Nitheesh NH

Introduction

On June 8 and 9, French luxury group Kering hosted its Capital Markets Day in Paris, France. Over the two days, the company primarily discussed two of its brands, Gucci and Yves Saint Laurent, as well as its Kering Eyewear business. We present key insights from the event, covering the group's growth plans and their implications.Kering Capital Markets Day 2022: Key Insights

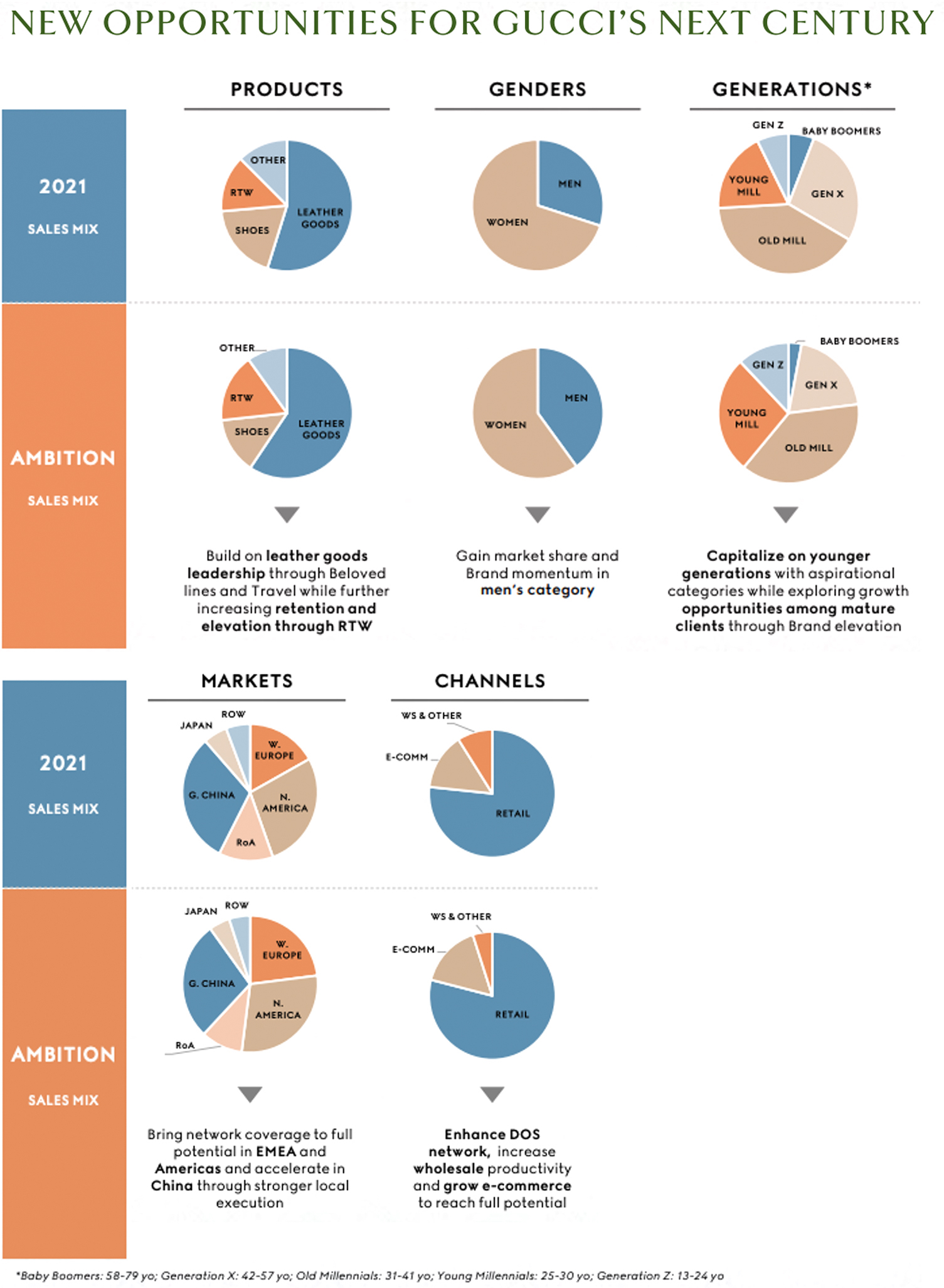

Developing Gucci into a €15 Billion Brand Kering reported that Gucci (its biggest house) has seen consistent double-digit growth in revenue over the last five years, with the exception of pandemic-impacted 2020. Still, “despite disruptions caused by the pandemic,” the brand achieved a goal it set in 2018: turning Gucci into a €10 billion ($10.4 billion) business. Now, Kering plans to grow Gucci’s revenues to €15 billion ($15.7 billion) and maintain an EBIT margin of 41% or over—it last achieved this level in 2019, after which its EBIT margin fell to 35.1% in 2020 and 38.2% in 2021. Although the company did not specify a timeline for achieving these goals, Kering did state the strategies it plans to use to accomplish them:- Improve leather goods and ready-to-wear offerings—Kering plans to improve Gucci’s leather goods offerings (which constitute over 50% of the brand’s revenues) through its Beloved and Travel lines. Meanwhile, the company plans to “further increase retention and elevation through ready-to-wear.”

- Increase men’s category share—While men’s products currently constitute a little over one-quarter of Gucci’s offerings, the group plans to grow this share to around one-third. In 2023, two of Gucci’s five collections will be men’s collections.

- Grow youthful client base—Kering plans to grow Gucci’s client base in the “young millennials” and Gen Z segments (25–30-year-olds and 13–24-year-olds, respectively). It intends to achieve this by collaborating with other brands, such as Gucci’s recent collection with Adidas, protecting price points of products in the aspirational segment and exploring tech innovations, including esports. In May 2022, Gucci created a gaming academy, Gucci Gaming Academy, to encourage young talent in the esports space.

- Expand directly operated store (DOS) network in key markets—The group plans to increase Gucci’s DOS network in the Americas, with new stores planned in several untapped markets in both the US and Latin America. Kering also intends to double the brand’s Canadian e-commerce business and roll out online stores in five Latin American countries. In China, the company plans to accelerate Gucci’s current growth trajectory with localized experiences after appointing a new President of Greater China Fashion Business, Laurent Cathala, in April 2022. In Europe, new flagship and special retail concept Gucci stores are planned to drive local consumption. Kering expects to improve Gucci’s sales density by 30% from its current €45,000 ($47,000)-per-square-meter rate.

Gucci’s future growth plans

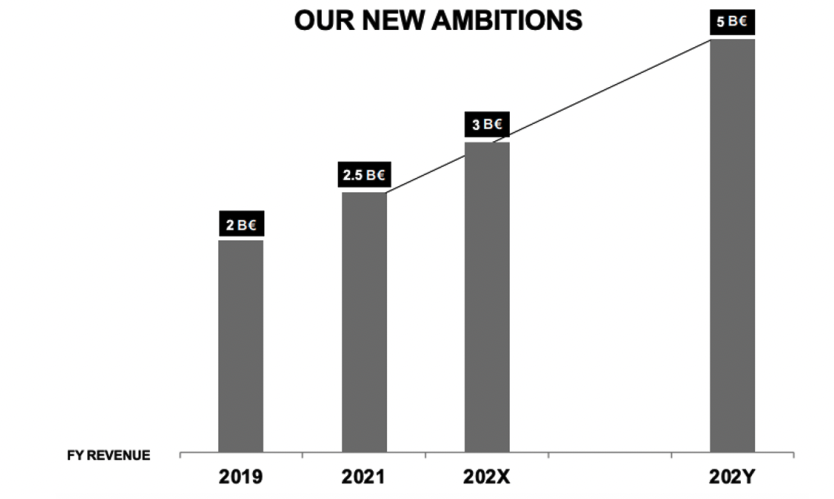

Gucci’s future growth plansSource: Kering[/caption] Doubling Yves Saint Laurent’s Revenues to €5 Billion In the near term, Kering aims to achieve €3 billion ($3.1 billion) in revenue and a 30% EBIT margin for Yves Saint Laurent, its second-largest house by revenue. In 2021, the brand brought in €2.5 billion ($2.6 billion) in revenue and achieved an EBIT margin of 28.3%, its highest in three years. In the medium term, the group plans to double Yves Saint Laurent’s revenue to €5 billion ($5.2 billion) and achieve and sustain an EBIT margin of 33%. Kering laid out an action plan for Yves Saint Laurent, focused on the following key aspects:

- Customers—Kering plans to grow Yves Saint Laurent’s local client base (which constitutes 84% of its total customer base) and its youthful customer base (currently 70% of its total base). The group also aims to increase average spending at Yves Saint Laurent and the brand’s loyal customer base.

- Products—Kering plans to grow the brand’s offerings in its ready-to-wear and shoe segments, which accounted for 12% and 9% of its total revenue in 2021, respectively. Similar to Gucci, Yves Saint Laurent’s collections will feature increased men’s options.

- Distribution channels—The group plans to increase its control over Yves Saint Laurent’s distribution by reducing its wholesale share from 22% to around 11%, while expanding its retail share. Kering will increase Yves Saint Laurent’s retail share by growing from 268 stores to 300–350 stores, increasing average store size from 170 square meters to nearly 200 square meters and expanding sales density from less than €40,000 ($41,800) per square meter to over €50,000 ($52,200) per square meter. Specifically, Kering plans to increase Yves Saint Laurent’s presence in parts of Asia—pointing to opportunities in Japan and South Korea—while consolidating the brand’s position in China.

- Operations—The group aims to expand Yves Saint Laurent’s production capacity to support its distribution growth goals. This includes opening a new 28,000-square-meter facility for leather goods in Tuscany, Italy, in 2023, transferring logistics and distribution to a new hub in Trecate, Italy, and developing processes that use automation technologies to improve distribution and time to market.

- Communication—Kering outlined Yves Saint Laurent’s focus on its sustainability agenda, stating that it is “a fundamental commitment” and part of the brand’s culture, “not a marketing tool.” The brand has laid out specific programs and objectives for its departments and monitors them regularly while driving action across all levels of its stakeholders—employees, clients and suppliers.

Yves Saint Laurent’s growth ambitions

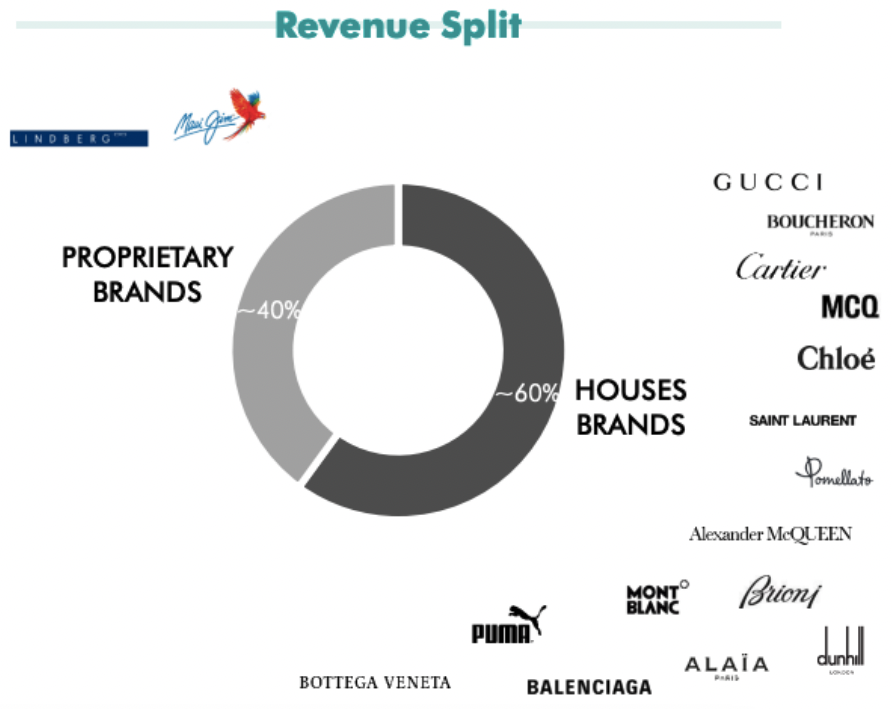

Yves Saint Laurent’s growth ambitionsSource: Kering[/caption] Increasing Kering Eyewear Revenue to €2 Billion Kering stated it plans to grow Kering Eyewear’s revenue from 2021’s €1 billion (just over $1 billion) to more than €2 billion ($2.1 billion) and achieve an EBIT margin of over 15%, up from the current EBIT margin of 10%. The company plans to do this by concentrating on the following:

- Proprietary brands—Kering plans to leverage the recent acquisitions of Lindberg and Maui Jim, which currently contribute 40% of the segment’s revenue, to increase revenue from its proprietary offerings. The group stated that the brands improve the Kering Eyewear’s reputation, size and sales force. Specifically, Kering plans to leverage Maui Jim’s polarized sunglasses technology and prescription competency and Lindberg’s optical expertise across its other brands.

Yves Saint Laurent’s current revenue split

Yves Saint Laurent’s current revenue splitSource: Kering[/caption]

- Online retailers—Kering Eyewear recorded a 37% CAGR across fashion and eyewear “e-tailers” over the last three years. Going forward, it plans to use a new, dedicated team to work exclusively with online players, using a “tailormade approach for product assortment, visibility projects and service level.” Specifically, with Chinese e-commerce platforms, the segment recorded a 53% CAGR between 2019 and 2021, and now plans to increase control over its e-commerce business in the region.

- Network expansion—Kering plans to grow Kering Eyewear’s direct presence by opening new subsidiaries in key global markets. Since 2018, it has opened five new direct subsidiaries in East Europe, India, Malaysia, the Middle East and Portugal.