DIpil Das

[caption id="attachment_86773" align="aligncenter" width="718"] Source: Company reports/Coresight Research[/caption]

Fiscal 2Q19 Results

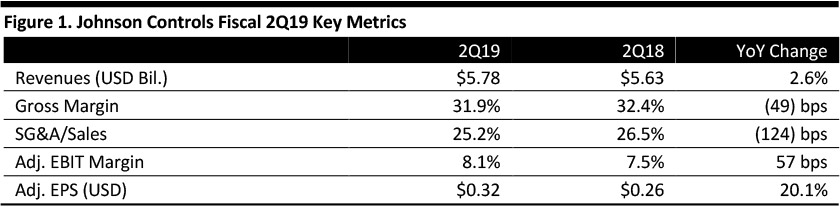

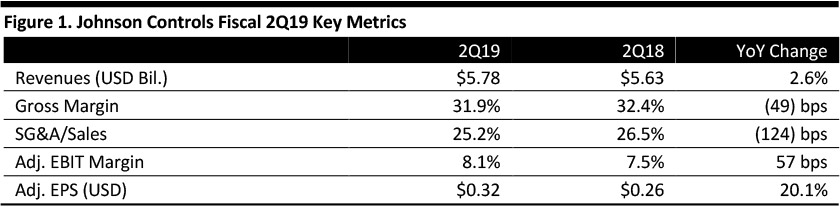

Johnson Controls reported fiscal 2Q19 revenues of $5.78 billion, up 2.6% and in line with the consensus estimate. Organic growth was 6%.

Revenues in the field business (building solutions) grew 3%, and 6% organically. Revenues in the products business grew 2%, and 7% organically.

The adjusted EBIT margin increased 57 bps year over year.

Adjusted EPS from continuing operations was $0.32, beating the consensus estimate by two cents. GAAP EPS from continuing operations was $0.26, compared to $0.20 in the year-ago quarter. Diluted EPS (including discontinued operations) was $0.57, compared with $0.47 I the year-ago quarter.

Results by Segment

Field Business:

Source: Company reports/Coresight Research[/caption]

Fiscal 2Q19 Results

Johnson Controls reported fiscal 2Q19 revenues of $5.78 billion, up 2.6% and in line with the consensus estimate. Organic growth was 6%.

Revenues in the field business (building solutions) grew 3%, and 6% organically. Revenues in the products business grew 2%, and 7% organically.

The adjusted EBIT margin increased 57 bps year over year.

Adjusted EPS from continuing operations was $0.32, beating the consensus estimate by two cents. GAAP EPS from continuing operations was $0.26, compared to $0.20 in the year-ago quarter. Diluted EPS (including discontinued operations) was $0.57, compared with $0.47 I the year-ago quarter.

Results by Segment

Field Business:

Source: Company reports/Coresight Research[/caption]

Fiscal 2Q19 Results

Johnson Controls reported fiscal 2Q19 revenues of $5.78 billion, up 2.6% and in line with the consensus estimate. Organic growth was 6%.

Revenues in the field business (building solutions) grew 3%, and 6% organically. Revenues in the products business grew 2%, and 7% organically.

The adjusted EBIT margin increased 57 bps year over year.

Adjusted EPS from continuing operations was $0.32, beating the consensus estimate by two cents. GAAP EPS from continuing operations was $0.26, compared to $0.20 in the year-ago quarter. Diluted EPS (including discontinued operations) was $0.57, compared with $0.47 I the year-ago quarter.

Results by Segment

Field Business:

Source: Company reports/Coresight Research[/caption]

Fiscal 2Q19 Results

Johnson Controls reported fiscal 2Q19 revenues of $5.78 billion, up 2.6% and in line with the consensus estimate. Organic growth was 6%.

Revenues in the field business (building solutions) grew 3%, and 6% organically. Revenues in the products business grew 2%, and 7% organically.

The adjusted EBIT margin increased 57 bps year over year.

Adjusted EPS from continuing operations was $0.32, beating the consensus estimate by two cents. GAAP EPS from continuing operations was $0.26, compared to $0.20 in the year-ago quarter. Diluted EPS (including discontinued operations) was $0.57, compared with $0.47 I the year-ago quarter.

Results by Segment

Field Business:

- Building Solutions North America recorded revenues of $2.2 billion, up 4.2% year over year and up 5% organically, driven by solid growth in HVAC (high voltage alternative current) & Controls and Fire and Security. Adjusted orders increased 2% year over year, and backlog stood at $5.6 billion at the end of the quarter, up 5% year over year. Adjusted EBITA (earnings before interest, taxes and amortization) margins expanded by 20 bps due to volume leverage, cost synergies and productivity savings, partially offset by unfavorable mix and salesforce additions.

- Building Solutions EMEA/LA (Europe, Middle East, Africa/Latin America) recorded revenues of $878 million, down 3.2% year over year but up 4% organically, driven by growth in service and project installation. Growth was positive in most regions, with strength in Fire & Security and Industrial Refrigeration in Europe and Latin America. Adjusted orders increased 3% year over year, and backlog stood at $1.7 billion at the end of the quarter, up 9% year over year. Adjusted EBITA margins expanded by 60 bps due to favorable volume, the benefit of cost synergies and productivity savings, partially offset by unfavorable mix and salesforce additions. Adjusted for currency, margins increased by 100 bps.

- Building Solutions Asia Pacific recorded revenues of $628 million, up 7.2% year over year and up 12% organically, driven by double-digit growth in project installations. Adjusted orders increased 1% year over year, and backlog stood at $1.6 billion at the end of the quarter, up 8% year over year. Adjusted EBITA margins were flat due to favorable volume more than offset by unfavorable mix, salesforce additions and margin pressure.

- Global Products recorded revenues of $2.1 million, up 2.3% year over year and up 7% organically, driven by double-digit growth in Building Management Systems, mid-single digit growth in HVAC & Refrigeration Equipment and low double-digit growth in Specialty Products. Adjusted EBITA margins increased by 60 bps due to cost synergies and productivity savings, slightly offset by ongoing investments in products.

- The company is executing the second phase of a multiyear energy efficiency and renewable energy project with the University of Hawaii.

- The company recently announced a joint project with Microsoft to deliver a building in he UAE fully powered by renewable energy sources with zero net energy consumption and a LEED (Leadership in Energy and Environmental Design) platinum certification.