Nitheesh NH

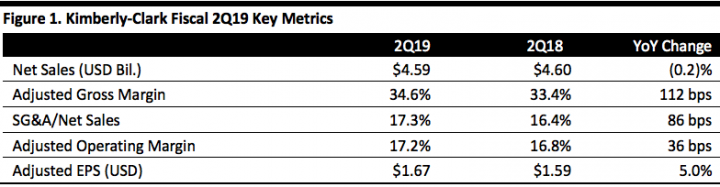

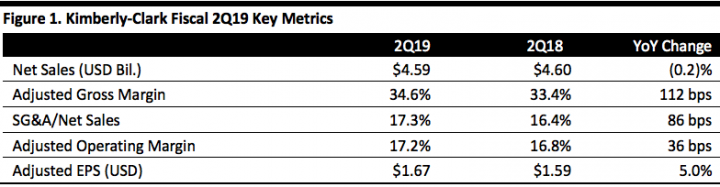

[caption id="attachment_93495" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

Kimberly-Clark reported net sales of $4.6 billion for the three months ended June 30, 2019, a decrease of 0.2% compared to the same period last year, roughly in line with consensus estimates. Currency effects reduced sales by 5%, and organic sales (at constant exchange rates) rose 5%, beating the consensus of 3.2% growth. The adjusted gross margin expanded 112 basis points (bps) year over year to 34.6%, beating the consensus of 33.8%. However, the adjusted operating margin expanded by only 36 bps to 17.2%, slightly missing the consensus of 17.3%, due to higher marketing, research and general expenses. Adjusted EPS increased 5.0% year over year to $1.67, ahead of the consensus estimate of $1.61. Below, we outline the performance of three business segments: personal care, consumer tissue and K-C Professional.

Personal Care

The personal care segment reported net sales of $2.3 billion, beating the consensus of $2.2 billion, with net selling prices increasing approximately 5%, volumes increasing 1% and product mix improving 1%. Changes in currency rates reduced sales by 6%. The operating margin expanded 79 basis points to 21.2%.

Sales in North America grew 5% year over year with net selling prices increasing 3%, driven by baby and child care, while volumes rose 3%. Volumes grew by high-single digits in adult care, including benefits from category growth, innovations and increased marketing support. Volumes increased low-single digits in the baby and child care segments and fell mid-single digits in feminine care.

Sales in developing and emerging markets fell 1%. Currency rates reduced sales by 13%, including significant declines in Latin America. Net selling prices increased 11% and product mix improved 2%, while volumes were flat year-on-year. The higher net selling prices were primarily in Latin America and secondarily in China and the Middle East/Eastern Europe/Africa. The company’s segment volumes increased in Eastern Europe, ASEAN and South Africa, but fell in Latin America and China.

Sales in developed markets outside North America (Australia, Korea and Western/Central Europe) fell 6%. Volumes and product mix each improved 1% but experienced a negative impact from currency rates.

Consumer Tissue

The company reported segment sales of $1.5 billion, flat year-on-year and in line with the consensus. Changes in currency rates reduced sales 4%. Net selling prices increased 5% while product mix improved slightly and volumes declined 2%. The operating margin expanded 95 basis points to 15%, led by topline growth and cost savings, partially offset by input cost inflation, other manufacturing cost increases, unfavorable currencies, lower volumes and higher general and administrative costs.

Sales in North America increased 5%. Net selling prices rose 7% while volumes fell 2%.

Sales in developing and emerging markets decreased 4%. Currency rates negatively impacted sales by 8%, primarily in Latin America. Net selling prices increased 5% while product mix improved 1%, and volumes fell 1%.

Sales in developed markets outside North America fell 7%. Changes in currency rates reduced sales by 7%. Net selling prices increased 3% while volumes fell 2% with the changes mainly occurring primarily in Western/Central Europe.

K-C Professional

K-C Professional segment sales fell 4.6% to $821 million, missing the consensus of $856 million. Changes in currency rates reduced sales by 4% and sale of business along with the 2018 Global Restructuring Program reduced sales 2%. Net selling prices increased 3% while product mix improved 1%, with volumes down 3%. Second quarter operating margin expanded 57 bps to 19.7%.

Outlook

The company provided the following guidance for fiscal 2019:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Kimberly-Clark reported net sales of $4.6 billion for the three months ended June 30, 2019, a decrease of 0.2% compared to the same period last year, roughly in line with consensus estimates. Currency effects reduced sales by 5%, and organic sales (at constant exchange rates) rose 5%, beating the consensus of 3.2% growth. The adjusted gross margin expanded 112 basis points (bps) year over year to 34.6%, beating the consensus of 33.8%. However, the adjusted operating margin expanded by only 36 bps to 17.2%, slightly missing the consensus of 17.3%, due to higher marketing, research and general expenses. Adjusted EPS increased 5.0% year over year to $1.67, ahead of the consensus estimate of $1.61. Below, we outline the performance of three business segments: personal care, consumer tissue and K-C Professional.

Personal Care

The personal care segment reported net sales of $2.3 billion, beating the consensus of $2.2 billion, with net selling prices increasing approximately 5%, volumes increasing 1% and product mix improving 1%. Changes in currency rates reduced sales by 6%. The operating margin expanded 79 basis points to 21.2%.

Sales in North America grew 5% year over year with net selling prices increasing 3%, driven by baby and child care, while volumes rose 3%. Volumes grew by high-single digits in adult care, including benefits from category growth, innovations and increased marketing support. Volumes increased low-single digits in the baby and child care segments and fell mid-single digits in feminine care.

Sales in developing and emerging markets fell 1%. Currency rates reduced sales by 13%, including significant declines in Latin America. Net selling prices increased 11% and product mix improved 2%, while volumes were flat year-on-year. The higher net selling prices were primarily in Latin America and secondarily in China and the Middle East/Eastern Europe/Africa. The company’s segment volumes increased in Eastern Europe, ASEAN and South Africa, but fell in Latin America and China.

Sales in developed markets outside North America (Australia, Korea and Western/Central Europe) fell 6%. Volumes and product mix each improved 1% but experienced a negative impact from currency rates.

Consumer Tissue

The company reported segment sales of $1.5 billion, flat year-on-year and in line with the consensus. Changes in currency rates reduced sales 4%. Net selling prices increased 5% while product mix improved slightly and volumes declined 2%. The operating margin expanded 95 basis points to 15%, led by topline growth and cost savings, partially offset by input cost inflation, other manufacturing cost increases, unfavorable currencies, lower volumes and higher general and administrative costs.

Sales in North America increased 5%. Net selling prices rose 7% while volumes fell 2%.

Sales in developing and emerging markets decreased 4%. Currency rates negatively impacted sales by 8%, primarily in Latin America. Net selling prices increased 5% while product mix improved 1%, and volumes fell 1%.

Sales in developed markets outside North America fell 7%. Changes in currency rates reduced sales by 7%. Net selling prices increased 3% while volumes fell 2% with the changes mainly occurring primarily in Western/Central Europe.

K-C Professional

K-C Professional segment sales fell 4.6% to $821 million, missing the consensus of $856 million. Changes in currency rates reduced sales by 4% and sale of business along with the 2018 Global Restructuring Program reduced sales 2%. Net selling prices increased 3% while product mix improved 1%, with volumes down 3%. Second quarter operating margin expanded 57 bps to 19.7%.

Outlook

The company provided the following guidance for fiscal 2019:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Kimberly-Clark reported net sales of $4.6 billion for the three months ended June 30, 2019, a decrease of 0.2% compared to the same period last year, roughly in line with consensus estimates. Currency effects reduced sales by 5%, and organic sales (at constant exchange rates) rose 5%, beating the consensus of 3.2% growth. The adjusted gross margin expanded 112 basis points (bps) year over year to 34.6%, beating the consensus of 33.8%. However, the adjusted operating margin expanded by only 36 bps to 17.2%, slightly missing the consensus of 17.3%, due to higher marketing, research and general expenses. Adjusted EPS increased 5.0% year over year to $1.67, ahead of the consensus estimate of $1.61. Below, we outline the performance of three business segments: personal care, consumer tissue and K-C Professional.

Personal Care

The personal care segment reported net sales of $2.3 billion, beating the consensus of $2.2 billion, with net selling prices increasing approximately 5%, volumes increasing 1% and product mix improving 1%. Changes in currency rates reduced sales by 6%. The operating margin expanded 79 basis points to 21.2%.

Sales in North America grew 5% year over year with net selling prices increasing 3%, driven by baby and child care, while volumes rose 3%. Volumes grew by high-single digits in adult care, including benefits from category growth, innovations and increased marketing support. Volumes increased low-single digits in the baby and child care segments and fell mid-single digits in feminine care.

Sales in developing and emerging markets fell 1%. Currency rates reduced sales by 13%, including significant declines in Latin America. Net selling prices increased 11% and product mix improved 2%, while volumes were flat year-on-year. The higher net selling prices were primarily in Latin America and secondarily in China and the Middle East/Eastern Europe/Africa. The company’s segment volumes increased in Eastern Europe, ASEAN and South Africa, but fell in Latin America and China.

Sales in developed markets outside North America (Australia, Korea and Western/Central Europe) fell 6%. Volumes and product mix each improved 1% but experienced a negative impact from currency rates.

Consumer Tissue

The company reported segment sales of $1.5 billion, flat year-on-year and in line with the consensus. Changes in currency rates reduced sales 4%. Net selling prices increased 5% while product mix improved slightly and volumes declined 2%. The operating margin expanded 95 basis points to 15%, led by topline growth and cost savings, partially offset by input cost inflation, other manufacturing cost increases, unfavorable currencies, lower volumes and higher general and administrative costs.

Sales in North America increased 5%. Net selling prices rose 7% while volumes fell 2%.

Sales in developing and emerging markets decreased 4%. Currency rates negatively impacted sales by 8%, primarily in Latin America. Net selling prices increased 5% while product mix improved 1%, and volumes fell 1%.

Sales in developed markets outside North America fell 7%. Changes in currency rates reduced sales by 7%. Net selling prices increased 3% while volumes fell 2% with the changes mainly occurring primarily in Western/Central Europe.

K-C Professional

K-C Professional segment sales fell 4.6% to $821 million, missing the consensus of $856 million. Changes in currency rates reduced sales by 4% and sale of business along with the 2018 Global Restructuring Program reduced sales 2%. Net selling prices increased 3% while product mix improved 1%, with volumes down 3%. Second quarter operating margin expanded 57 bps to 19.7%.

Outlook

The company provided the following guidance for fiscal 2019:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Kimberly-Clark reported net sales of $4.6 billion for the three months ended June 30, 2019, a decrease of 0.2% compared to the same period last year, roughly in line with consensus estimates. Currency effects reduced sales by 5%, and organic sales (at constant exchange rates) rose 5%, beating the consensus of 3.2% growth. The adjusted gross margin expanded 112 basis points (bps) year over year to 34.6%, beating the consensus of 33.8%. However, the adjusted operating margin expanded by only 36 bps to 17.2%, slightly missing the consensus of 17.3%, due to higher marketing, research and general expenses. Adjusted EPS increased 5.0% year over year to $1.67, ahead of the consensus estimate of $1.61. Below, we outline the performance of three business segments: personal care, consumer tissue and K-C Professional.

Personal Care

The personal care segment reported net sales of $2.3 billion, beating the consensus of $2.2 billion, with net selling prices increasing approximately 5%, volumes increasing 1% and product mix improving 1%. Changes in currency rates reduced sales by 6%. The operating margin expanded 79 basis points to 21.2%.

Sales in North America grew 5% year over year with net selling prices increasing 3%, driven by baby and child care, while volumes rose 3%. Volumes grew by high-single digits in adult care, including benefits from category growth, innovations and increased marketing support. Volumes increased low-single digits in the baby and child care segments and fell mid-single digits in feminine care.

Sales in developing and emerging markets fell 1%. Currency rates reduced sales by 13%, including significant declines in Latin America. Net selling prices increased 11% and product mix improved 2%, while volumes were flat year-on-year. The higher net selling prices were primarily in Latin America and secondarily in China and the Middle East/Eastern Europe/Africa. The company’s segment volumes increased in Eastern Europe, ASEAN and South Africa, but fell in Latin America and China.

Sales in developed markets outside North America (Australia, Korea and Western/Central Europe) fell 6%. Volumes and product mix each improved 1% but experienced a negative impact from currency rates.

Consumer Tissue

The company reported segment sales of $1.5 billion, flat year-on-year and in line with the consensus. Changes in currency rates reduced sales 4%. Net selling prices increased 5% while product mix improved slightly and volumes declined 2%. The operating margin expanded 95 basis points to 15%, led by topline growth and cost savings, partially offset by input cost inflation, other manufacturing cost increases, unfavorable currencies, lower volumes and higher general and administrative costs.

Sales in North America increased 5%. Net selling prices rose 7% while volumes fell 2%.

Sales in developing and emerging markets decreased 4%. Currency rates negatively impacted sales by 8%, primarily in Latin America. Net selling prices increased 5% while product mix improved 1%, and volumes fell 1%.

Sales in developed markets outside North America fell 7%. Changes in currency rates reduced sales by 7%. Net selling prices increased 3% while volumes fell 2% with the changes mainly occurring primarily in Western/Central Europe.

K-C Professional

K-C Professional segment sales fell 4.6% to $821 million, missing the consensus of $856 million. Changes in currency rates reduced sales by 4% and sale of business along with the 2018 Global Restructuring Program reduced sales 2%. Net selling prices increased 3% while product mix improved 1%, with volumes down 3%. Second quarter operating margin expanded 57 bps to 19.7%.

Outlook

The company provided the following guidance for fiscal 2019:

- Net sales guidance up but still flat to down 1% year-on-year compared to prior guidance of down 1% to 2%.

- Organic sales growth of 3%, up from the previous estimate of 2%.

- Adjusted operating profit growth increased to 3-5%, versus the prior guidance of 1-4%.

- Inflation in key cost inputs of $150 to $250 million compared to the prior assumption of $300 to $400 million, led primarily by an improved outlook for pulp and secondarily for other raw materials such as superabsorbent and polymer resin.

- Higher spend on marketing, general and administrative costs than previously estimated.

- Adjusted earnings per share increased to $6.65 to $6.80 compared to the prior guidance of $6.50 to $6.70.