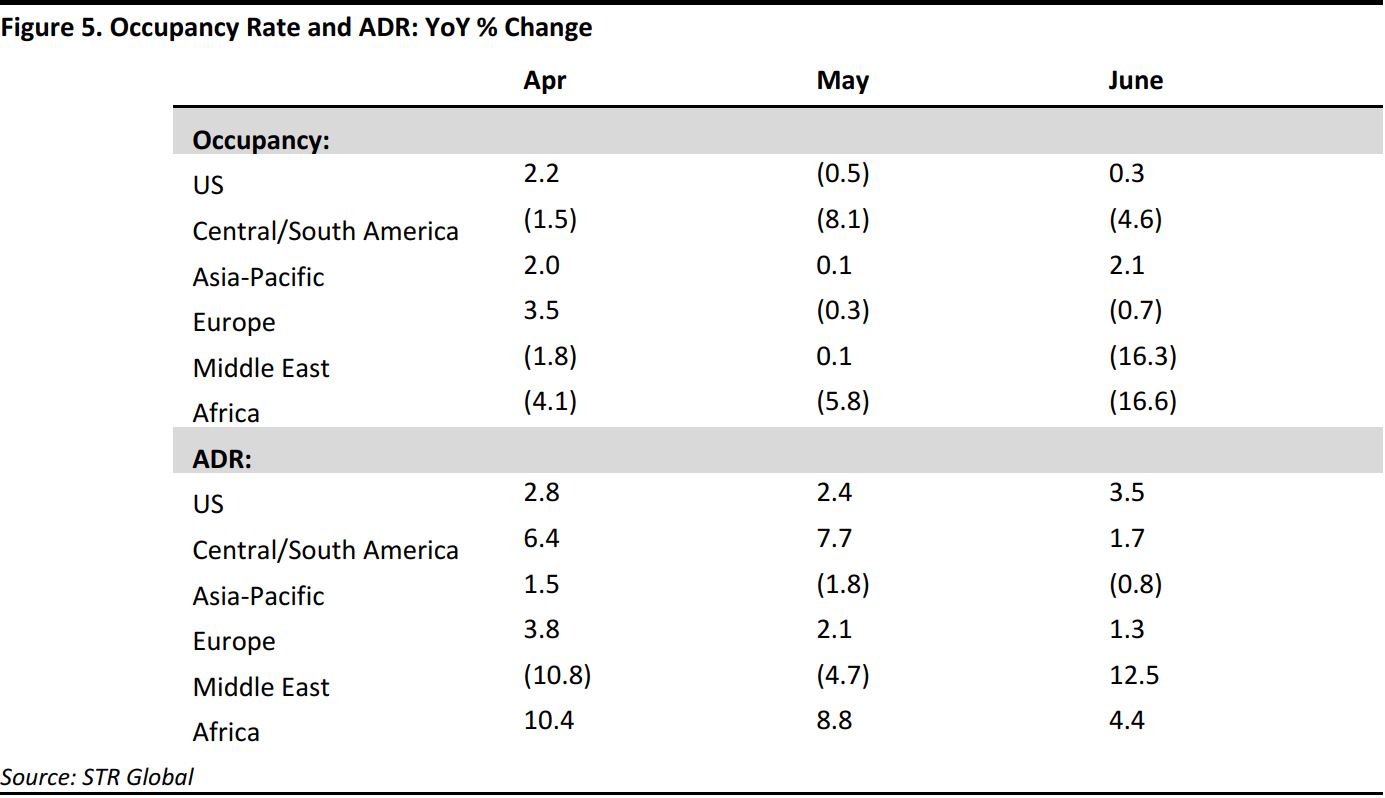

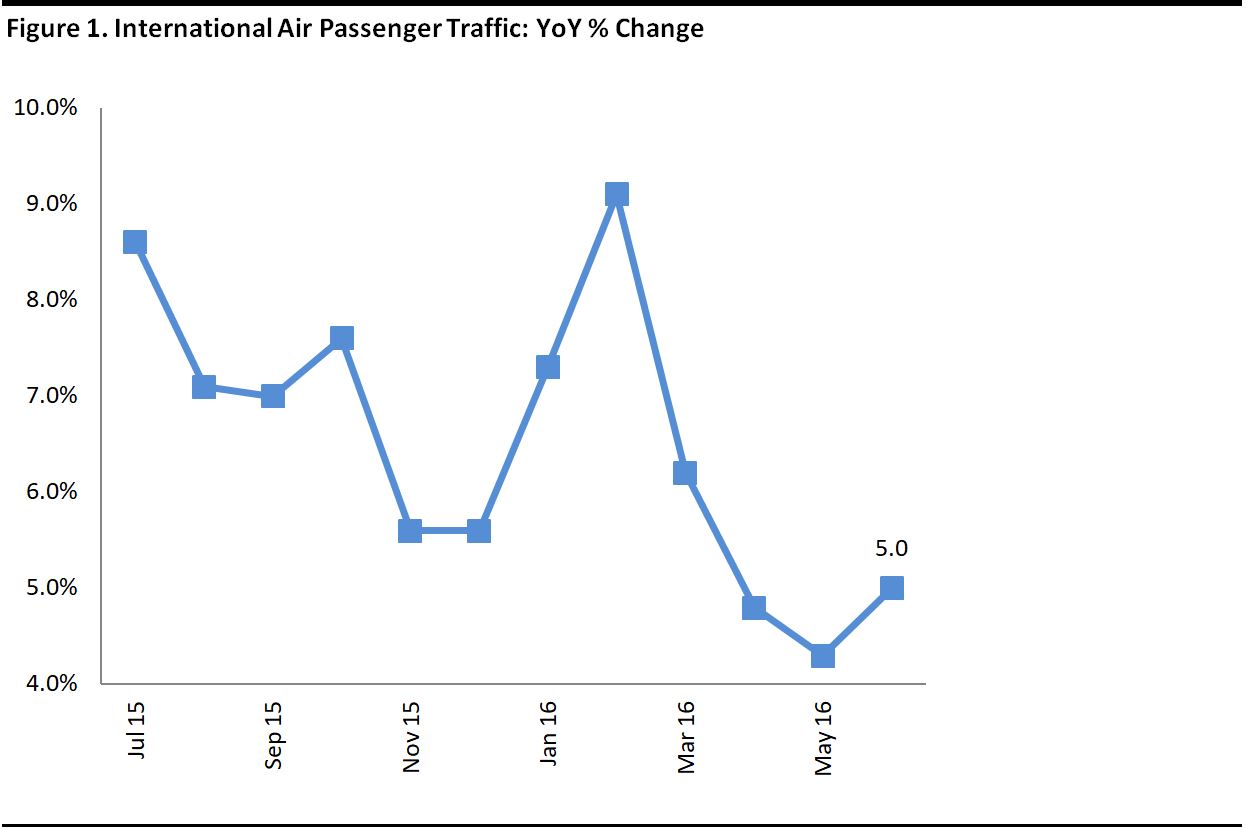

International Air Travel Growth Continues Despite Uncertainty

International air passenger traffic gained momentum in June, despite an uncertain economic backdrop and continuing concern over terrorism-related threats, particularly in Europe. Positive performance in the Asia-Pacific region, which accounts for 17.4% of global cross-border passenger traffic, helped to sustain international air travel growth.

Source: IATA

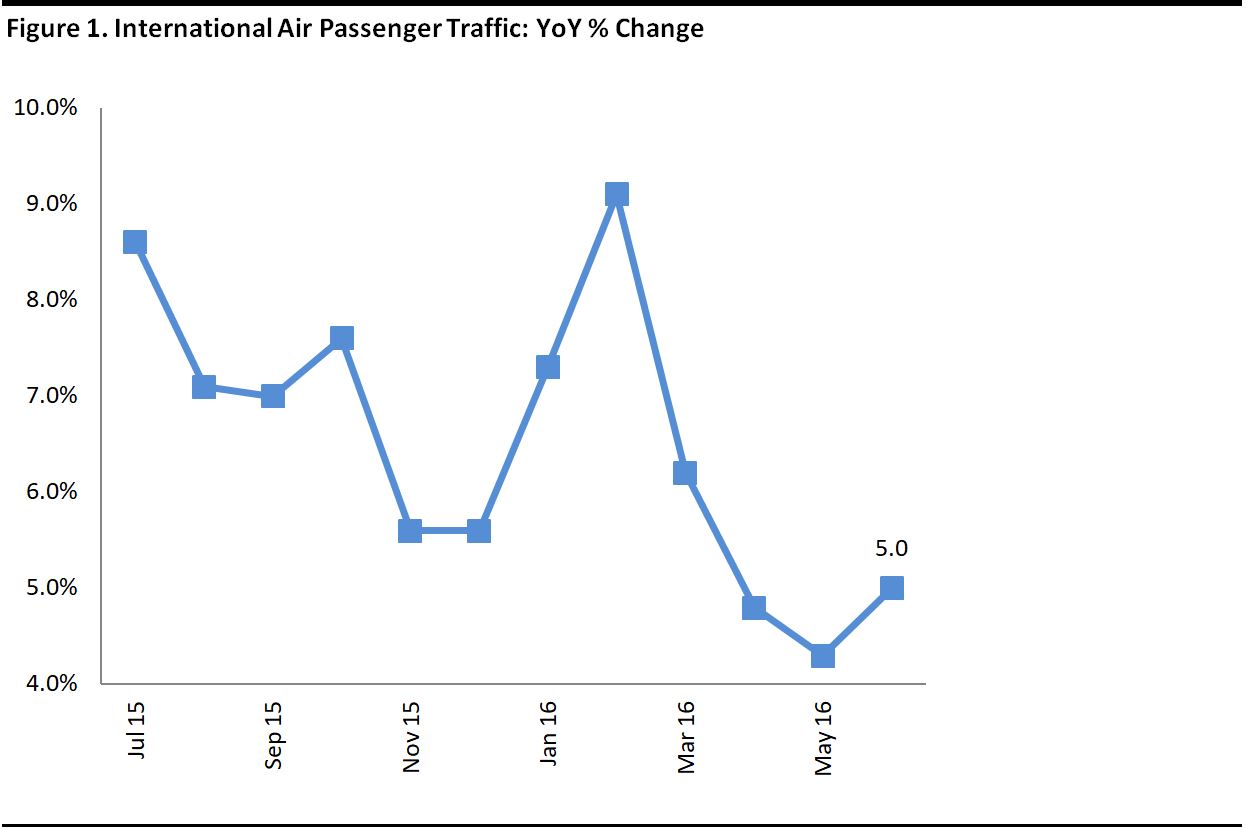

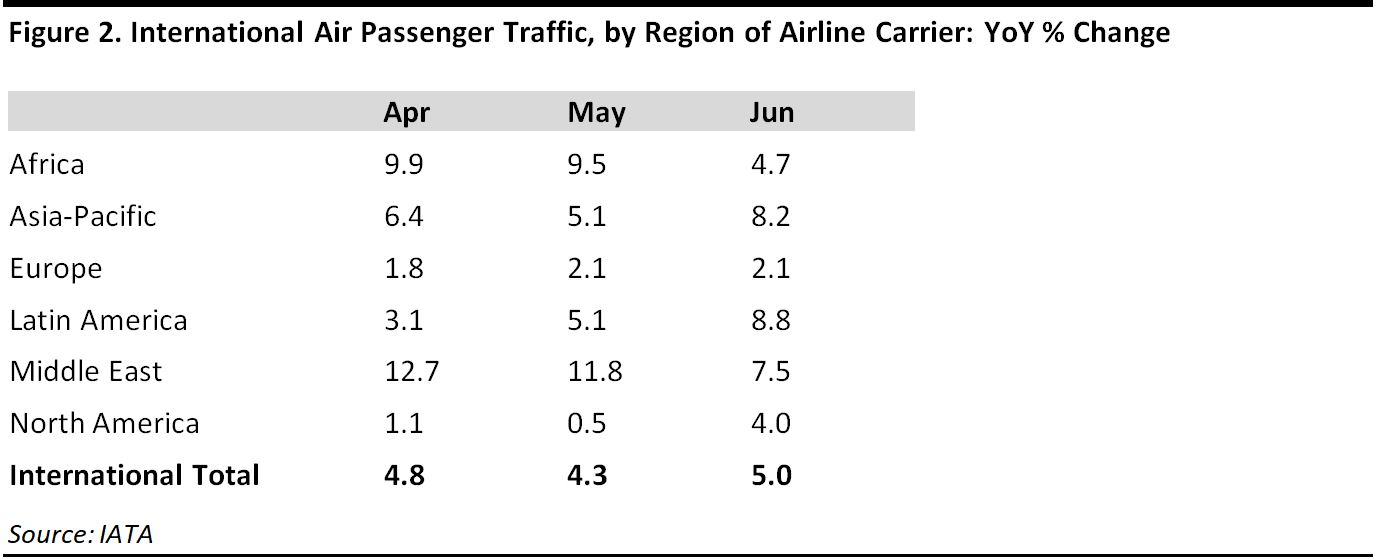

Latin America Leads International Air Passenger Traffic Growth

The IATA offered the following commentary on international passenger traffic in June:

- Traffic in Africa grew by 4.7%. Challenging economic conditions in Nigeria and South Africa, Africa’s biggest economies, slowed the growth of international air passenger traffic.

- In the Asia-Pacific region, traffic growth increased to 8.2%. According to IATA, the year-over-year growth in June was the result of positive momentum from the strong upward trend recorded in the final months of 2015 and into 2016, but it noted that the region was showing signs of a slowdown, particularly on Europe-Asia routes.

- Growth in Europe was 2.1%. Growth in the region—which is the largest globally for international air passenger traffic—was affected by continuing concerns about terrorism-related threats.

- Latin America traffic increased by 8.8%. Air passenger traffic growth continued to accelerate, despite the weakness of Brazil, the region’s largest economy, which saw its domestic air passenger traffic decrease by 6.5% during the month.

- Growth in the Middle East slowed to 7.5%. International air passenger traffic slowed in June because of the timing of Ramadan, during which air travel tends to decline.

- North America traffic growth accelerated to 4.0%. International air passenger traffic picked up in June. In previous months, North American carriers had increased their focus on the large domestic US market at the expense of cross-border traffic.

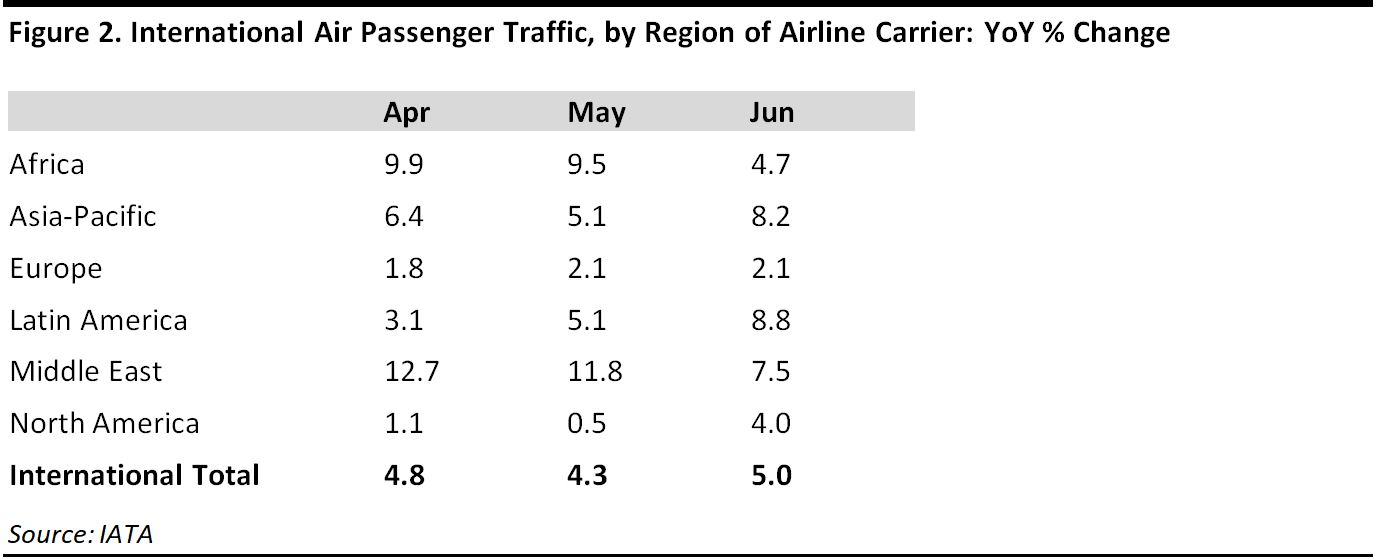

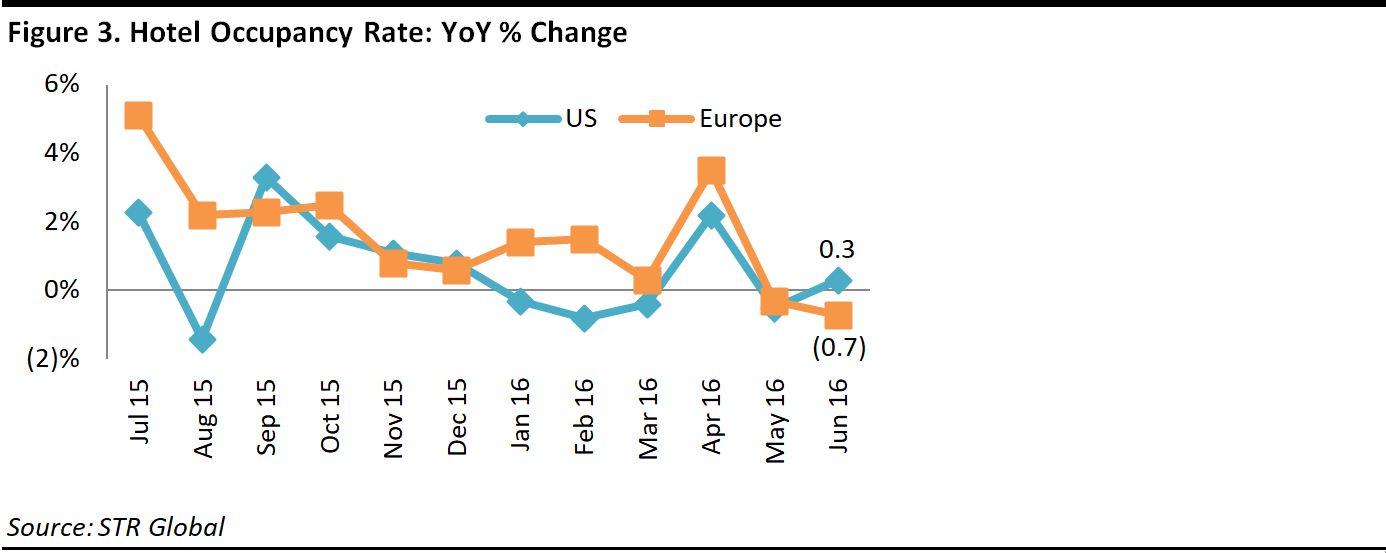

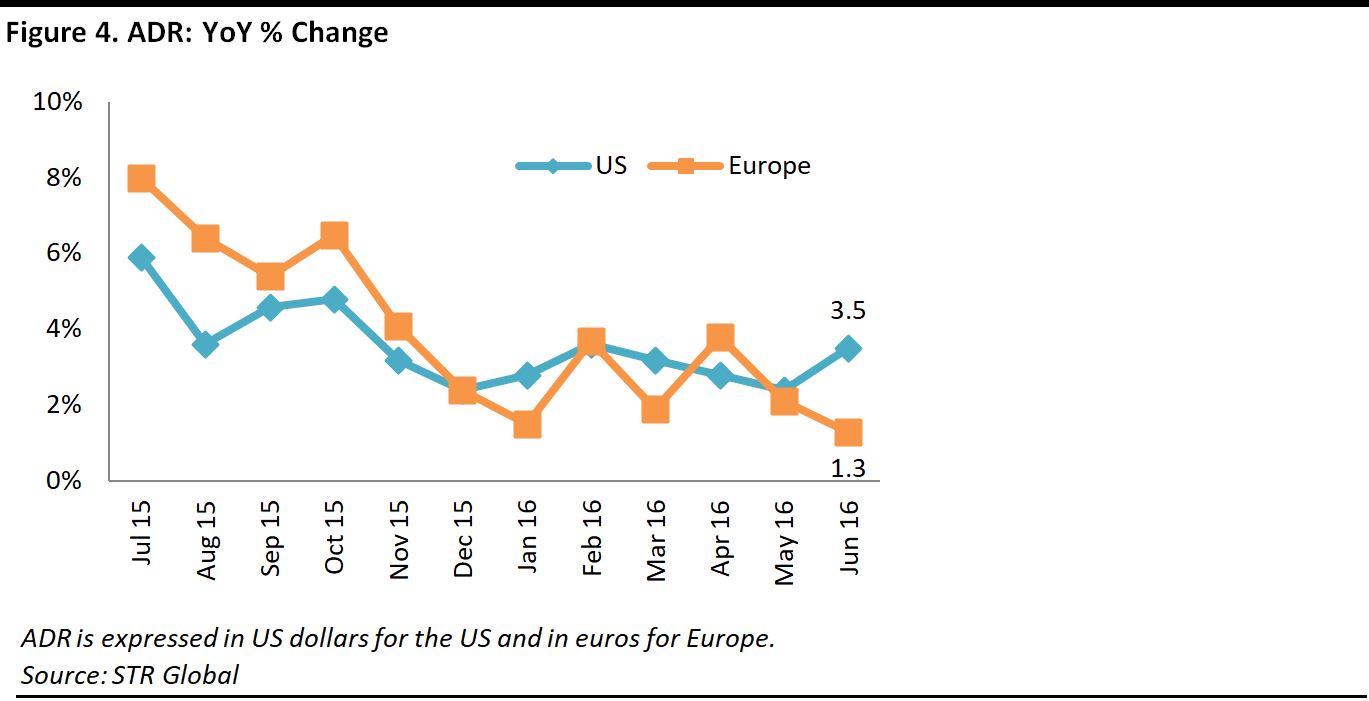

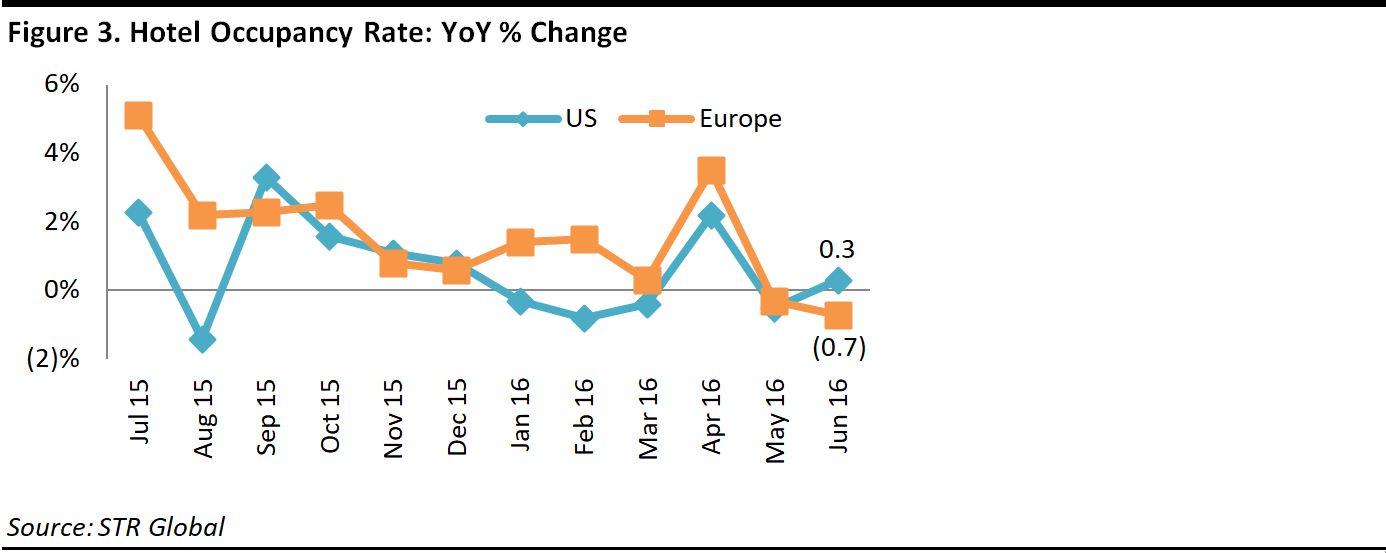

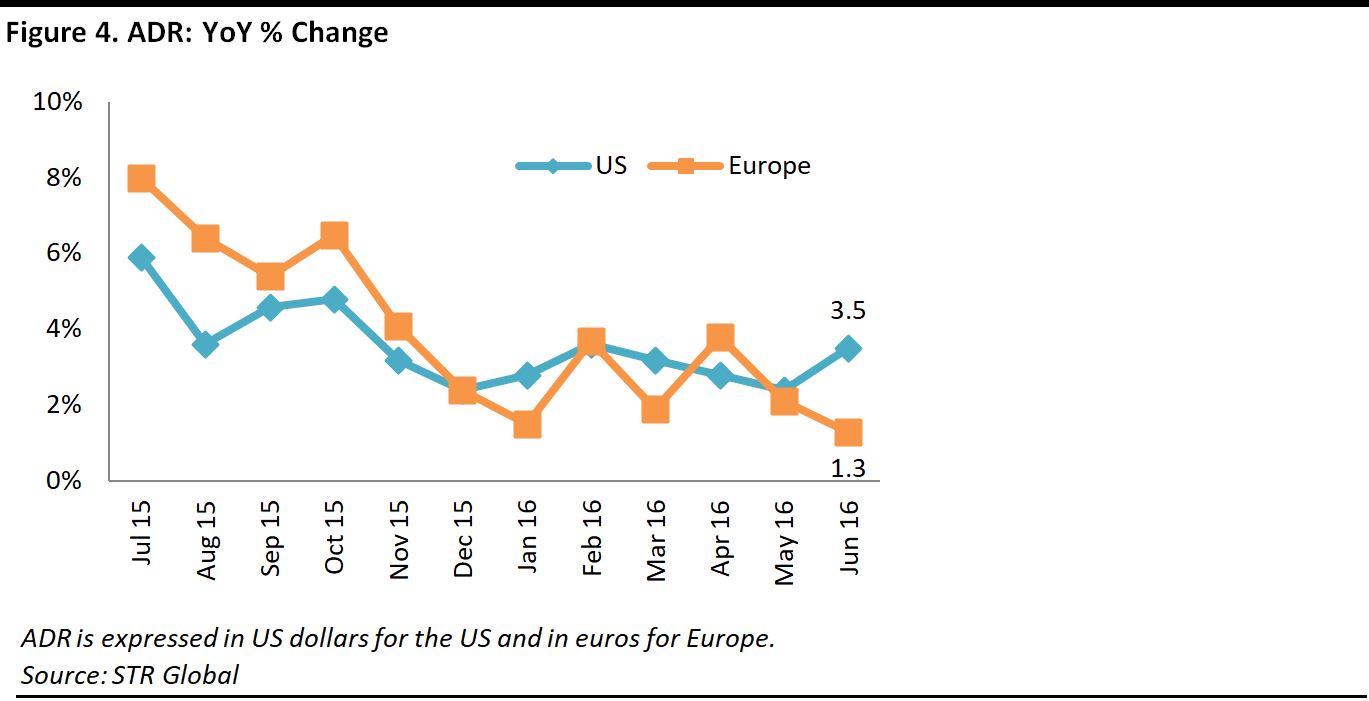

Hotel Occupancy and ADR: The US Outperforms Europe in June

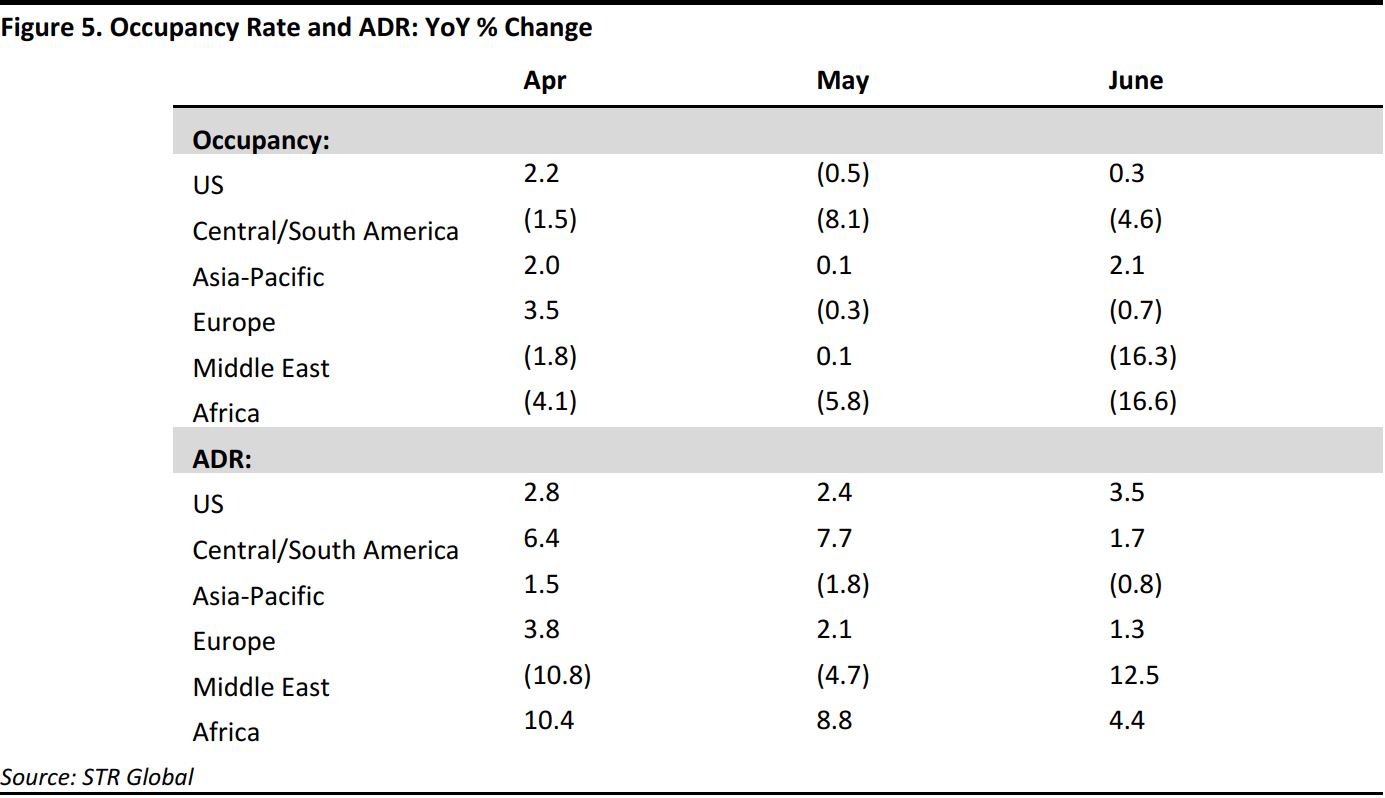

STR Global offered the following commentary on regional occupancy and ADR figures for June and the second quarter of 2016:

- The occupancy rate in the US increased by 0.3%, to 73.1%, and ADR grew by 3.5%, to US$126.14. New York City showed the highest absolute value for ADR (US$273.44).

- The occupancy rate in Central/South America declined by 4.6%, to 54.2%, and ADR grew by 1.7%, to US$86.48. As a result of inflation, Argentina experienced a 5.5% decline in occupancy but a 53.2% increase in ADR during the second quarter of 2016.

- Occupancy increased in the Asia-Pacific region by 2.1%, to 67.0%, while ADR decreased by 0.8%, to US$93.55. Australia showed an increase in occupancy of 2.0% and an increase in ADR of 1.8% during the second quarter of 2016. The devaluation of the Australian dollar encouraged international and domestic demand in the country.

- Occupancy in Europe declined by 0.7%, to 77.1%, and ADR increased by 1.3% in euro terms, to €119.48 (US$134.35). France showed a 5.5% decrease in occupancy and a 5.3% decline in ADR, despite hosting the 2016 UEFA European Championship.

- Occupancy in the Middle East decreased by 16.3%, to 48.9%, while ADR increased by 12.5%, to US$184.69. ADR in June was up 40.7% in Saudi Arabia, thanks to strong performance during Ramadan.

- Occupancy in Africa decreased by 16.6%, to 44.4%, while ADR increased by 4.4%, to US$94.69. Occupancy in Nigeria decreased by 13.8%, to 44.1%. The country showed supply of hotel accommodations growing by 3.3%, but demand declining by 10.9%.

Outlook: Growth in International Air Travel Might Weaken During the Second Half of 2016

International air travel is expected to continue to grow in the second half of 2016, albeit at a slower pace compared to the second half of 2015. The stimulus of lower airfares should continue, but the perceived risk of terrorist attacks is likely to keep affecting travel in Europe. The Rio 2016 Olympics should encourage international air travel and boost hotel occupancy and ADR in August, but concerns about the Zika virus might keep some visitors from traveling to the region. The impact of the Brexit referendum is still unclear, as it might result in an increase in tourism to the UK due to a cheaper pound or in a decrease in air passenger traffic due to economic uncertainty.

STR Global offered the following commentary on regional occupancy and ADR figures for June and the second quarter of 2016:

STR Global offered the following commentary on regional occupancy and ADR figures for June and the second quarter of 2016: