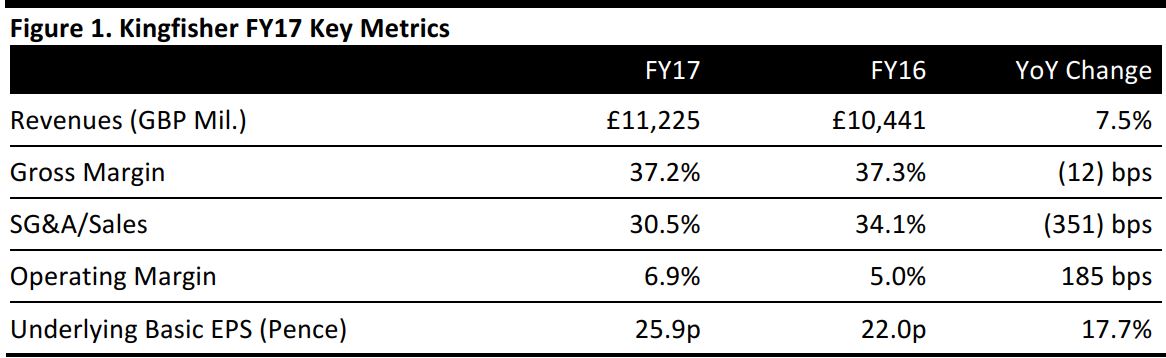

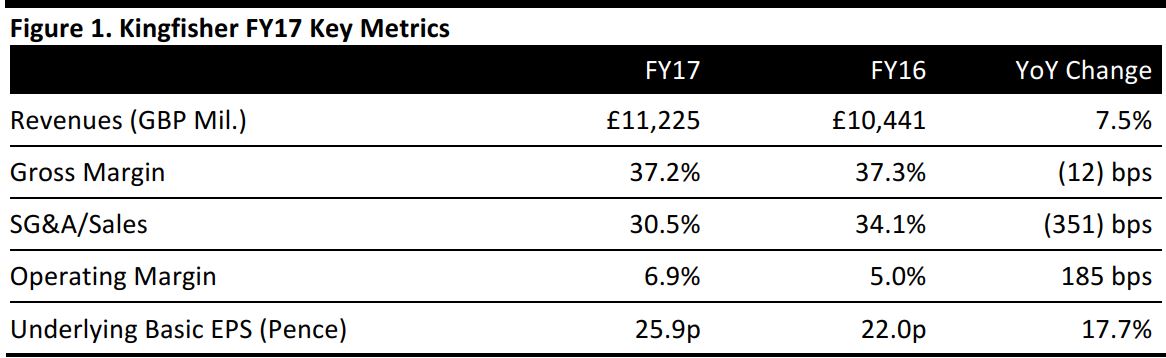

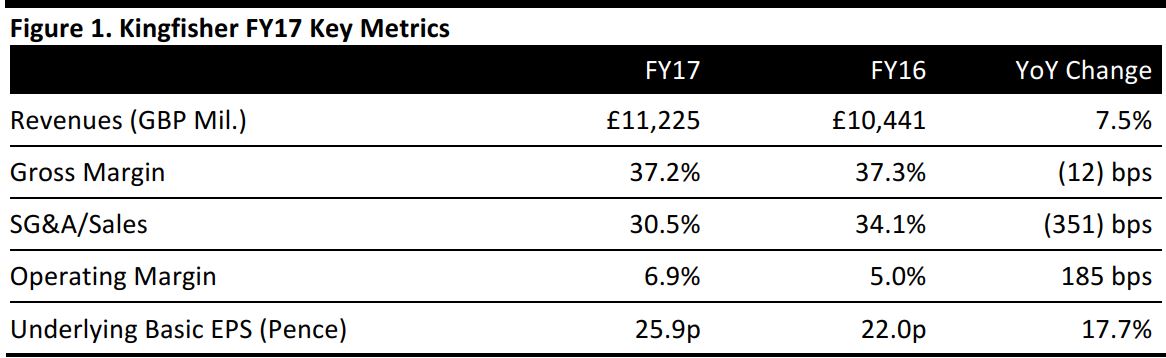

Year ended January 31

Source: Company reports/Fung Global Retail & Technology

FY17 Results

Kingfisher delivered a strong set of FY17 results for the year ended January 31, with the annualization of exceptional costs boosting statutory results. The company beat analyst expectations at both the top and bottom lines.

The weak pound flattered Kingfisher’s reported top-line results, with total sales up 7.5% on a statutory basis. On an adjusted basis, which strips out B&Q China from the prior year, total sales were up 8.7%. On an adjusted

and constant-currency basis, total sales were up 1.7% with comps up 2.3%.

Revenues of £11,225 million were marginally ahead of consensus of £11,207 million.

Gross margins were down 80 basis points in the UK, due to growth in its trade division, Screwfix, clearance related to B&Q store closures and higher online sales. Gross margins in France climbed 20 bps, on the back of less promotional activity. Gross margins in Poland were up 90 bps, due to strong top-line growth and sales-mix benefits.

SG&A expenses as a ratio of sales fell, due largely to £305 million of exceptional restructuring costs in the prior year. The effect of this was a 47% jump in operating profit after exceptionals, and a consequent 185 bps rise in the operating margin, to 6.9%. Operating profit before exceptional items came in at £692 million versus consensus of £683 million.

Statutory pretax profit and net profit both leapt by 48%.

Underlying basic EPS increased by 17.7% to 25.9 pence, ahead of consensus of 25 pence.

Performance by Segment

All the figures below are on a constant-currency basis.

UK & Ireland sales were up 2.4%, or 5.9% on a comparable basis. Comps included a 2.6% sales transfer benefit as a result of B&Q store closures. B&Q sales were down 3.3%, while Screwfix sales were up 23.2%.

French sales fell 1.4%, and were down 2.7% on a comparable basis. This was against a French home-improvement market that declined only 0.6% in total, the company said. Sales at consumer-focused Castorama were down 2.4%, and sales at heavy-end DIY chain Brico Dépôt were flat.

UK & Ireland and French comparable sales missed consensus, according to Bloomberg. These metrics weakened sequentially in the final quarter: UK & Ireland comps were 4.0% in 4Q17 versus 5.8% in 3Q17; French comps were (4.3)% in 4Q17 versus (3.6)% in 3Q17.

Polish sales jumped 10.1%, and comps rose 7.5%. Russian sales fell 0.2%, but were up 0.3% on a comparable basis.

Outlook

CEO Véronique Laury noted that the UK’s decision to leave the EU has created “uncertainty for the UK economic outlook,” and that the company “remains cautious on the outlook for France.”

The company reaffirmed its five-year financial transformation targets, which include £500 million EBIT uplift by the end of FY21.

For the fiscal year ending January 2018, analysts expect Kingfisher to grow revenues by 4.4%, EBIT by 0.6% and adjusted EPS by 8.6%.