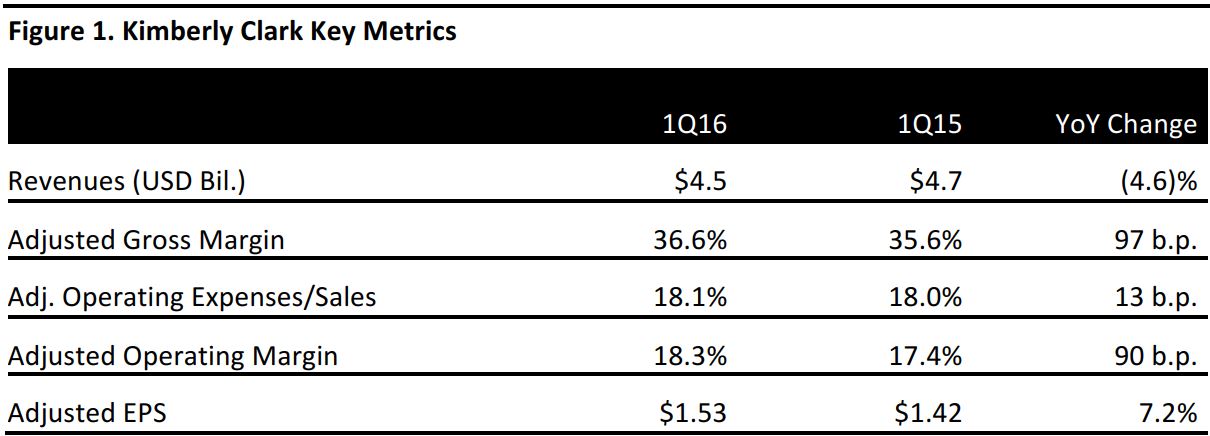

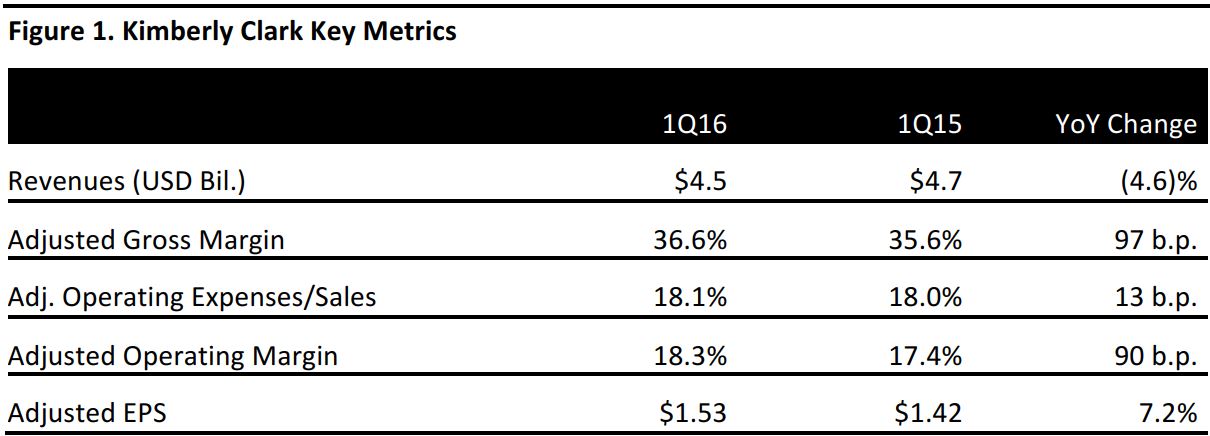

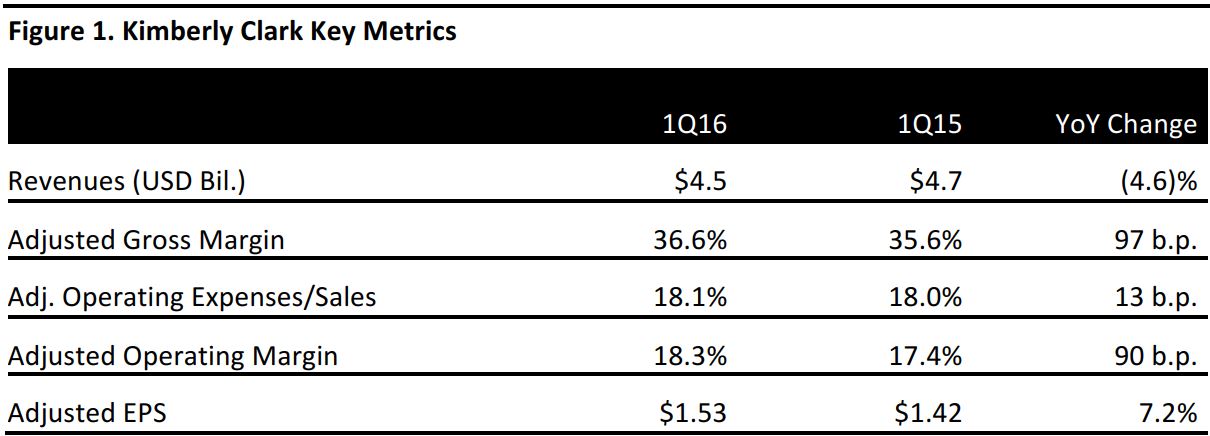

Source: Company reports

1Q16 RESULTS

Kimberly Clark reported 1Q16 revenues of $4.5 billion, down 4.6% from a year ago. This figure is a combination of a 7% decline in sales due to foreign exchange rate changes, which more than offset a 2% increase in organic sales.

Personal Care Segment—Sales of $2.2 billion were down 4%, comprised of a 9% decline due to currency, a 3% volume increase, and a 1% gain from product mix. Sales were 3% higher in North America, down 11% in developing and emerging markets and down 7% in developed markets outside North America.

Consumer Tissue Segment—Sales of $1.5 billion were down 5%, due to a 5% unfavorable currency change, 1% higher selling prices and an unfavorable product mix hurting revenues by 1%. Sales in North America increased by 1%, sales in developing and emerging markets decreased by 14% and sales in developed markets outside North America decreased by 9%.

K-C Professional (KCP) Segment—Sales of $0.8 billion were down 4%, due a 5% unfavorable change in currency, volumes and selling prices each up 1% and a 1% unfavorable product mix. Sales in North America were up 3%, sales in developing and emerging markets decreased 11% and sales in developed markets outside North America decreased by 8%.

Adjusted EPS was $1.53, up 7.7% from the year-ago quarter, due to a combination of organic sales growth, cost-saving programs, input cost deflation and a lower adjusted effective tax rate.

2016 GUIDANCE

For 2016, negative currency translation effects are expected to push revenues towards the lower end of the range of up 5%–6%. The company also announced several near-term product innovations to be launched in North America, including the best-ever Pull-Ups Training Pants, upgraded Huggies diapers and baby wipes.

Key cost inputs are expected to experience deflation of $0–$150 million, compared to the prior expectation of a range of $50 million of inflation to $100 million of deflation.

Net income in 2016 is expected to be similar to or slightly lower than in 2015, primarily due to negative foreign currency translation effects. 2016 EPS guidance is for $5.95–$6.15, representing 3% to 7% growth. Management remains optimistic regarding product innovation and cost savings.