albert Chan

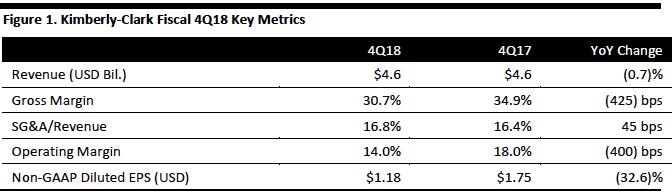

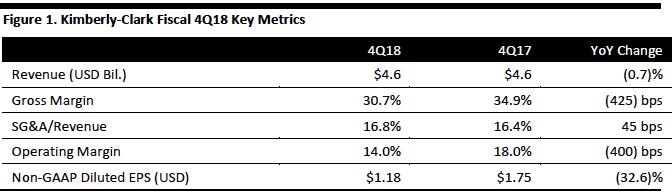

[caption id="attachment_67133" align="aligncenter" width="672"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

Kimberly-Clark reported sales of $4.6 billion for the three months ended December 31, 2018, down 1% year over year due to the impact of currency exchange rates. Gross margin decreased by 425 basis points to 30.7% from a year ago. Operating profit was $639 million, down 23% year over year due to higher input costs and changes in currency rates. Operating margin decreased 400 basis points year over year to 14.0%. Non-GAAP diluted EPS decreased 32.6% to $1.18 year over year. Below we outline the performance of three business segments: personal care, consumer tissue and K-C professional.

Personal Care

The personal care segment reported sales of $2.2 billion, down 2% year over year, and operating profit of $436 million, down 11% due to higher input costs and operating expenses as well as currency exchange effects.

Higher sales volumes drove North America sales, increasing 4% year over year, driven by growth in Pull-Ups training pants, GoodNites youth pants and Depend adult care products. Developed markets outside North America saw sales decrease 4% while net selling prices dropped slightly.

Developing and emerging markets recorded a 9% decrease in sales as currency rates were particularly unfavorable in Latin America. China saw both net selling prices and volumes fall. But sales volumes increased in ASEAN and Eastern Europe markets.

Consumer Tissue

The consumer tissue segment reported sales of $1.5 billion, which was essentially even year over year with net selling prices rising.

North America reported a 2% increase in sales while other developed markets outside North America saw sales fall 2%. Developing and emerging markets decreased 3% due to unfavorable currency rates, particularly in Latin America.

K-C Professional

The K-C Professional segment reported sales of $0.8 billion, up 2% year over year, and operating profit of $151 million, down 3% due to higher input costs and currency exchange effects.

North America reported a 6% increase in sales with volumes up 3%, driven by stronger demand for washroom and safety products. Other developed markets outside North America recorded a 3% decrease in sales as sales volumes fell.

Developing and emerging markets saw sales decrease 4% due to the negative impact of currency exchange rates.

Outlook

The company provided the following guidance for 2019:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Kimberly-Clark reported sales of $4.6 billion for the three months ended December 31, 2018, down 1% year over year due to the impact of currency exchange rates. Gross margin decreased by 425 basis points to 30.7% from a year ago. Operating profit was $639 million, down 23% year over year due to higher input costs and changes in currency rates. Operating margin decreased 400 basis points year over year to 14.0%. Non-GAAP diluted EPS decreased 32.6% to $1.18 year over year. Below we outline the performance of three business segments: personal care, consumer tissue and K-C professional.

Personal Care

The personal care segment reported sales of $2.2 billion, down 2% year over year, and operating profit of $436 million, down 11% due to higher input costs and operating expenses as well as currency exchange effects.

Higher sales volumes drove North America sales, increasing 4% year over year, driven by growth in Pull-Ups training pants, GoodNites youth pants and Depend adult care products. Developed markets outside North America saw sales decrease 4% while net selling prices dropped slightly.

Developing and emerging markets recorded a 9% decrease in sales as currency rates were particularly unfavorable in Latin America. China saw both net selling prices and volumes fall. But sales volumes increased in ASEAN and Eastern Europe markets.

Consumer Tissue

The consumer tissue segment reported sales of $1.5 billion, which was essentially even year over year with net selling prices rising.

North America reported a 2% increase in sales while other developed markets outside North America saw sales fall 2%. Developing and emerging markets decreased 3% due to unfavorable currency rates, particularly in Latin America.

K-C Professional

The K-C Professional segment reported sales of $0.8 billion, up 2% year over year, and operating profit of $151 million, down 3% due to higher input costs and currency exchange effects.

North America reported a 6% increase in sales with volumes up 3%, driven by stronger demand for washroom and safety products. Other developed markets outside North America recorded a 3% decrease in sales as sales volumes fell.

Developing and emerging markets saw sales decrease 4% due to the negative impact of currency exchange rates.

Outlook

The company provided the following guidance for 2019:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Kimberly-Clark reported sales of $4.6 billion for the three months ended December 31, 2018, down 1% year over year due to the impact of currency exchange rates. Gross margin decreased by 425 basis points to 30.7% from a year ago. Operating profit was $639 million, down 23% year over year due to higher input costs and changes in currency rates. Operating margin decreased 400 basis points year over year to 14.0%. Non-GAAP diluted EPS decreased 32.6% to $1.18 year over year. Below we outline the performance of three business segments: personal care, consumer tissue and K-C professional.

Personal Care

The personal care segment reported sales of $2.2 billion, down 2% year over year, and operating profit of $436 million, down 11% due to higher input costs and operating expenses as well as currency exchange effects.

Higher sales volumes drove North America sales, increasing 4% year over year, driven by growth in Pull-Ups training pants, GoodNites youth pants and Depend adult care products. Developed markets outside North America saw sales decrease 4% while net selling prices dropped slightly.

Developing and emerging markets recorded a 9% decrease in sales as currency rates were particularly unfavorable in Latin America. China saw both net selling prices and volumes fall. But sales volumes increased in ASEAN and Eastern Europe markets.

Consumer Tissue

The consumer tissue segment reported sales of $1.5 billion, which was essentially even year over year with net selling prices rising.

North America reported a 2% increase in sales while other developed markets outside North America saw sales fall 2%. Developing and emerging markets decreased 3% due to unfavorable currency rates, particularly in Latin America.

K-C Professional

The K-C Professional segment reported sales of $0.8 billion, up 2% year over year, and operating profit of $151 million, down 3% due to higher input costs and currency exchange effects.

North America reported a 6% increase in sales with volumes up 3%, driven by stronger demand for washroom and safety products. Other developed markets outside North America recorded a 3% decrease in sales as sales volumes fell.

Developing and emerging markets saw sales decrease 4% due to the negative impact of currency exchange rates.

Outlook

The company provided the following guidance for 2019:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Kimberly-Clark reported sales of $4.6 billion for the three months ended December 31, 2018, down 1% year over year due to the impact of currency exchange rates. Gross margin decreased by 425 basis points to 30.7% from a year ago. Operating profit was $639 million, down 23% year over year due to higher input costs and changes in currency rates. Operating margin decreased 400 basis points year over year to 14.0%. Non-GAAP diluted EPS decreased 32.6% to $1.18 year over year. Below we outline the performance of three business segments: personal care, consumer tissue and K-C professional.

Personal Care

The personal care segment reported sales of $2.2 billion, down 2% year over year, and operating profit of $436 million, down 11% due to higher input costs and operating expenses as well as currency exchange effects.

Higher sales volumes drove North America sales, increasing 4% year over year, driven by growth in Pull-Ups training pants, GoodNites youth pants and Depend adult care products. Developed markets outside North America saw sales decrease 4% while net selling prices dropped slightly.

Developing and emerging markets recorded a 9% decrease in sales as currency rates were particularly unfavorable in Latin America. China saw both net selling prices and volumes fall. But sales volumes increased in ASEAN and Eastern Europe markets.

Consumer Tissue

The consumer tissue segment reported sales of $1.5 billion, which was essentially even year over year with net selling prices rising.

North America reported a 2% increase in sales while other developed markets outside North America saw sales fall 2%. Developing and emerging markets decreased 3% due to unfavorable currency rates, particularly in Latin America.

K-C Professional

The K-C Professional segment reported sales of $0.8 billion, up 2% year over year, and operating profit of $151 million, down 3% due to higher input costs and currency exchange effects.

North America reported a 6% increase in sales with volumes up 3%, driven by stronger demand for washroom and safety products. Other developed markets outside North America recorded a 3% decrease in sales as sales volumes fell.

Developing and emerging markets saw sales decrease 4% due to the negative impact of currency exchange rates.

Outlook

The company provided the following guidance for 2019:

- Net sales are anticipated to fall 1–2%, as foreign exchange rates continue to be unfavorable and the 2018 Global Restructuring Program will dispose of less profitable businesses, mostly in K-C Professional.

- Adjusted operating profit is anticipated to grow 1-4%, due to cost savings from the FORCE program and the 2018 Global Restructuring Program.

- Adjusted earnings per share will be $6.50 to $6.70.

- The dividend will rise 3%.

- Grow sales and organic sales by 1–3% annually.

- Grow adjusted earnings per share by mid-single digits annually.

- Dividend growth to be in line with the adjusted earnings per share growth.