albert Chan

US

| What’s New? | Trend Data | Positive or Negative* |

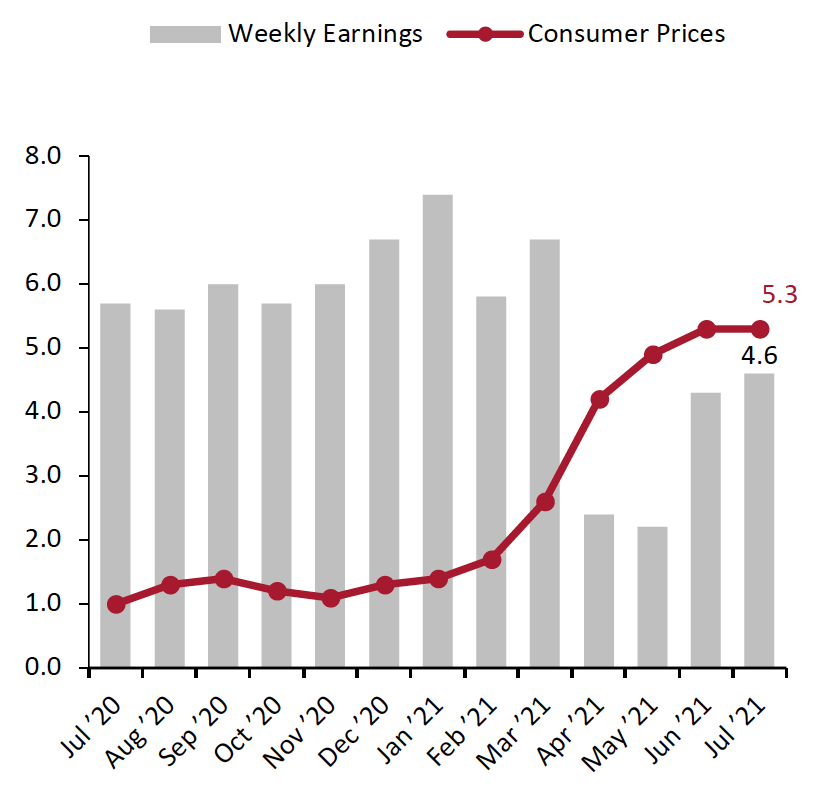

| Earnings vs. Inflation: In the US, seasonally adjusted inflation stood at 5.3% in July, unchanged from June. Inflation remained high, mainly due to increases in the price of airline fares and used cars and trucks. Nominal wage growth slightly accelerated to 4.6% in July, from 4.3% in June. Year-over-year growth was low, mainly due to strong comparatives from June and July 2020—both of which recorded a substantial rise in average weekly earnings owing to huge job losses among lower-paid workers. In July 2021, average hourly earnings rose by $0.11 to $30.54, following an increase of $0.10 in June. Average weekly hours stood at 34.8, unchanged from June. In July, the seasonally adjusted unemployment rate slightly decreased to 5.4%, from June’s 5.9%—with improvements in the financial, government education, healthcare, information, leisure and hospitality, manufacturing, mining, professional and business services, and transportation and warehousing sectors, but very little or no change in the construction sector. In the week ended August 14, 2021, approximately 348,000 Americans filed for unemployment benefits, around 29,000 lower than the previous week’s revised level. |

Average Weekly Earnings vs. Consumer Prices: YoY % Change  |

|

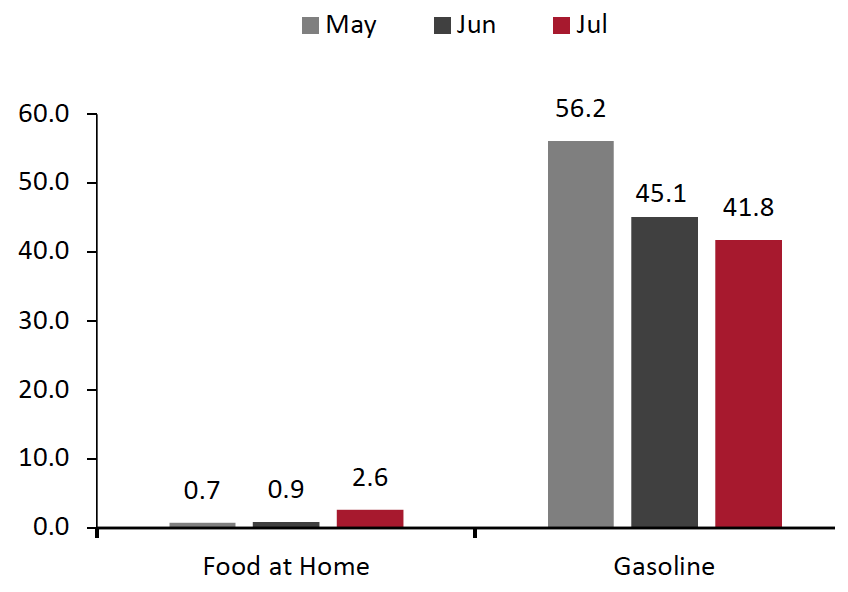

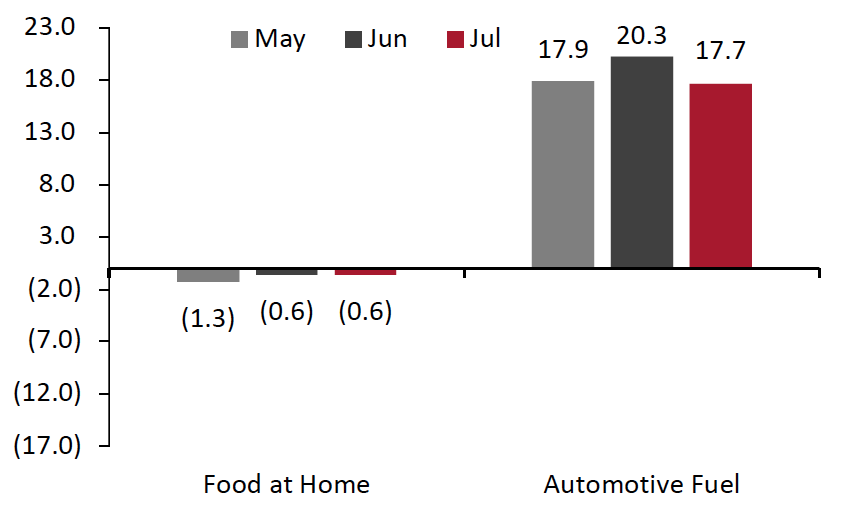

| Food and Fuel Prices: Food and gas price inflation rates are significant metrics because higher costs in these categories can impact discretionary spending. In July, US food inflation increased from June. Gasoline price inflation decreased from June to July—but remained very high, caused by a rapid recovery in demand and a tightening of global crude supply by the Organization of the Petroleum Exporting Countries (OPEC). On August 11, the office of US President Joe Biden requested that OPEC and its allies boost crude oil production to mitigate rising gasoline prices. Separately, in July, OPEC and its allies agreed to boost crude oil production by 400,000 barrels per day (bpd) starting in August until bpd reaches pre-pandemic levels—the oil producers are currently supplying 5.8 million fewer bpd than before the crisis. On September 1, OPEC will hold a meeting with its allies to review the situation. |

Consumer Prices for Food at Home and Gasoline: YoY % Change  |

|

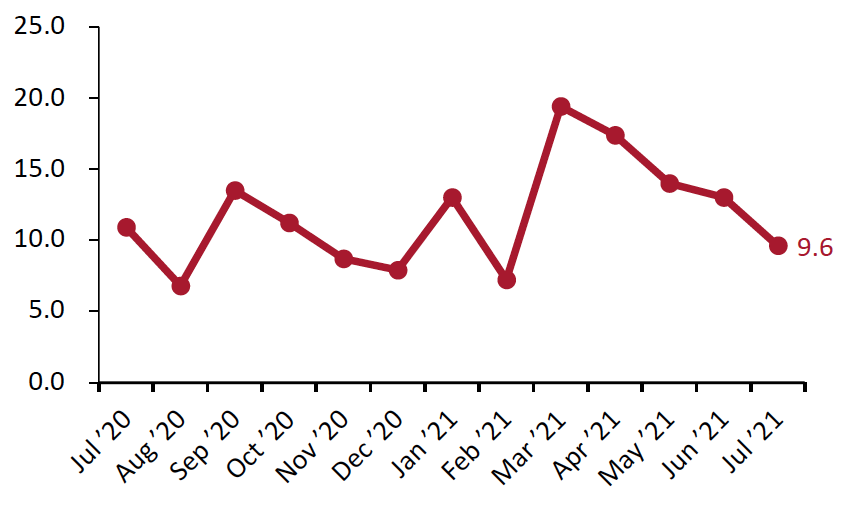

| Retail Sales: Total US retail sales, excluding gasoline and automobiles, grew by a strong 9.6% year over year and increased by 21.4% when compared to 2019 values. Many sectors saw strong growth in July 2021 compared to pre-pandemic July 2019 sales: Sales increased by 38.2% at sporting goods and hobby stores, by 31.2% at nonstore retailers, by 23.3% at home-improvement retailers, by 20.6% at furniture and home-furnishing stores, by 19.3% at clothing and clothing accessories stores, by 16.3% at food and beverage stores and by 13.9% at health and personal care stores. Department stores saw a robust recovery, with sales growth of 9.6% compared to 2019 levels, increasing from June’s 6.1% rise. |

Total Retail Sales ex. Automobiles and Gasoline: YoY % Change [caption id="attachment_131859" align="aligncenter" width="300"] Data are not seasonally adjusted[/caption] Data are not seasonally adjusted[/caption]

|

UK

| What’s New? | Trend Data | Positive or Negative* |

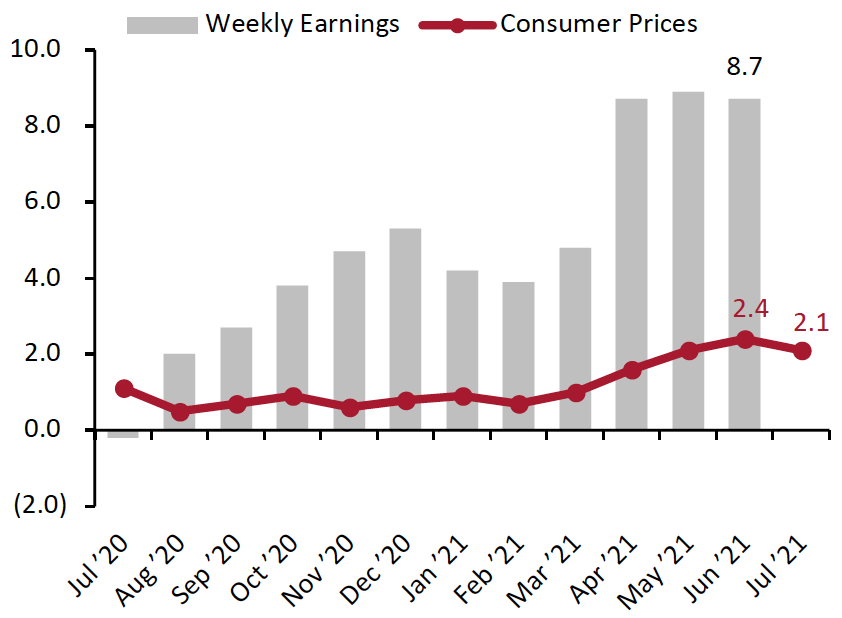

| Earnings vs. Inflation: In the UK, inflation slightly decelerated to 2.1% in July, from 2.4% in June. Average earnings growth slightly decelerated to 8.7% in June (latest), from 8.9% in May, against weak comparatives from 2020. In July 2021, the number of payroll employees increased by 2.0%, or 576,000 year over year. Median monthly pay increased by 6.4% compared to July 2020. From May to July 2021, the number of job vacancies increased by 43.8% or 290,000 quarter over quarter, standing at 953,000—and 21.4% or 168,000 above pre-pandemic levels in January–March 2020. Most industries displayed strong growth, showing vacancies above pre-pandemic levels—notably, accommodation and food services, and arts entertainment and recreation. From April to June 2021 (latest), the unemployment rate is at an estimated 4.7%, a quarter-over-quarter decrease of 0.2 percentage points, but 0.8 percentage points higher than pre-pandemic levels in January–March 2020. |

Average Weekly Earnings vs. Consumer Prices: YoY % Change [caption id="attachment_131866" align="aligncenter" width="300"] Latest earnings data are for June[/caption] Latest earnings data are for June[/caption] |

|

| Food and Fuel Prices: Higher costs for food and automotive fuel can impact discretionary spending. In July, UK food price deflation remained unchanged at (0.6)%. Automotive fuel price inflation decreased from June to July—but still remained very high, caused by a rapid recovery in demand. |

Consumer Prices for Food at Home and Automotive Fuel: YoY % Change  |

|

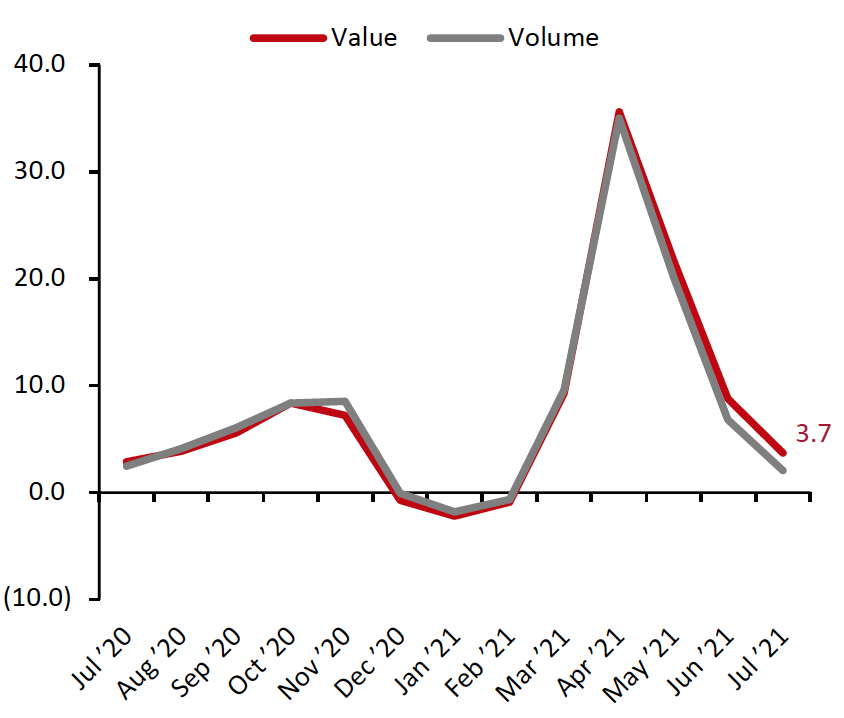

| Retail Sales: Total UK retail sales growth decelerated for the third consecutive month, recording 3.7% year-over-year growth—substantially lower than June’s 8.8% increase. On a two-year basis (versus pre-pandemic 2019), July retail sales showed a similar pattern: July sales grew 6.7% from 2019 values but that was a slowdown of 3.9 percentage points compared to June’s growth from 2019 levels. Clothing specialists’ sales increased by 18.2% year over year in July 2021. Compared to 2019, specialists’ sales declined by 9.0%, versus the two-year sales decrease of 6.4% in June 2021. On a two-year basis, sales at department stores—which have been heavily challenged during the pandemic—decreased by 4.6% in July, following a 4.8% decline in June 2021 on a two-year basis. Health and beauty sales were up 4.3% in July 2021 compared to two years prior, a deceleration from the 10.8% two-year growth in June. Online sales accounted for 26.4% of all retail sales in July 2021—a decrease of 1.9 percentage points from July 2020, but still 7.7 percentage points higher than July 2019’s online sales penetration. |

Total Retail Sales ex. Automobiles and Automotive Fuel: YoY % Change [caption id="attachment_131868" align="aligncenter" width="300"] Data are not seasonally adjusted[/caption] Data are not seasonally adjusted[/caption] |

|

China

| What’s New? | Trend Data | Positive or Negative* |

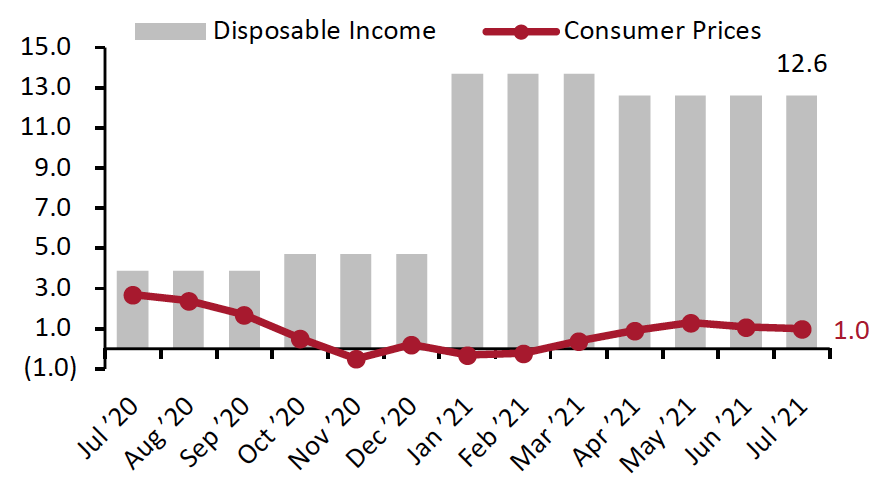

| Income vs. Inflation: In China, the consumer price index grew 1.0% in July, slightly down from June’s 1.1% growth. Data on per capita disposable income are released quarterly. In the second quarter of 2021, per capita disposable income grew 12.6% year over year, versus 13.7% growth in the first quarter of 2021, as the economy continued to recover steadily. |

Per Capita Disposable Income vs. Consumer Prices: YoY % Change [caption id="attachment_131869" align="aligncenter" width="300"] Disposable income data are quarterly[/caption] Disposable income data are quarterly[/caption] |

|

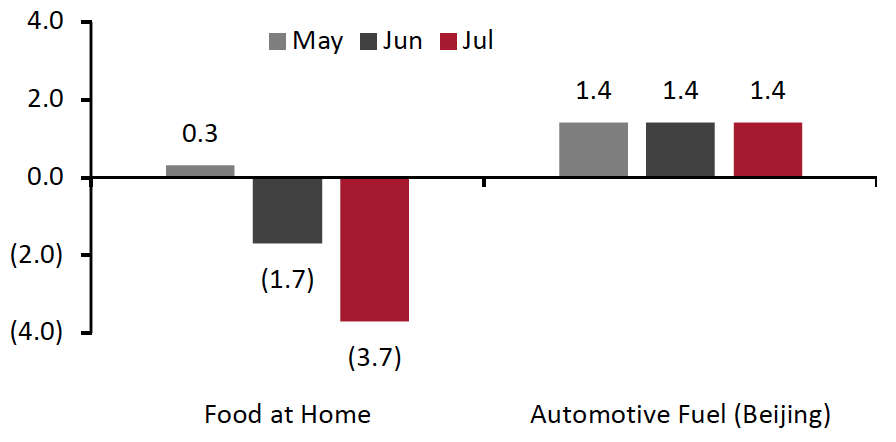

| Food and Fuel Prices: Higher costs for food and automotive fuel can impact discretionary spending. In July, food prices in China decreased by 3.7%, versus a 1.7% decline in June. Beijing’s fuel price inflation stood at 1.4%, unchanged from May and June. |

Consumer Prices for Food at Home and Automotive Fuel: YoY % Change  |

|

| Retail Sales: Retail sales in China grew 7.8% in July. While facing undemanding comparatives from last year, July’s retail figures nevertheless saw strong growth compared to pre-pandemic values: Growth from July 2019 totaled 6.0%. Apparel and footwear sales grew 7.5% year over year in July 2021. On a two-year basis, the sector’s sales increased by 1.2%, below June’s increase of 7.6%. Beauty retailers experienced 2.8% year-over-year growth in July 2021. Compared to the same period in 2019, sales grew by 18.5%. Beverage retailers witnessed the highest sales growth in July: 20.8% year over year and 29.2% on a two-year basis. Food retailers saw steady year-over-year growth of 11.3% in July 2021. The sector saw two-year growth of 12.5%. |

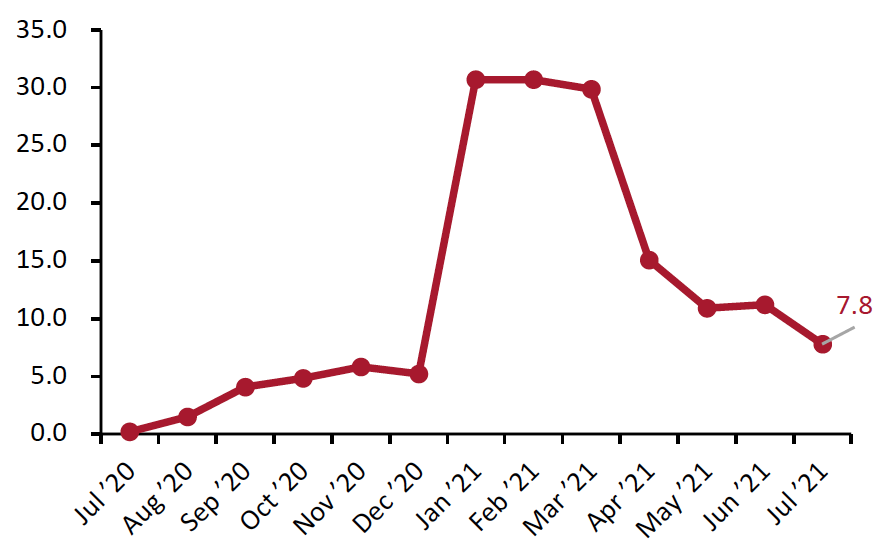

Total Retail Sales incl. Automobiles and Gasoline: YoY % Change [caption id="attachment_131871" align="aligncenter" width="300"] From December 2020, our China retail sales index excludes food-service sales; data in prior reports included food-service sales. Data for January and February 2021 are aggregated[/caption] From December 2020, our China retail sales index excludes food-service sales; data in prior reports included food-service sales. Data for January and February 2021 are aggregated[/caption] |