Kaola Forms Strategic Partnership with Beiersdorf

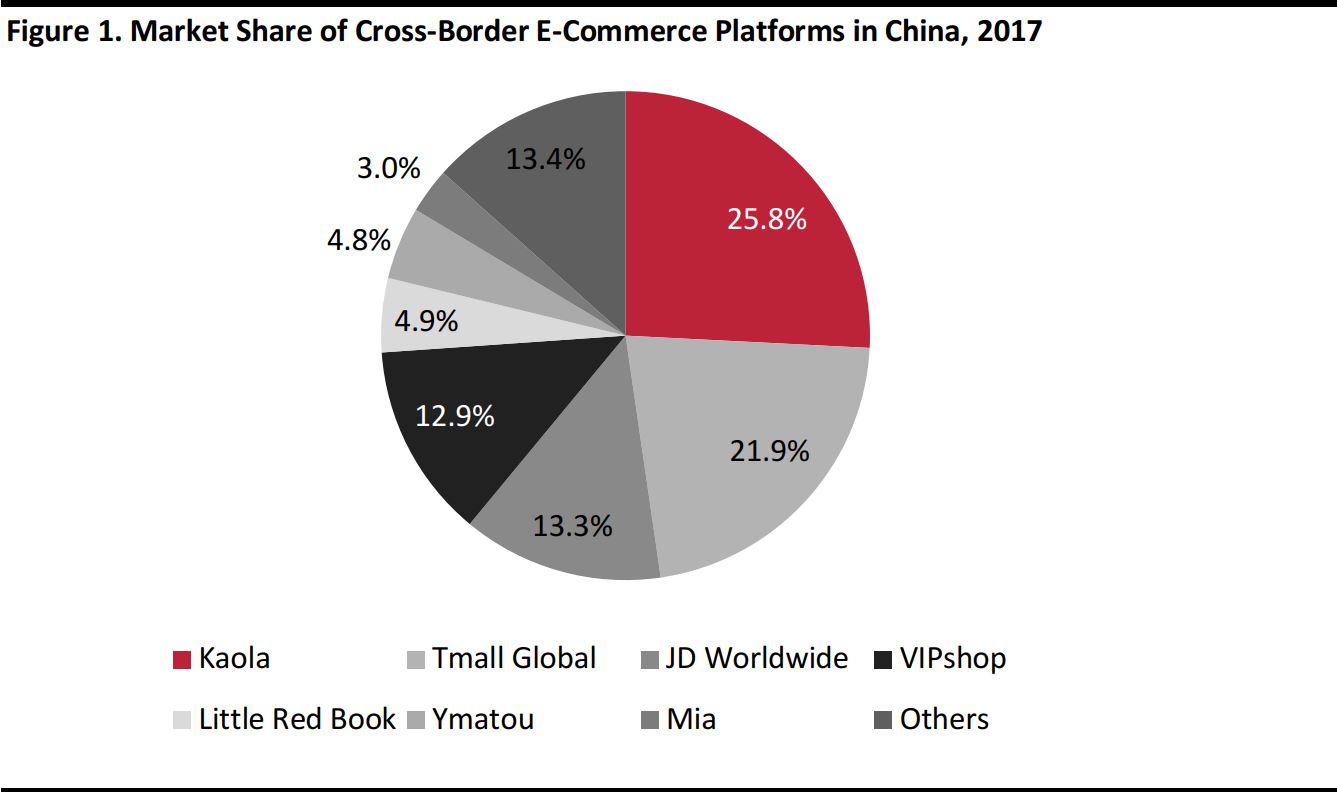

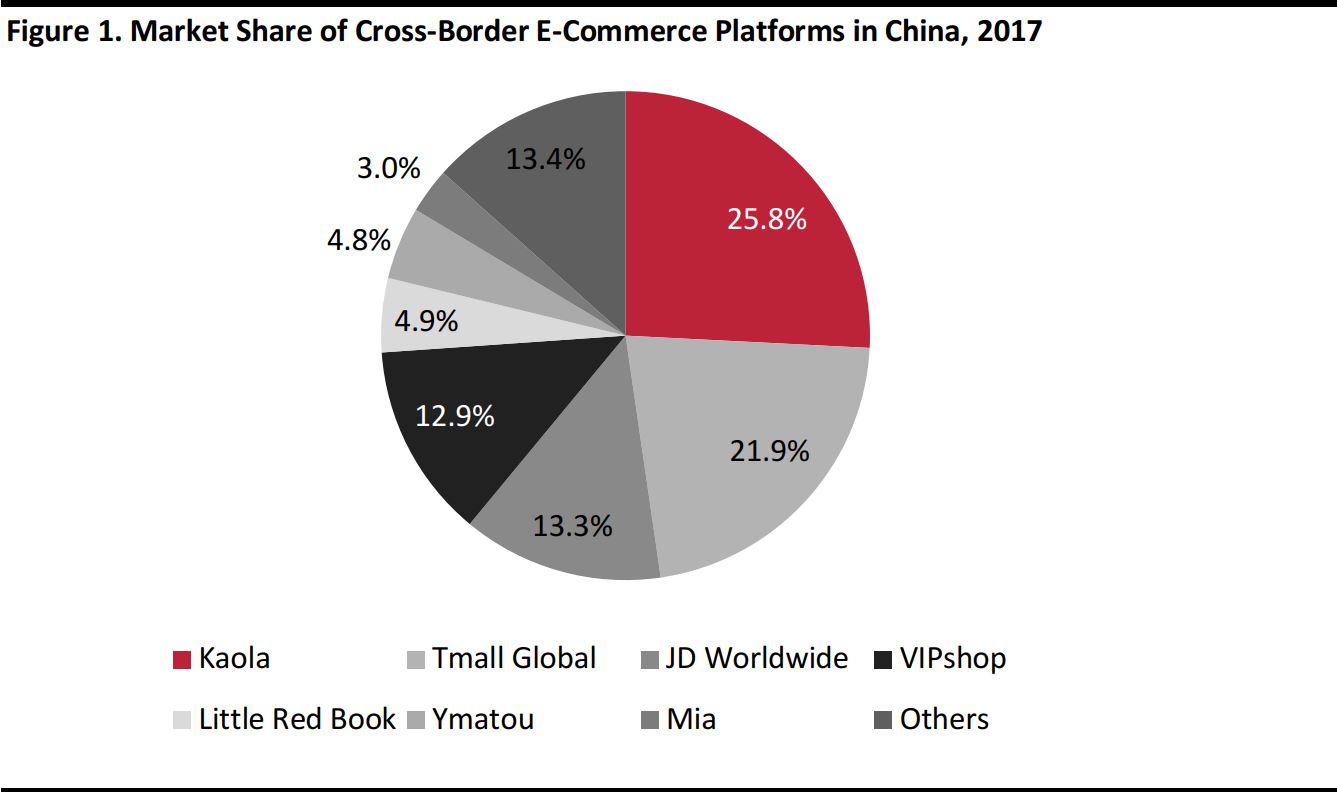

China’s largest cross-border online marketplace Kaola recently established a strategic partnership with German skincare company Beiersdorf—the maker of Nivea skin care products. Kaola is a subsidiary of publicly traded NetEase, a leading Chinese Internet company that provides online services such as content, community and games. At the end of 2017, the company had a 25.8% share of the cross-border e-commerce market in China, followed by Tmall Global at 21.9% and JD Worldwide at 13.3%.

Source: iiMedia

Source: iiMedia

Kaola sells a large variety of products, including fashion and apparel, jewelry and accessories, sports and outdoor gears, children’s wear and shoes, home and personal care, nutrition and health food, digital appliances, fresh food products, maternity and baby products, and cosmetics.

The strategic collaboration gives Beiersdorf access to the growing cross-border ecommerce market in China, which rose 80.6% growth year over year in 2017 compared to 2016, according to the General Administration of Customs (GAC) China. Online spending on imported goods is expected to grow at a compound annual growth rate (CAGR) of 15% from 2016 to 2021, to reach nearly $194.3 billion from around $91.8 billion in 2016, according to market research firm Mintel.

The partnership will bring more product options, benefiting its customers and giving them more choice. Currently, Kaola offers more than 3,000 brands from over 80 countries and regions, and has around 900 million users, of which 80% are women. According to the company, most of these female customers are between the ages of 25 and 35, and shop for themselves, their children and their parents at the frequency of 1.5 times per month. The average Kaola customer is generally wealthier and better educated and in the growing middle class.

Quality-Control Efforts

As China’s middle class grows, more and more consumers are looking for higher-quality items and want to enjoy the same quality of life as their middle-class peers in developed economies. Enabled by its business model, Kaola strives to provide high-quality products at competitive prices, while providing good after-sales service. It sources products directly from suppliers and exports them to China from its own warehouses to ensure a high level of customer service. As part of its direct sourcing operation, Kaola has branch offices in the US, Germany, Italy, Japan, Korea, Australia, Hong Kong and Taiwan.

Adding More Brands to its Platform

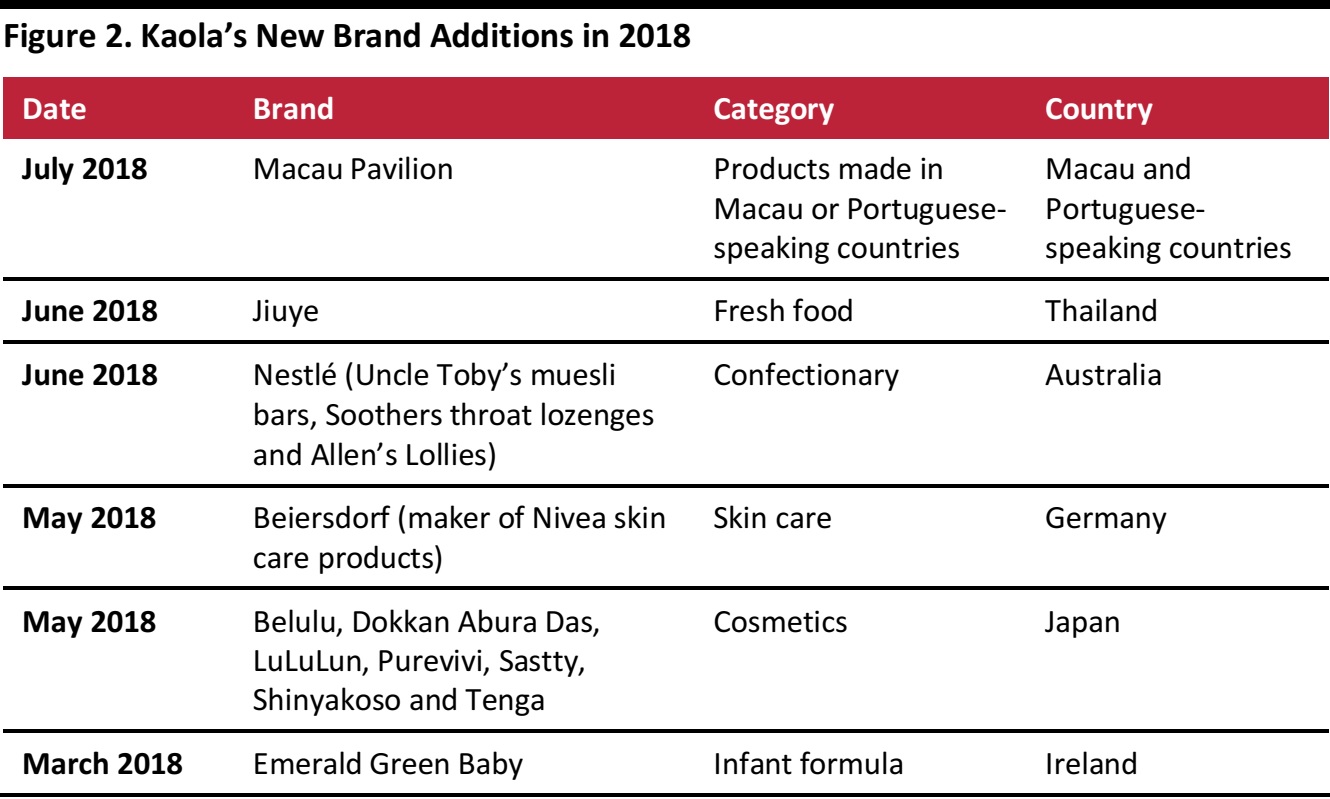

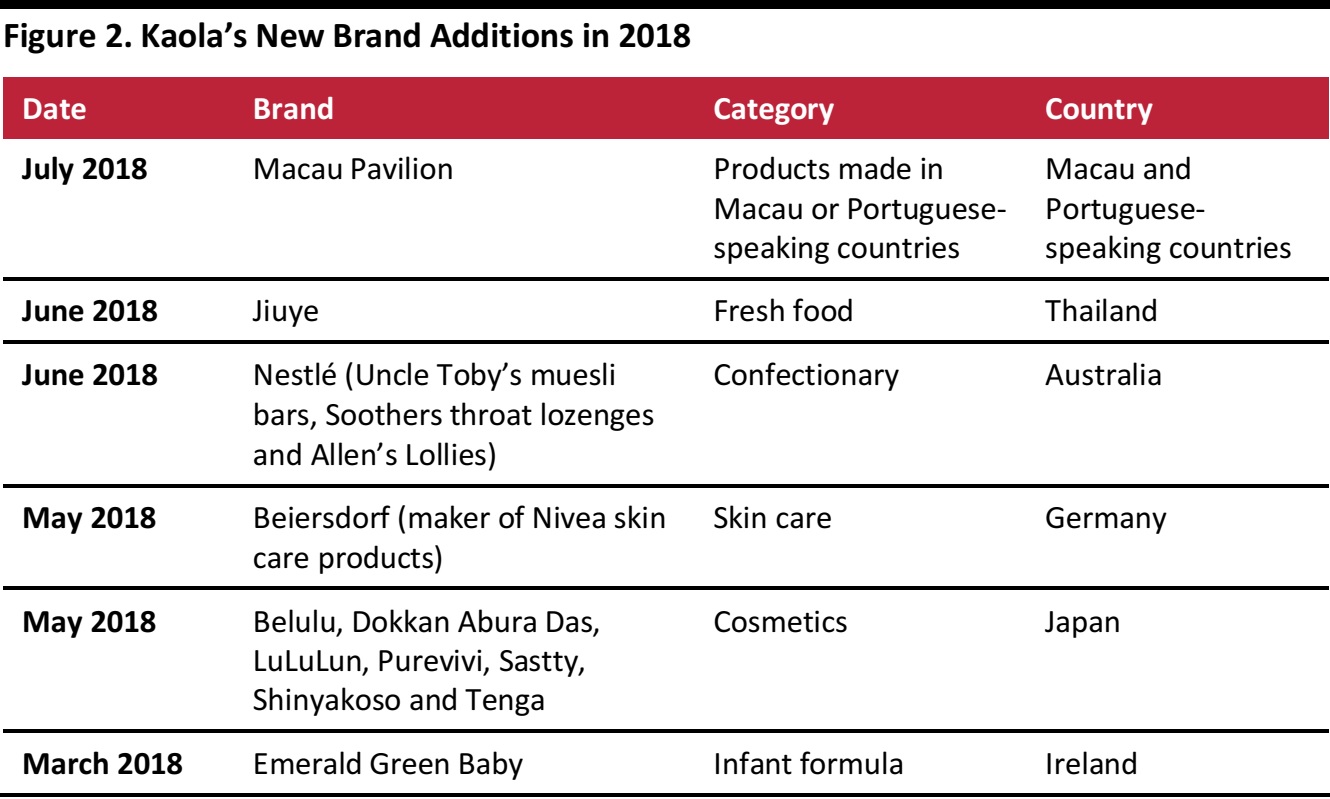

Kaola continues to add more brands to its product offering in its goal to provide more choices to customers. Flexible arrangements help it to easily cooperate with brands: partners can set up pop-up stores, flagship stores, shopfronts (business-to-commerce [B2C]), or direct sales to Kaola (business-to-business [B2B]). According to company CEO Zhang Lei, Kaola is targeting the purchase of close to $11 billion of inventory from the US, Europe and Japan by 2020. Specifically, the company plans to spend $4.7 billion on Japanese products and $3.7 billion on European products, its two regions of focus. Sales of Japanese products rank first on Kaola, followed by the US, Germany, South Korea and Australia, according to company data.

Kaola has been quickly gearing up. In 2018 alone, it has formed partnerships with brands from Japan, Thailand, Australia and Germany, and set up an online pavilion focusing on Macau and Portuguese-speaking countries.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Moving Offline

As the company looks to gain market share, in April it launched its first offline cross-border e-commerce store in Hangzhou, taking advantage of preferential tariff policies in China’s cross-border e-commerce pilot zone. The store has around 1,000 SKUs (store-keeping units) covering fashion and apparel, home and personal care, maternity and baby products, and cosmetics. Customers can browse prices on digital screens in the store or scan a QR code using an app or WeChat mini program.

Payment is settled via a secure transaction, and customers need only pay the required cross-border e-commerce taxes and tariffs. The store seemingly enjoys the same protected status as bonded warehouses, where custom clearance can be carried out in advance or at the point of sale. This helps customers save time from queuing and allow customers more time to shop. More and more consumers will be expected to shop at Kaola, as consumers no longer need to go overseas to purchase goods at duty free stores. Kaola plans to open another five stores, similar to its Hangzhou store, in Beijing, Tianjin, Shanghai, Guangzhou and Chongqing.

Key Takeaways

Kaola, the largest cross-border e-commerce platform in China, has established a strategic partnership with German skincare company Beiersdorf—the maker of Nivea skin care products. Benefiting both parties, the partnership will help Kaola to expand its European product offering, while Beiersdorf will be able to reach the growing cross-border e-commerce market in China.

Its direct procurement and export model—in other words directly purchasing from sellers and importing into China—helps Kaola ensure the quality of the products it imports. As part of its focus on bringing more European brands to Chinese consumers, the partnership will help Kaola further its plans to increase its brand offering. Not only is the company continuing to add brands to its product portfolio, in April, it also launched its first offline cross-border e-commerce store in Hangzhou.

Source: iiMedia

Source: iiMedia Source: Company reports/Coresight Research

Source: Company reports/Coresight Research