DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Fiscal 3Q19 Results

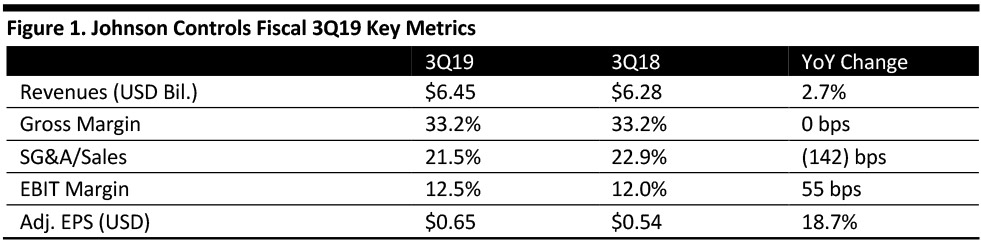

Johnson Controls reported fiscal 3Q19 revenues of $6.45 billion, up 2.7% and in line with the consensus estimate. Organic growth was 6%.

The EBIT margin increased 55 basis points (bps) year over year.

Adjusted EPS from continuing operations was $0.65, beating the consensus estimate by two cents. GAAP EPS from continuing operations was $0.16, compared to $0.51 in the year-ago quarter. Diluted EPS (including discontinued operations) was $4.79, compared with $0.78 in the year-ago quarter. The difference in figures is due to the sale of the sale of Power Solutions.

Management characterized the results as strong, benefiting from new product development, talent management and enhanced commercial excellence.

Buildings field orders increased 6% year over year, and backlog increased 7% year over year, improving the company’s visibility into fiscal Q4 and 2020.

Results by Segment

- Building solutions North America recorded revenues of $2.2 billion, up 3.6% year over year and up 4% organically, driven by a 4% increase in installations and a 3% increase in service. The HVAC and controls businesses were up high-single digits, fire and security was up low-single digits, and the performance solutions business revenues were down high-single digits. Orders and backlog both increased by 6% organically.

- Building solutions Europe, Middle East, Africa/Latin America recorded revenues of $922 million, down 0.4% year over year but up 6% organically, driven by a 10% increase in installations and a 2% increase in service. Europe was up high single digits with solid growth across HVAC, fire and security and industrial refrigeration. Middle East and Africa was down mid-single digits driven by weakness in HVAC. Latin America was up double digits led by fire and security. Orders increased 8% organically and backlog increased 11% organically.

- Building solutions Asia Pacific recorded revenues of $691 million, up 1.5% year over year and up 6% organically, driven by a 9% increase in installations and a 1% increase in service. Growth was strong in HVAC and building management systems. China was up by mid-single digits.

- Global products recorded revenues of $2.5 billion, up 3.4% year over year and up 7% organically, driven by building management systems up low double digits with strength across all businesses and specialty products up high-single digits.

Details from the Quarter

On April 30, the company closed the sale of the Power Solutions business to Brookfield Business Partners for approximately $11.6 billion. The company made an equity tender for approximately 102 million shares for $4.0 billion and repaid $3.4 billion in debt, leaving $4.1 billion of the proceeds ready for deployment.

Management offered the following highlights:

- The company is seeing continued revenue momentum, which is supporting the fundamentals across its businesses.

- JCI continues to invest in growth across its portfolio.

- The company continues to transfer its business portfolio, with noncore businesses held for sale, following the sale of Power Solutions.

- JCI returned cash to shareholders in the form of debt and equity tender offers.

Implications for Retail

Management commented that its retail business (Sensormatic, included in the building solutions North America segment) is a $1 billion business, of which a significant portion is in North America. Within that business, the existing antitheft and emerging digital traffic businesses are performing well. With the ongoing challenges in retail, some business has been pushed out, and management is watching it closely in Q4. Still, growth was characterized as good.

In January 2019, the company rebranded its former Tyco Retail Solutions product lines for loss prevention, inventory intelligence and traffic insights as Sensormatic Solutions. These solutions support secure, adaptive retail environments and help retailers make more accurate decisions.

Outlook

The company narrowed 2019 EPS (from continuing operations) guidance range upwards to $1.93-1.95 (up 21-23% year over year) from $1.85-1.95 previously.