British department store chain John Lewis has shaken up its top management team with the introduction of two new roles: Customer Director and Group Productivity Director.

Craig Inglis, currently Marketing Director, will take on an expanded role as he becomes Customer Director. He will continue to be responsible for marketing and customer insight and will now oversee the end-to-end customer experience, too.

Andrew Murphy, currently Retail Director, will become Group Productivity Director. In his new position, he will develop plans that support the John Lewis Partnership’s productivity improvements, financial strategy and future organizational structure.

At the same time, Dino Rocos, who currently oversees supply chain and merchandising as Operations Director, will assume responsibility for the “omnichannel customer journey,” including customer ordering.

It is the latest evolution for the company, which is widely seen as the preeminent multi-channel retailer.

NEW ROLES TO PUT THE CUSTOMER AT THE CENTER

The shake-up appears designed to strengthen John Lewis’s position at the forefront of customer experience and multi-channel retailing. The Customer Director role and Rocos’s new responsibilities for the omnichannel customer journey are likely to fortify the company’s reputation for merging the online and in-store shopping experiences.

Commenting on the management changes, Andy Street, Managing Director of John Lewis, said, “These important changes…place the customer at the heart of our decision making. The new John Lewis Board composition will ensure we continue to lead omnichannel retailing in the UK.”

And Sir Charlie Mayfield, Chairman of the John Lewis Partnership, said, “The rapid rate of change in retail is set to continue and therefore the time is right for us to develop the thinking that will help sustain the Partnership in the next generation...”

STAYING AHEAD ON MULTI-CHANNEL METRICS

John Lewis already sees unusually high levels of multi-channel shopping, as measured by several key metrics:

- Fully 33% of John Lewis’s sales were made online in the year ending January 2015, up from 28% in fiscal year 2014—these are unusually high percentages for a store-based retailer.

- Click-and-collect accounted for 54% of Internet orders in fiscal year 2015, and for fully 56% over the Christmas 2014 trading period. Fiscal year 2015 was the first year in which click-and-collect was more popular than home delivery at John Lewis.

- In turn, collection through John Lewis’s sister grocery chain, Waitrose, now accounts for the majority of click-and-collect orders: 66% in fiscal year 2015, up from 57% in fiscal year 2014.

Given this strong demand, John Lewis is not afraid to put profitability ahead of subsidizing cross-channel services. In July 2015, the company became the first major British retailer to start charging for click-and-collect, although it charges only for purchases under £30. It is something of a risk, but other, similarly developed, multi-channel retailers may also start charging for the service as fulfillment costs mount.

IS JOHN LEWIS A LEADER IN MULTI-CHANNEL?

The types of metrics noted above have been used by many commentators to suggest that John Lewis offers a superlative cross-channel shopping experience; many hold the retailer aloft as an exemplar of multi-channel retailing.

But we think this risks overstating the relevance of these metrics, which are perhaps more suggestive of shopper demand than of retailer capabilities. And we suspect that John Lewis’s customer demographics contribute to its high levels of cross-channel shopping. The affluent, time-pressured middle-class shoppers who are John Lewis’s key constituency are likely to be early adopters of services such as in-store collection.

Moreover, cross-channel services offered by John Lewis versus its key competitors suggest that its multi-channel offering is not as distinctive as some imply. House of Fraser and Next are among those offering more convenient click-and-collect options, with later cutoff times for placing final orders and earlier start times for collecting in-store the following day.

Source: Company websites

FALLING SALES SUGGEST SHAKE-UP WAS NEEDED

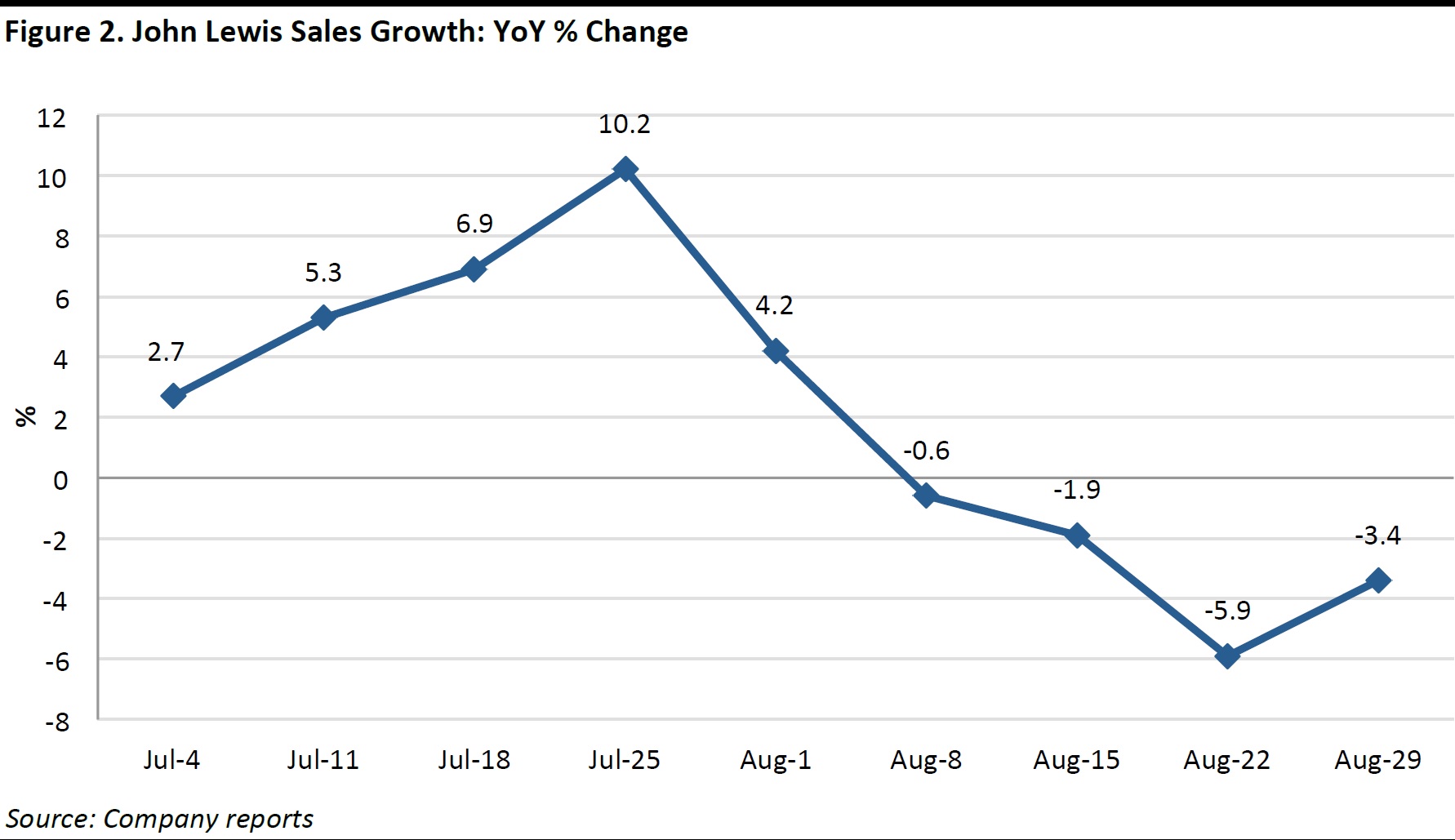

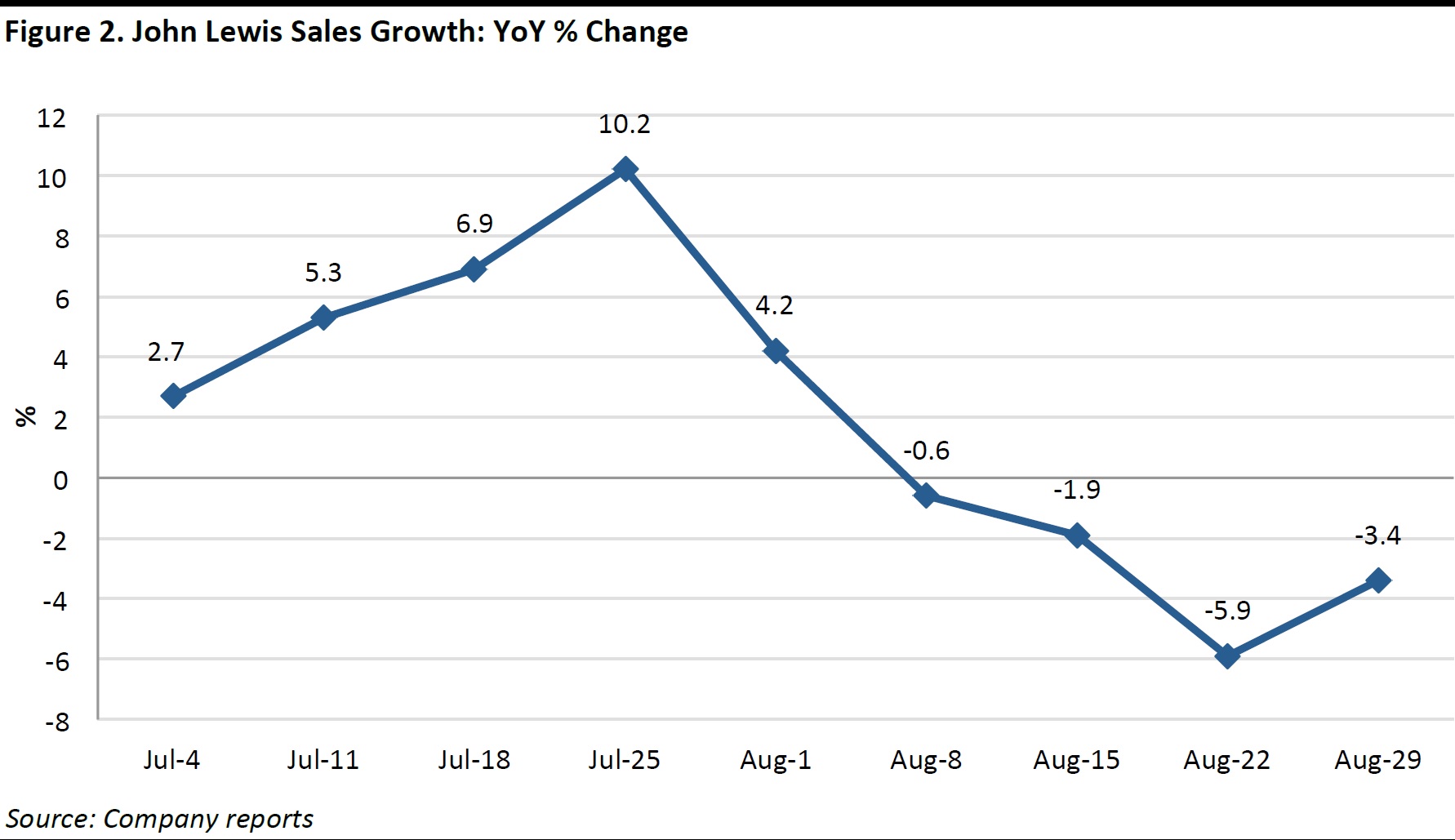

John Lewis has rapidly moved from leading growth on the high street to trailing the sector, making the need for renewed thinking more urgent. Lately, negative top-line growth has emerged following a sustained period of outperformance, with sales down 3.4% in the week ending August 29 compared to positive growth of 8.9% in fiscal year 2015.

In its most recent two weekly sales figures (August 22 and August 29), the retailer noted that home and fashion were falling categories.

Source: Company reports

The management changes, and the rethinking of the multi-channel proposition that they imply, could be designed to stem this downturn. Moreover, the new role of Group Productivity Director, coupled with John Lewis’s introduction of a charge for lower-value click-and-collect purchases, suggests that top-line growth is not the company’s only focus.

JOHN LEWIS’S CHANGES: OUR VIEW

We think the changes at John Lewis are driven by the ceaseless need to develop the multi-channel proposition in the face of ever-heightening competition. And there is scope for improvement at the company, despite it often being proclaimed the preeminent multi-channel retailer.

The pressures to improve the proposition come from rivals such as House of Fraser and Next, which offer enhanced multi-channel options, as well as from pure plays, which often seem to be under little pressure to turn a profit and which are able to subsidize services such as ultrafast delivery.

In the UK sector, the first-generation multi-channel model of in-store collection and in-store returns is no longer a competitive advantage—shoppers now expect these kinds of services. In a world of same-day and one-hour delivery, retailers must constantly innovate to outpace the pack on customer service. For many, it is a race to stand still.

British department store chain John Lewis has shaken up its top management team with the introduction of two new roles: Customer Director and Group Productivity Director.

Craig Inglis, currently Marketing Director, will take on an expanded role as he becomes Customer Director. He will continue to be responsible for marketing and customer insight and will now oversee the end-to-end customer experience, too.

Andrew Murphy, currently Retail Director, will become Group Productivity Director. In his new position, he will develop plans that support the John Lewis Partnership’s productivity improvements, financial strategy and future organizational structure.

At the same time, Dino Rocos, who currently oversees supply chain and merchandising as Operations Director, will assume responsibility for the “omnichannel customer journey,” including customer ordering.

It is the latest evolution for the company, which is widely seen as the preeminent multi-channel retailer.

British department store chain John Lewis has shaken up its top management team with the introduction of two new roles: Customer Director and Group Productivity Director.

Craig Inglis, currently Marketing Director, will take on an expanded role as he becomes Customer Director. He will continue to be responsible for marketing and customer insight and will now oversee the end-to-end customer experience, too.

Andrew Murphy, currently Retail Director, will become Group Productivity Director. In his new position, he will develop plans that support the John Lewis Partnership’s productivity improvements, financial strategy and future organizational structure.

At the same time, Dino Rocos, who currently oversees supply chain and merchandising as Operations Director, will assume responsibility for the “omnichannel customer journey,” including customer ordering.

It is the latest evolution for the company, which is widely seen as the preeminent multi-channel retailer.

The shake-up appears designed to strengthen John Lewis’s position at the forefront of customer experience and multi-channel retailing. The Customer Director role and Rocos’s new responsibilities for the omnichannel customer journey are likely to fortify the company’s reputation for merging the online and in-store shopping experiences.

Commenting on the management changes, Andy Street, Managing Director of John Lewis, said, “These important changes…place the customer at the heart of our decision making. The new John Lewis Board composition will ensure we continue to lead omnichannel retailing in the UK.”

And Sir Charlie Mayfield, Chairman of the John Lewis Partnership, said, “The rapid rate of change in retail is set to continue and therefore the time is right for us to develop the thinking that will help sustain the Partnership in the next generation...”

The shake-up appears designed to strengthen John Lewis’s position at the forefront of customer experience and multi-channel retailing. The Customer Director role and Rocos’s new responsibilities for the omnichannel customer journey are likely to fortify the company’s reputation for merging the online and in-store shopping experiences.

Commenting on the management changes, Andy Street, Managing Director of John Lewis, said, “These important changes…place the customer at the heart of our decision making. The new John Lewis Board composition will ensure we continue to lead omnichannel retailing in the UK.”

And Sir Charlie Mayfield, Chairman of the John Lewis Partnership, said, “The rapid rate of change in retail is set to continue and therefore the time is right for us to develop the thinking that will help sustain the Partnership in the next generation...”