Source: Company reports

2015 RESULTS

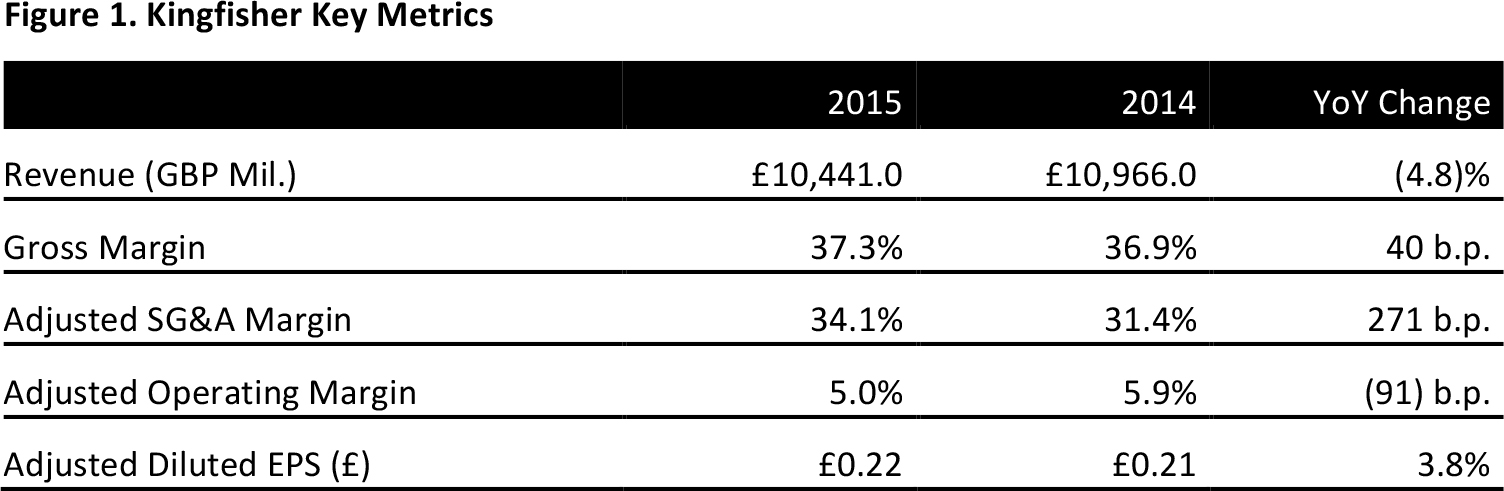

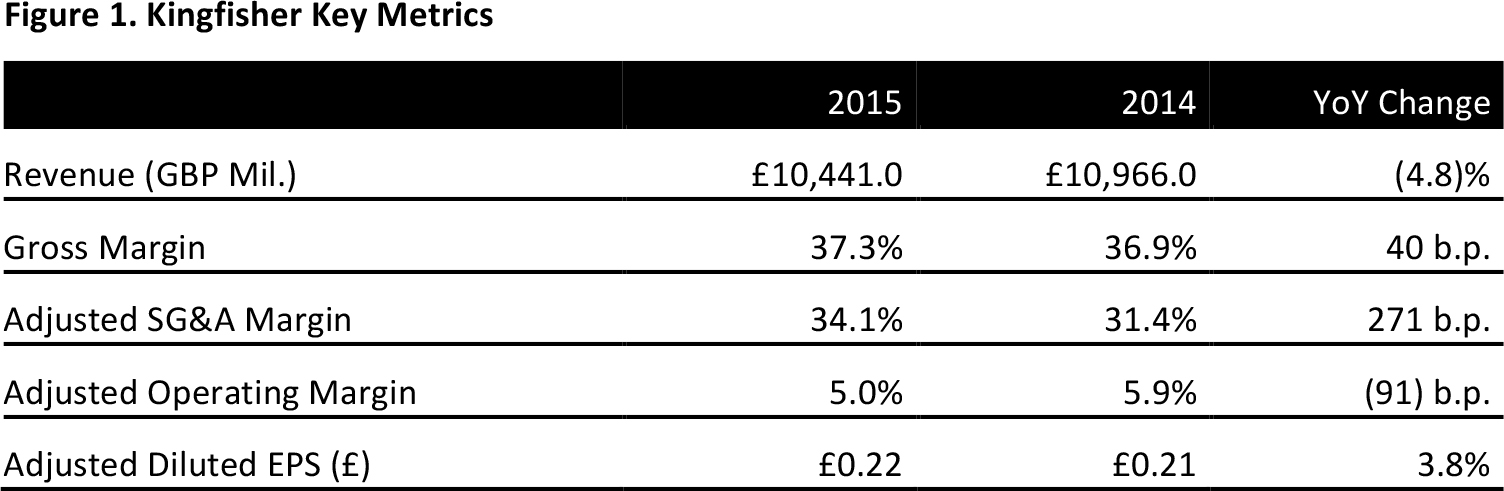

Kingfisher, the UK-based multinational home improvement retail company, reported a 2015 revenue decline of 4.8%, to £10.4 billion, above the consensus estimate of £10.3 billion. Sales were up 3.8% in constant currency and adjusted to exclude B&Q China, to £10.3 billion. Kingfisher sold 70% of its China business to Wumei Holdings Group in 2015.

The company reported operating profit before exceptional items up 0.7%, to £692.0 million, beating expectations of £682.8 million. Adjusted diluted EPS was up 3.8%, to £0.22, versus consensus of £0.21.

Profit before tax was down 20.5%, to £512.0 million, below consensus at £608.5 million. Net income was down 28.1%, to £412.0 million, below expectations at £458.3 million. Profit before tax before exceptional items, which excludes B&Q China, was down 0.1%, to £678.0 million and above consensus of £665.5 million. Retail profit, excluding B&Q China’s operating loss, was up 0.7% in reported currency and 7.4% in constant currency, to £746 million.

While the impact of unfavorable currency rates and the divestment of China operations weighed negatively on reported revenues, the strong performance of Screwfix in the UK and of the operations in Poland sustained top-line growth in constant currencies.

PERFORMANCE BY GEOGRAPHY

Sales in the UK and Ireland were up 5.5% in reported currency and 5.6% in constant currency, to £4.9 billion, with comps up 4.4%. Retail profit was up 18.0%. Results in the region, which accounts for 47% of Kingfisher’s total sales, benefited from a strong UK economy and housing market. Screwfix was the best-performing division, with total sales up 26.3%, to £1.0 billion, and comps up 15.3%. Screwfix’s performance was helped by the expansion of the store network, with 62 new store openings during the fiscal year, the strong performance of the specialist trade desk exclusive to plumbers and electricians and the growth of its multichannel sales. B&Q sales were up 1.1%, with comps up 1.9%.

Sales in France declined by 8.4% in reported currency but increased by 1.2% in constant currency, to £3.8 billion. Comps were (0.4)%. Retail profit was down 10.9% as reported and down 1.6% in constant currency, to £311 million. The company’s near-flat sales performance in France, which accounts for 36% of its total revenue, was affected by weak consumer confidence and a subdued housing market. Kingfisher operates Castorama and Brico Depot in France. A planned acquisition of Mr Bricolage was abandoned in 2015.

Kingfisher also operates in Germany, Poland, Portugal, Romania, Russia, Spain and Turkey, reported as ”Other International” in company reports. Sales in Other International were down 9.7% in reported currency but up 4.8% in constant currency, to £1.7 billion. Comps were up 2.5%. Retail profit was down 5.8% as reported and up 6.4% in constant currency, to £109 million.

GUIDANCE

In January 2016, Kingfisher announced a five-year plan to deliver an additional £500 million of sustainable annual profit by the end of year five. The plan includes a focus on Screwfix Europe, and three strategic pillars: creating a unified, unique and leading offer, investing in digital capability and optimizing operational efficiency.

In the short term, Kingfisher expects the fundamentals of the UK economic backdrop to remain positive, although the impact of the Brexit referendum is unknown, while the economic outlook for France and for the wider global economy remains uncertain.

Consensus estimates call for Kingfisher to generate £10.6 billion in revenue in 2016, along with £701 billion in EBIT and £422 million in net income.

�