All data in this report are nonseasonally adjusted.

Source: Office for National Statistics (ONS)/Fung Global Retail & Technology

Notable Winners and Losers

Source: ONS/Fung Global Retail & Technology

Retail in Detail

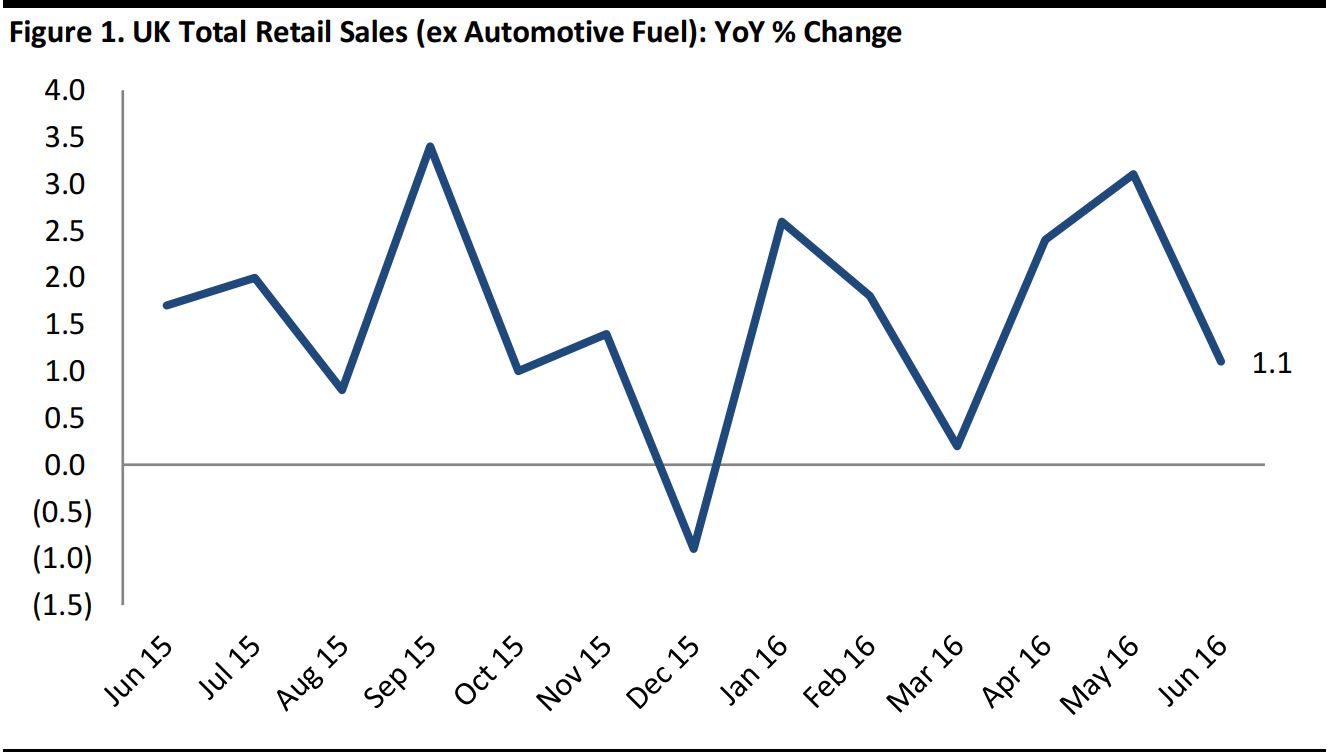

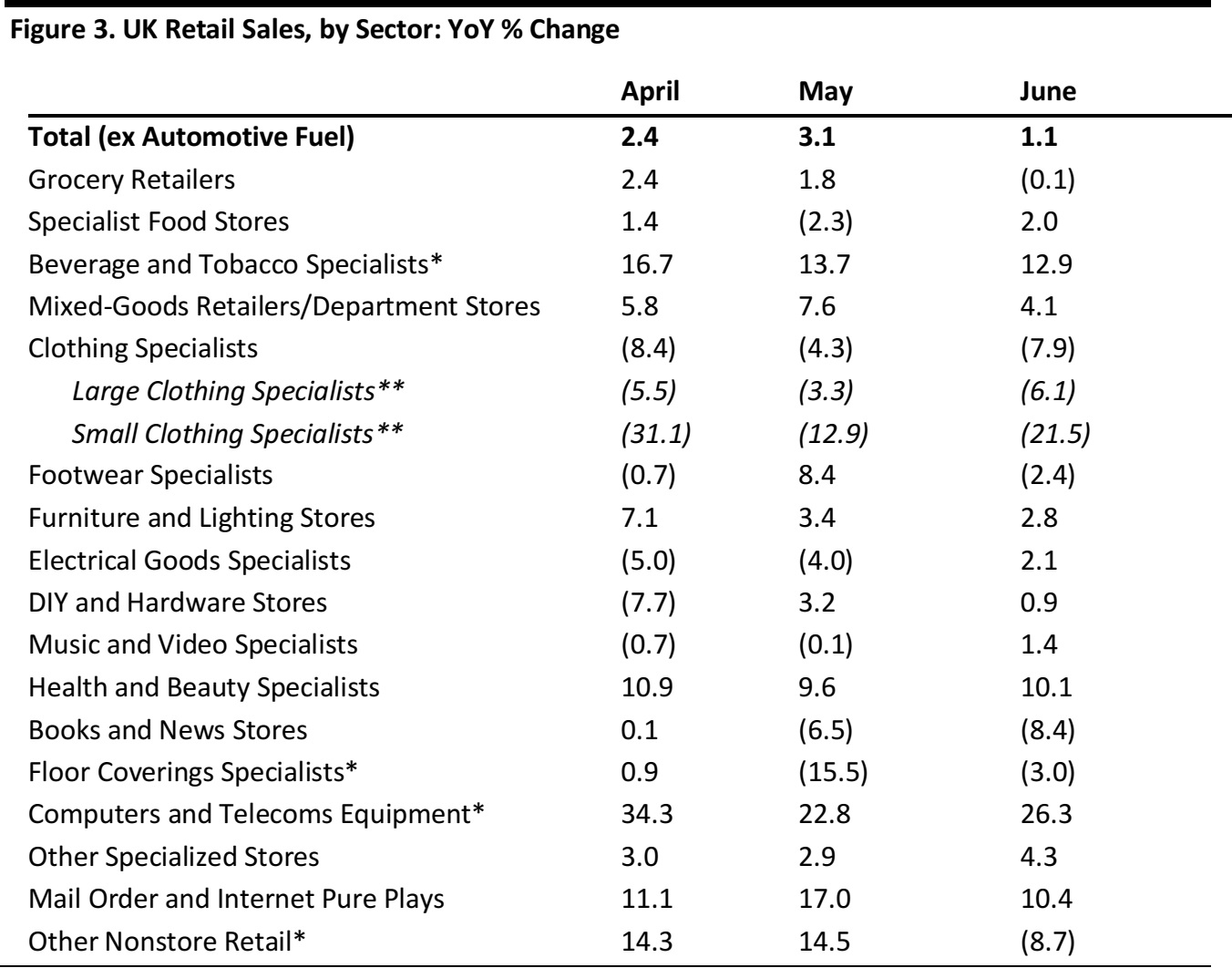

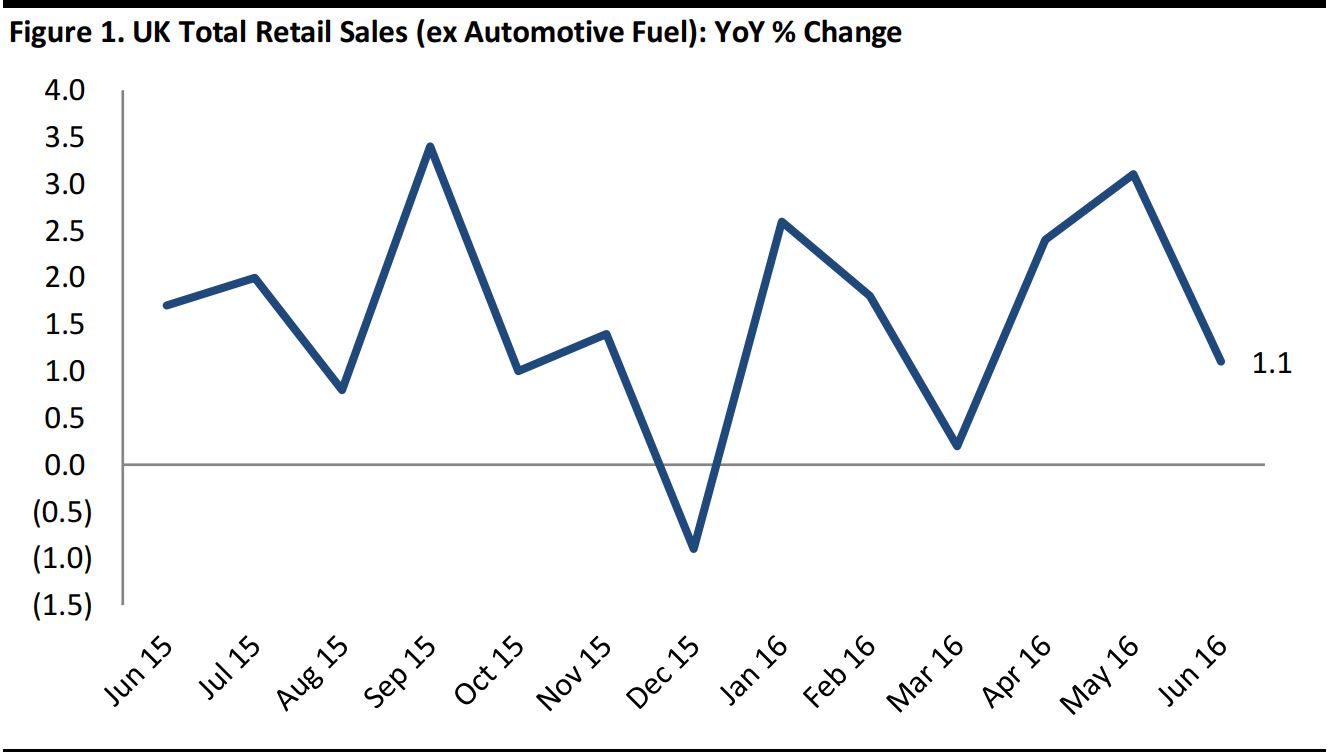

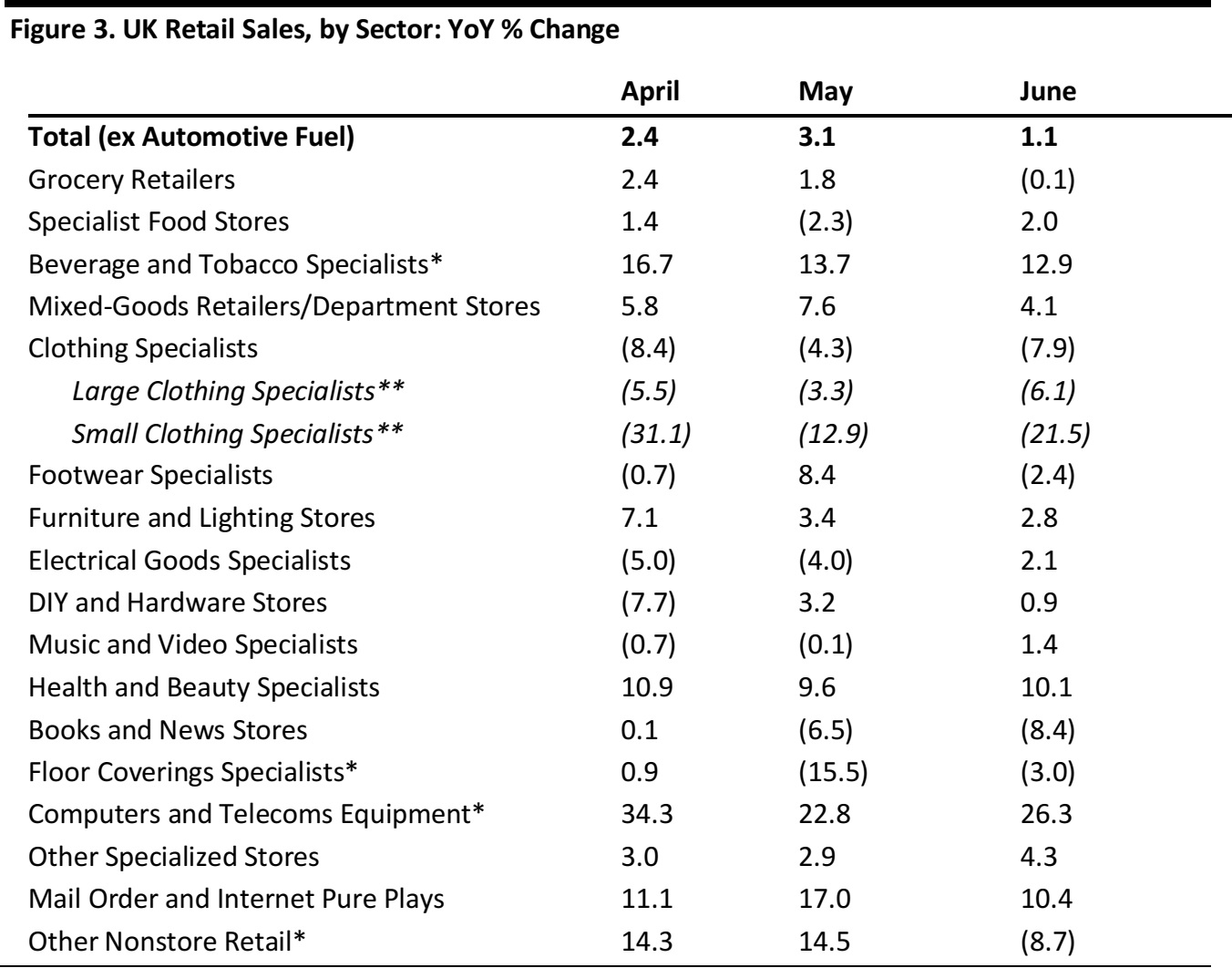

June retail sales showed a softening growth trend, climbing 1.1% year over year. Clothing store sales decelerated meaningfully, by 7.9%, marking their seventh straight month of decline. This was exacerbated by a 1.6% decline in online clothing and footwear sales, which had grown consistently every month for several years prior to June. We discuss this ongoing trend of apparel sales weakness in our recent report entitled

UK Apparel Slide Signals a Shift in Consumer Spending Priorities. In short, we think that apparel is being hit by consumers’ current preference for spending their discretionary income on leisure services rather than on goods.

Grocery store sales declined slightly in June, by 0.1%, despite the fact that the UEFA Euro 2016 soccer championship, Wimbledon and Queen Elizabeth’s 90

th birthday celebrations all occurred during the month. Given deflation of 2.5% in the grocery sector, however, the result indicates a substantial increase in sales volumes.

Also noteworthy is that June represented the third consecutive month of rising automotive fuel sales, which were up 0.7%. Fuel sales have not been consistently positive since the summer of 2013. We exclude fuel from our main index.

*Relatively small sector, where figures may be distorted by methodological issues such as changes in the survey sample.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS

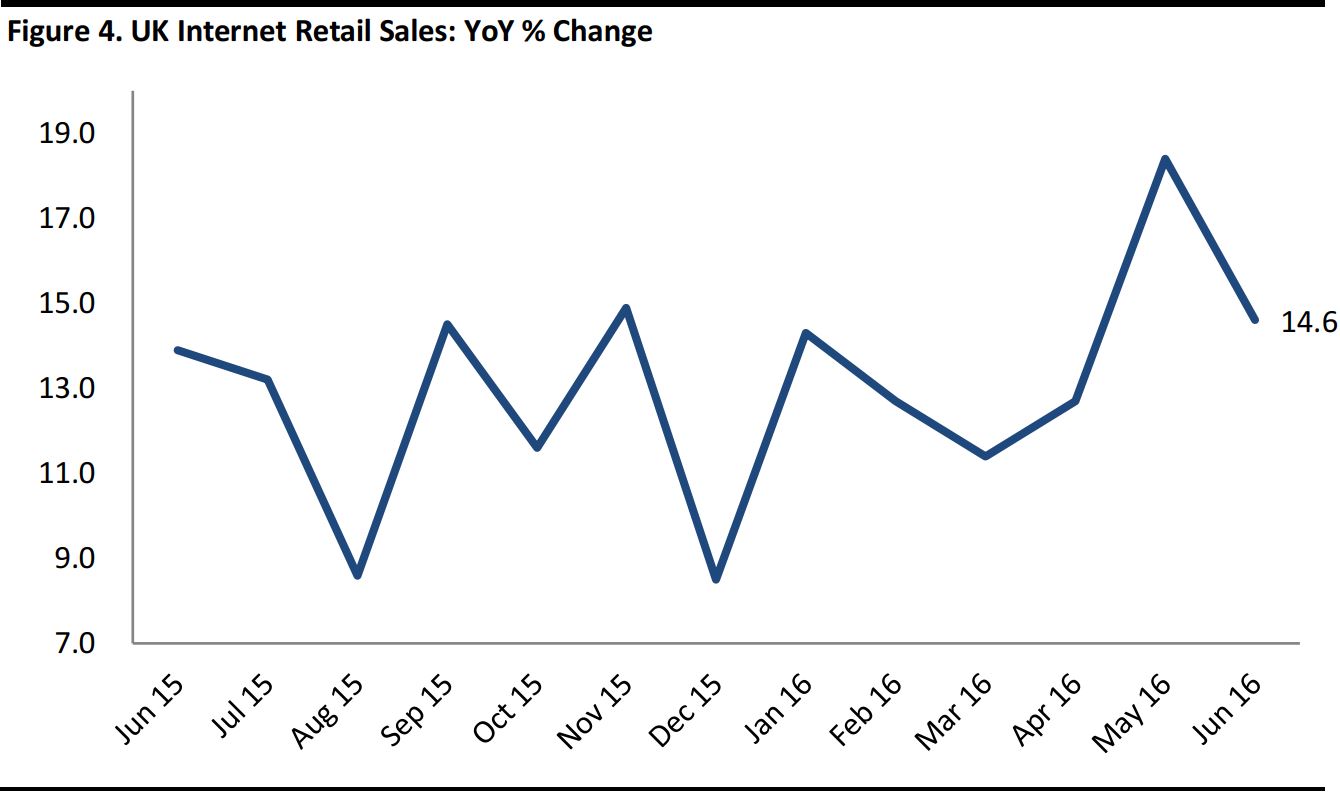

Online Retail Sales

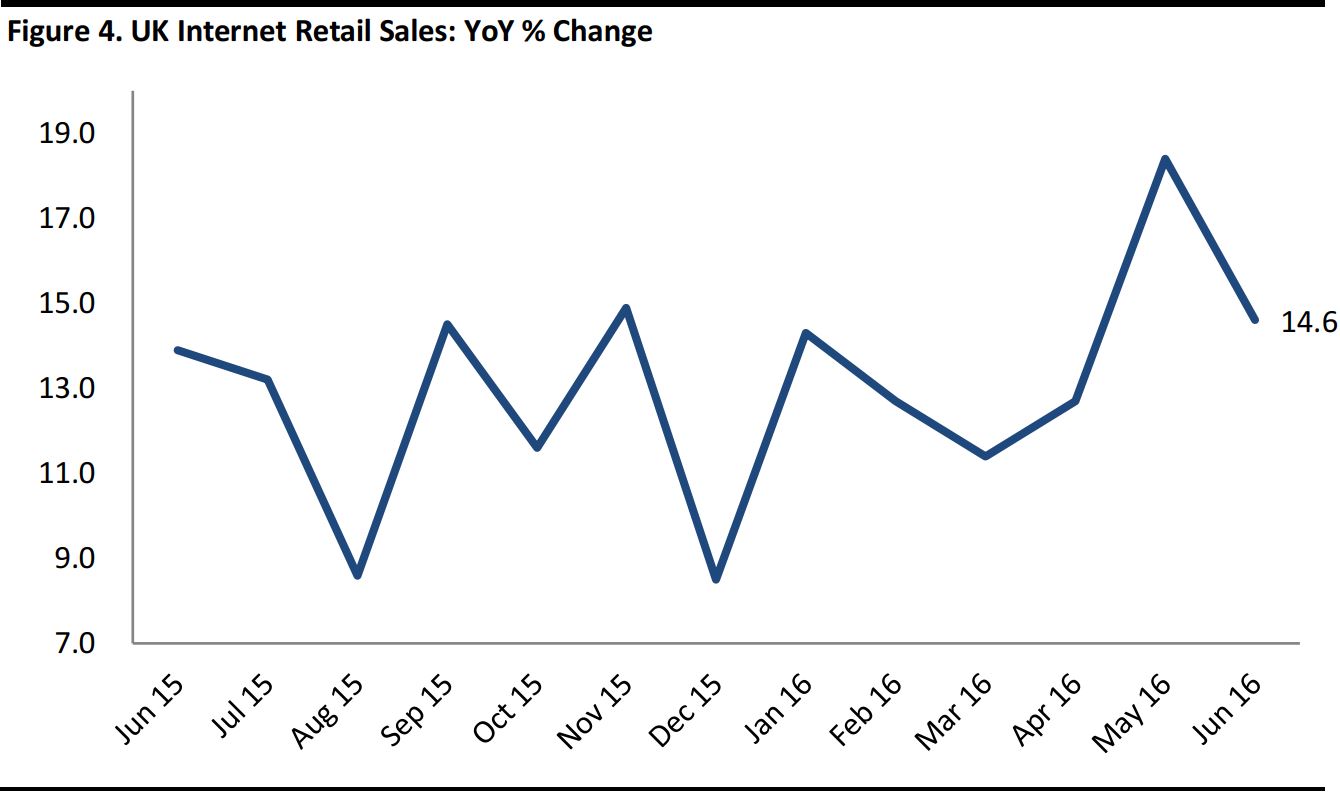

June Internet sales increased by 14.6% year over year. However, this growth rate decelerated by 380 basis points from May, in line with the slowing trend in overall June retail sales. The channel accounted for 13.5% of all UK retail sales in the month

Source: ONS

Online clothing and footwear specialists’ sales fell by a surprising 1.6% year over year in June, marking the first decline for the sector in the last three years. E-commerce accounted for 12.7% of clothing and footwear specialists’ sales in June.

The household goods sector was a standout during the month, posting very robust, 44.6% year-over-year online sales growth.

*Includes furniture and lighting specialists, electrical goods retailers, DIY and hardware stores, and music and video retailers.

Source: ONS