DIpil Das

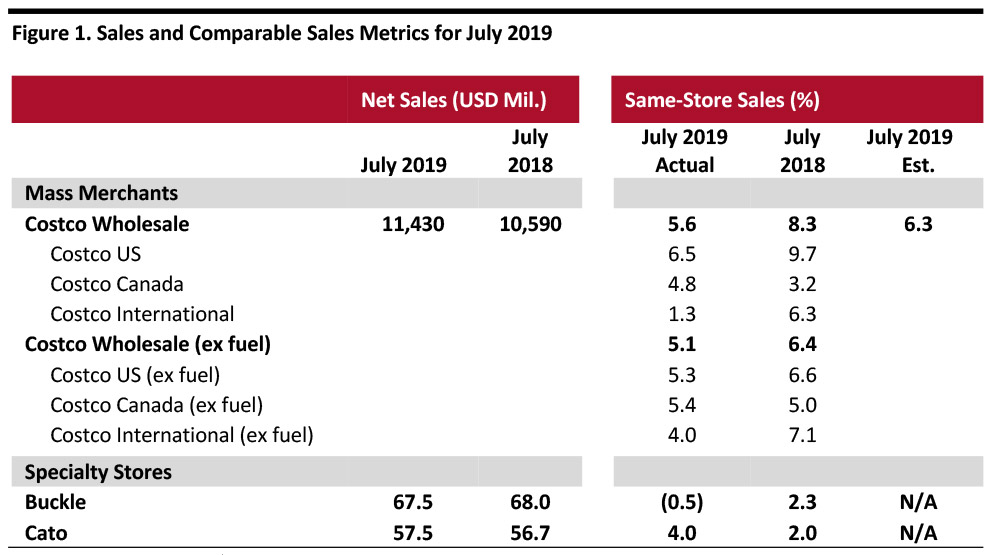

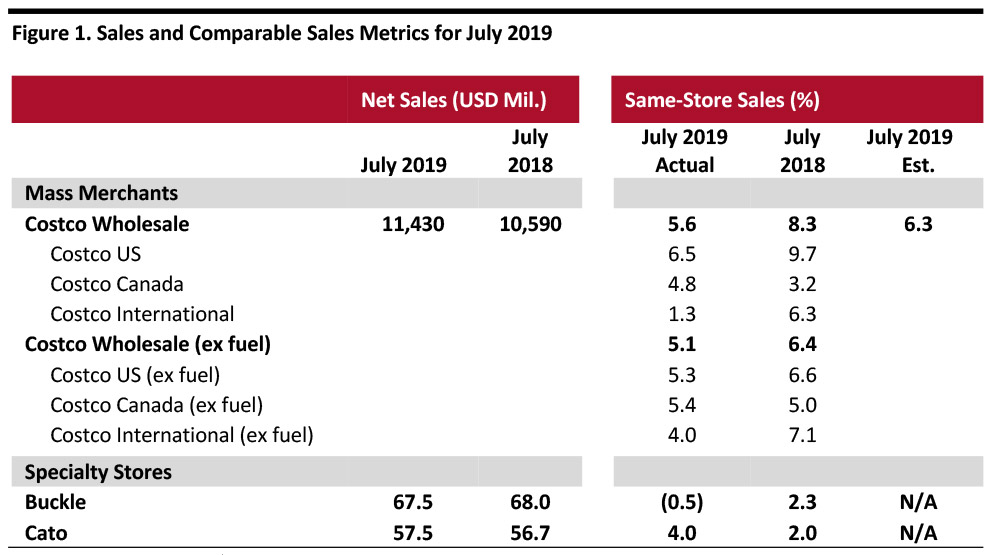

[caption id="attachment_94537" align="aligncenter" width="700"] Source: Company reports/StreetAccount[/caption]

Source: Company reports/StreetAccount[/caption]

Source: Company reports/StreetAccount[/caption]

Source: Company reports/StreetAccount[/caption]

Costco Comps Below Consensus; E-Commerce Comparable Sales Growth Accelerates

- In July, Costco grew global same-store sales by 5.6% year over year, slightly faster than the 5.4% growth in June and 70 basis points below the consensus estimate recorded by StreetAccount. Ex fuel, global comps were up 5.1% in July.

- Costco’s e-commerce comparable sales growth was 21.3% in July, substantially higher than June’s 15.7% growth.

- Ex fuel, Costco US comps were up 5.3% in July, same as June. In terms of US regions, the retailer witnessed the strongest results in the Midwest, San Diego and Los Angeles in July. Internationally, Costco saw strong sales growth in Taiwan, Mexico and Japan.

- Currency fluctuations negatively impacted the company’s comps. Canada same-store sales growth was hurt by about 10 basis points, while other international comp growth was negatively impacted by approximately 240 basis points. Overall, group comparable sales were negatively impacted by 30 basis points.

- Cannibalization negatively impacted US comps by about 50 basis points, Canada by 110 basis points and other international segments by approximately 150 basis points. Overall, comparable sales were negatively impacted by 70 basis points.

- In the merchandise segment, excluding currency effects, comps for food and sundries were positive mid-single digits; departments that showed the strongest results were candy, liquor and sundries. Hardlines posted comps in the positive mid-single digits; the departments with the strong performances were garden, toys, seasonal and majors. Softlines were up low-single digits; the departments that showed better performance were kiosks, housewares and small appliances.

- Fresh food comparable sales were up mid-single digits, with service deli and produce being better-performing departments. In the ancillary businesses, hearing aids, optical and gas saw the strongest comp sales increases.

- Gasoline price deflation negatively impacted total comps by about 50 basis points; the overall average selling price decreased to $2.93 per gallon this year from $3.03 last year.

Buckle’s Sales Decrease; Both Men’s and Women’s Segments Performed Poorly

- Buckle’s comparable sales decreased 0.5% year over year in July, compared to a 6.2% increase in June. In July, the company’s net sales declined 0.8% year over year versus a 5.5% rise in June.

- By business segment, total sales in men’s were down 0.5% year over year. The men’s segment accounted for approximately 53.5% of total sales in July 2019, compared to 52.5% in July 2018. In July, price points were down by about 3% in the men’s segment.

- Total sales in the women’s segment were down 2.5% year over year. The women’s segment accounted for 46.5% of total monthly sales in July 2019, down from 47.5% in July 2018. In the women’s business, price points were down about 7.5% for the month of July.

- By product type, accessories sales were down 0.5% year over year in July and accounted for 9.0% of total sales. Footwear sales grew 22% year over year and represented 7.5% of total sales. Average accessory price points decreased about 12% and average footwear price points were down by about 6%.

- In July, units per transaction grew 2% and the average transaction value fell 3%.

Cato Same-Store Sales Growth Decelerates; Management Remains Cautious for the Second Half

- Cato’s sales increased 1.0% year over year to $57.5 million, compared to a 5.0% increase in June. Comparable sales increased 4.0% year over year in July, decelerating from an 8.0% increase in June.

- The company’s CEO John Cato commented that July sales have exceeded the company’s expectations however the company will remain cautious in the second half of the year. Cato also said that the second half will be more challenging given the effect of new tariffs impacting jewelry, shoes, apparel and accessories.

- As of August 3, 2019, the company operated 1,299 stores in 31 states, down from 1,350 stores in 33 states as of August 4, 2018.