DIpil Das

China Retail Sales: June 2021

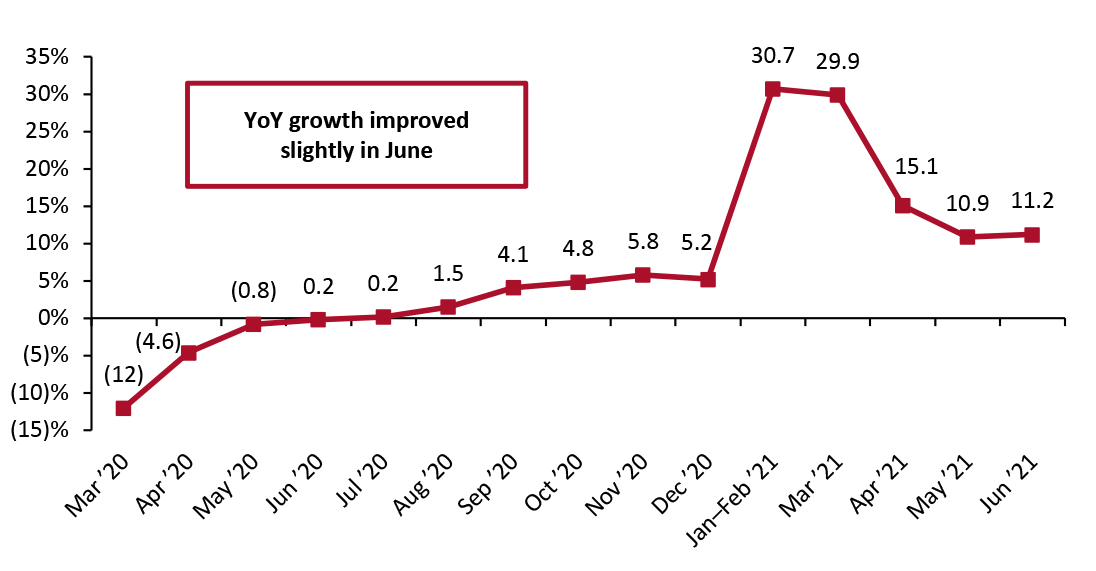

Following 30.7% year-over-year growth in January and February, 29.9% growth in March, 15.1% growth in April, and 10.9% growth in May, year-over-year growth in China’s total retail sales (ex. food service, incl. automobiles and gasoline) stabilized in June 2021. Total retail sales grew 11.2% year over year, reaching ¥3.4 trillion ($521 billion). Year-over-year growth was against weak comparatives—sales declined by 0.2% year over year in June 2020. Nevertheless, against pre-pandemic 2019 values, total sales in June 2021 saw strong growth of 11.6%. Figure 1 shows the recovery trajectory of total retail sales in China. We expect retail sales to see year-over-year growth in the high single-digits or low teens in the coming months.Figure 1. Total China Retail Sales (ex. Food Service; incl. Automobiles and Gasoline): YoY % Change [caption id="attachment_130107" align="aligncenter" width="726"]

January and February figures are reported together

January and February figures are reported together Source: National Bureau of Statistics/Coresight Research [/caption] Retail Sales Growth by Sector All sectors saw positive year-over-year sales growth in June:

- Beverage retailers grew 29.1% year over year, the highest growth rate in the month. On a two-year basis, the beverage sector grew 48.9%. A wave of new beverage brands targeting young consumers reported rapid growth during the 6.18 Shopping Festival. According to JD.com, sales from beverage brands including Genki Forest, Oatly and Wonderlab surged 10 times in the first five minutes of the June 18 event.

- Gold, silver and jewelry retailers recorded the second-largest sales growth in June, although growth slowed to 26.0% from 31.5% last month and 48.3% two months ago. On a two-year basis, the sector increased 10.1%.JD.com saw jewelry sales spike 100% on the first day of the 6.18 Shopping Festival.

- School and office supplies and computers saw 25.9% year-over-year growth in June. Compared to the same period in 2019, sales rose 34.9%. Solid growth this month was most likely boosted by the 6.18 Shopping Festival, as JD.com noted that computers were one of the three best-selling product categories during the festival.

- The apparel and footwear sector grew at a steady rate of 12.8% year over year in June, versus 12.3% in May. On a two-year basis, the sector rose 7.6%, slightly below May’s increase of 8.2%. Online channels performed strongly in apparel and footwear. Data company Taosj reported that the total GMV of apparel and footwear on Tmall and Taobao grew 45.6% year over year, driven by women’s apparel and men’s and children’s footwear. International brands including Adidas and NIKE have returned as top-selling sports brands, indicating that the government-led boycott of their products initiated in April in China is losing steam.

- Beauty retailers witnessed a decline in year-over-year growth this year. In June, the sector increased by 13.5%, down from 14.6% in May and 17.8% in April. However, on a two-year basis, sales by beauty retailers saw the second-highest growth among all sectors, at 43.0%. Against strong online sales comparatives last year, sales of beauty products, including skincare and makeup on Tmall rose by 18.9% year over year in June. International beauty brands remain appealing to Chinese consumers, with Lancôme, L’Oréal and Estée Lauder ranking as June’s best-selling skincare brands by GMV.

- Food retailers saw higher growth in June, reaching 15.6% compared to 10.6% growth in May and 6.5% growth in April, as shown in Figure 2. The food sector has performed steadily overall, with little fluctuation during the Covid-19 crisis: Food retail saw year-over-year growth of 10.5% in June 2020 and 9.8% growth in the same period of 2019.

- Furniture and Chinese and Western medicine are the only two sectors that are yet to return to pre-pandemic sales levels. Furniture retailers reported year-over-year sales increases of 13.4%, and a 12.5% decline on a two-year basis.

Figure 2. China Retail Sales (ex. Food Service; incl. Gasoline and Automobiles), by Sector: YoY % Change and Two-Year % Change [wpdatatable id=1113 table_view=regular]

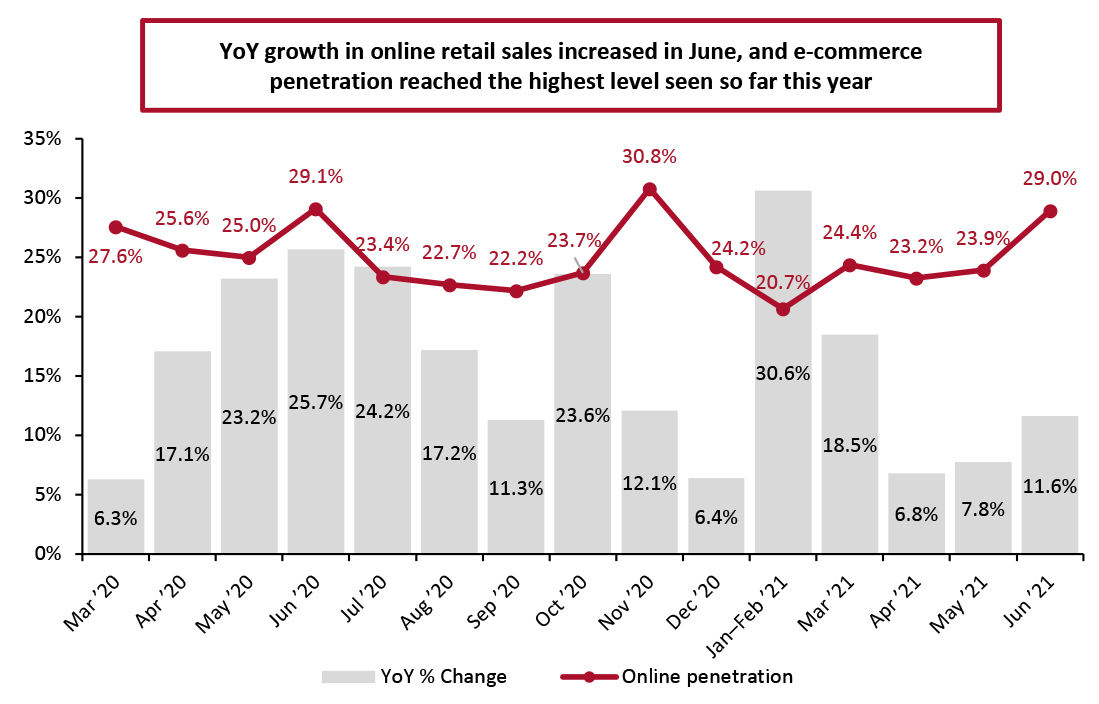

The sector breakdown is based on surveys from enterprises with annual sales of ¥5 million (around $730,000) and above Source: National Bureau of Statistics Online Retail Sales Account for 29.0% of Total Retail Sales In June, online retail sales growth in China reached 11.6% year over year. The channel accounted for 29.0% of total retail sales in the period, much higher than May’s figure of 23.9%, with the increase attributed to the 6.18 Shopping Festival. Online retail sales include food service, as the National Bureau of Statistics does not provide online data that exclude food service. In Figure 3, online sales are benchmarked to total retail sales.

Figure 3. Online Retail Sales as % of Total Retail Sales (incl. Automobiles, Gas and Food Service) [caption id="attachment_130108" align="aligncenter" width="724"]

Online retail sales include food service

Online retail sales include food service Source: National Bureau of Statistics [/caption]