DIpil Das

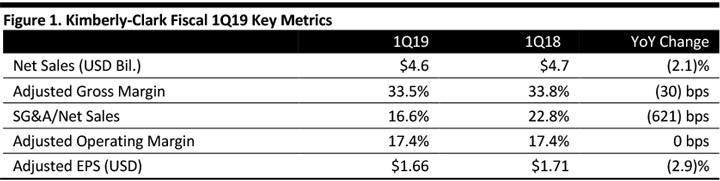

[caption id="attachment_84964" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Kimberly-Clark reported net sales of $4.6 billion for the three months ended March 31, 2019, a decrease of 2.1% compared to the same period last year but beating the consensus estimate of $4.55 billion. Currency effects reduced sales by 5%, and organic sales (at constant exchange rates) rose 3%, driven by higher net selling prices. The adjusted gross margin decreased 30 basis points year over year to 33.5%. The adjusted operating margin was even versus last year at 17.4%. Adjusted EPS decreased 2.9% year over year to $1.66, ahead of consensus estimate of $1.55. Below, we outline the performance of three business segments: personal care, consumer tissue and K-C Professional.

Personal Care

The personal care segment reported net sales of $2.3 billion, with organic sales up 5%, driven by increases in net selling prices, volumes and product mix. The operating margin was up 90 basis points to 21.3%, driven by organic sales growth and cost savings.

Organic sales in North America increased 3% year over year, driven by innovations, increased marketing support and higher volumes in adult, baby and child care.

Developed markets outside North America recorded organic sales growth of 1% year over year.

Organic sales in Brazil rose by double-digits due to higher selling prices, while organic sales for China were down high-single digits due to competitive pricing in diapers in the local market. Organic sales in Vietnam and Eastern Europe grew due to strong performance in diapers.

Consumer Tissue

The consumer tissue segment reported net sales of $1.5 billion, with organic sales even versus a year ago due to higher net selling prices offset by lower volumes. The operating margin was even versus a year ago at 15.8%.

North America reported a 2% decrease in organic sales, with higher net selling prices offset by falling volumes.

K-C Professional

The K-C Professional segment recorded 3% growth in organic sales due to higher net selling prices and increased product mix. The operating margin was down 60 basis points year over year to 18.4% due to commodity inflation and currency headwinds.

North America saw a 1% increase in organic sales driven by solid price realization.

Outlook

The company confirmed its previous full-year outlook for organic sales growth of 2% and adjusted EPS of between $6.50 and $6.70. Management believes earnings are likely to be higher in the second half of the year.

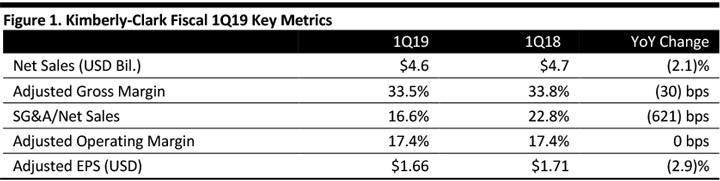

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Kimberly-Clark reported net sales of $4.6 billion for the three months ended March 31, 2019, a decrease of 2.1% compared to the same period last year but beating the consensus estimate of $4.55 billion. Currency effects reduced sales by 5%, and organic sales (at constant exchange rates) rose 3%, driven by higher net selling prices. The adjusted gross margin decreased 30 basis points year over year to 33.5%. The adjusted operating margin was even versus last year at 17.4%. Adjusted EPS decreased 2.9% year over year to $1.66, ahead of consensus estimate of $1.55. Below, we outline the performance of three business segments: personal care, consumer tissue and K-C Professional.

Personal Care

The personal care segment reported net sales of $2.3 billion, with organic sales up 5%, driven by increases in net selling prices, volumes and product mix. The operating margin was up 90 basis points to 21.3%, driven by organic sales growth and cost savings.

Organic sales in North America increased 3% year over year, driven by innovations, increased marketing support and higher volumes in adult, baby and child care.

Developed markets outside North America recorded organic sales growth of 1% year over year.

Organic sales in Brazil rose by double-digits due to higher selling prices, while organic sales for China were down high-single digits due to competitive pricing in diapers in the local market. Organic sales in Vietnam and Eastern Europe grew due to strong performance in diapers.

Consumer Tissue

The consumer tissue segment reported net sales of $1.5 billion, with organic sales even versus a year ago due to higher net selling prices offset by lower volumes. The operating margin was even versus a year ago at 15.8%.

North America reported a 2% decrease in organic sales, with higher net selling prices offset by falling volumes.

K-C Professional

The K-C Professional segment recorded 3% growth in organic sales due to higher net selling prices and increased product mix. The operating margin was down 60 basis points year over year to 18.4% due to commodity inflation and currency headwinds.

North America saw a 1% increase in organic sales driven by solid price realization.

Outlook

The company confirmed its previous full-year outlook for organic sales growth of 2% and adjusted EPS of between $6.50 and $6.70. Management believes earnings are likely to be higher in the second half of the year.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Kimberly-Clark reported net sales of $4.6 billion for the three months ended March 31, 2019, a decrease of 2.1% compared to the same period last year but beating the consensus estimate of $4.55 billion. Currency effects reduced sales by 5%, and organic sales (at constant exchange rates) rose 3%, driven by higher net selling prices. The adjusted gross margin decreased 30 basis points year over year to 33.5%. The adjusted operating margin was even versus last year at 17.4%. Adjusted EPS decreased 2.9% year over year to $1.66, ahead of consensus estimate of $1.55. Below, we outline the performance of three business segments: personal care, consumer tissue and K-C Professional.

Personal Care

The personal care segment reported net sales of $2.3 billion, with organic sales up 5%, driven by increases in net selling prices, volumes and product mix. The operating margin was up 90 basis points to 21.3%, driven by organic sales growth and cost savings.

Organic sales in North America increased 3% year over year, driven by innovations, increased marketing support and higher volumes in adult, baby and child care.

Developed markets outside North America recorded organic sales growth of 1% year over year.

Organic sales in Brazil rose by double-digits due to higher selling prices, while organic sales for China were down high-single digits due to competitive pricing in diapers in the local market. Organic sales in Vietnam and Eastern Europe grew due to strong performance in diapers.

Consumer Tissue

The consumer tissue segment reported net sales of $1.5 billion, with organic sales even versus a year ago due to higher net selling prices offset by lower volumes. The operating margin was even versus a year ago at 15.8%.

North America reported a 2% decrease in organic sales, with higher net selling prices offset by falling volumes.

K-C Professional

The K-C Professional segment recorded 3% growth in organic sales due to higher net selling prices and increased product mix. The operating margin was down 60 basis points year over year to 18.4% due to commodity inflation and currency headwinds.

North America saw a 1% increase in organic sales driven by solid price realization.

Outlook

The company confirmed its previous full-year outlook for organic sales growth of 2% and adjusted EPS of between $6.50 and $6.70. Management believes earnings are likely to be higher in the second half of the year.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Kimberly-Clark reported net sales of $4.6 billion for the three months ended March 31, 2019, a decrease of 2.1% compared to the same period last year but beating the consensus estimate of $4.55 billion. Currency effects reduced sales by 5%, and organic sales (at constant exchange rates) rose 3%, driven by higher net selling prices. The adjusted gross margin decreased 30 basis points year over year to 33.5%. The adjusted operating margin was even versus last year at 17.4%. Adjusted EPS decreased 2.9% year over year to $1.66, ahead of consensus estimate of $1.55. Below, we outline the performance of three business segments: personal care, consumer tissue and K-C Professional.

Personal Care

The personal care segment reported net sales of $2.3 billion, with organic sales up 5%, driven by increases in net selling prices, volumes and product mix. The operating margin was up 90 basis points to 21.3%, driven by organic sales growth and cost savings.

Organic sales in North America increased 3% year over year, driven by innovations, increased marketing support and higher volumes in adult, baby and child care.

Developed markets outside North America recorded organic sales growth of 1% year over year.

Organic sales in Brazil rose by double-digits due to higher selling prices, while organic sales for China were down high-single digits due to competitive pricing in diapers in the local market. Organic sales in Vietnam and Eastern Europe grew due to strong performance in diapers.

Consumer Tissue

The consumer tissue segment reported net sales of $1.5 billion, with organic sales even versus a year ago due to higher net selling prices offset by lower volumes. The operating margin was even versus a year ago at 15.8%.

North America reported a 2% decrease in organic sales, with higher net selling prices offset by falling volumes.

K-C Professional

The K-C Professional segment recorded 3% growth in organic sales due to higher net selling prices and increased product mix. The operating margin was down 60 basis points year over year to 18.4% due to commodity inflation and currency headwinds.

North America saw a 1% increase in organic sales driven by solid price realization.

Outlook

The company confirmed its previous full-year outlook for organic sales growth of 2% and adjusted EPS of between $6.50 and $6.70. Management believes earnings are likely to be higher in the second half of the year.

- Kimberly-Clark will launch further innovations for its Huggies and Kotex brands this year.

- Kimberly-Clark expects its 2018 restructuring program to generate annual pre-tax cost savings of up to $550 million by the end of 2021, driven by workforce reductions and manufacturing supply chain efficiencies.

- Kimberly-Clark will continue to pursue longer-term, balanced and sustainable growth opportunities as part of its K-C Strategy 2022.