Web Developers

On March 1, US department store retailer Kohl’s announced that it would be slimming down 12 of its stores and that, as part of a pilot program,5–10 of those stores would carve out space to house Aldi discount supermarkets. Kohl’s CEO Kevin Mansell said on the company’s fourth-quarter conference call that Aldi would be the company’s initial partner as it downsizes stores through carve-outs, but that it could lease excess space to other grocery retailers or service providers, such as fitness centers, in the future. Mansell identified such outlets as “traffic drivers” that Kohl’s knows it “can coexist together [with] for a long time.”

The announcement that Kohl’s is seeking to rightsize selected stores comes in the context of a department store sector that is increasingly recognized as overspaced.The sector has been marked by news of store closures by Macy’s, JCPenney, Sears and others, but Kohl’s has so far stood apart from those names by announcing no closure program.

Space: Small Box in a Big Box

Contrary to some media reports, Aldi will not be opening shops in any Kohl’s department stores. Instead, Kohl’s will be carving out space for separate, adjoining stores that will be leased to Aldi or, in time, other companies. So, Aldi and Kohl’s will be neighbors rather than cohabitants. Kohl’s has the advantage of being a predominantly off-mall department store retailer; we see this as one factor behind its recent strong performance. Kohl’s stores in open-air centers are fundamentally square boxes. The company’s core estate of larger stores (which are the kind we expect to see downsized) average 88,000 gross square feet. Aldi’s stores are smaller square boxes. According to two recent Aldi US real estate brochures, the company looks for stores that are 17,000–22,000 gross square feet in size. If we split the difference and assume that Aldi will take an average of 20,000 square feet of space from each of the Kohl’s stores involved in the pilot program, then the implication is that Aldi will take approximately 23% of space from each of the downsized Kohl’s stores. We provide an approximate representation of such a carve-out in the graphic below.

Source: Google StreetView/company reports/Coresight Research

This also implies that the typical Kohl’s store involved in the program will lose one of its two entrances, which will be used to provide customer entry to the new Aldi store.Aldi Hunting for Real Estate

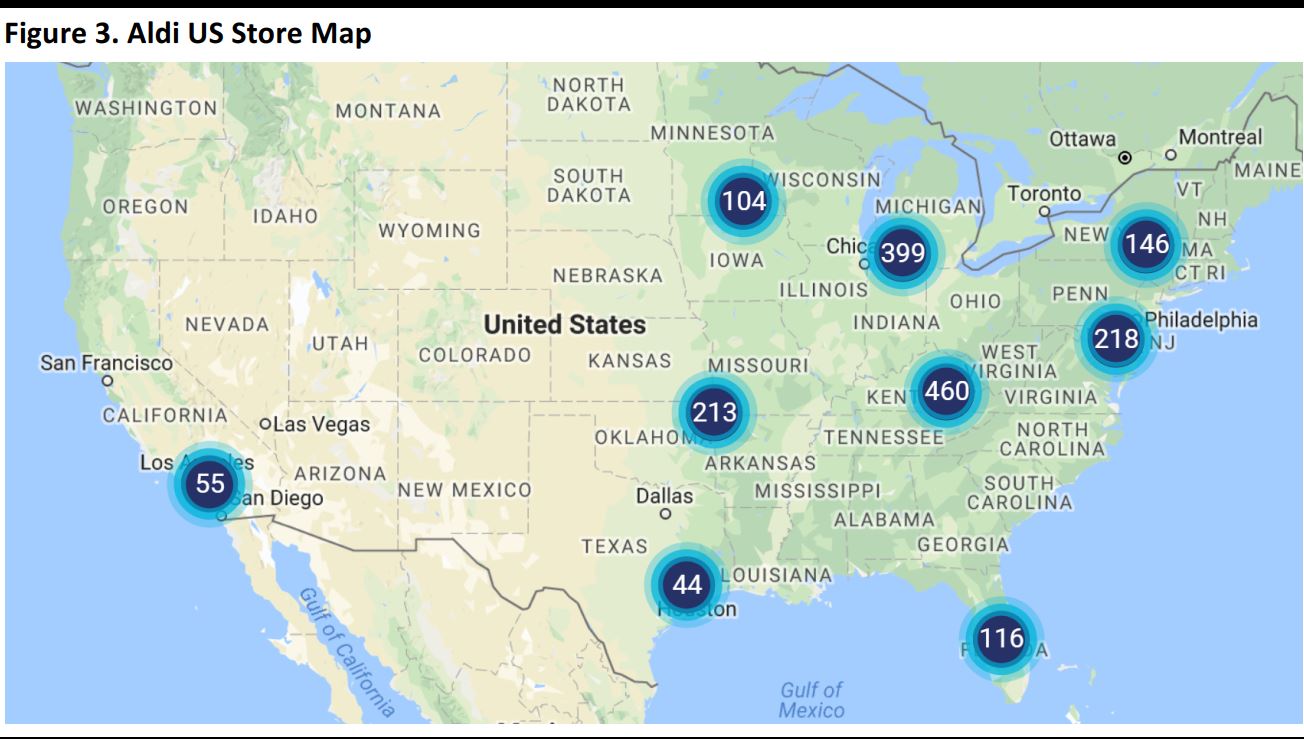

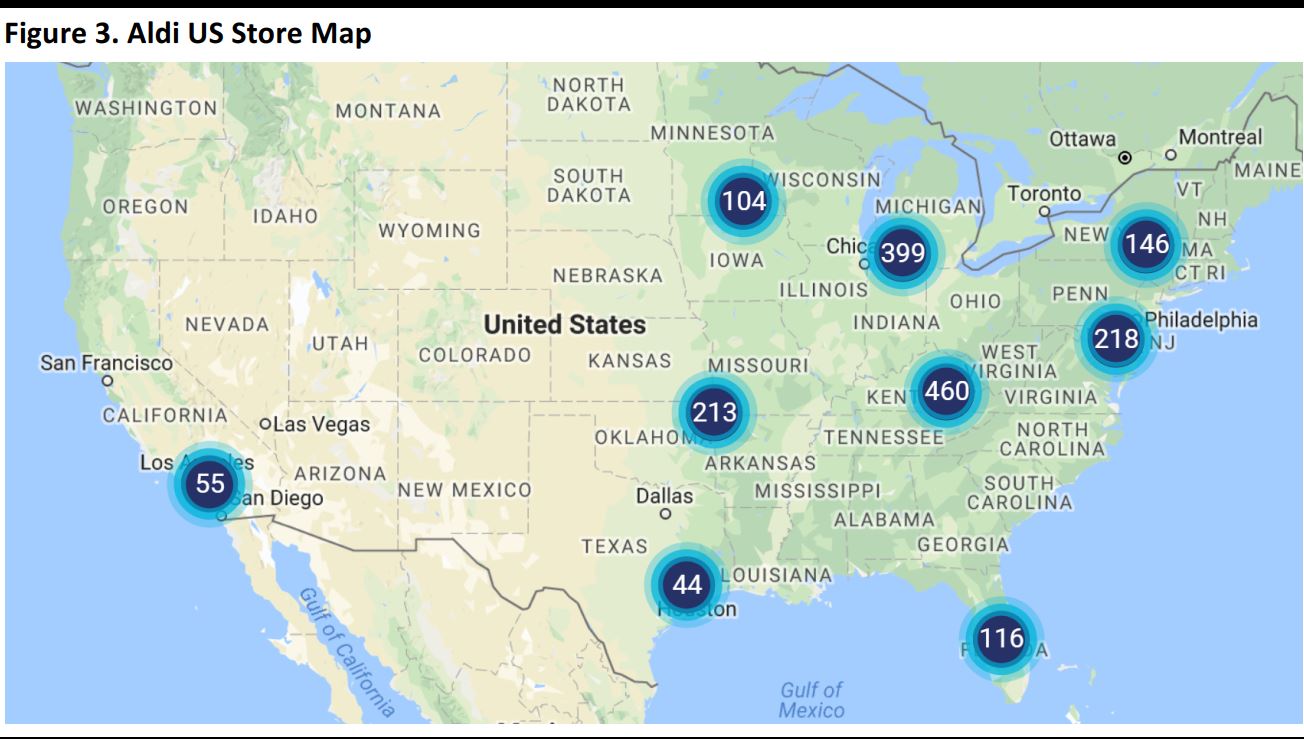

Aldi aims to operate 2,500 US stores by the end of 2022, up from a current 1,755 (per Aldi’s online store locator). We believe that Aldi opened approximately 150 US stores in 2017, and we estimate that it will open 200 more in 2018. The expansion of retailers such as Aldi, Lidl, dollar stores and off-price chains is underpinning strong demand at open-air shopping centers, which we noted in our January 2018 report What Retail Apocalypse? Reviewing Trends in US Brick-and-Mortar Retail. By carving out space for Aldi stores, Kohl’s is giving Aldi access to such open-air centers, including those where high occupancy levels mean that there are no existing retail units available for Aldi to move into. Kohl’s operates 1,158 stores in 49 US states, providing a potentially wide network of locations for Aldi to tap—although, of course, availability depends on which stores Kohl’s is willing to downsize.

Source: Company website

Aldi’s 1,755 US stores are all located in the Eastern US and California.