timm is appointed as replacement CFO, effective November 1, 2019 |

| September 2019 | Paul Gaffney is named Senior Executive Vice President and Chief Technology Officer effective mid-September 2019; Sona Chawla steps down as President at Kohl’s |

| August 2019 | In collaboration with Facebook, Kohl’s launches Curated by Kohl’s, a new initiative that features a rotating selection of products from emerging brands, allowing consumers to check out beauty products in a fun and exciting way. |

| April 2019 | Kohl’s announces that all of its stores will be accepting Amazon returns starting in July 2019. |

Source: Company reports

Management Team- Michelle Gass—CEO

- Douglas Howe—Chief Merchandising Officer

- Jill Timm—Senior Executive Vice President, CFO

- Marc Chini—Senior Executive Vice President, Chief People Officer

- Paul Gaffney—Senior Executive Vice President, CTO and Supply Chain Officer

- Greg Revelle—Senior Executive Vice President, Chief Marketing Officer

- Mark Andrew Rupe—Vice President of Investor Relations

Source: Company reports