Kering SA

Sector: Luxury

Countries of operation: Operates stores and sells online in over 100 countries, including China, France, Germany, Japan, South Korea, the UK and the US

Key product categories: Apparel, eyewear, footwear, jewelry, leather goods, watches and others.

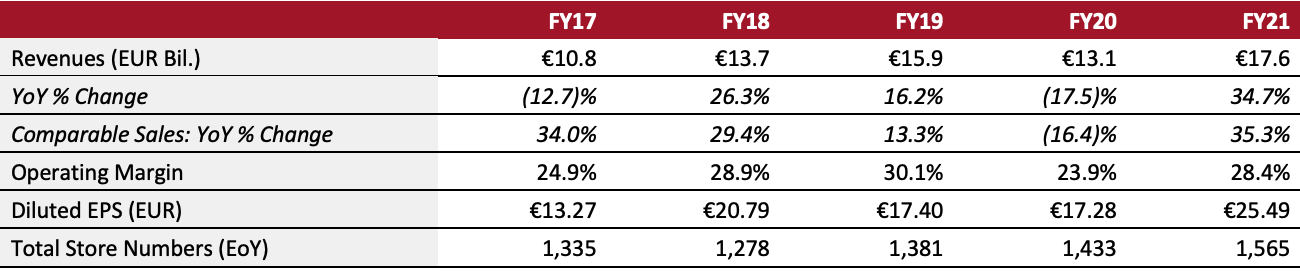

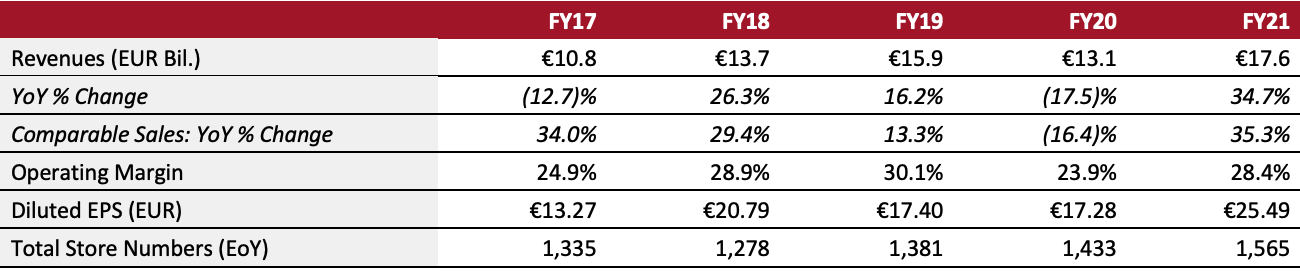

Annual Metrics

[caption id="attachment_144938" align="aligncenter" width="700"]

Last fiscal year end: December 31, 2021.

Last fiscal year end: December 31, 2021.[/caption]

Summary

Headquartered in Paris, Kering started as the Pinault Group in 1963 and initially specialized in timber trading. The company’s first true foray into luxury was with its acquisition of a 42% stake in Gucci Group in 1999, which it progressively increased, finally owning 99.4% by 2004. The Pinault Group was rebranded as Pinault-Printemps-Redoute in 1994, as PPR in 2005 and as Kering in 2013.

Today, Kering operates 12 brands in 100 mature and emerging markets across the world through directly operated stores, wholesale distribution and e-commerce.

Company Analysis

Coresight Research insight: Kering has rebounded strongly and surpassed pre-pandemic revenues—on a two-year basis, revenues were up 13.4% at the end of fiscal 2021 (ended December 31, 2021). Kering has been agile in responding to market changes, disruptions and crises. It has embraced technology with its brands Balenciaga and Gucci, which has resonated well with the increasingly younger luxury audience. Kering’s ability to adopt new trends quickly make it more accessible, positioning it for growth—possibly enabling the company to reach the level of LVMH’s top brands.

During fiscal 2021, Kering undertook strategic moves to capitalize on several trends in the luxury sector. It staked its claim in the high-growth luxury resale market by acquiring a 5% share in Vestiaire Collective. The group has also enhanced it logistics hub in Northern Italy with an additional 100,000 square meters to serve rising e-commerce demand and to get ahead of future supply chain congestions.

In May 2021, the group offloaded a 5.91% stake in Puma, making its operations leaner and more focused on pure luxury goods. As the global economy opens back up and the threat of Covid-19 subsides, Kering seems poised for further growth.

| Tailwinds |

Headwinds |

- New and aspirational shoppers looking to purchase luxury goods

- Growing segment of youthful consumers with rising incomes

- Demand for timeless, seasonless and durable luxury goods

- Recovery in travel

|

- Economic uncertainty across global markets

- Competition from other luxury brands

- Supply-side disruptions and input cost inflation

|

Strategy

Kering laid out the following objectives for fiscal year 2022 during its earnings call on February 17, 2022:

1. Focus on execution of strategy

- Focus on brands and segments of the business that it can scale over time. The sale of watch brands Girard-Perregaux and Ulysse Nardin in January 2022 aligned with this goal.

2. Continued Investment In Houses and Platforms

- Continue to invest in internalizing its e-commerce platforms and in clienteling activities trend.

- Expand its store network in terms of number of units and regions served.

3. Nurturing Culture of Innovation, Creativity and Caring:

- Update its 2016 emissions target to align with the universal target to limit global warming to 1.5 degrees Celsius.

- Innovate and look for new consumption models that align with its sustainability goals, including its investment in resale platform Vestiaire Collective.

4. Profitable Growth Trajectory:

- Continue to hold ground through the disruptions over the last two years and the group’s brands’ strong rebounds in margins, despite price increases.

- Further improve their margins gradually over the course of fiscal 2022.

5. Healthy Financial Situation:

- Maintain a similar financial trajectory this year. Management pointed to its healthy financial situation, which includes lower debt at €168 million ($191 million) versus last year’s €2.1 billion ($2.4 billion), and improved cash flow and operating income.

6. Further Potential and Opportunities:

- Seek acquisition opportunities as the group’s “portfolio is not yet perfect,” according to the company. It cited its 2021 Lindberg acquisition as an example and added that it will seek similar strategic acquisitions that will help scale its position.

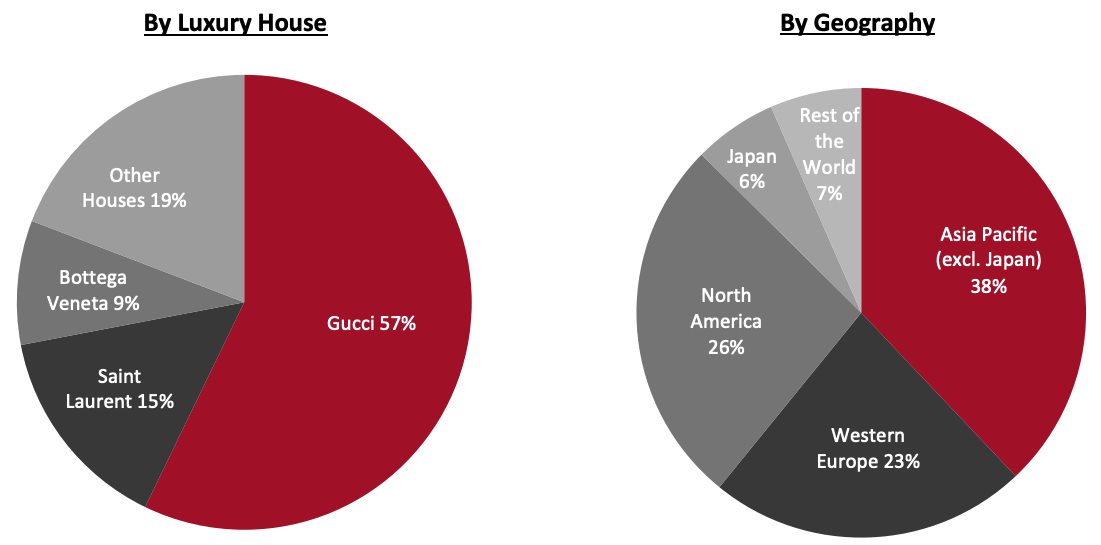

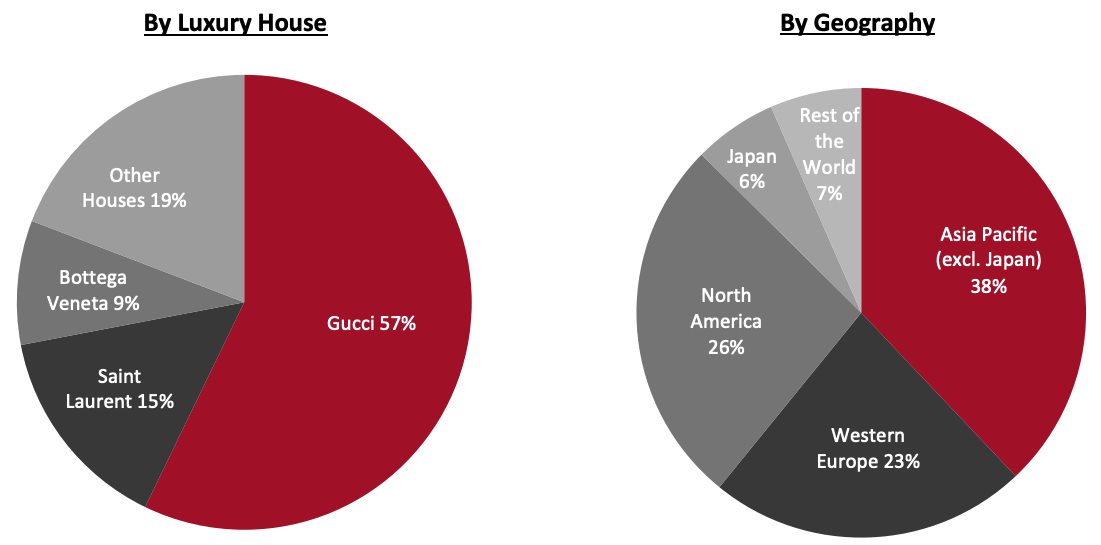

Revenue Breakdown (FY21)

Company Developments

Company Developments

| Date |

Development |

| Jan 24, 2022 |

Sells its full stake in Sowind Group SA, the owner of Swiss watch brands Girard-Perregaux and Ulysse Nardin, to Sowind’s current management. Kering expects to complete the transaction in the first half of 2022. |

| Nov 15, 2021 |

Bottega Veneta appoints Matthieu Blazy as Creative Director effective November 15, 2021. Blazy served as ready-to-wear design director at Bottega Veneta since 2020. |

| Nov 10, 2021 |

Bottega Veneta and Daniel Lee, the Creative Director at Bottega Veneta since July 1, 2018, announce joint decision to end their partnership. |

| Sep 30, 2021 |

Kering Eyewear completes the acquisition of Danish luxury eyewear brand Lindberg, after receiving approval from antitrust authorities. |

Management Team

- François-Henri Pinault—Chairman and CEO

- Jean-Francois Palus—Group MD and Director

- Jean-Marc Duplaix—CFO

- Matthieu Blazy—Creative Director

Source: Company reports/S&P Capital IQ

Last fiscal year end: December 31, 2021.[/caption]

Summary

Headquartered in Paris, Kering started as the Pinault Group in 1963 and initially specialized in timber trading. The company’s first true foray into luxury was with its acquisition of a 42% stake in Gucci Group in 1999, which it progressively increased, finally owning 99.4% by 2004. The Pinault Group was rebranded as Pinault-Printemps-Redoute in 1994, as PPR in 2005 and as Kering in 2013.

Today, Kering operates 12 brands in 100 mature and emerging markets across the world through directly operated stores, wholesale distribution and e-commerce.

Company Analysis

Coresight Research insight: Kering has rebounded strongly and surpassed pre-pandemic revenues—on a two-year basis, revenues were up 13.4% at the end of fiscal 2021 (ended December 31, 2021). Kering has been agile in responding to market changes, disruptions and crises. It has embraced technology with its brands Balenciaga and Gucci, which has resonated well with the increasingly younger luxury audience. Kering’s ability to adopt new trends quickly make it more accessible, positioning it for growth—possibly enabling the company to reach the level of LVMH’s top brands.

During fiscal 2021, Kering undertook strategic moves to capitalize on several trends in the luxury sector. It staked its claim in the high-growth luxury resale market by acquiring a 5% share in Vestiaire Collective. The group has also enhanced it logistics hub in Northern Italy with an additional 100,000 square meters to serve rising e-commerce demand and to get ahead of future supply chain congestions.

In May 2021, the group offloaded a 5.91% stake in Puma, making its operations leaner and more focused on pure luxury goods. As the global economy opens back up and the threat of Covid-19 subsides, Kering seems poised for further growth.

Last fiscal year end: December 31, 2021.[/caption]

Summary

Headquartered in Paris, Kering started as the Pinault Group in 1963 and initially specialized in timber trading. The company’s first true foray into luxury was with its acquisition of a 42% stake in Gucci Group in 1999, which it progressively increased, finally owning 99.4% by 2004. The Pinault Group was rebranded as Pinault-Printemps-Redoute in 1994, as PPR in 2005 and as Kering in 2013.

Today, Kering operates 12 brands in 100 mature and emerging markets across the world through directly operated stores, wholesale distribution and e-commerce.

Company Analysis

Coresight Research insight: Kering has rebounded strongly and surpassed pre-pandemic revenues—on a two-year basis, revenues were up 13.4% at the end of fiscal 2021 (ended December 31, 2021). Kering has been agile in responding to market changes, disruptions and crises. It has embraced technology with its brands Balenciaga and Gucci, which has resonated well with the increasingly younger luxury audience. Kering’s ability to adopt new trends quickly make it more accessible, positioning it for growth—possibly enabling the company to reach the level of LVMH’s top brands.

During fiscal 2021, Kering undertook strategic moves to capitalize on several trends in the luxury sector. It staked its claim in the high-growth luxury resale market by acquiring a 5% share in Vestiaire Collective. The group has also enhanced it logistics hub in Northern Italy with an additional 100,000 square meters to serve rising e-commerce demand and to get ahead of future supply chain congestions.

In May 2021, the group offloaded a 5.91% stake in Puma, making its operations leaner and more focused on pure luxury goods. As the global economy opens back up and the threat of Covid-19 subsides, Kering seems poised for further growth.

Company Developments

Company Developments