*Before exceptional items

Source: Company reports/Fung Global Retail & Technology

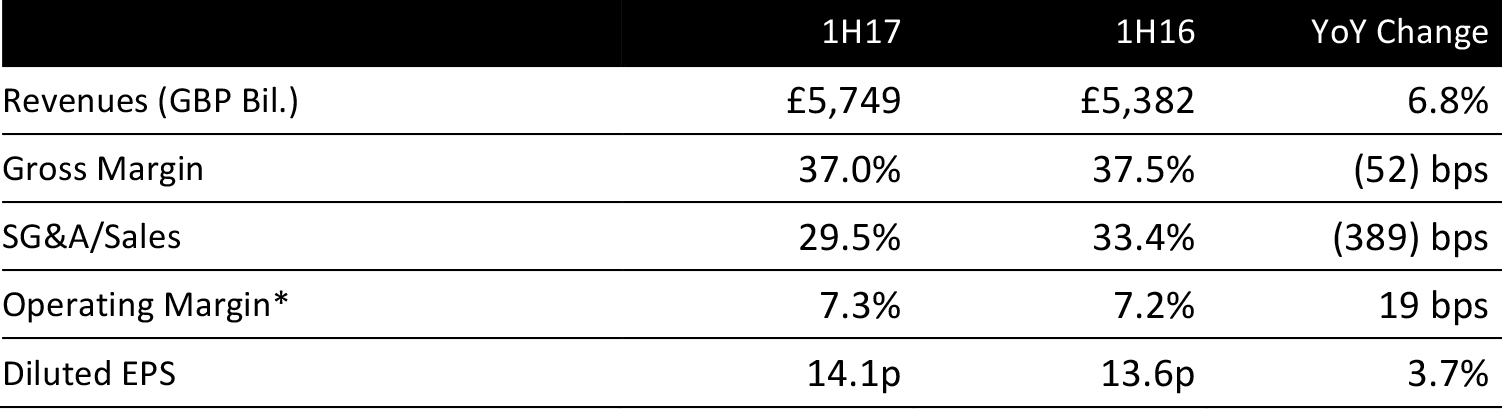

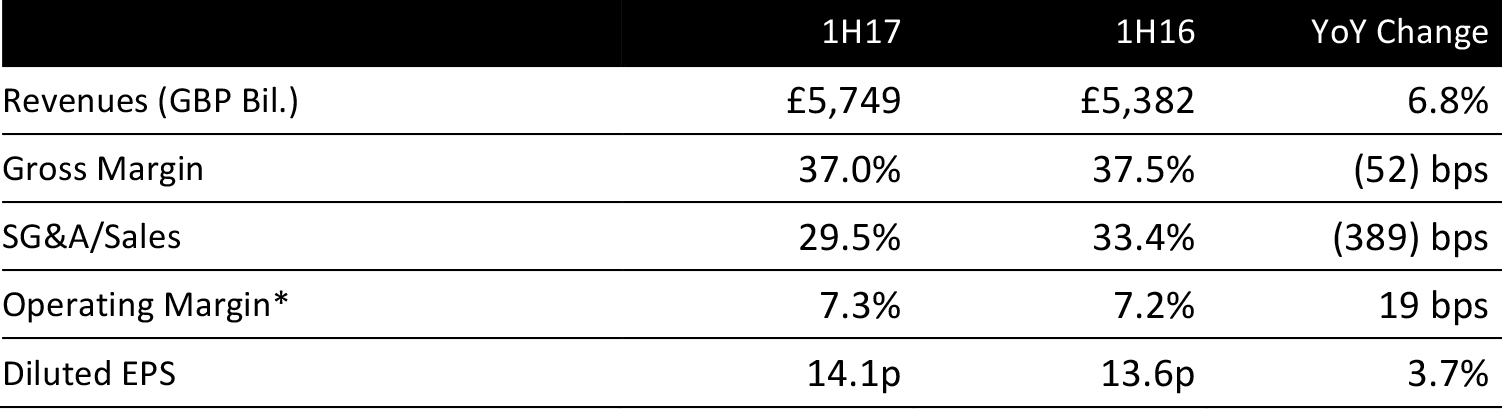

1H17 RESULTS

Kingfisher’s top line gained from the devaluation of the British pound; the reported 6.8% jump in revenues converted to 2.7% growth at constant-currency. Comparable sales growth at constant currencies was an impressive 3.3%, helped by solid underlying growth in the UK & Ireland and Poland.

The gross margin fell 100 basis points in the UK due to the growth of the Screwfix chain, clearance related to B&Q store closures and a greater contribution from online sales. Gross margins rose 70 basis points in France due to less promotional activity and tight cost control. Gross margins climbed 140 basis points in Poland on the back of strong trading.

A 389-basis-point decline in the selling, general and administrative expense (SG&A) ratio boosted the bottom line. Statutory pre-tax profit increased by 10.6%, net profit nudged up 0.9% and diluted EPS climbed 3.7% to 14.1 pence, ahead of the consensus of 13.1 pence recorded by S&P Capital IQ.

BY REGION

All the growth figures cited below are at constant currency.

In the

UK & Ireland, revenues rose 3.1% and comparable sales jumped 6.7%. This was a strong performance in a UK market where DIY appears to be out of fashion and a growing proportion of the population rent rather than own their homes.

- B&Q reported impressive comps of +4.6%, including an approximate 2% benefit from the transfer of sales from stores that were closed down. Total B&Q sales were down 1.9% because the company trimmed store numbers; 22 stores were shut in the period.

- Trade-oriented Screwfix posted a 14.7% jump in comps and total sales were up 24%. We expect comps were flattered by the maturing of space as the chain adds more stores. Screwfix is well placed to tap growing demand from trade customers, which in turn is underpinned by the increasing population of renters.

The UK and Ireland contributed 45% of group revenues.

In

France, Kingfisher sales grew by 0.3% at constant currency, but comps fell 1.6% at constant currency. The company said its total sales growth compared to a 0.2% increase in the overall home-improvement market. Industrial action and unusually wet weather hampered growth in 2Q17.

- Consumer-focused Castorama suffered a decline in total sales of 1.1% and comps were down 2.1%.

- Trade-positioned Brico Dépôt grew total sales 2.1%, helped by store openings; comps were negative at (0.9)%.

France contributed 38% of group revenues.

In Poland, sales were up 11.4% and comps grew strongly at 8.9%. Poland contributed 10% of group revenues.

Russian sales fell by 0.6% but comps rose 1.2% against demanding comparatives. Russia contributed 3% of group revenues. The remaining proportion of group revenues consists of the minor, “New Countries” segment which includes Romania, Portugal and Germany. Kingfisher did not provide sales growth figures for this segment.

STRATEGY UPDATE

The company started its “ONE Kingfisher” five-year plan in the current fiscal year. The plan aims to leverage the scale of the business and create a more unified company. We think elements of the new strategy, such as leveraging scale to create common ranges, sound familiar from the previous, “Creating the Leader,” plan.

These are the pillars of the new strategy and recent achievements within them:

- Create a unified, unique and leading offer. The company aims to offer the same products across its chains. Four percent of the costs of goods sold are now uniform across chains.

- Drive digital capability. It is implementing a unified information technology (IT) system and in 1H17 completed a unified IT platform roll-out at B&Q, and started this at Castorama in France.

- Optimize operation efficiency. Unifying around 90% of goods not for resale (i.e., procurement) will deliver cost savings. The company said Wave 1 of this plan is well advanced. Store closures at B&Q are also a part of this plan, with 65 stores scheduled to close, or 15% of total B&Q space. Eighty percent of this is complete.

In summary, Kingfisher said, “good progress” had been made against strategic milestones. The company reiterated its five-year transformation cost guidance of £800 million.

The company expects ONE Kingfisher to yield a sustained £500 million annual profit uplift by the end of the five-year period.

OUTLOOK

Kingfisher joins a growing list of UK companies that report no impact from the UK’s vote to leave the EU. They describe no impact on demand for products in the British market, despite widespread negative warnings from companies and institutions ahead of the vote. In fact, France was the country chosen by Kingfisher as having uncertain short-term prospects.

Kingfisher updated its cost guidance for the ONE Kingfisher plan for FY17; it expects transformation profit and loss (P&L) costs of around £60 million this year, with exceptional costs of up to £10 million, down from previous estimates of £50 million. Exceptional costs over the five-year period are expected to total £270 million.

For FY17, analysts expect Kingfisher to delivery GAAP EPS of 20.9 pence, up 17.2% year over year. This is derived from consensus FY17 revenues of £11.17 billion, up 6.9% year over year, and earnings before interest and tax (EBIT) of £733.5 million, up 6.0% year over year.

�