DIpil Das

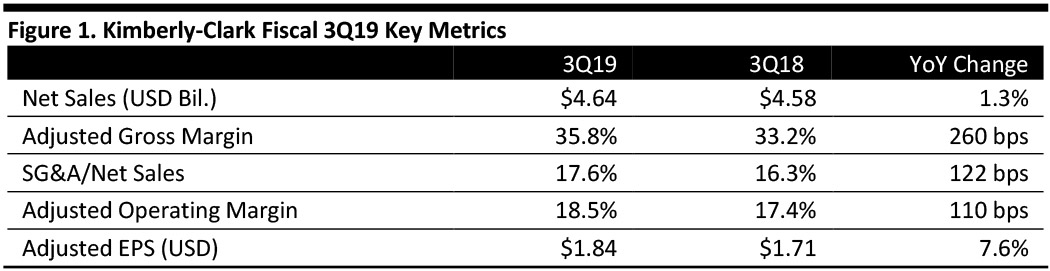

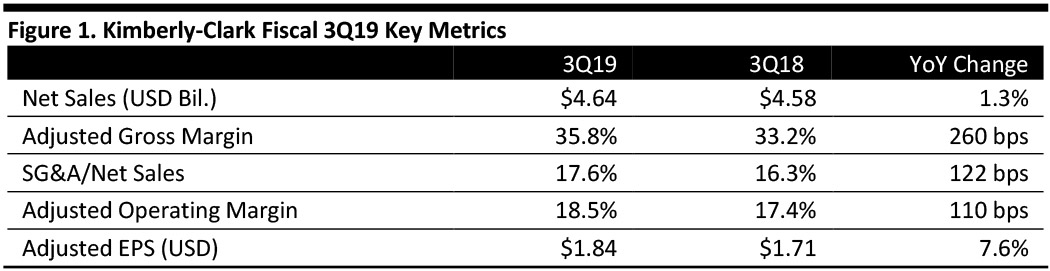

[caption id="attachment_98482" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

3Q19 Results

Kimberly-Clark reported net sales of $4.64 billion for the three months ended September 30, 2019, an increase of 1.3% compared to the same period last year, roughly in line with the consensus estimates of $4.65 billion.Currency effects reduced sales by 2%, and organic sales (at constant exchange rates) rose 4%. The adjusted gross margin expanded 260 basis points (bps) year over year to 35.8%, and the adjusted operating margin expanded 110 bps to 18.5%. Adjusted EPS increased 7.6% year over year to $1.84, ahead of the consensus estimate of $1.80. Below, we outline the performance of three business segments: personal care, consumer tissue and K-C Professional.

Personal Care

The personal care segment reported net sales of $2.3 billion, with net selling prices increasing 3%, volumes increasing 1% and product mix improving 1%. Changes in currency rates reduced sales by 3%. The operating margin expanded 60 basis points to 21.3%.

Sales in North America grew 4% year over year with net selling prices increasing 2% and product mix improving 1%, both driven by baby and child care, while volumes rose 1%. Volumes grew by double digits in adult care but were down mid-single digits in baby and child compared with a mid-single digit increase in the same period last year.

Sales in developing and emerging markets increased 3%. While net selling prices rose 6% and the product mix improved 1%, currency rates reduced sales by 5%. Volumes were even year-on-year. Higher net selling prices mostly occurred in Argentina, the Middle East/Eastern Europe/Africa and China. The company’s segment volumes increased in Eastern Europe, ASEAN and South Africa, but fell in Latin America.

Sales in developed markets outside North America (Australia, Korea and Western/Central Europe) fell 3%. Volumes rose 1% and the product mix improved 2%, but sales were negatively impacted by 6% by currency rates.

Consumer Tissue

The company reported segment sales of $1.5 billion, an increase of 1% year over year. Changes in currency rates reduced sales by 2%. Net selling prices increased 5% while volumes declined 2%. The operating margin expanded 340 bps to 17.8%, led by higher net selling prices, cost savings and lower input costs.

Sales in North America increased 3%. Net selling prices rose 8% while volumes fell 4% and product mix was off 1%.

Sales in developing and emerging markets increased 1%. While currency rates negatively impacted sales by 2%, net selling prices and product mix each improved by 1%.

Sales in developed markets outside North America fell 4%, including a 5% negative impact from currency rates offset by a 2% increase in net selling prices.

K-C Professional

K-C Professional segment sales fell 1% to $839 million. Changes in currency rates along with the 2018 Global Restructuring Program each reduced sales by 2%. Net selling prices increased more than 3% while product mix improved 1%, with volumes down 2%. Third quarter operating margin expanded 210 bps to 21.0%, driven by increased net selling prices and cost savings.

Sales in North America increased 4%. While net selling prices rose 4% and volumes increased by 1%, business exits along with the 2018 Global Restructuring Program reduced sales by roughly 2%

Sales in developing and emerging markets slipped 2%, including a 2% negative impact from currency rates. Volumes declined 5% while net selling prices rose 4%.

Sales in developed markets outside North America fell 7%, including a 5% negative impact from currency rates and the 2018 Global Restructuring Program reducing sales by 1%, offset by a 2% increase in net selling prices. Volumes fell 7% while the product mix improved 4% and net selling prices rose 2%.

Outlook

The company provided the following guidance for fiscal 2019:

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Kimberly-Clark reported net sales of $4.64 billion for the three months ended September 30, 2019, an increase of 1.3% compared to the same period last year, roughly in line with the consensus estimates of $4.65 billion.Currency effects reduced sales by 2%, and organic sales (at constant exchange rates) rose 4%. The adjusted gross margin expanded 260 basis points (bps) year over year to 35.8%, and the adjusted operating margin expanded 110 bps to 18.5%. Adjusted EPS increased 7.6% year over year to $1.84, ahead of the consensus estimate of $1.80. Below, we outline the performance of three business segments: personal care, consumer tissue and K-C Professional.

Personal Care

The personal care segment reported net sales of $2.3 billion, with net selling prices increasing 3%, volumes increasing 1% and product mix improving 1%. Changes in currency rates reduced sales by 3%. The operating margin expanded 60 basis points to 21.3%.

Sales in North America grew 4% year over year with net selling prices increasing 2% and product mix improving 1%, both driven by baby and child care, while volumes rose 1%. Volumes grew by double digits in adult care but were down mid-single digits in baby and child compared with a mid-single digit increase in the same period last year.

Sales in developing and emerging markets increased 3%. While net selling prices rose 6% and the product mix improved 1%, currency rates reduced sales by 5%. Volumes were even year-on-year. Higher net selling prices mostly occurred in Argentina, the Middle East/Eastern Europe/Africa and China. The company’s segment volumes increased in Eastern Europe, ASEAN and South Africa, but fell in Latin America.

Sales in developed markets outside North America (Australia, Korea and Western/Central Europe) fell 3%. Volumes rose 1% and the product mix improved 2%, but sales were negatively impacted by 6% by currency rates.

Consumer Tissue

The company reported segment sales of $1.5 billion, an increase of 1% year over year. Changes in currency rates reduced sales by 2%. Net selling prices increased 5% while volumes declined 2%. The operating margin expanded 340 bps to 17.8%, led by higher net selling prices, cost savings and lower input costs.

Sales in North America increased 3%. Net selling prices rose 8% while volumes fell 4% and product mix was off 1%.

Sales in developing and emerging markets increased 1%. While currency rates negatively impacted sales by 2%, net selling prices and product mix each improved by 1%.

Sales in developed markets outside North America fell 4%, including a 5% negative impact from currency rates offset by a 2% increase in net selling prices.

K-C Professional

K-C Professional segment sales fell 1% to $839 million. Changes in currency rates along with the 2018 Global Restructuring Program each reduced sales by 2%. Net selling prices increased more than 3% while product mix improved 1%, with volumes down 2%. Third quarter operating margin expanded 210 bps to 21.0%, driven by increased net selling prices and cost savings.

Sales in North America increased 4%. While net selling prices rose 4% and volumes increased by 1%, business exits along with the 2018 Global Restructuring Program reduced sales by roughly 2%

Sales in developing and emerging markets slipped 2%, including a 2% negative impact from currency rates. Volumes declined 5% while net selling prices rose 4%.

Sales in developed markets outside North America fell 7%, including a 5% negative impact from currency rates and the 2018 Global Restructuring Program reducing sales by 1%, offset by a 2% increase in net selling prices. Volumes fell 7% while the product mix improved 4% and net selling prices rose 2%.

Outlook

The company provided the following guidance for fiscal 2019:

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Kimberly-Clark reported net sales of $4.64 billion for the three months ended September 30, 2019, an increase of 1.3% compared to the same period last year, roughly in line with the consensus estimates of $4.65 billion.Currency effects reduced sales by 2%, and organic sales (at constant exchange rates) rose 4%. The adjusted gross margin expanded 260 basis points (bps) year over year to 35.8%, and the adjusted operating margin expanded 110 bps to 18.5%. Adjusted EPS increased 7.6% year over year to $1.84, ahead of the consensus estimate of $1.80. Below, we outline the performance of three business segments: personal care, consumer tissue and K-C Professional.

Personal Care

The personal care segment reported net sales of $2.3 billion, with net selling prices increasing 3%, volumes increasing 1% and product mix improving 1%. Changes in currency rates reduced sales by 3%. The operating margin expanded 60 basis points to 21.3%.

Sales in North America grew 4% year over year with net selling prices increasing 2% and product mix improving 1%, both driven by baby and child care, while volumes rose 1%. Volumes grew by double digits in adult care but were down mid-single digits in baby and child compared with a mid-single digit increase in the same period last year.

Sales in developing and emerging markets increased 3%. While net selling prices rose 6% and the product mix improved 1%, currency rates reduced sales by 5%. Volumes were even year-on-year. Higher net selling prices mostly occurred in Argentina, the Middle East/Eastern Europe/Africa and China. The company’s segment volumes increased in Eastern Europe, ASEAN and South Africa, but fell in Latin America.

Sales in developed markets outside North America (Australia, Korea and Western/Central Europe) fell 3%. Volumes rose 1% and the product mix improved 2%, but sales were negatively impacted by 6% by currency rates.

Consumer Tissue

The company reported segment sales of $1.5 billion, an increase of 1% year over year. Changes in currency rates reduced sales by 2%. Net selling prices increased 5% while volumes declined 2%. The operating margin expanded 340 bps to 17.8%, led by higher net selling prices, cost savings and lower input costs.

Sales in North America increased 3%. Net selling prices rose 8% while volumes fell 4% and product mix was off 1%.

Sales in developing and emerging markets increased 1%. While currency rates negatively impacted sales by 2%, net selling prices and product mix each improved by 1%.

Sales in developed markets outside North America fell 4%, including a 5% negative impact from currency rates offset by a 2% increase in net selling prices.

K-C Professional

K-C Professional segment sales fell 1% to $839 million. Changes in currency rates along with the 2018 Global Restructuring Program each reduced sales by 2%. Net selling prices increased more than 3% while product mix improved 1%, with volumes down 2%. Third quarter operating margin expanded 210 bps to 21.0%, driven by increased net selling prices and cost savings.

Sales in North America increased 4%. While net selling prices rose 4% and volumes increased by 1%, business exits along with the 2018 Global Restructuring Program reduced sales by roughly 2%

Sales in developing and emerging markets slipped 2%, including a 2% negative impact from currency rates. Volumes declined 5% while net selling prices rose 4%.

Sales in developed markets outside North America fell 7%, including a 5% negative impact from currency rates and the 2018 Global Restructuring Program reducing sales by 1%, offset by a 2% increase in net selling prices. Volumes fell 7% while the product mix improved 4% and net selling prices rose 2%.

Outlook

The company provided the following guidance for fiscal 2019:

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Kimberly-Clark reported net sales of $4.64 billion for the three months ended September 30, 2019, an increase of 1.3% compared to the same period last year, roughly in line with the consensus estimates of $4.65 billion.Currency effects reduced sales by 2%, and organic sales (at constant exchange rates) rose 4%. The adjusted gross margin expanded 260 basis points (bps) year over year to 35.8%, and the adjusted operating margin expanded 110 bps to 18.5%. Adjusted EPS increased 7.6% year over year to $1.84, ahead of the consensus estimate of $1.80. Below, we outline the performance of three business segments: personal care, consumer tissue and K-C Professional.

Personal Care

The personal care segment reported net sales of $2.3 billion, with net selling prices increasing 3%, volumes increasing 1% and product mix improving 1%. Changes in currency rates reduced sales by 3%. The operating margin expanded 60 basis points to 21.3%.

Sales in North America grew 4% year over year with net selling prices increasing 2% and product mix improving 1%, both driven by baby and child care, while volumes rose 1%. Volumes grew by double digits in adult care but were down mid-single digits in baby and child compared with a mid-single digit increase in the same period last year.

Sales in developing and emerging markets increased 3%. While net selling prices rose 6% and the product mix improved 1%, currency rates reduced sales by 5%. Volumes were even year-on-year. Higher net selling prices mostly occurred in Argentina, the Middle East/Eastern Europe/Africa and China. The company’s segment volumes increased in Eastern Europe, ASEAN and South Africa, but fell in Latin America.

Sales in developed markets outside North America (Australia, Korea and Western/Central Europe) fell 3%. Volumes rose 1% and the product mix improved 2%, but sales were negatively impacted by 6% by currency rates.

Consumer Tissue

The company reported segment sales of $1.5 billion, an increase of 1% year over year. Changes in currency rates reduced sales by 2%. Net selling prices increased 5% while volumes declined 2%. The operating margin expanded 340 bps to 17.8%, led by higher net selling prices, cost savings and lower input costs.

Sales in North America increased 3%. Net selling prices rose 8% while volumes fell 4% and product mix was off 1%.

Sales in developing and emerging markets increased 1%. While currency rates negatively impacted sales by 2%, net selling prices and product mix each improved by 1%.

Sales in developed markets outside North America fell 4%, including a 5% negative impact from currency rates offset by a 2% increase in net selling prices.

K-C Professional

K-C Professional segment sales fell 1% to $839 million. Changes in currency rates along with the 2018 Global Restructuring Program each reduced sales by 2%. Net selling prices increased more than 3% while product mix improved 1%, with volumes down 2%. Third quarter operating margin expanded 210 bps to 21.0%, driven by increased net selling prices and cost savings.

Sales in North America increased 4%. While net selling prices rose 4% and volumes increased by 1%, business exits along with the 2018 Global Restructuring Program reduced sales by roughly 2%

Sales in developing and emerging markets slipped 2%, including a 2% negative impact from currency rates. Volumes declined 5% while net selling prices rose 4%.

Sales in developed markets outside North America fell 7%, including a 5% negative impact from currency rates and the 2018 Global Restructuring Program reducing sales by 1%, offset by a 2% increase in net selling prices. Volumes fell 7% while the product mix improved 4% and net selling prices rose 2%.

Outlook

The company provided the following guidance for fiscal 2019:

- Net sales to be down slightly year on year.

- Organic sales growth of 3-4%, up from the previous estimate of 3%.

- Adjusted operating profit growth increased to 4-5%, versus the prior guidance of 3-5%.

- Currency effects to be slightly more unfavorable than previously assumed.

- Adjusted earnings per share of $6.75-6.90, up from prior guidance of $6.65-6.80.