DIpil Das

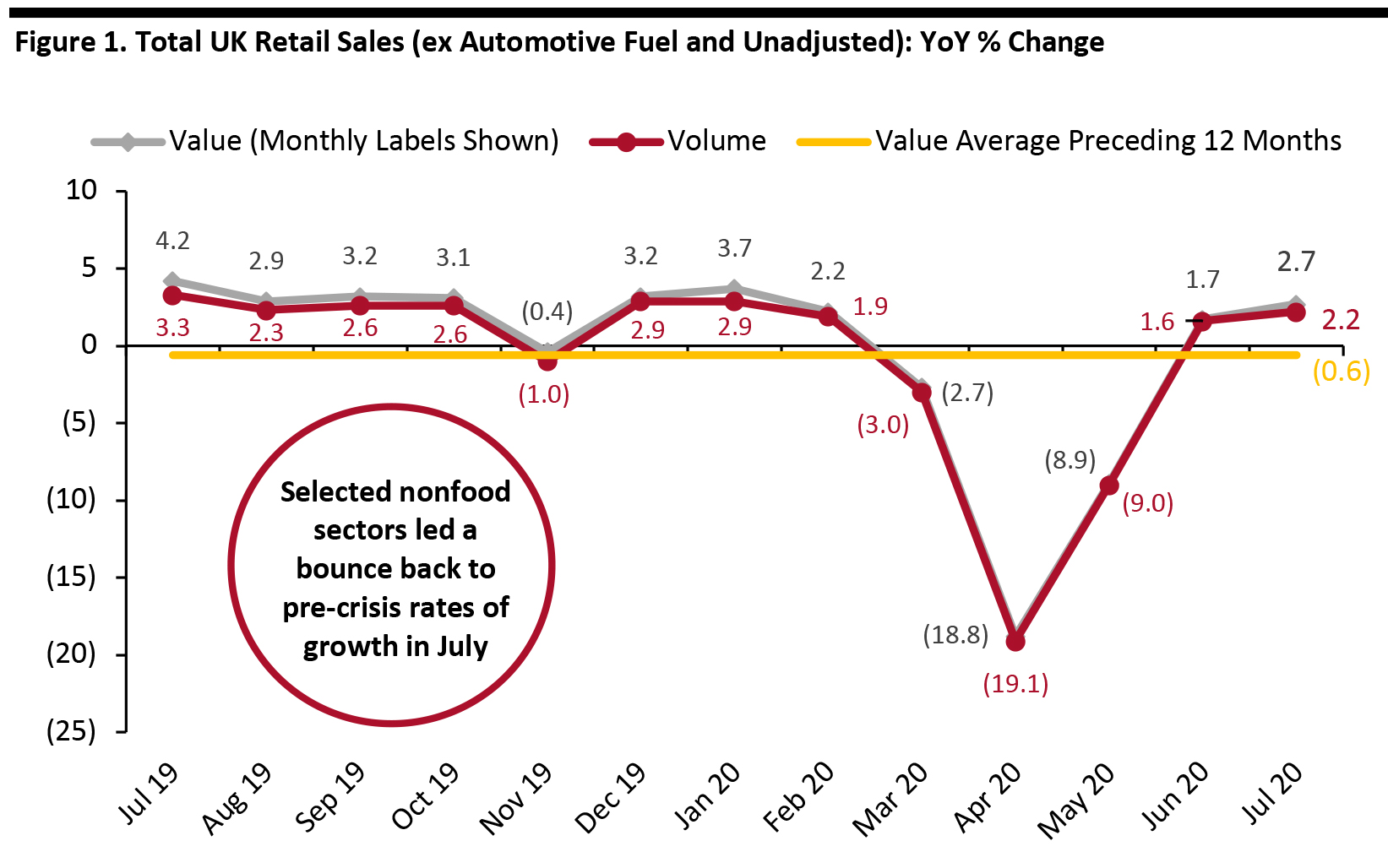

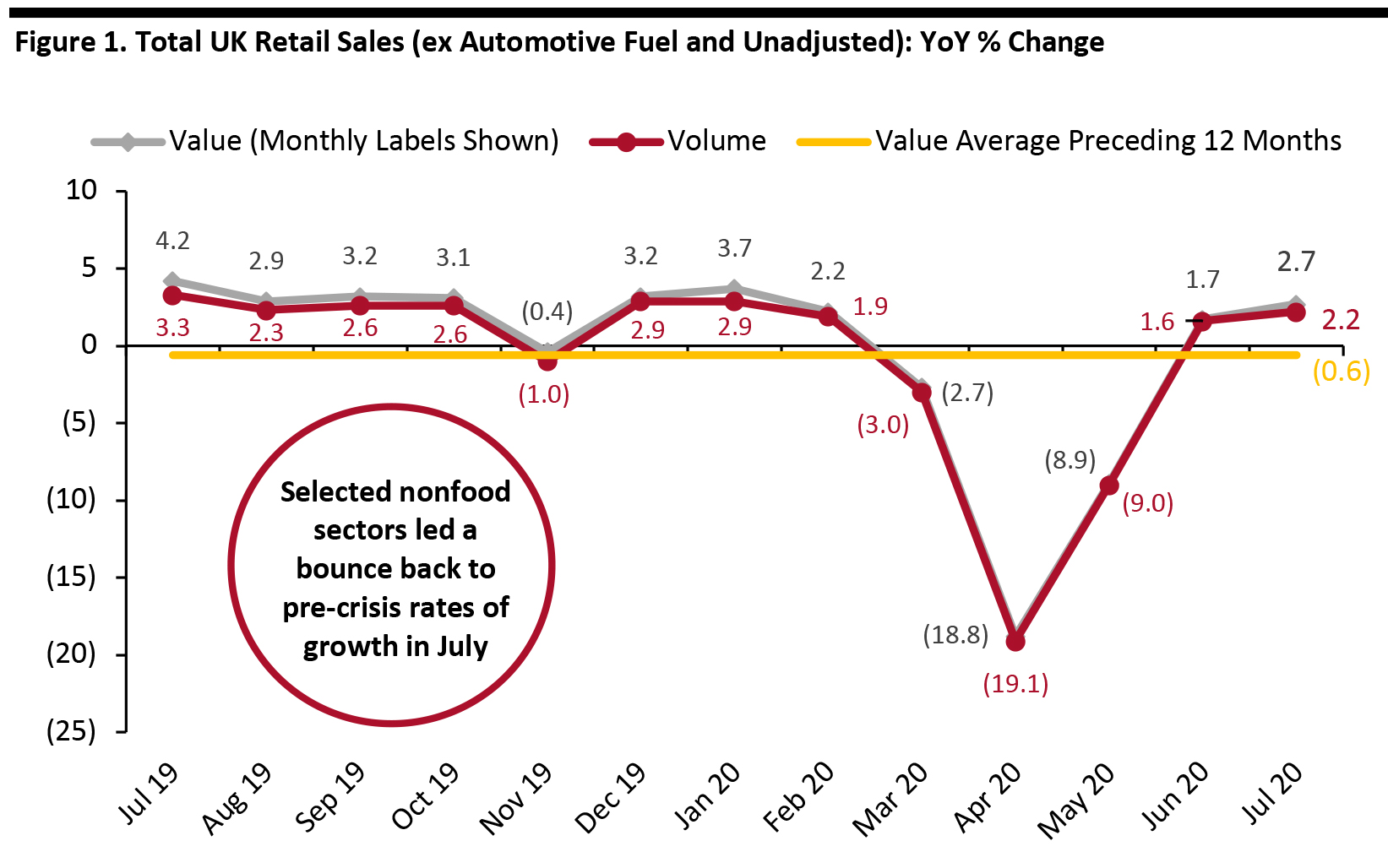

UK retail sales growth returned to pre-crisis levels in July, supported by reported strong year-over-year increases in big-ticket sectors (such as electronics and home improvement) and despite grocery-sector growth slowing sharply.

[caption id="attachment_114926" align="aligncenter" width="700"] Data in this report are not seasonally adjusted

Data in this report are not seasonally adjusted

Source: ONS/Coresight Research [/caption] Retail Sales Growth by Sector Total growth in July was supported by a reported strong recovery by small retailers in selected sectors such as department stores/mixed-goods retailers, some specialist nonfood sectors and nonstore retail. In total, large retailers, which account for the bulk of retail sales, saw a slight year-over-year decline. Grocery slows: Grocery-sector growth slowed to low, single digits in July, according to the ONS. Big-ticket bounce: The ONS reported double-digit growth for each of electrical-goods retailers, furniture stores, DIY retailers and floorcoverings stores. This included a 50% year-over-year rise for the floorcoverings sector, although this has long been a highly volatile sector in the ONS index, along with other fragmented sectors. For DIY, the July figures continued a medium-term run of strong growth. Apparel and department stores/mixed-goods retailers weak: Clothing and footwear stores continued to see deep double-digit declines. The clothing specialists sector saw a 31% sequential easing in the pace of decline (a percentage on a percentage, not a percentage-point change), compared to a 39% easing in June and led by large chains, which saw a 34% easing in the pace of decline in July. The department stores/mixed-goods sector is a combination of full-range department stores such as John Lewis and variety-store retailers such as B&M Bargains; the former segment is likely to be the principal drag on this sector’s growth, given its reliance on the weak apparel category and observed low traffic levels.

Figure 2. UK Retail Sales, by Sector: YoY % Change [wpdatatable id=401 table_view=regular]

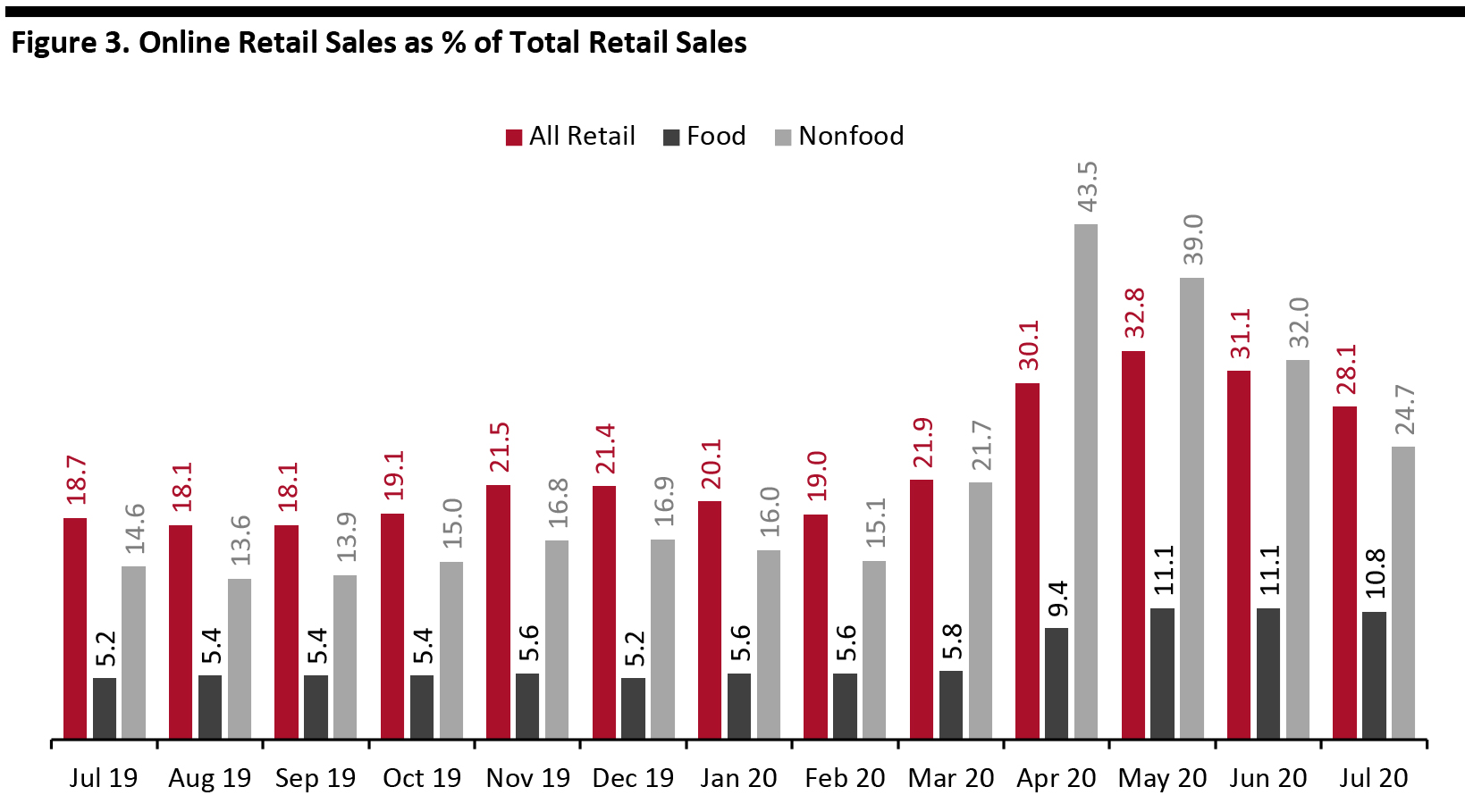

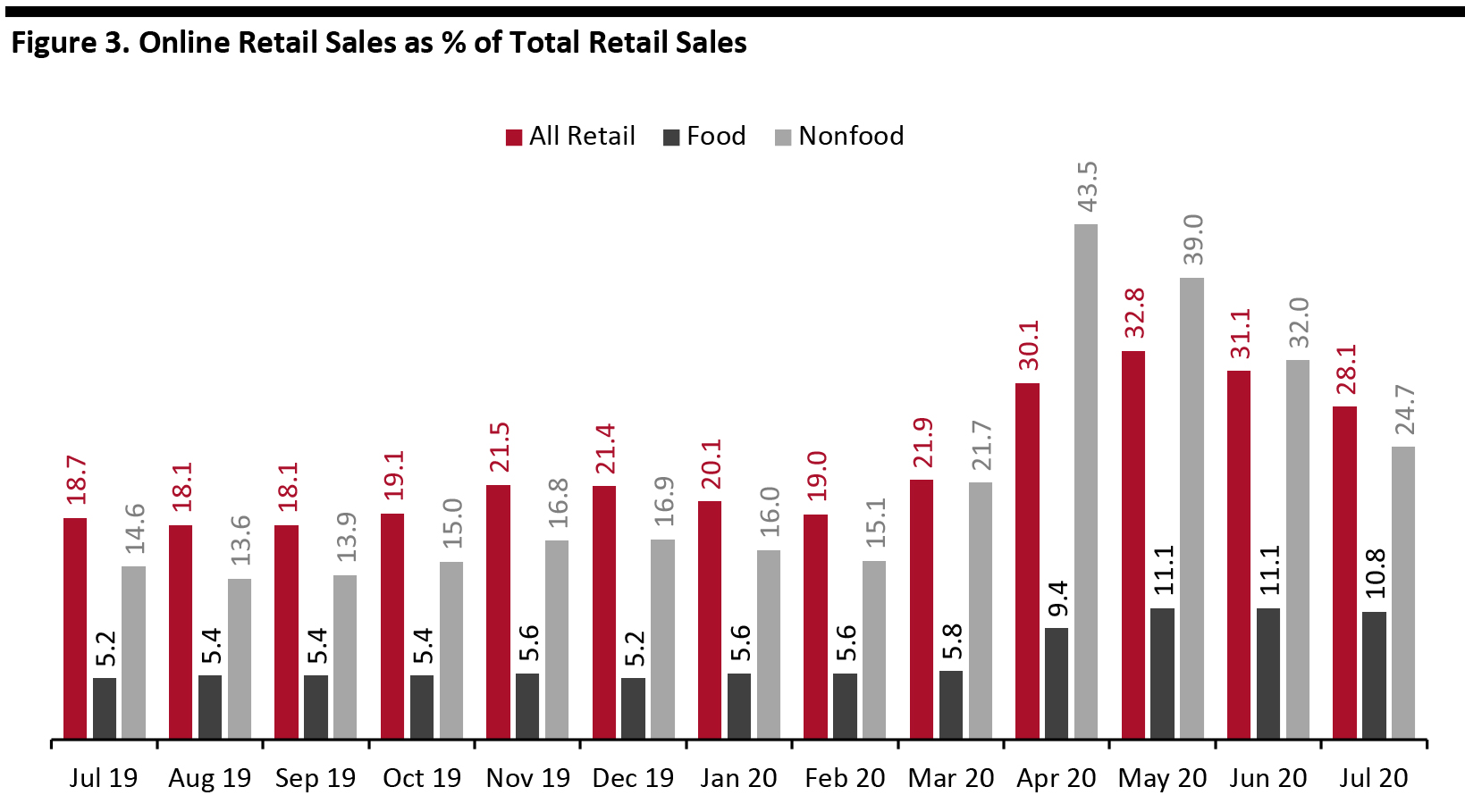

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers **A relatively fragmented sector, in which reported figures have traditionally been volatile Source: ONS Online Retail Sales Account for 28% of All Retail Sales Total online retail sales were up 54.1% year over year in July, compared to 73.5% in June. At food retailers, Internet sales were up 109.2% in July, versus 129.3% in June. In July, Internet sales were up 59.6% at store-based nonfood retailers, versus 78.2% in June, supported by strong sales at household-goods retailers, which were up 82.8%. Online sales were up 38.1% at nonstore retailers. Online retail sales continued to fall as a share of overall retail sales, as shoppers returned to stores. Online sales accounted for 28.1% of all retail sales in July, down from 31.1% in June. We chart the trend for all retail and the store-based food and nonfood sectors below. [caption id="attachment_114927" align="aligncenter" width="700"] Food and Nonfood data are for store-based sectors; All Retail total includes nonstore retail, which is not charted

Food and Nonfood data are for store-based sectors; All Retail total includes nonstore retail, which is not charted

Source: ONS [/caption] Covid-19 Lockdown Timeline The UK was put into lockdown on March 23, initially for three weeks in an attempt to limit the spread of coronavirus, temporarily closing all nonessential retail stores. The government announced on April 16 that it would extend the lockdown by another three weeks. On May 11, Prime Minister Boris Johnson announced that the restrictions would be eased in a phased manner, allowing nonessential stores to reopen from the start of June. However, garden centers were allowed to reopen from May 13 and furniture stores from May 23. On May 26, the government announced that all nonessential retailers in England and Northern Ireland, including department stores and small independent shops, would be allowed to reopen from June 15, given that stores implement measures to meet the necessary social distancing and hygiene standards. On June 23, Johnson announced that restaurants, pubs, museums, cinemas and hotels would be allowed to reopen from July 4.

Data in this report are not seasonally adjusted

Data in this report are not seasonally adjusted Source: ONS/Coresight Research [/caption] Retail Sales Growth by Sector Total growth in July was supported by a reported strong recovery by small retailers in selected sectors such as department stores/mixed-goods retailers, some specialist nonfood sectors and nonstore retail. In total, large retailers, which account for the bulk of retail sales, saw a slight year-over-year decline. Grocery slows: Grocery-sector growth slowed to low, single digits in July, according to the ONS. Big-ticket bounce: The ONS reported double-digit growth for each of electrical-goods retailers, furniture stores, DIY retailers and floorcoverings stores. This included a 50% year-over-year rise for the floorcoverings sector, although this has long been a highly volatile sector in the ONS index, along with other fragmented sectors. For DIY, the July figures continued a medium-term run of strong growth. Apparel and department stores/mixed-goods retailers weak: Clothing and footwear stores continued to see deep double-digit declines. The clothing specialists sector saw a 31% sequential easing in the pace of decline (a percentage on a percentage, not a percentage-point change), compared to a 39% easing in June and led by large chains, which saw a 34% easing in the pace of decline in July. The department stores/mixed-goods sector is a combination of full-range department stores such as John Lewis and variety-store retailers such as B&M Bargains; the former segment is likely to be the principal drag on this sector’s growth, given its reliance on the weak apparel category and observed low traffic levels.

- We are seeing similar weakness in apparel and department stores in the US. See our report on July US retail sales or our new US Retail Sales Databank for more details.

Figure 2. UK Retail Sales, by Sector: YoY % Change [wpdatatable id=401 table_view=regular]

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers **A relatively fragmented sector, in which reported figures have traditionally been volatile Source: ONS Online Retail Sales Account for 28% of All Retail Sales Total online retail sales were up 54.1% year over year in July, compared to 73.5% in June. At food retailers, Internet sales were up 109.2% in July, versus 129.3% in June. In July, Internet sales were up 59.6% at store-based nonfood retailers, versus 78.2% in June, supported by strong sales at household-goods retailers, which were up 82.8%. Online sales were up 38.1% at nonstore retailers. Online retail sales continued to fall as a share of overall retail sales, as shoppers returned to stores. Online sales accounted for 28.1% of all retail sales in July, down from 31.1% in June. We chart the trend for all retail and the store-based food and nonfood sectors below. [caption id="attachment_114927" align="aligncenter" width="700"]

Food and Nonfood data are for store-based sectors; All Retail total includes nonstore retail, which is not charted

Food and Nonfood data are for store-based sectors; All Retail total includes nonstore retail, which is not charted Source: ONS [/caption] Covid-19 Lockdown Timeline The UK was put into lockdown on March 23, initially for three weeks in an attempt to limit the spread of coronavirus, temporarily closing all nonessential retail stores. The government announced on April 16 that it would extend the lockdown by another three weeks. On May 11, Prime Minister Boris Johnson announced that the restrictions would be eased in a phased manner, allowing nonessential stores to reopen from the start of June. However, garden centers were allowed to reopen from May 13 and furniture stores from May 23. On May 26, the government announced that all nonessential retailers in England and Northern Ireland, including department stores and small independent shops, would be allowed to reopen from June 15, given that stores implement measures to meet the necessary social distancing and hygiene standards. On June 23, Johnson announced that restaurants, pubs, museums, cinemas and hotels would be allowed to reopen from July 4.