DIpil Das

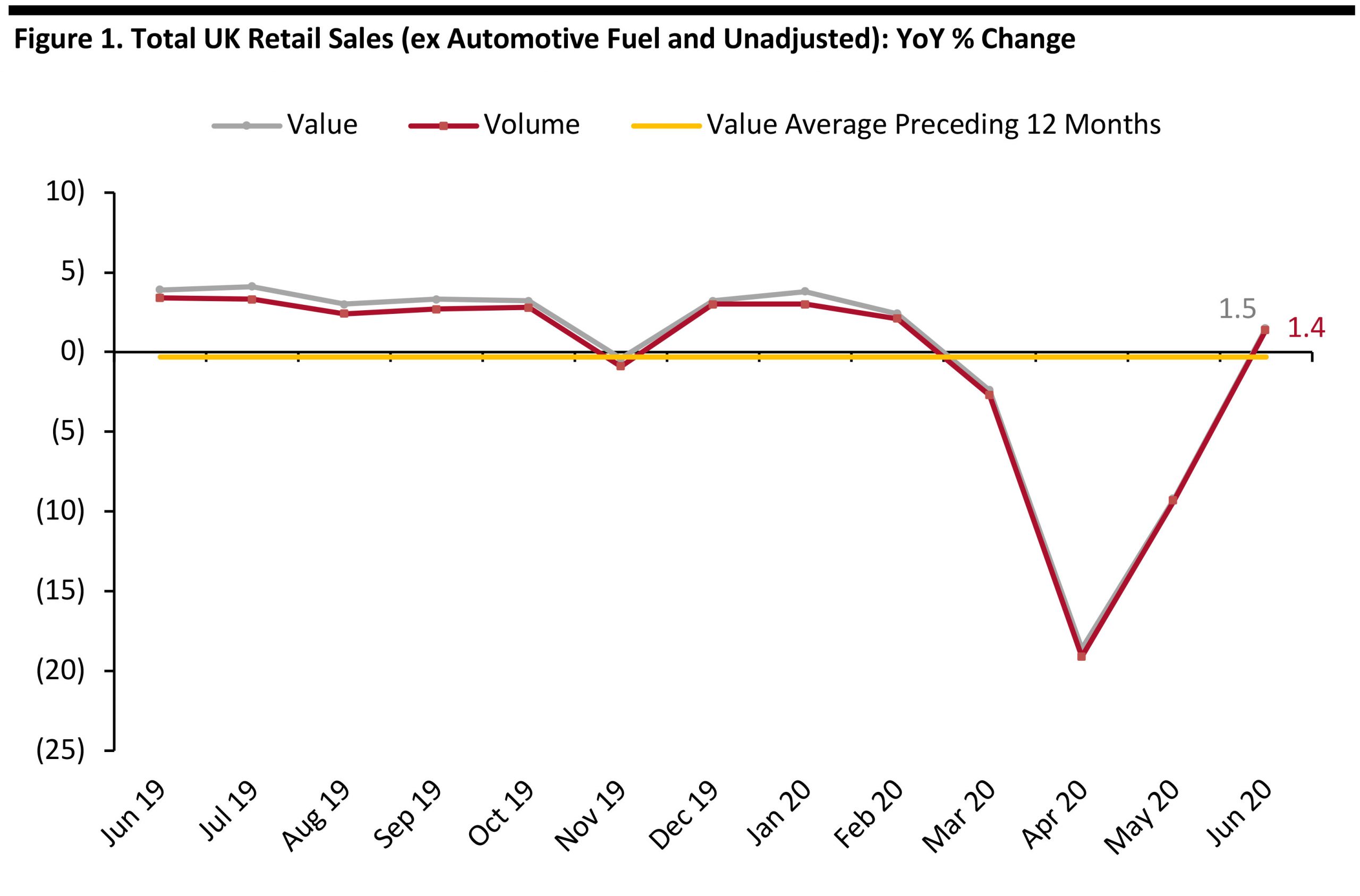

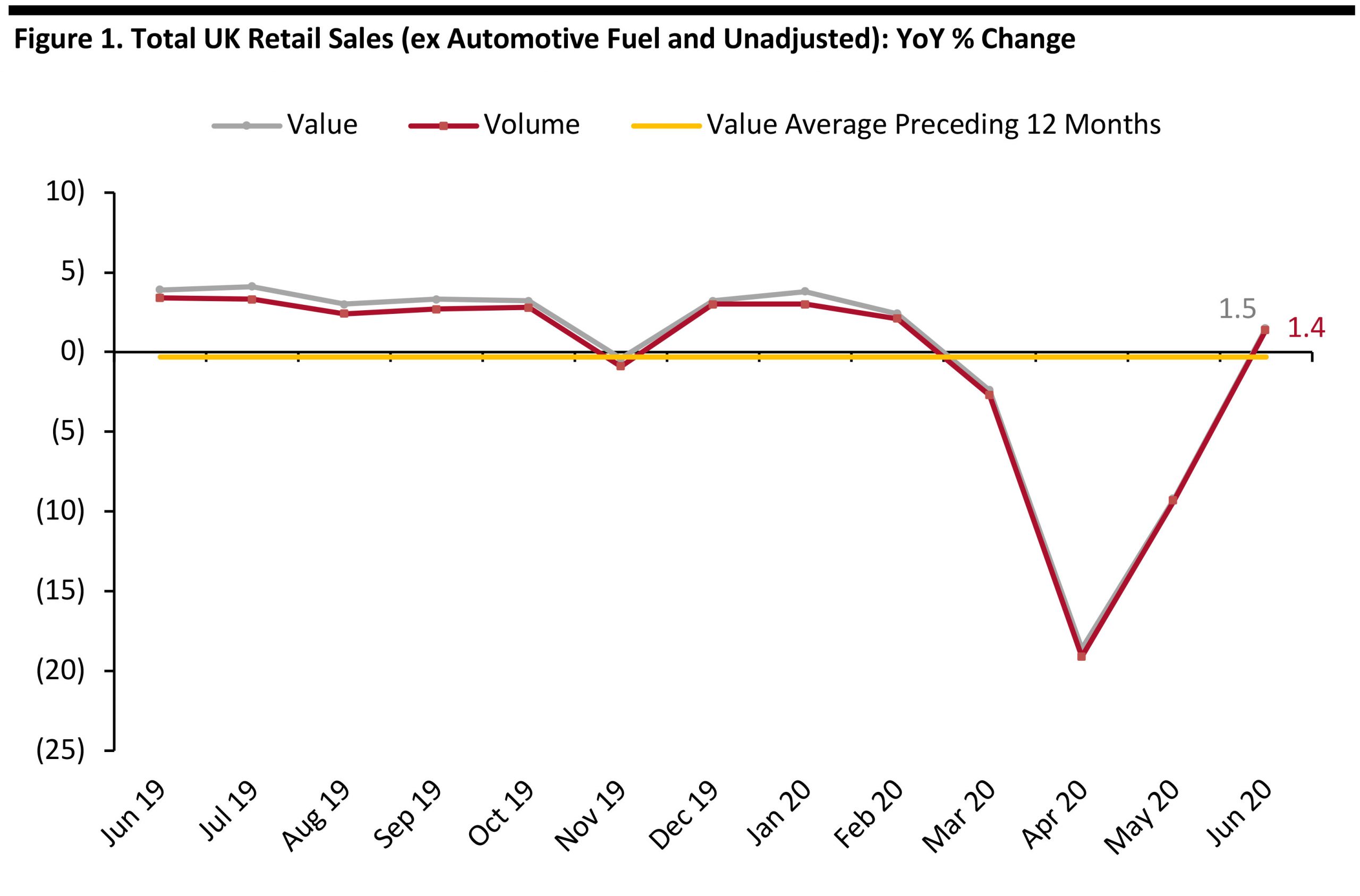

UK retail sales recovered strongly in June and almost reached pre-lockdown levels as nonessential stores in England and Northern Ireland reopened from June 15. Total sales grew 1.5% in June, versus the 9.0% contraction in May, when the government relaxed lockdown restrictions slightly, allowing only garden centers and furniture stores to restart trade.

Online sales continued their growth momentum in June, although the rate of the increase slowed, and e-commerce’s share of overall retail sales declined slightly as shoppers were able to return to stores from June 15.

[caption id="attachment_113411" align="aligncenter" width="700"] Data in this report are not seasonally adjusted

Data in this report are not seasonally adjusted

Source: ONS/Coresight Research [/caption]

Figure 2. UK Retail Sales, by Sector: YoY % Change [wpdatatable id=342 table_view=regular]

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers **A relatively fragmented sector, in which reported figures have traditionally been volatile Source: ONS Online Retail Sales Contribute 31.2% of All Retail Sales Total online retail sales were up 73.4% year over year in June, compared to 59.0% in May. For food retailers, Internet sales were up 129.2% in June, versus a 126.9% increase in May. In June, Internet sales were up 78.3% at store-based nonfood retailers, versus 58.5% in May, supported by strong sales at household-goods retailers, which surged 113.0%. Online sales were up 56.5% at nonstore retailers. Online retail sales fell as a share of overall retail sales as shoppers were able to return to stores from June 15 onwards. Online sales accounted for 31.2% of all retail sales in June, down from 32.8% in May. There was a slight uptick in online spending for food, which accounted for 11.2% of sales at food retailers (versus 11.1% in May). At store-based nonfood retailers, e-commerce accounted for 32.0% of sales in June (versus 39.0% in May).

Data in this report are not seasonally adjusted

Data in this report are not seasonally adjusted Source: ONS/Coresight Research [/caption]

Covid-19 Lockdown Timeline

The UK was put into lockdown on March 23, initially for three weeks in an attempt to limit the spread of the coronavirus, temporarily closing all nonessential retail stores. The government announced on April 16 that it would extend the lockdown by another three weeks. On May 11, Prime Minister Boris Johnson announced that the restrictions would be eased in a phased manner, allowing nonessential stores to reopen from the start of June. However, garden centers were allowed to reopen from May 13 and furniture stores from May 23.

On May 26, the government announced that all nonessential retailers in England and Northern Ireland, including department stores and small independent shops, would be allowed to reopen from June 15, given that stores implement measures to meet the necessary social distancing and hygiene standards.

On June 23, Johnson announced that restaurants, pubs, museums, cinemas and hotels would be allowed to reopen from July 4.

Retail Sales Growth by Sector

A number of sectors saw strong growth in June—notably DIY and hardware, grocery, and health and beauty.

- DIY and hardware stores, which were deemed essential and allowed to stay open during the lockdown, maintained their growth momentum, surging 12.8% in June, compared to a 6.9% increase in May. With fewer leisure and travel options available, many consumers used their time to take on DIY projects and spend on gardening and outdoor-living categories. Home-improvement group Kingfisher, which owns B&Q and Screwfix, reported comparable sales growth of 25.9% in the UK and Ireland in June, compared to 15.5% in May.

- The grocery sector reported a deceleration in growth to 8.8% in June, from 9.8% growth in May. We expect growth to slow further in July, as pubs and restaurants were allowed to reopen from July 4.

- Health and beauty specialists saw the biggest sequential rebound, with sales growth turning positive for the first time since the lockdown. Sales grew 2.4% in June, compared to May’s 34.8% slide. Discretionary beauty stores, which were forced to close during the lockdown, reopened in June and supported growth in this sector. Health-care stores such as pharmacies were allowed to stay open during the lockdown.

- Clothing stores saw an easing of sales contraction, recovering partially from May’s slide of 61.0% to a 35.7% decrease in June. We have seen mixed reopenings from large retailers. Major chains such as John Lewis and Nextfollowed a phased approach and reopened some stores on June 15, with more following thereafter. Marks & Spencer reopened all its clothing-and-home stores on June 15. Primark also opened all of its 153 stores in England on June 15.

- Department stores/mixed-goods retailers also saw an improvement. Department-store stalwart John Lewis began reopening stores in a phased manner from mid-June.

Figure 2. UK Retail Sales, by Sector: YoY % Change [wpdatatable id=342 table_view=regular]

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers **A relatively fragmented sector, in which reported figures have traditionally been volatile Source: ONS Online Retail Sales Contribute 31.2% of All Retail Sales Total online retail sales were up 73.4% year over year in June, compared to 59.0% in May. For food retailers, Internet sales were up 129.2% in June, versus a 126.9% increase in May. In June, Internet sales were up 78.3% at store-based nonfood retailers, versus 58.5% in May, supported by strong sales at household-goods retailers, which surged 113.0%. Online sales were up 56.5% at nonstore retailers. Online retail sales fell as a share of overall retail sales as shoppers were able to return to stores from June 15 onwards. Online sales accounted for 31.2% of all retail sales in June, down from 32.8% in May. There was a slight uptick in online spending for food, which accounted for 11.2% of sales at food retailers (versus 11.1% in May). At store-based nonfood retailers, e-commerce accounted for 32.0% of sales in June (versus 39.0% in May).