DIpil Das

US

| What’s New? | Trend Data | Positive or Negative* |

| Earnings vs. Inflation: In June, consumer price increases accelerated and reached another four-decade high, growing 9.1% year over year, up from 8.6% in May. Average weekly earnings year-over-year growth slightly slowed in June to 4.2%, continuing the slowing that started in April. |

Average Weekly Earnings vs. Consumer Prices: YoY % Change [caption id="attachment_152475" align="aligncenter" width="300"] Data are not seasonally adjusted[/caption] Data are not seasonally adjusted[/caption] |

|

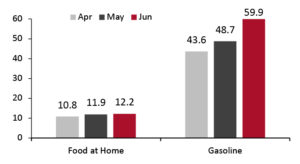

| Food and Fuel Prices: Food and gas inflation rates are significant metrics because higher costs in these categories can impact discretionary spending. US food-at-home inflation continued to accelerate in June, with food prices rising 12.2% from the previous year. Meanwhile, gas price inflation accelerated to 59.9% year over year due in June, up from 48.7% in May, due to high seasonal demand for summer travel. |

Consumer Prices for Food at Home and Gasoline: YoY % Change [caption id="attachment_152476" align="aligncenter" width="300"] Data are not seasonally adjusted[/caption] Data are not seasonally adjusted[/caption] |

|

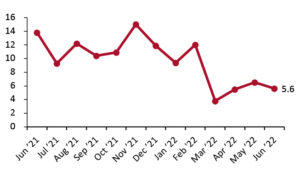

| Retail Sales: Total US retail sales, excluding gas and automobile sales, remained nominally healthy in June, growing 5.6% year over year. Additionally, the US Census Bureau revised May’s estimates from 6.5% year-over-year growth to 6.1%. However, retail sales growth continues to underpace consumer price increases, implying that real sales growth has likely been in the negative territory for four consecutive months. |

Total Retail Sales ex. Automobiles and Gasoline: YoY % Change [caption id="attachment_152477" align="aligncenter" width="300"] Data are not seasonally adjusted[/caption] Data are not seasonally adjusted[/caption] |

UK

| What’s New? | Trend Data | Positive or Negative* |

| Earnings vs. Inflation: In the UK, inflation continued to accelerate in June. Consumer prices grew 8.2% from the previous year, up from May’s 7.9% year-over-year growth. After surging in March, average weekly earnings growth in the UK fell in April and continued to do so in May (latest available data). In May, average weekly earnings grew 3.9% year over year—the lowest growth in 2022—down from April’s 4.8% growth. |

Average Weekly Earnings vs. Consumer Prices: YoY % Change [caption id="attachment_152489" align="aligncenter" width="300"] Latest earnings data are for December; consumer prices are CPIH[/caption] Latest earnings data are for December; consumer prices are CPIH[/caption] |

|

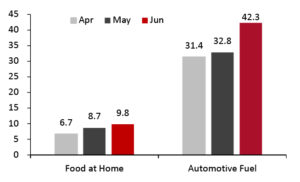

| Food and Fuel Prices: Higher costs for food and automotive fuel can impact discretionary spending. In June, UK food price inflation climbed even further, growing to 9.8%, up from May’s 8.7% year-over-year growth. At the same time, automotive fuel price inflation continued to accelerate because of the Russia-Ukraine war. Automotive fuel prices grew 42.3% year over year in June, up from May’s 32.8%. |

Consumer Prices for Food at Home and Automotive Fuel: YoY % Change [caption id="attachment_152479" align="aligncenter" width="300"]  Data are not seasonally adjusted[/caption] Data are not seasonally adjusted[/caption] |

|

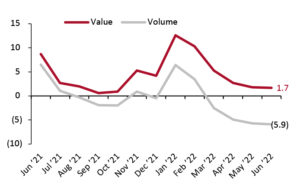

| Retail Sales: Total UK retail sales growth continued to slow in June as consumer price inflation accelerated overall, with UK retail sales growing 1.7% from the previous year. Meanwhile, sales volumes further declined to (5.9)%—the lowest volume in three decades—reflecting the impact of rising prices on the UK consumer. |

Total Retail Sales ex. Automobiles and Automotive Fuel: YoY % Change [caption id="attachment_152480" align="aligncenter" width="300"] Data are not seasonally adjusted[/caption] Data are not seasonally adjusted[/caption] |

|

China

| What’s New? | Trend Data | Positive or Negative* |

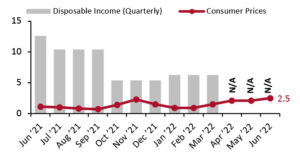

| Income vs. Inflation: In China, consumer inflation for June came in at 2.5%, up from May’s 2.1%. June’s result mark’s the country’s highest inflation rate since July 2020. Data on per capita disposable income are released quarterly in China. In the first quarter of 2022, disposable income per capita grew 6.3% from the previous year, accelerating from the 5.4% growth in the fourth quarter of 2021. |

Per Capita Disposable Income vs. Consumer Prices: YoY % Change [caption id="attachment_152490" align="aligncenter" width="300"] Disposable income data are quarterly[/caption] Disposable income data are quarterly[/caption] |

|

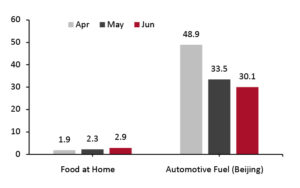

| Food and Fuel Prices: Higher costs for food and automotive fuel can impact discretionary spending. In June, China’s food-at-home prices continued their upward momentum, growing 2.9% year over year. While the price increase is not significant, it is the third consecutive month of food price inflation after the country witnessed five consecutive months of food price deflation. Meanwhile, automotive fuel prices saw further easing. While they remained high, automotive fuel prices grew 30.1% from the previous year—the third consecutive month of fuel price inflation easing—down from May’s 33.5% year-over-year growth. |

Consumer Prices for Food at Home and Automotive Fuel: YoY % Change  |

|

| Retail Sales: In June, total retail sales growth in China rebounded into positive territory after three successive months of sales declines. Total retail sales increased by 3.9% year over year, improving significantly from May’s (5.0)% growth, reflecting the impacts of loosening Covid-19 lockdowns and the gradual reopening of cities. | Total Retail Sales ex. Food Service, incl. Automobiles and Gasoline: YoY % Change

[caption id="attachment_152483" align="aligncenter" width="300"] From December 2020, our China retail sales index excludes food-service sales; data in prior reports included food-service sales. Data for January and February 2021 are aggregated.[/caption] From December 2020, our China retail sales index excludes food-service sales; data in prior reports included food-service sales. Data for January and February 2021 are aggregated.[/caption] |