Nitheesh NH

[caption id="attachment_75643" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

FY18 Results

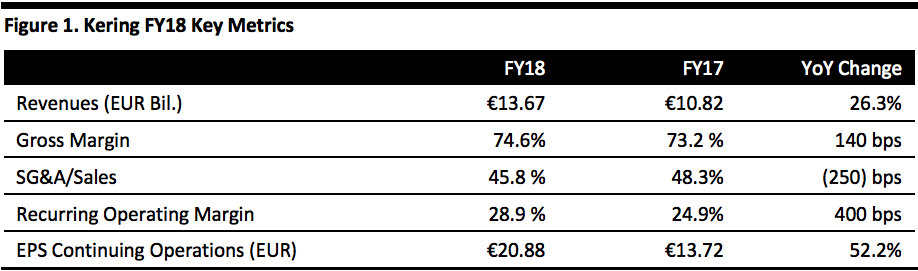

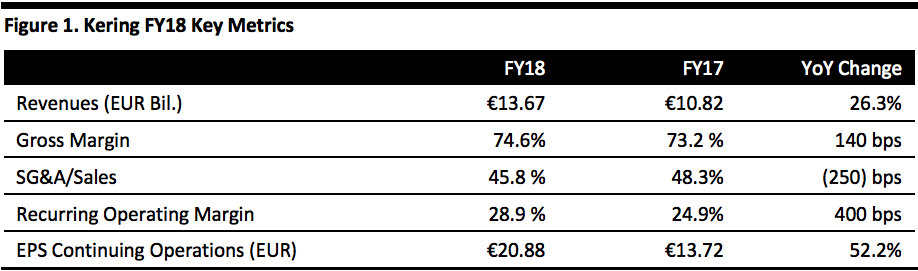

Kering reported 2018 EPS from continuing operations of €20.88, up 52.2% from €13.72 in 2017. Total revenues were €13.67 billion, up 26.3% year over year (up 29.4% on a comparable currency basis) and above the €13.59 billion consensus estimate.

Direct to consumer revenue growth of 31% drove the top line with all regions participating. E-commerce revenues jumped 71% and now represent 6% of total sales. On a constant-currency basis, Western Europe revenues rose 22%, North America was up 38%, Japan climbed 26%, Asia Pacific was up 37% and the rest of the world up 27%. Wholesale revenues grew 24%.

Gucci saw a 33.4% revenue increase, to €$8.29 billion and operating income of €3.28 billion, up 54.2% for a 39.5% operating margin. Gucci retail revenues increased 38% and represent 85% of brand sales. Gucci e-commerce sales also climbed 70%.

Saint Laurent sales increased 16.1% to €1.71 billion and operating profits rose 21.9% to €459 million, or 26.3% of brand sales. Bottega Veneta lagged with a 5.7% revenue decline in 2018 and an operating margin contraction of 320 bps to 21.8% as it is in the midst of a turnaround. However, the trend improved by 4Q with a 3% revenue decline and an early positive response to new creative director Daniel Lee’s initial collections. Revenue growth at Kering’s other houses (Balenciaga, Alexander McQueen, Boucheron, Brioni, Ulysse Nardin, Pomellato) was 29.8% in 2018 to €2.11 billion, accompanied by a 114% increase in recurring operating income, to €215 million, for a 400 bp operating margin increase, to 10.2% of sales.

Gross margin expanded 140 bps to 74.6% of sales. Operating leverage and cost controls led to a 250-bps reduction in the SG&A expense ratio, to 45.8% of sales. This resulted in a 400 bp operating margin increase to 28.9% of sales.

Growth in 2018 was driven both by local and tourist customers; however, Kering experienced a slight downturn in tourist spending towards the end of the year. In Europe, across the aggregated scope of the three main brands (Gucci, Saint Laurent and Bottega Veneta), all nationalities rose during 2018, with sales to Europeans, Chinese and U.S. customers (Kering’s three main customer nationalities) up 20-40%. Chinese customers specifically remained buoyant in 4Q in mainland China and the rest of Asia.

Use of AI to identify and target high-potential customers proved almost twice as successful as selections made by sales associates. Kering will now roll out this function as part of its transformational initiatives. Other initiatives include digital; B2C logistics functionality across the brand portfolio that provides a consolidated and in real time 360-degree view of customers and testing leasing, renting, subscriptions, and previously owned services.

Outlook

The company did not provide quantitative guidance for 2019.

Source: Company reports/Coresight Research[/caption]

FY18 Results

Kering reported 2018 EPS from continuing operations of €20.88, up 52.2% from €13.72 in 2017. Total revenues were €13.67 billion, up 26.3% year over year (up 29.4% on a comparable currency basis) and above the €13.59 billion consensus estimate.

Direct to consumer revenue growth of 31% drove the top line with all regions participating. E-commerce revenues jumped 71% and now represent 6% of total sales. On a constant-currency basis, Western Europe revenues rose 22%, North America was up 38%, Japan climbed 26%, Asia Pacific was up 37% and the rest of the world up 27%. Wholesale revenues grew 24%.

Gucci saw a 33.4% revenue increase, to €$8.29 billion and operating income of €3.28 billion, up 54.2% for a 39.5% operating margin. Gucci retail revenues increased 38% and represent 85% of brand sales. Gucci e-commerce sales also climbed 70%.

Saint Laurent sales increased 16.1% to €1.71 billion and operating profits rose 21.9% to €459 million, or 26.3% of brand sales. Bottega Veneta lagged with a 5.7% revenue decline in 2018 and an operating margin contraction of 320 bps to 21.8% as it is in the midst of a turnaround. However, the trend improved by 4Q with a 3% revenue decline and an early positive response to new creative director Daniel Lee’s initial collections. Revenue growth at Kering’s other houses (Balenciaga, Alexander McQueen, Boucheron, Brioni, Ulysse Nardin, Pomellato) was 29.8% in 2018 to €2.11 billion, accompanied by a 114% increase in recurring operating income, to €215 million, for a 400 bp operating margin increase, to 10.2% of sales.

Gross margin expanded 140 bps to 74.6% of sales. Operating leverage and cost controls led to a 250-bps reduction in the SG&A expense ratio, to 45.8% of sales. This resulted in a 400 bp operating margin increase to 28.9% of sales.

Growth in 2018 was driven both by local and tourist customers; however, Kering experienced a slight downturn in tourist spending towards the end of the year. In Europe, across the aggregated scope of the three main brands (Gucci, Saint Laurent and Bottega Veneta), all nationalities rose during 2018, with sales to Europeans, Chinese and U.S. customers (Kering’s three main customer nationalities) up 20-40%. Chinese customers specifically remained buoyant in 4Q in mainland China and the rest of Asia.

Use of AI to identify and target high-potential customers proved almost twice as successful as selections made by sales associates. Kering will now roll out this function as part of its transformational initiatives. Other initiatives include digital; B2C logistics functionality across the brand portfolio that provides a consolidated and in real time 360-degree view of customers and testing leasing, renting, subscriptions, and previously owned services.

Outlook

The company did not provide quantitative guidance for 2019.

Source: Company reports/Coresight Research[/caption]

FY18 Results

Kering reported 2018 EPS from continuing operations of €20.88, up 52.2% from €13.72 in 2017. Total revenues were €13.67 billion, up 26.3% year over year (up 29.4% on a comparable currency basis) and above the €13.59 billion consensus estimate.

Direct to consumer revenue growth of 31% drove the top line with all regions participating. E-commerce revenues jumped 71% and now represent 6% of total sales. On a constant-currency basis, Western Europe revenues rose 22%, North America was up 38%, Japan climbed 26%, Asia Pacific was up 37% and the rest of the world up 27%. Wholesale revenues grew 24%.

Gucci saw a 33.4% revenue increase, to €$8.29 billion and operating income of €3.28 billion, up 54.2% for a 39.5% operating margin. Gucci retail revenues increased 38% and represent 85% of brand sales. Gucci e-commerce sales also climbed 70%.

Saint Laurent sales increased 16.1% to €1.71 billion and operating profits rose 21.9% to €459 million, or 26.3% of brand sales. Bottega Veneta lagged with a 5.7% revenue decline in 2018 and an operating margin contraction of 320 bps to 21.8% as it is in the midst of a turnaround. However, the trend improved by 4Q with a 3% revenue decline and an early positive response to new creative director Daniel Lee’s initial collections. Revenue growth at Kering’s other houses (Balenciaga, Alexander McQueen, Boucheron, Brioni, Ulysse Nardin, Pomellato) was 29.8% in 2018 to €2.11 billion, accompanied by a 114% increase in recurring operating income, to €215 million, for a 400 bp operating margin increase, to 10.2% of sales.

Gross margin expanded 140 bps to 74.6% of sales. Operating leverage and cost controls led to a 250-bps reduction in the SG&A expense ratio, to 45.8% of sales. This resulted in a 400 bp operating margin increase to 28.9% of sales.

Growth in 2018 was driven both by local and tourist customers; however, Kering experienced a slight downturn in tourist spending towards the end of the year. In Europe, across the aggregated scope of the three main brands (Gucci, Saint Laurent and Bottega Veneta), all nationalities rose during 2018, with sales to Europeans, Chinese and U.S. customers (Kering’s three main customer nationalities) up 20-40%. Chinese customers specifically remained buoyant in 4Q in mainland China and the rest of Asia.

Use of AI to identify and target high-potential customers proved almost twice as successful as selections made by sales associates. Kering will now roll out this function as part of its transformational initiatives. Other initiatives include digital; B2C logistics functionality across the brand portfolio that provides a consolidated and in real time 360-degree view of customers and testing leasing, renting, subscriptions, and previously owned services.

Outlook

The company did not provide quantitative guidance for 2019.

Source: Company reports/Coresight Research[/caption]

FY18 Results

Kering reported 2018 EPS from continuing operations of €20.88, up 52.2% from €13.72 in 2017. Total revenues were €13.67 billion, up 26.3% year over year (up 29.4% on a comparable currency basis) and above the €13.59 billion consensus estimate.

Direct to consumer revenue growth of 31% drove the top line with all regions participating. E-commerce revenues jumped 71% and now represent 6% of total sales. On a constant-currency basis, Western Europe revenues rose 22%, North America was up 38%, Japan climbed 26%, Asia Pacific was up 37% and the rest of the world up 27%. Wholesale revenues grew 24%.

Gucci saw a 33.4% revenue increase, to €$8.29 billion and operating income of €3.28 billion, up 54.2% for a 39.5% operating margin. Gucci retail revenues increased 38% and represent 85% of brand sales. Gucci e-commerce sales also climbed 70%.

Saint Laurent sales increased 16.1% to €1.71 billion and operating profits rose 21.9% to €459 million, or 26.3% of brand sales. Bottega Veneta lagged with a 5.7% revenue decline in 2018 and an operating margin contraction of 320 bps to 21.8% as it is in the midst of a turnaround. However, the trend improved by 4Q with a 3% revenue decline and an early positive response to new creative director Daniel Lee’s initial collections. Revenue growth at Kering’s other houses (Balenciaga, Alexander McQueen, Boucheron, Brioni, Ulysse Nardin, Pomellato) was 29.8% in 2018 to €2.11 billion, accompanied by a 114% increase in recurring operating income, to €215 million, for a 400 bp operating margin increase, to 10.2% of sales.

Gross margin expanded 140 bps to 74.6% of sales. Operating leverage and cost controls led to a 250-bps reduction in the SG&A expense ratio, to 45.8% of sales. This resulted in a 400 bp operating margin increase to 28.9% of sales.

Growth in 2018 was driven both by local and tourist customers; however, Kering experienced a slight downturn in tourist spending towards the end of the year. In Europe, across the aggregated scope of the three main brands (Gucci, Saint Laurent and Bottega Veneta), all nationalities rose during 2018, with sales to Europeans, Chinese and U.S. customers (Kering’s three main customer nationalities) up 20-40%. Chinese customers specifically remained buoyant in 4Q in mainland China and the rest of Asia.

Use of AI to identify and target high-potential customers proved almost twice as successful as selections made by sales associates. Kering will now roll out this function as part of its transformational initiatives. Other initiatives include digital; B2C logistics functionality across the brand portfolio that provides a consolidated and in real time 360-degree view of customers and testing leasing, renting, subscriptions, and previously owned services.

Outlook

The company did not provide quantitative guidance for 2019.

- In the medium term, Kering sees travel retail and e-commerce as billion-euro opportunities for Gucci. It also sees fine jewelry, fragrance and cosmetics as growth vehicles. Despite Gucci’s recent momentum, management spoke to further gains in sales per square meter, currently slightly north of €40,000 per square meter (about $4,500 per square foot) up to €45,000 per square meter, versus best-in-class at €50,000 per square meter. With 540 doors, Gucci isn’t planning significant door growth, but will instead focus on renovating, relocating and refurbishing.

- At Saint Laurent, Kering sees opportunity for openings, notably in emerging markets and eastern Asia (EMEA), North America and greater China. Saint Laurent had 219 stores at 2018 yearend.

- Repositioning Bottega Veneta includes relocations, enlargements and new flagships as well as a reinvention of ready-to-wear and renewed leather goods offerings.

- The company anticipates digital channels will remain strong sales growth drivers.