DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

1H19 Results

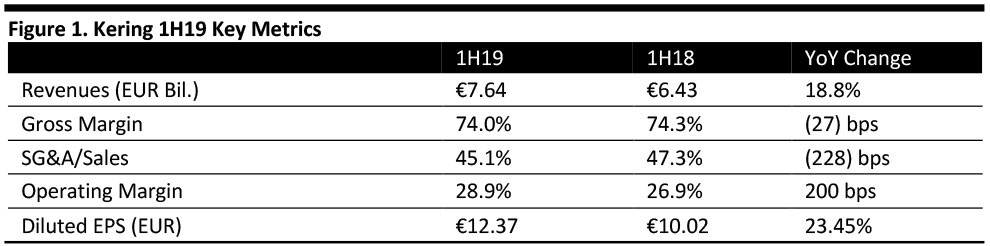

Kering’s 1H19 revenues came in at €7.64 billion, up 18.8% year over year on a reported basis. Kering reported 1H19 diluted EPS of €12.37, up 23.45% year over year.

Gucci saw a 19.8% revenue increase on a reported basis, to €4.62 billion, and recurring operating margin increased by 220 basis points to 40.6%. Gucci sales in directly operated stores increased 16.2% and wholesale rose 15.8% on a comparable basis. Sales in 1H19 were greater than all of 2016, when Gucci began a revamp of the brand.

Saint Laurent sales increased 20.4% on a reported basis to €973.0 million. Recurring operating margin increased 80 basis points (bps) to 25.9%. Sales in directly operated stores were up 19.0% year on year, on a comparable basis.

Bottega Veneta lagged with a 0.6% revenue decline in 1H19. Recurring operating margin was 18.9%, down 600 bps. The new collections from creative director Daniel Lee saw a positive response.

Revenue growth at Kering’s other houses (Balenciaga, Alexander McQueen, Boucheron, Brioni, Ulysse Nardin, Pomellato and others) was 23.1% in 1H19 to €1.23 billion, accompanied by a 54.5% increase in recurring operating income, to €138.3 million. Operating margin was up 230 basis points year on year to 11.3%.

Kering Eyewear 1H19 sales rose to €320.8 million due to the success of Gucci, Saint Laurent and Cartier licenses and by the takeover of Montblanc and Balenciaga licenses.

Performance by Geographic Segment

Asia Pacific ex Japan: Sales grew 24.5% in Asia Pacific. Mainland China posted the strongest growth in the region at 35.3% year on year. Excluding Hong Kong and Macau, all main regions posted good results.

Western Europe: Sales grew 14.0%, with mostly even growth across all regions.

Japan: Sales grew 10.3% owing to good performace from Yves Saint Laurent and Balenciaga.

North America: Sales grew 7.4%.

Outlook

- Kering will continue to implement its strategy to achieve growth in same-store revenue. It will also look at targeted and selective expansion of its store network.

- Kering will invest in e-commerce, omni-channel distribution, logistics and IT infrastructure, expertise, and innovative digital technologies to develop cross-business growth platforms.

- Kering will work on strategic measures: Manage and allocate its resouces to further improve operating performance, maintain a high level of cash flow and continue to grow return on capital employed.