albert Chan

UK Retail Sales: July 2021

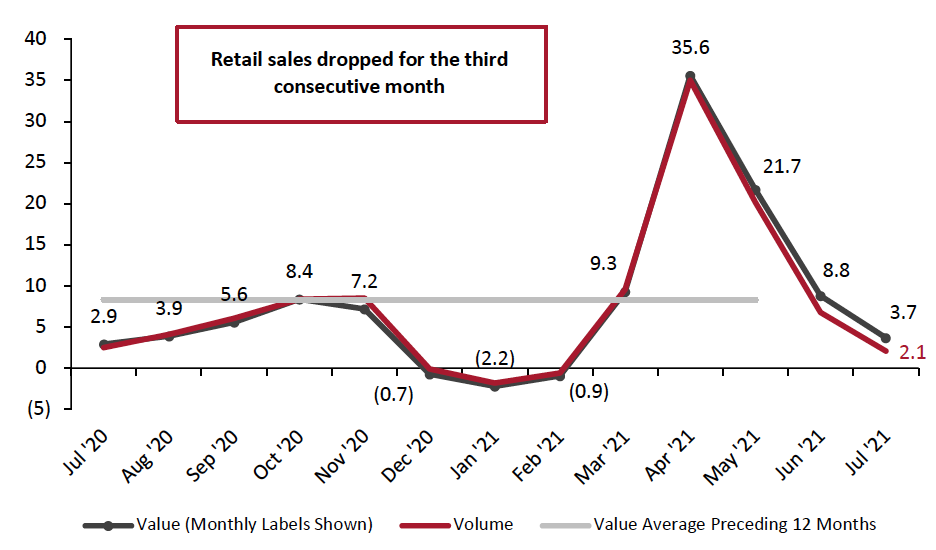

In July, total UK retail sales eased to the weakest performance since stores reopened in April following pandemic-led closures. Sales grew 3.7% in July, following an 8.8% increase in June and a 21.7% jump in May. The growth slowdown in July may be partly attributed to dilution in consumer spending in retail following the reopening of the hospitality and leisure sectors, after the complete end of restrictions on July 19, 2021—combined with much stronger comparatives. Growth of 2.9% was recorded in the same month last year as nonessential retailers experienced strong recovery in July 2020, following the lifting of lockdown restrictions on June 15, 2020.

Total growth was impacted by a reported decline in small retailers’ sales. Large retailers, which account for the bulk of retail sales, also saw moderate sales following a June increase.

We expect that total retail sales growth will continue to soften or turn negative in the coming months, likely until November, as we cycle through tough comparisons from last year.

Figure 1. Total UK Retail Sales (ex. Automotive Fuel and Unadjusted): YoY % Change [caption id="attachment_131655" align="aligncenter" width="700"]

Data in this report are not seasonally adjusted

Data in this report are not seasonally adjustedSource: ONS/Coresight Research [/caption]

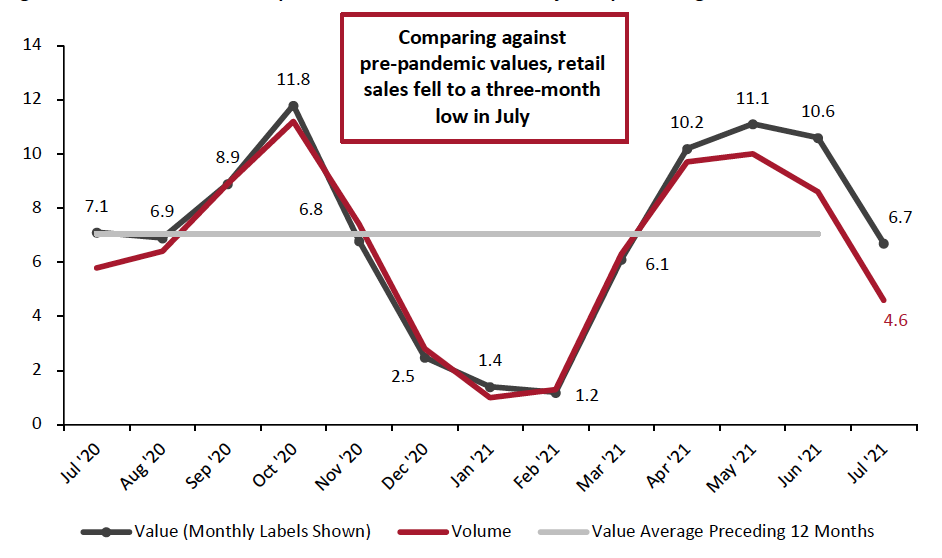

In relation to the more consistent comparatives of 2019, July retail sales showed a similar pattern. July sales grew 6.7% from 2019 values but were down 3.9 percentage points from June’s growth.

Figure 2. Total UK Retail Sales (ex. Automotive Fuel and Unadjusted): % Change from Two Years Prior

[caption id="attachment_131656" align="aligncenter" width="700"] Data in this report are not seasonally adjusted

Data in this report are not seasonally adjustedSource: ONS/Coresight Research[/caption]

Retail Sales Growth by Sector

The lockdown measures imposed last year had a major detrimental impact on retail sales, causing certain sectors to see dramatic sales declines and skewing year-over-year growth numbers. To control for the effects of the pandemic in 2020’s retail sales figures, we largely compare July 2021 sales to pre-pandemic July 2019 sales in this section.

Small retailers (as defined below Figure 3) saw two-year sales growth of 9.4%. Within this category, small clothing retailers’ sales fell 49.5% from 2019 values. Large retailers, which account for the bulk of retail sales, posted total two-year growth of 5.9% in July, following a rise of 9.1% in June.

Grocery retail store sales slowed to 4.0% from pre-pandemic values, following an 8.1% increase in the previous month.

DIY and hardware retailers saw sales growth of 22.3% from 2019 levels—though strong, it was weaker than June’s 34.0% rise. On a year-over-year basis, the sector grew 9.2%. Kingfisher, which owns B&Q and Screwfix in the UK, expects its like-for-like sales to fall by between 5% and 15%, given tougher comparative numbers and uncertainty in the consumer environment.

Furniture and lighting stores’ two-year sales growth jumped 36.1% in July, increasing from 12.2% growth in June. On the other hand, electrical goods specialists experienced growth deceleration, slowing down from 20.6% in June to 12.4% in July.

Clothing and footwear retail sales continue to stay volatile compared to 2019 levels, with declines widening. Clothing retailers’ sales declined by 9.0% in July, compared to a 6.4% decrease in June. Similarly, footwear retailers saw sales slide by 16.3%, compared to a 12.2% decrease in June.

Department stores—a sector also challenged by the pandemic—saw sales decline again in July, but at a slightly slower rate than in June. Department store sales declined by 4.6% in July from 2019 levels, a slightly improvement compared to June’s 4.8% decline.

The health and beauty sector also reported a growth slowdown, with sales increasing by 4.3% in July compared to a 10.8% increase in June, on a two-year basis.

Figure 3. UK Retail Sales, by Sector: YoY % Change (Top) and Yo2Y % Change (Bottom) [wpdatatable id=1206] [wpdatatable id=1207]

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers **A relatively fragmented sector, in which reported figures have traditionally been volatile Source: ONS

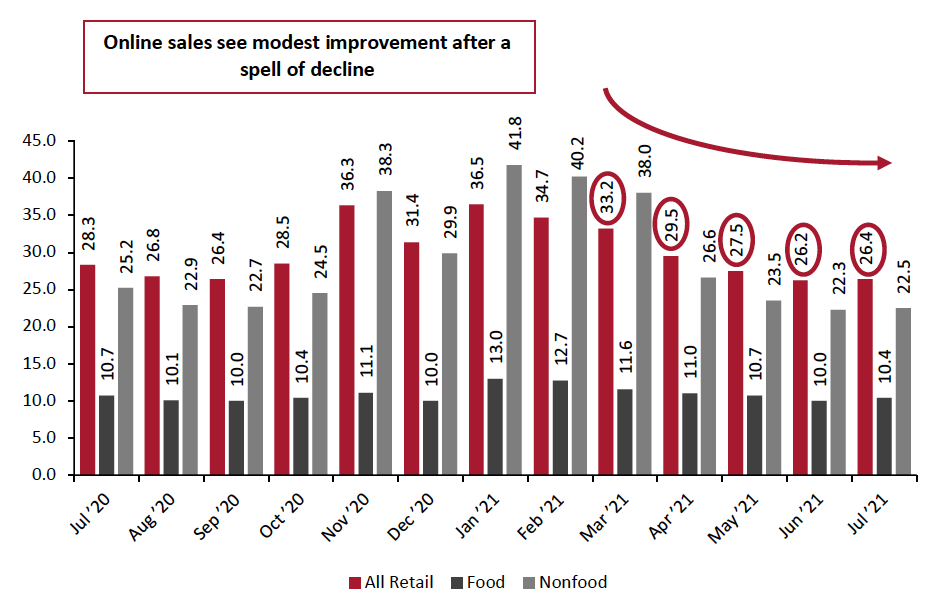

Online Retail Sales Account for 26.4% of All Retail Sales

Total online sales growth stayed in the negative territory, declining by 3.1% year over year in July, versus an 8.7% decrease in June. Food retailers’ e-commerce sales saw negative growth for the third consecutive month, which fell 1.3% but—an improvement from the 9.4% decline recorded in June. According to Kantar Worldpanel, online grocery sales in the UK hit their lowest levels in nearly a year over the three months to August 12, as the end of lockdown encouraged shoppers back into physical supermarkets.

Nonfood retailers’ sales saw sales decline for two consecutive months, falling 3.1% in July, compared to an 11.3% decrease in June. Online sales of apparel retailers saw year-over-year growth strengthened sequentially, growing 6.6% in July, following June’s underwhelming growth of 2.1%.

As shown in Figure 4, online sales as a percentage of overall retail sales increased slightly after trending downwards for four consecutive months, reaching 26.4% in July—a decrease of 1.9 percentage points compared to online sales penetration in July 2020, but 7.7 percentage points higher than July 2019.

Figure 4. Online Retail Sales as % of Total Retail Sales

[caption id="attachment_131659" align="aligncenter" width="700"] “Food” and “Nonfood” data are for store-based sectors; “All Retail” total includes nonstore retail, which is not charted

“Food” and “Nonfood” data are for store-based sectors; “All Retail” total includes nonstore retail, which is not chartedSource: ONS[/caption]

Covid-19 Lockdown Timeline

Lockdown 1: The UK was put into lockdown on March 23, 2020, initially for three weeks, in an attempt to limit the spread of the coronavirus. Nonessential retail stores were closed.

On April 16, the government extended the lockdown by another three weeks.

On May 11, Prime Minister Boris Johnson announced that the government would begin easing restrictions in a phased manner, allowing nonessential stores to reopen from the start of June. However, garden centers were allowed to reopen from May 13 and furniture stores from May 23.

On May 26, the government announced that all nonessential retailers in England and Northern Ireland—including department stores and small independent shops—would be allowed to reopen from June 15, but stores would need to implement measures to meet the necessary social distancing and hygiene standards.

On June 23, Johnson announced that restaurants, pubs, museums, cinemas and hotels could reopen on July 4.

On September 14, a new “rule of six” prohibited social gatherings of more than six people, unless they are from the same household.

On September 22, Johnson outlined a slew of new restrictions in the wake of a fresh spike in the number of infections. These included the closing of bars, pubs and other hospitality services by 10:00 p.m., effective September 24.

On October 7, the Scottish government implemented tighter restrictions, largely on the hospitality industry. Retail was not directly affected, although stores were requested to enforce two-meter distancing.

On October 12, the UK government announced a three-tier lockdown system, which classifies regions based on the severity of infection rates. In the week beginning October 19, a number of regions in England, including London and Manchester, moved into higher “tiers” of control, which include restrictions on households mixing and, in some cases, some service industries; however, these did not change the direct rules for retailers.

On October 23, a 17-day lockdown began in Wales, with nonessential retailers being forced to close once more.

Lockdown 2: On October 31, Prime Minister Johnson announced a second lockdown for England for the period November 5 to December 2. All nonessential retail was forced to close, “including, but not limited to, clothing and electronics stores, vehicle showrooms, travel agents, betting shops, auction houses, tailors, car washes and tobacco and vape shops.” Food shops, supermarkets, garden centers and certain other retailers providing essential goods and services could remain open. Nonessential retail could remain open for delivery to customers and click- and-collect. Hospitality venues such as restaurants, bars and pubs were forced to close but could still provide takeaway and delivery services. Also forced to close were entertainment venues, indoor and outdoor leisure facilities, and personal care services.

Following the lockdown, UK regions were placed into different tiers, each of which had different restrictions.

On December 8, the UK’s National Health Service started vaccinations, with the aim of vaccinating the most vulnerable groups of people by February 15, 2021.

On December 21, the UK government scrapped a planned easing of rules on the mixing of households over the Christmas period. In England and Scotland, households in many areas were banned from mixing; in some areas, households could mix on Christmas Day only. The devolved Welsh and Northern Irish administrations implemented their own restrictions.

Lockdown 3: On January 4, 2021, Johnson announced a lockdown in England, effective January 5 and with an unspecified end date but with laws formally expiring on March 31. Scotland, Wales and Northern Ireland also implemented lockdowns.

On January 19, Scotland’s First Minister Nicola Sturgeon announced that that country’s lockdown would be extended until at least the middle of February.

On January 27, the government announced that travelers arriving from “red list” countries must quarantine in hotels specified by the government.

On February 22, the government laid out a roadmap to ending lockdowns in England. Restrictions will start to be eased from March 29, nonessential retail stores and services such as hairdressers will be allowed to reopen from April 12, and final restrictions will be ended on June 21.

On March 25, the UK lowered the Covid-19 risk level from four to three on a scale of five.

On April 12, the government eased raft of restrictions across England, with gyms, zoos, theme parks, pubs and restaurants allowed to reopen for outdoor service and shops and hairdressers again permitted to serve customers.

On April 20, Sturgeon announced that Scotland will move to Covid protection Level 3 from Level 4 on April 26, meaning hospitality venues such as cafés, pubs and restaurants and beauty salons can reopen.

On May 17, England eased restrictions further with groups of up to six people from different households allowed to socialize indoors, pubs and restaurants can serve indoors and entertainment venues such as museums, cinemas, and theatres can reopen.

On June 14, England delayed the final stage of easing lockdown restrictions by month, until July 19, due to the increase in more transmissible Delta variant.

After more than a year under some form of restriction, England lifted almost all the remaining Covid-19 rules on July 19, 2021. This includes opening of nightclubs and lifting capacity restrictions on big events and performances.