DIpil Das

The Coresight Research team was at CEW’s Connected Consumer Conference 2019 on November 15 in New York City. The conference brought together 18 global industry executives to discuss the use of technology in the beauty sector and shifts in consumer behavior that are shaping the retail experience.

These are the top insights from the conference:

Changing consumption in Asia is bringing more opportunities to Western retailers.

The beauty industry continues to evolve at a rapid pace in China. Consumption is being driven by a young, affluent generation, which has led to the advent of New Retail—a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. Moreover, shopping holidays in China are booming, evidenced by Singles’ Day 2019 on November 11.

As part of our presentation on what beauty retailers can learn from Asia’s dynamic retail ecosystems, Deborah Weinswig, CEO and Founder of Coresight Research, defined our 11 key insights from this year’s Singles’ Day:

Deborah Weinswig, CEO and Founder of Coresight Research, discusses what beauty retailers can learn from the dynamic retail ecosystem of Asia.

Deborah Weinswig, CEO and Founder of Coresight Research, discusses what beauty retailers can learn from the dynamic retail ecosystem of Asia.

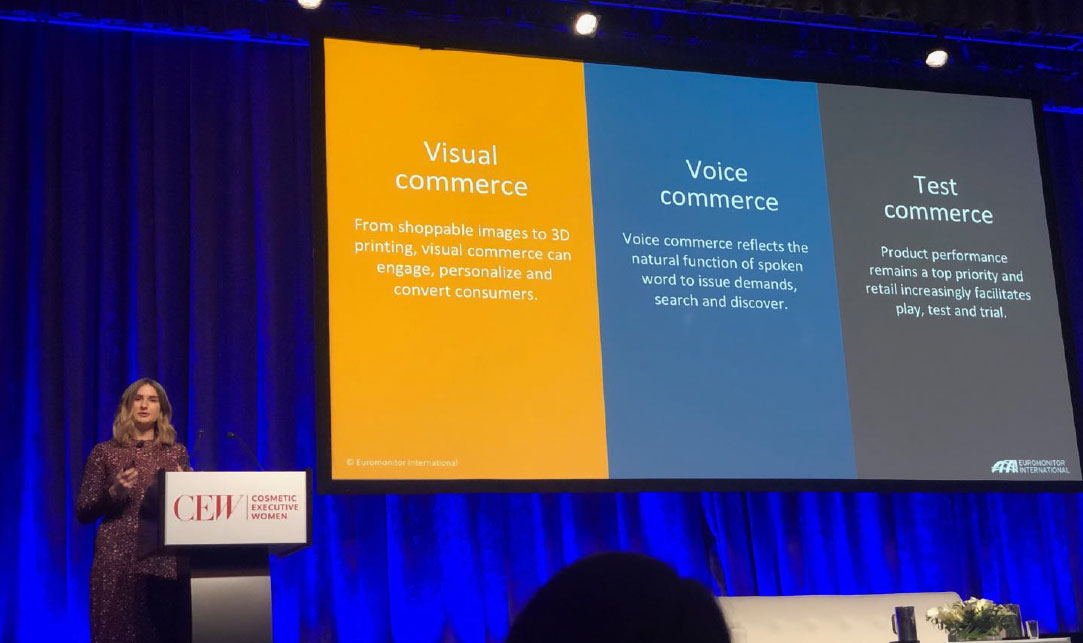

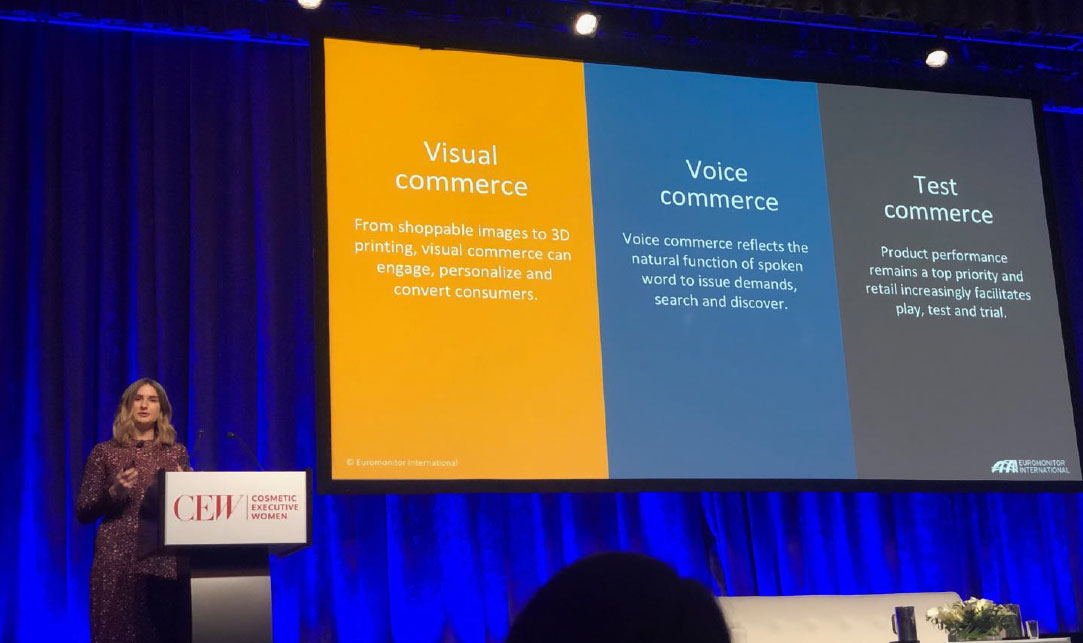

Source: Coresight Research [/caption] The new era of brand globalization means more collaboration, experience, immediacy and seamlessness. Hannah Symons, Head of Beauty and Personal Care at Euromonitor International, emphasized that consumers are increasingly looking for “harmonized retail,” which includes immediacy, brand consistency and a seamless shopping experience. Euromonitor predicts that online retailing will grow twice as fast as in-store retailing, driven by visual commerce, voice commerce and test commerce—the elements of harmonized retail. Visual commerce: Studies show that people remember 80% of what they see, 20% of what they read and 10% of what they hear. Visual searches are preferred by shoppers during the inspiration and purchase phases of the purchase journey. MAC’s new experience center in Shanghai uses interactive visual commerce to appeal to its customers; it features virtual makeup mirrors, 3D printing stations and an infrared touchscreen to match foundation shades and offer personalized digital greetings to customers. Voice Commerce: 60% of digital professionals expect voice-powered applications to have industry-wide impacts, and Euromonitor predicts that by 2023, 5% of digital commerce sales in the US and China will be made via voice. According to the market research firm, 80% of voice users say they would like to engage with brands via their voice assistant, and 37% leverage their voice assistants for at least one shopping-related activity. Beauty retailer Sephora recently launched its app on Google Assistant—which allows consumers to book appointments—becoming one the first forays of the beauty world into voice. Test Commerce: Physical retail is still thriving: 47% of consumers say that they shop in store to see or try a product before buying, and 45% of consumers spend 15 minutes or more considering a color cosmetic purchase. Offering opportunities for consumers to play, test and trial beauty items therefore drives higher sales. Retailers are able to do this through online and offline pop-up stores, for example. [caption id="attachment_100035" align="aligncenter" width="700"] Hannah Symons, Head of Beauty and Personal Care of Euromonitor International, is talking about the future of commerce in beauty

Hannah Symons, Head of Beauty and Personal Care of Euromonitor International, is talking about the future of commerce in beauty

Source: Coresight Research [/caption] Retailers need to create customer-centric experiences across all touchpoints. Sephora has a “flywheel effect,” where customers are introduced to the brand through the physical retail experience, but then go on to spend more online. It therefore focuses on product engagement and an enjoyable retail experience, rather than sales. Bridget Dolan, SVP of New Ventures at Sephora, highlighted Sephora’s three key strategies: 1. Blend physical and digital assets to benefit the client Utilizing online innovation and assets can drive traffic both online and offline, such as through mobile-first, hyper-localized discovery and reservation tools that improve the shopping experience for customers. 2. Connect consumers seamlessly across channels Omnichannel communication with consumers provides an integrated shopping experience. Using geolocation and mobile technology, customers can be alerted through their cell phone when they are near a store that stocks an item from their online shopping cart. Geofencing transforms an app into an in-store shopping companion, which then captures pre-visit and in-store journey data about users to enable more targeted brand messaging. 3. Personalize the consumer journey across channels Consumers crave rich and personalized content. Technology can be leveraged to customize service offerings. Over the next three to five years, the beauty sector will see developments in mass personalization (for example, offering personalized hair color instructions for individual consumers) and precision technology (to fill in an individual wrinkle, for instance). Technology should provide a stronger, closer relationship with consumers that evolves over time. [caption id="attachment_100037" align="aligncenter" width="700"] Bridget Dolan, SVP of New Ventures at Sephora, presented on Redefining Omnichannel Through Holistic Client Journeys.

Bridget Dolan, SVP of New Ventures at Sephora, presented on Redefining Omnichannel Through Holistic Client Journeys.

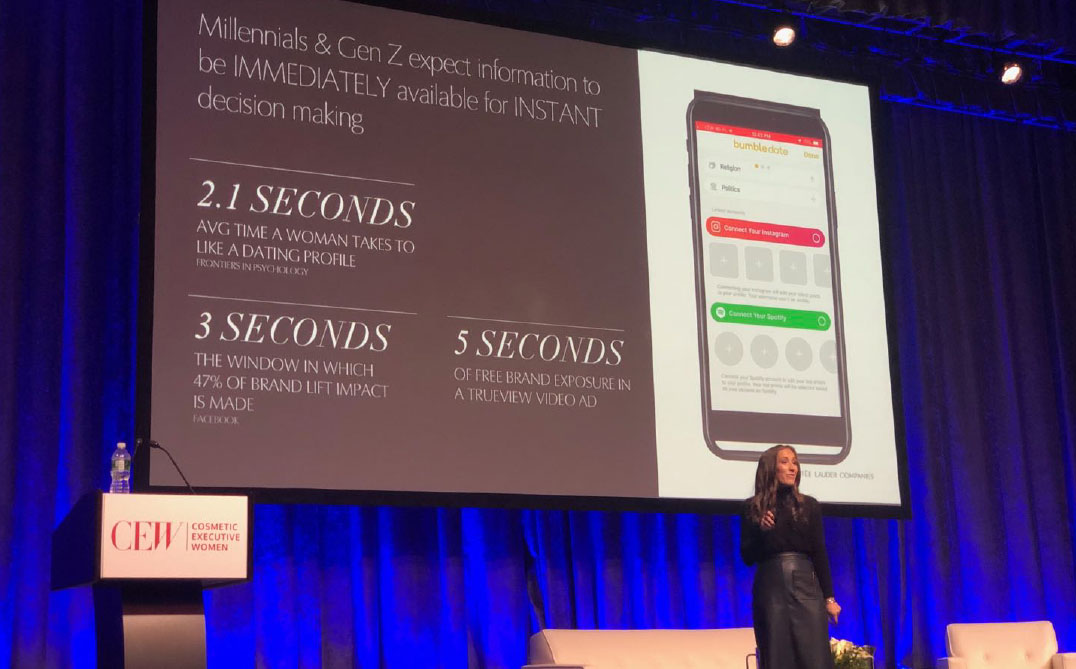

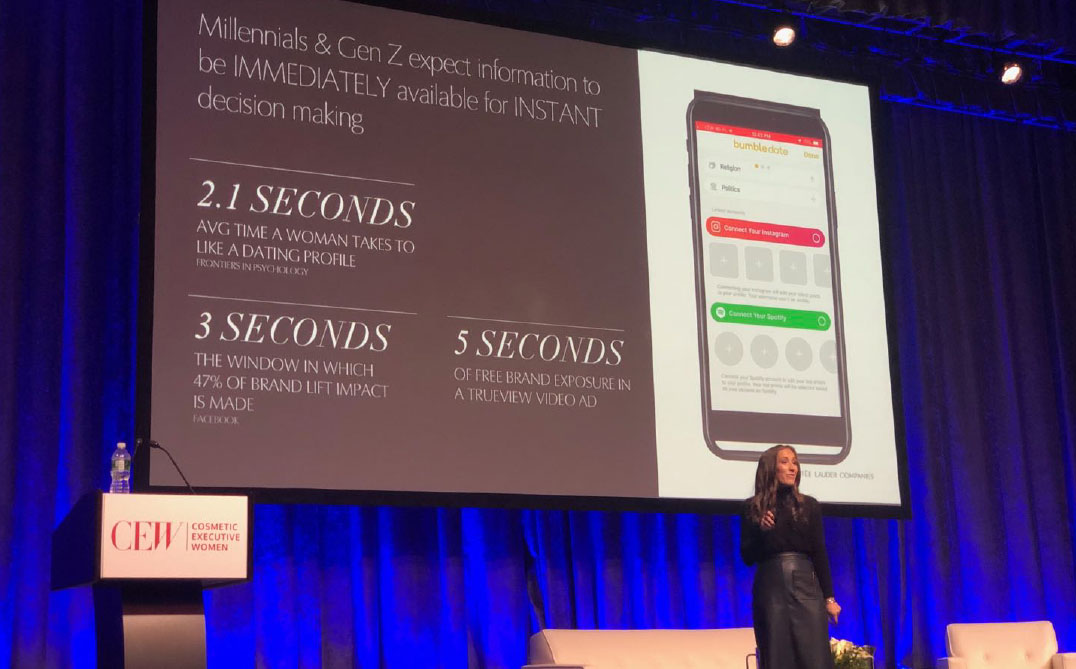

Source: Coresight Research [/caption] Brand identity is shaped by influencers. Studies show that the average human attention span is eight seconds. Particularly for today’s millennials and Gen-Z consumers living in the digital age, information is expected to be immediately available for instant decision-making. Brand exposure and identity is thus informed and shaped by influencers through channels such as social media. The influencer market is expected to be worth up to $15 billion by 2022, according to Business Insider. [caption id="attachment_100038" align="aligncenter" width="900"] Kate Jalkut, Executive Director of Media and Influencer at The Estée Lauder Companies, drew parallels with the online dating sector to describe influencers as matchmakers between brands and consumers.

Kate Jalkut, Executive Director of Media and Influencer at The Estée Lauder Companies, drew parallels with the online dating sector to describe influencers as matchmakers between brands and consumers.

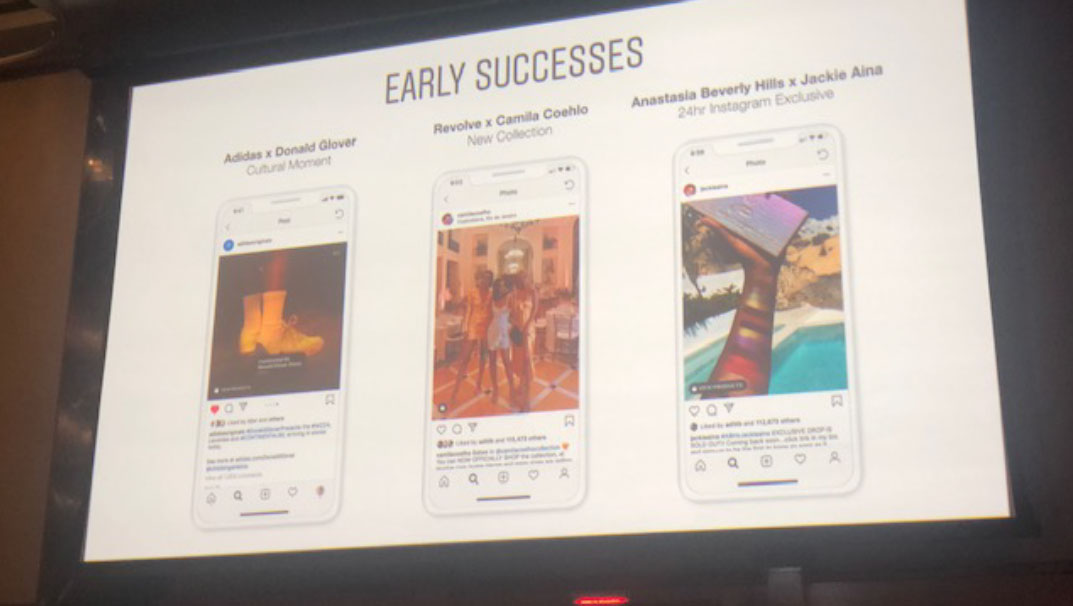

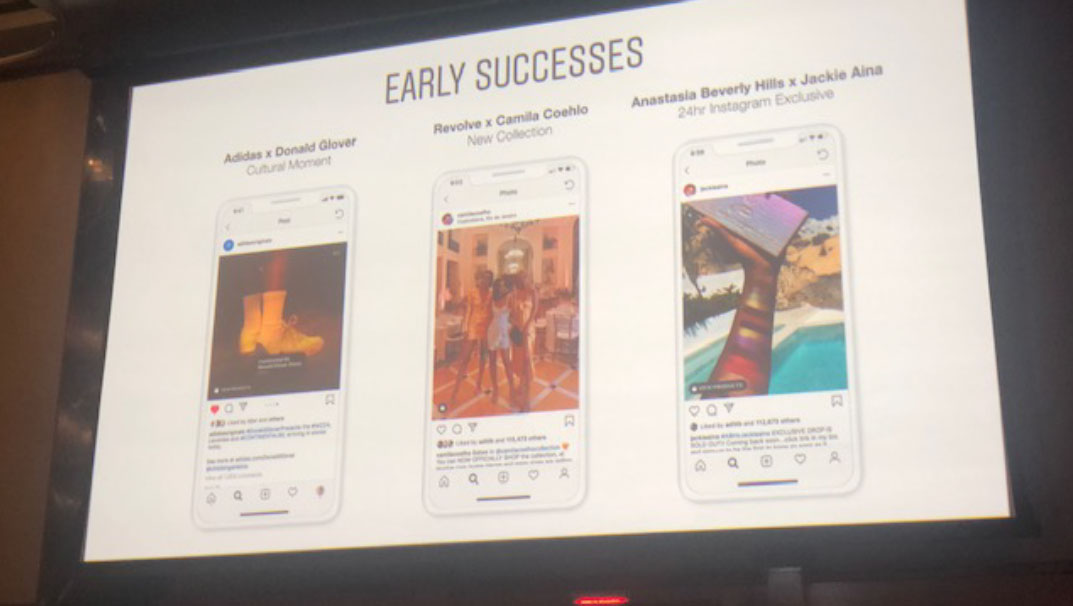

Source: Coresight Research [/caption] Social media commerce may help brands to acquire new customers and drive sales. We live in a world that changed from “I am going shopping” to “I am always shopping,” according to Karin Tracy, US Head of Industry at Facebook. Instagram is in a closed beta phase with 30 brands to offer retail through the online social media platform. Tracy said that early results have been very positive regarding consumers’ ability to use Instagram to purchase products. For example, Adidas reported a 40% increase in sales, attributing Instagram as one driver of growth. Brands are also creating “Instagram exclusives,” which are only available for limited runs, in order to boost sales. In a new development, influencers are now able to create tags on the items that they are wearing, which opens a new world for the future of shoppable product placement. [caption id="attachment_100039" align="aligncenter" width="700"] Instagram collaborations; Adidas x Donald Glover (Cultural Moment); Revolve x Camila Coehlo (New Collection); Anastasia Beverly Hills x Jackie Aina

Instagram collaborations; Adidas x Donald Glover (Cultural Moment); Revolve x Camila Coehlo (New Collection); Anastasia Beverly Hills x Jackie Aina

Source: Coresight Research [/caption] In addition, Facebook introduced “Facebook Pay” on November 12, which allows users to seamlessly make payments across its apps. The payment platform stores customer information to allow for simple checkout processes.

- The top five beauty brands that sold to China during the shopping holiday by total GMV were L'Oréal, Lancôme, Estée Lauder, Olay and SK-II.

- Alibaba focused on everything new, launching 1 million new products and highlighting new shopping experiences and new consumers.

- Beauty was one of the strongest categories, driven by product innovation.

- Key opinion leaders are helping grow the beauty industry in China through their online presence.

- Livestreaming has become a popular channel for marketing, helping to drive sales for brands.

- Gamification engages customers during shopping festivals.

- Data helped Alibaba to forecast regional demand in order to increase penetration into China’s lower-tier cities.

- Effective pricing strategies—such as bundle sales, “buy one get one free” and free gift incentives—boosted sales for many brands.

- Last-mile delivery was key on Singles’ Day, with Alibaba offering a two-hour delivery window to drive sales.

- “Virtual try-on” was one of the most widely used AI technologies, further driving sales in beauty.

- There were 100 million new global consumers this Singles’ Day.

Deborah Weinswig, CEO and Founder of Coresight Research, discusses what beauty retailers can learn from the dynamic retail ecosystem of Asia.

Deborah Weinswig, CEO and Founder of Coresight Research, discusses what beauty retailers can learn from the dynamic retail ecosystem of Asia. Source: Coresight Research [/caption] The new era of brand globalization means more collaboration, experience, immediacy and seamlessness. Hannah Symons, Head of Beauty and Personal Care at Euromonitor International, emphasized that consumers are increasingly looking for “harmonized retail,” which includes immediacy, brand consistency and a seamless shopping experience. Euromonitor predicts that online retailing will grow twice as fast as in-store retailing, driven by visual commerce, voice commerce and test commerce—the elements of harmonized retail. Visual commerce: Studies show that people remember 80% of what they see, 20% of what they read and 10% of what they hear. Visual searches are preferred by shoppers during the inspiration and purchase phases of the purchase journey. MAC’s new experience center in Shanghai uses interactive visual commerce to appeal to its customers; it features virtual makeup mirrors, 3D printing stations and an infrared touchscreen to match foundation shades and offer personalized digital greetings to customers. Voice Commerce: 60% of digital professionals expect voice-powered applications to have industry-wide impacts, and Euromonitor predicts that by 2023, 5% of digital commerce sales in the US and China will be made via voice. According to the market research firm, 80% of voice users say they would like to engage with brands via their voice assistant, and 37% leverage their voice assistants for at least one shopping-related activity. Beauty retailer Sephora recently launched its app on Google Assistant—which allows consumers to book appointments—becoming one the first forays of the beauty world into voice. Test Commerce: Physical retail is still thriving: 47% of consumers say that they shop in store to see or try a product before buying, and 45% of consumers spend 15 minutes or more considering a color cosmetic purchase. Offering opportunities for consumers to play, test and trial beauty items therefore drives higher sales. Retailers are able to do this through online and offline pop-up stores, for example. [caption id="attachment_100035" align="aligncenter" width="700"]

Hannah Symons, Head of Beauty and Personal Care of Euromonitor International, is talking about the future of commerce in beauty

Hannah Symons, Head of Beauty and Personal Care of Euromonitor International, is talking about the future of commerce in beauty Source: Coresight Research [/caption] Retailers need to create customer-centric experiences across all touchpoints. Sephora has a “flywheel effect,” where customers are introduced to the brand through the physical retail experience, but then go on to spend more online. It therefore focuses on product engagement and an enjoyable retail experience, rather than sales. Bridget Dolan, SVP of New Ventures at Sephora, highlighted Sephora’s three key strategies: 1. Blend physical and digital assets to benefit the client Utilizing online innovation and assets can drive traffic both online and offline, such as through mobile-first, hyper-localized discovery and reservation tools that improve the shopping experience for customers. 2. Connect consumers seamlessly across channels Omnichannel communication with consumers provides an integrated shopping experience. Using geolocation and mobile technology, customers can be alerted through their cell phone when they are near a store that stocks an item from their online shopping cart. Geofencing transforms an app into an in-store shopping companion, which then captures pre-visit and in-store journey data about users to enable more targeted brand messaging. 3. Personalize the consumer journey across channels Consumers crave rich and personalized content. Technology can be leveraged to customize service offerings. Over the next three to five years, the beauty sector will see developments in mass personalization (for example, offering personalized hair color instructions for individual consumers) and precision technology (to fill in an individual wrinkle, for instance). Technology should provide a stronger, closer relationship with consumers that evolves over time. [caption id="attachment_100037" align="aligncenter" width="700"]

Bridget Dolan, SVP of New Ventures at Sephora, presented on Redefining Omnichannel Through Holistic Client Journeys.

Bridget Dolan, SVP of New Ventures at Sephora, presented on Redefining Omnichannel Through Holistic Client Journeys. Source: Coresight Research [/caption] Brand identity is shaped by influencers. Studies show that the average human attention span is eight seconds. Particularly for today’s millennials and Gen-Z consumers living in the digital age, information is expected to be immediately available for instant decision-making. Brand exposure and identity is thus informed and shaped by influencers through channels such as social media. The influencer market is expected to be worth up to $15 billion by 2022, according to Business Insider. [caption id="attachment_100038" align="aligncenter" width="900"]

Kate Jalkut, Executive Director of Media and Influencer at The Estée Lauder Companies, drew parallels with the online dating sector to describe influencers as matchmakers between brands and consumers.

Kate Jalkut, Executive Director of Media and Influencer at The Estée Lauder Companies, drew parallels with the online dating sector to describe influencers as matchmakers between brands and consumers. Source: Coresight Research [/caption] Social media commerce may help brands to acquire new customers and drive sales. We live in a world that changed from “I am going shopping” to “I am always shopping,” according to Karin Tracy, US Head of Industry at Facebook. Instagram is in a closed beta phase with 30 brands to offer retail through the online social media platform. Tracy said that early results have been very positive regarding consumers’ ability to use Instagram to purchase products. For example, Adidas reported a 40% increase in sales, attributing Instagram as one driver of growth. Brands are also creating “Instagram exclusives,” which are only available for limited runs, in order to boost sales. In a new development, influencers are now able to create tags on the items that they are wearing, which opens a new world for the future of shoppable product placement. [caption id="attachment_100039" align="aligncenter" width="700"]

Instagram collaborations; Adidas x Donald Glover (Cultural Moment); Revolve x Camila Coehlo (New Collection); Anastasia Beverly Hills x Jackie Aina

Instagram collaborations; Adidas x Donald Glover (Cultural Moment); Revolve x Camila Coehlo (New Collection); Anastasia Beverly Hills x Jackie Aina Source: Coresight Research [/caption] In addition, Facebook introduced “Facebook Pay” on November 12, which allows users to seamlessly make payments across its apps. The payment platform stores customer information to allow for simple checkout processes.