Web Developers

Source: Company reports

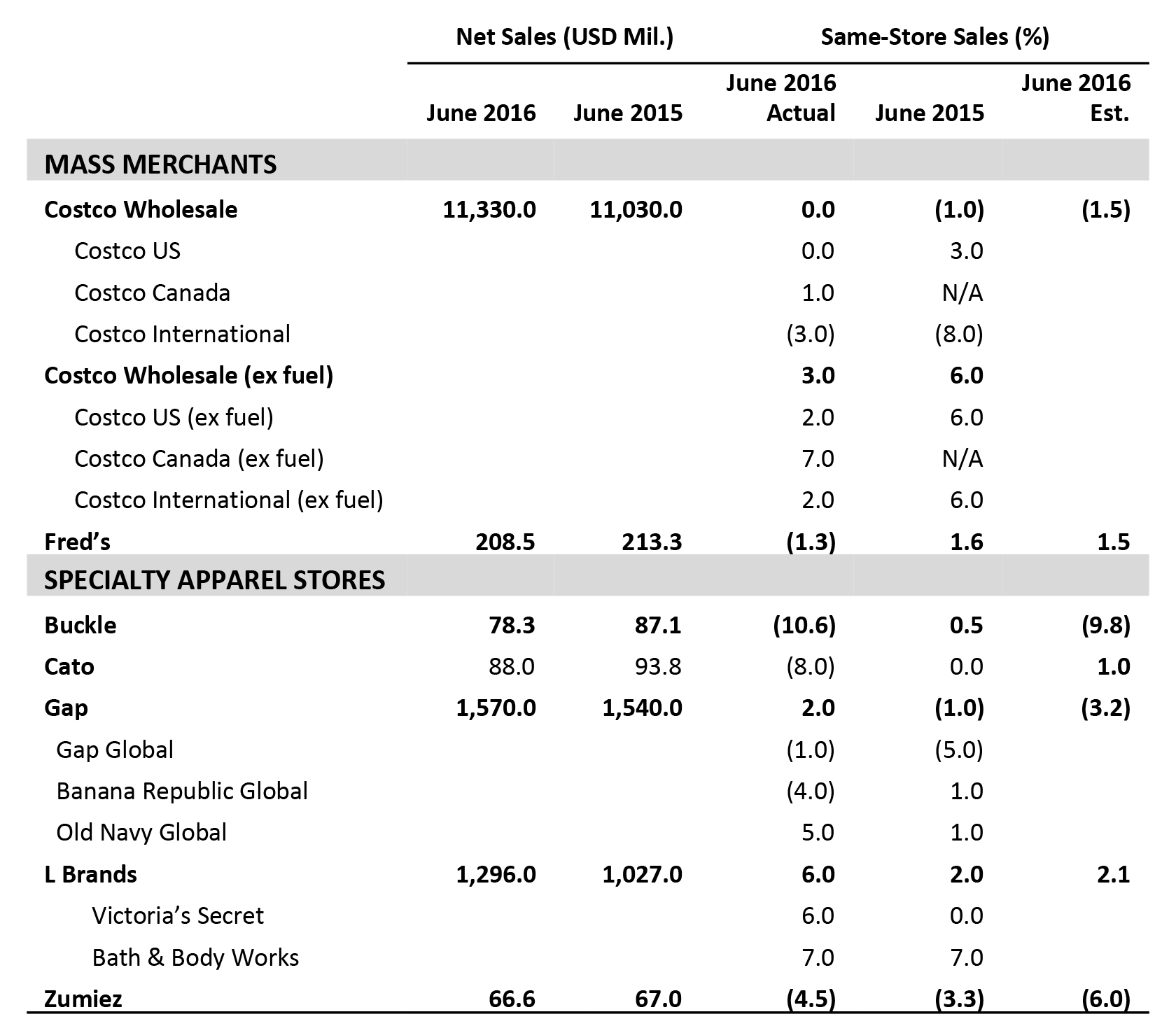

Low Gasoline Prices Once Again Dampened Costco’s Results

- Traffic at Costco was up about 3.6% in March.

- The average transaction value was down about 2.75%, including the negative impact of foreign exchange and gas deflation of more than 3.5%.

- Gas comps fell dramatically, with the average price per gallon down 21% year over year, to $2.05, versus $2.60 last year. Comps were negatively impacted by two points.

- Foreign exchange negatively impacted sales by 1.35%.

- Within the US, the strongest sales regions were the Midwest, Texas and the Southeast. Internationally, Mexico, the UK and Taiwan were the better-performing countries, in local currencies.

- By category, food and sundries comps were up by low to mid-single digits. Better categories included sundries, food and cooler. Global food inflation was slightly higher year over year, but food inflation was flat in the US.

- Hardlines comps were up by low to mid-single digits. Better categories were automotive, sporting goods, tickets, and lawn and garden. Consumer electronics comps were in the negative low single digits.

- Softlines comps were up by mid-single digits. Better categories were men’s apparel, small appliances and home furnishings.

- Fresh foods comps were up by low to mid-single digits. Better categories were produce and service deli. Globally, inflation was slightly higher, but the US showed slight deflation.

- Better categories in the ancillary space were hearing aids and pharmacy.

Earlier Easter Hampers Comps at L Brands

- L Brands’ comps were up 3% in March. Victoria’s Secret’s comps were up 2% and Bath & Body Works’ comps were up 5%.

- Merchandise margins for the overall company were down compared to last year.

- Inventories per square foot were up 3%.

- At Victoria’s Secret, the comp increase was driven by strength in Pink and lingerie that was partially offset by beauty.

- At Bath & Body Works, comps were driven by a favorable customer response to the new Aloha Hawaii floor set and growth in direct channel, which were partially offset by the negative impact of the Easter shift.

Inventory Levels at Gap Elevated into April

- March comps at Gap were down 6%, compared to an increase of 2% in March last year.

- Comps for the Gap brand were down 3%, compared to a decrease of 7% during March last year. Banana Republic comps were down 14%, compared to a decrease of 3% for the same month last year, and Old Navy comps were down 6%, compared to a 14% increase last March.

- The company entered April with more inventory than planned, which it expects will pressure its gross margin rate for the first quarter.

Comparable Scripts and Sales Were Positive for Fred’s in March

- Total sales for discount store and pharmacy Fred’s increased by 10.7% in March, to $214.4 million.

- Same-store sales for the month increased by 1.8%.

- March sales reflected the strong performance in general merchandise departments across most categories, especially health, beauty, personal care, apparel, spring seasonal and Easter holiday. For the second consecutive month, comparable scripts and sales were positive.

Cato Reaffirms 1Q Guidance Following March Sales

- Cato reported sales of $118.8 million for March, up 1.5% from last year. Comp sales were down 1%.

- March sales were impacted by the shift of Easter from early April last year to mid-March this year.

- Management reaffirmed its first-quarter EPS guidance of $1.12–$1.16 versus consensus of $1.15.

Weakness in Women’s Continues to Drive Down Buckle’s Results

- Teen retailer Buckle saw overall comps decline by 11.8% in March. Units per transaction were down 2.5%, while average transaction value was down 1.5%.

- The women’s section accounted for 54.5% of total monthly sales versus 57% last year. Total sales for the women’s segment were down 15%.

- The total sales portion for men’s categories increased to 45.5% from 43% last year. Total sales for the men’s segment were down 5.5%.

- Accessories and footwear represented 7.5% and 6.5% of sales, respectively. Average accessory price points were up 3.5% and average footwear price points were down slightly.

Earlier Easter a Negative for Zumiez, Too

- Zumiez reported sales of $68.8 million for March, down 2.6% from last year. Comp sales were down 7.8%.

- The company believes the earlier Easter holiday this year was a detriment to March comps, but will benefit April comps.

- The decrease in comps was driven by a decrease in comparable transactions that was partially offset by an increase in dollars per transaction. The increase in dollars per transaction was due to an increase in average unit retail that was partially offset by a decrease in units per transaction.

- By category, hard goods, juniors, accessories, footwear and men’s posted negative comps.