Web Developers

The third week of July 2015 was an exciting one for retail. We saw both hype and grumbling mover Amazon’s Prime Day launch on July 15 and, ultimately, solid results from the company. Jet.com completed its public launch on July 21, backed by a $100 million marketing budget. Now that Jet has launched, the discussion has shifted to its economic viability, in the face of its seemingly unreasonably low prices. The company is currently getting flak in the press for linking to other retailers’ websites without their consent, as part of its “Jet Anywhere” rewards program.

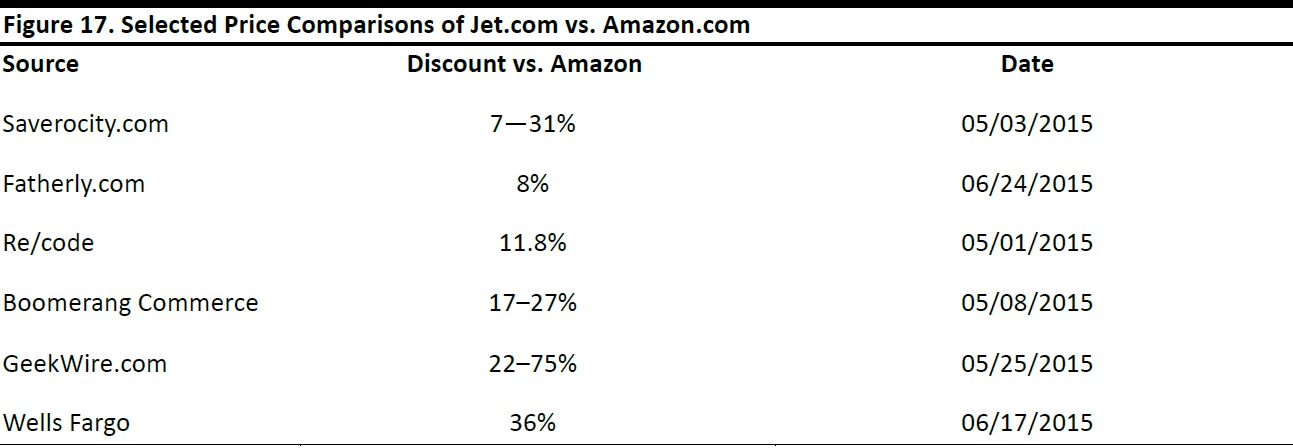

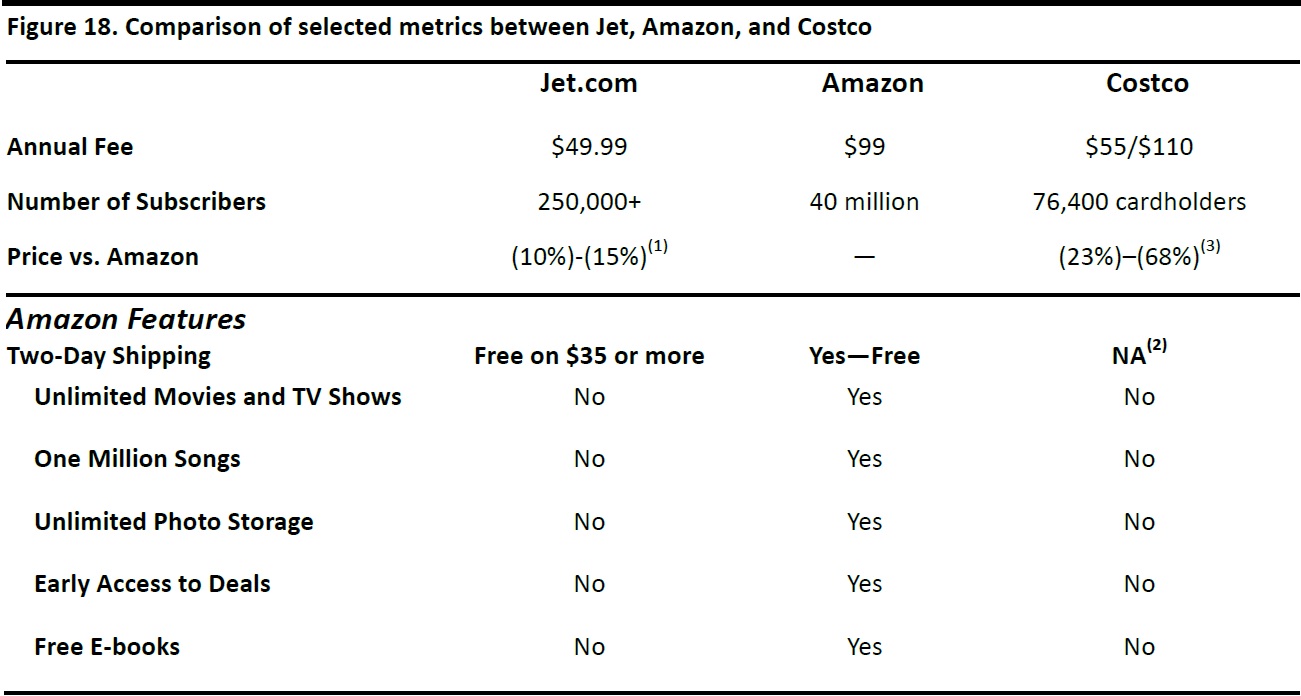

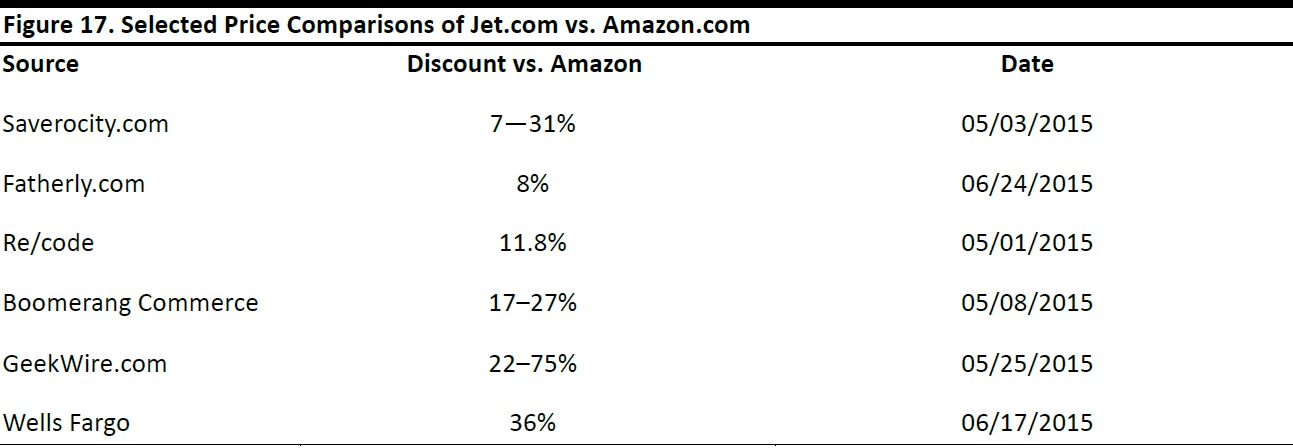

Jet is taking a page (or two) right out of Amazon’s playbook by offering a friendly user interface and low prices. That is no surprise, since Jet’s CEO, Marc Lore, spent two years at Amazon after it acquired his company (the parent company of Diapers.com). What’s different is that Jet seeks no profit on the goods it sells; rather, it aims to generate profits only from membership fees. To entice new customers, Jet is offering a free trial membership for the first six months. Jet claims to offer prices that are 10%–15% lower than those of other e-‐commerce retailers, and several analyses have calculated that ts prices are 7%–36% lower than Amazon’s.

The company aims to offer a premium browsing experience through a clean, easy-‐to-‐use website. Its unique business model relies on deriving profits solely from membership subscriptions. Wholesale prices are passed along to subscribers, resulting in extremely discounted prices versus MSRPs and prices for like products at competing retailers.

The company offers the following membership benefits:

- Big savings

- Savings at an additional 700+ sites using Jet Anywhere (“From Gap.com to Apple.com”)

- Free shipping with purchase of over $35 and free returns within 30 days

- Two-‐day shipping on “essentials”; two-‐ to five-‐day shipping on everything else

- Customer support (from its team, called the “Jet Heads”)

- To t a l m e m b e r s a v i n g s : $ 8 1 5 , 6 4 2

- Most popular product sold: protein bars (enough daily recommended protein for 212 years)

- Second-most popular product sold: toilet paper (enough to cover the Empire State Building twice)

- Biggest pantry cart: 39 items

Comparisons with Amazon and Costco

Amazon is Jet.com’s most-often mentioned competitor, and Jet.com’s website promises prices that are 10%–15% lower than Amazon’s. A Boomerang Commerce survey found that Jet.com’s household product prices were 39% cheaper than Amazon’s, that its appliance prices were 27% cheaper, and that its electronics and cellphone prices were 16% cheaper, for an average product price that is 27% cheaper. Below is a list of price comparisons generated by selected sources: