Source: Company reports

4Q15 RESULTS

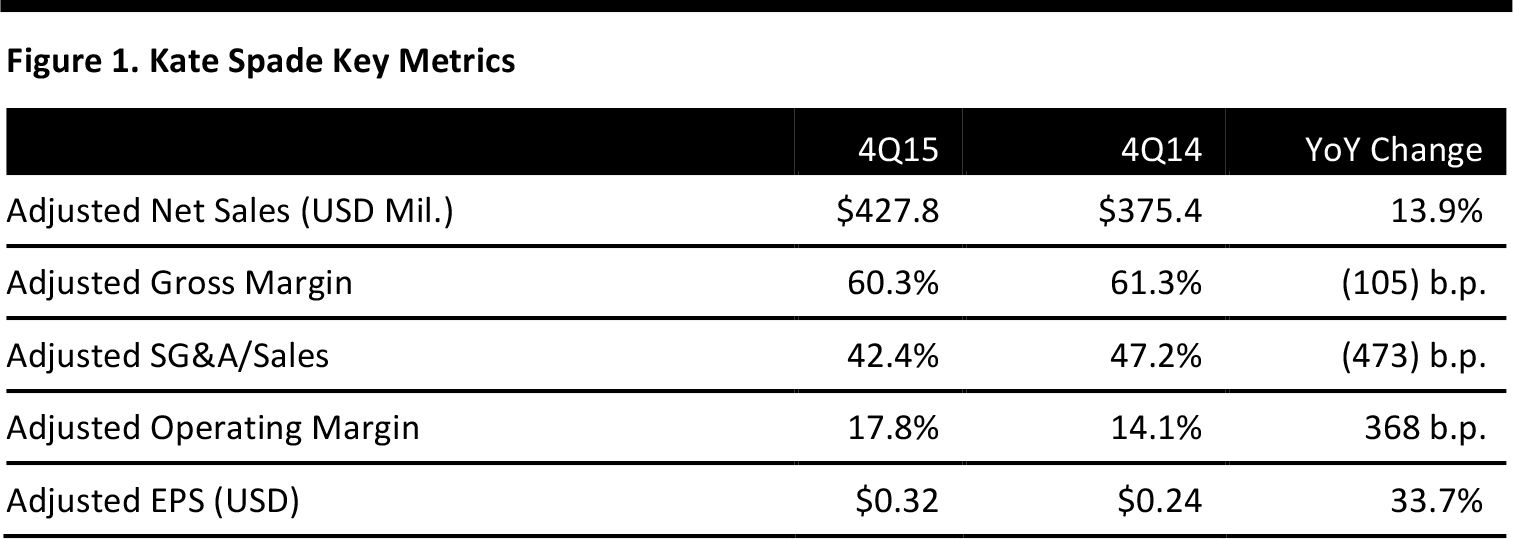

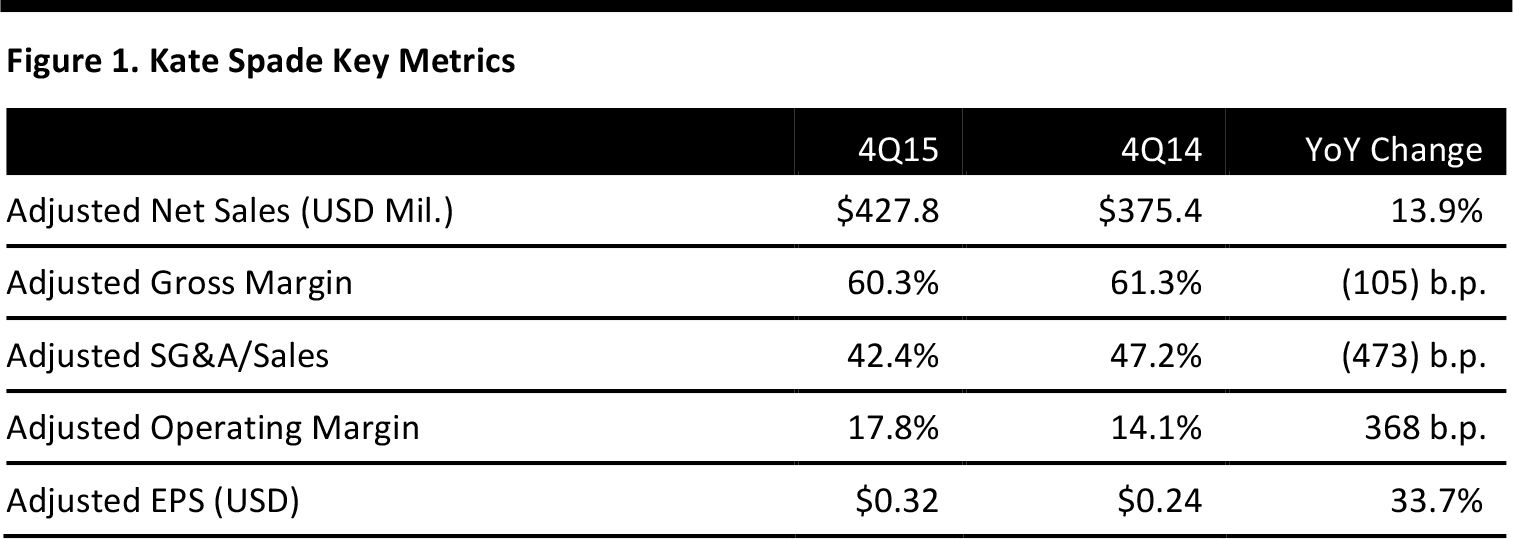

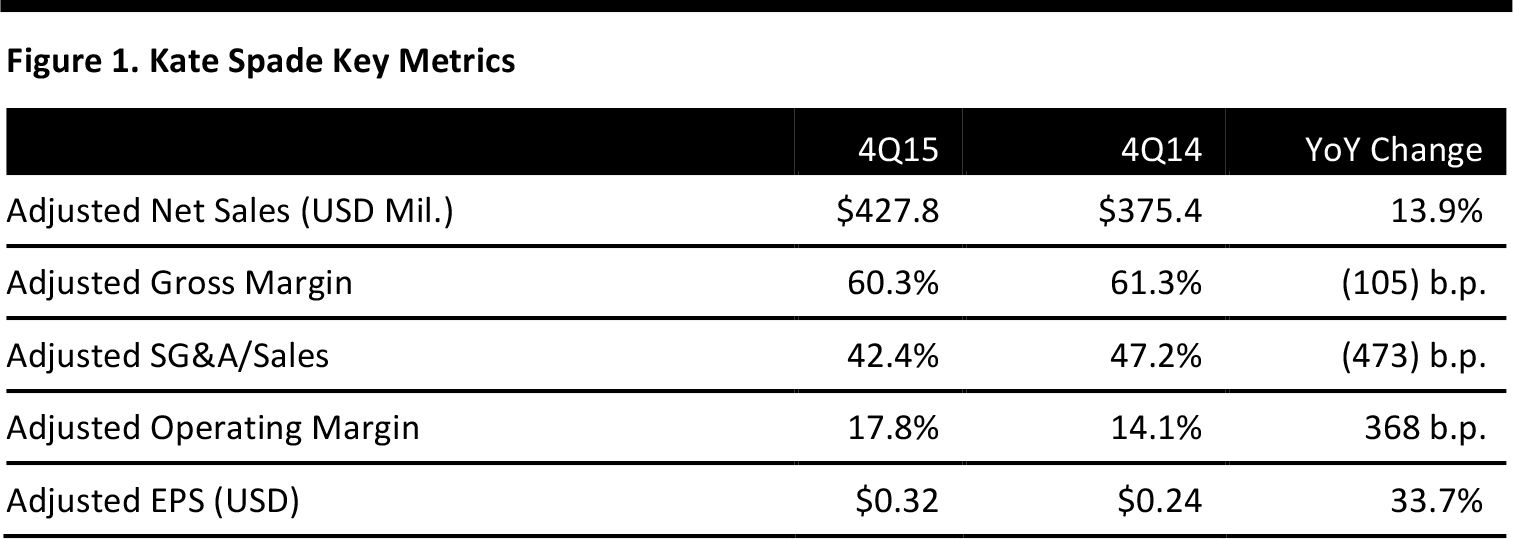

Kate Spade reported adjusted 4Q15 net sales of $427.8 million, up 13.9% from $375.4 million in the year-ago period but 2.7% below the consensus estimate. Adjusted net sales exclude the winding down of operations but include the impact of strategic initiatives, an additional week in the quarter in 2014 and the impact of foreign currency. GAAP revenues were $429.0 million, up 7.6% year over year.

The company reported quarterly comp growth of 7.6%, driven by “two axes of growth,” product categories and geographic expansion. In 2015, Kate Spade introduced 14 new product categories and established business in eight new countries. Separately, the company announced a partnership with Reliance Brands Limited to enter the Indian market. The brand’s channel-agnostic approach was also a key factor in its satisfying quarterly performance.

2015 RESULTS

Adjusted net sales were $1.22 billion for 2015, up 20.6% from 2014 but slightly below the consensus estimate of $1.23 billion. Comp sales increased by 13% for the year. Management was pleased with the rapid comp sales growth and expressed confidence that the company would generate strong, double-digit growth on both the top and bottom lines in 2016.

Moreover, management aims to continue the momentum from 2015 and generate growth across its four category pillars: women’s, men’s, children and home.

GUIDANCE

Kate Spade provided guidance for diluted EPS of $0.70–$0.80 for 2016, assuming comp growth in the low to mid-teens and total sales of $1.39–$1.41 billion. The revenue guidance was slightly below the consensus estimate of $1.44 billion. In addition, the company plans to open 40–45 new stores in 2016.