Summary

There’s a new e-commerce startup in town—by the name of Jet.com—that’s poised to give Amazon some competition by combining the membership approach of Costco, the broad retail category coverage of Amazon, and some innovative analytics for computing pricing and shipping. The Jet.com team is extremely familiar with Amazon’s competitive advantages as well as its weaknesses, since Jet.com‘s CEO Marc Lore worked at Amazon for a couple of years after it acquired his startup (Quidsi, the parent company of Diapers.com).

Jet.com is employing all the techniques that successful e-commerce companies use today: viral marketing, savvy use of social media and membership by invitation only so as to create scarcity and pent-up demand for access to membership. First and foremost, Jet.com plans to deliver what many consumers want most—lower prices. In a recent interview, Lore told The Washington Post, “Price is still king.” The company claims it can underprice Amazon and others by 10%–15%, and some analyses point to even greater savings.

The company is taking a page from Amazon’s playbook by going for scale at the expense of profits. The company plans to generate profits solely from membership fees and therefore offer goods and shipping services at rates very close to cost. By optimizing product selection and shipping methods, Jet.com can reduce prices even further.

Amazon, as one would expect, is not taking the competitive threat lying down. To celebrate its 20th birthday on July 15, the company launched Amazon Prime Day—which it boasted would surpass Black Friday in terms of the quality and quantity of deals offered. Prime Day was scheduled about a week before Jet.com’s public launch (July 21), and Amazon’s deals threatened to steal customers and attention from Jet.com, since consumers are unlikely to pay for two e-commerce memberships at the same time.

Unfortunately for Amazon, though, many consumers were underwhelmed by its sale offerings on Prime Day, and they vented their complaints on social media. In fact, many subscribers were so disappointed by Amazon’s offerings that they threatened to cancel their Amazon Prime memberships altogether. The figures tell a different story, though, and Amazon said that orders were 18% higher than on Black Friday 2014 and that the company had signed up hundreds of thousands of new members.

The occasion also encouraged several other large retailers to jump on the midsummer sale bandwagon, offering onetime and regular promotions of their own in order to compete with Amazon. That made mid-July sweet for consumers and possibly provided a much-needed boost to the back-to-school shopping season.

What Is Jet.com?

Jet.com is an e-commerce company that’s currently in stealth mode, with a public launch scheduled for July 21. The company aims to offer a premium browsing experience through a clean, easy-to-use website. Its unique business model relies on deriving profits solely from membership subscriptions. Wholesale prices are passed along to subscribers, resulting in extremely discounted prices versus MSRPs and prices for like products at competing retailers.

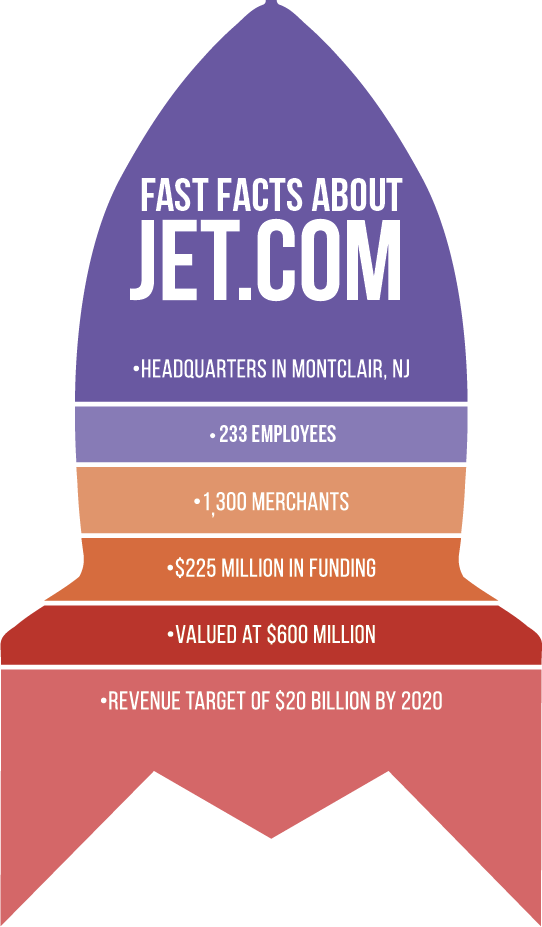

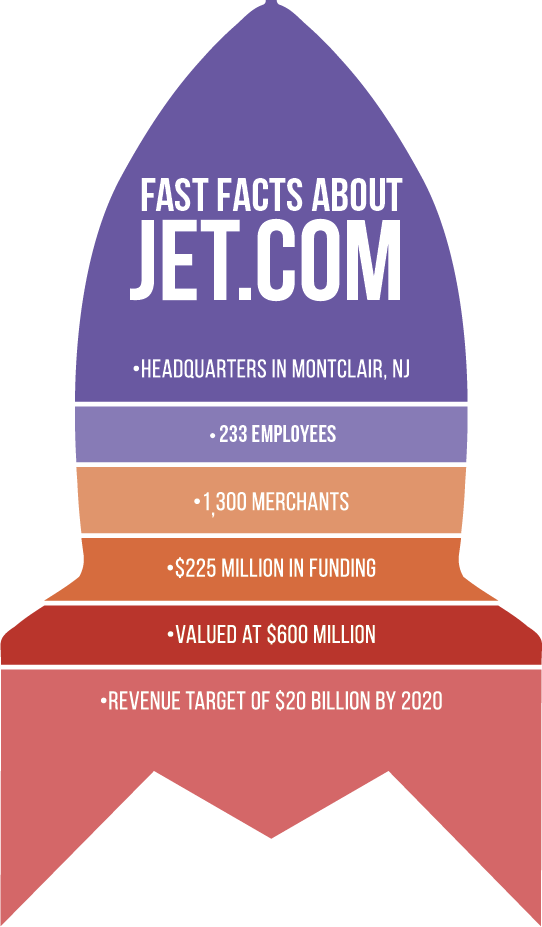

Jet.com was founded by Marc Lore, who previously founded Quidsi (the operator of Diapers.com). Quidsi was acquired by Amazon for $545 million in 2010, and Lore stayed on at Amazon for two years after the acquisition. He founded Jet.com in 2014. The company is located in Montclair, New Jersey (but will soon to move to Hoboken, NJ), has about 233 employees and has raised more than $225 million in venture capital.

Jet.com offers the following membership benefits:

- Big savings

- Savings at an additional 700+ sites using Jet Anywhere (“From Gap.com to Apple.com”)

- Free shipping with purchase of over $35 and free returns within 30 days

- Two-day shipping on “essentials”; two- to five-day shipping on everything else

- Customer support (from its team, called the “Jet Heads”)

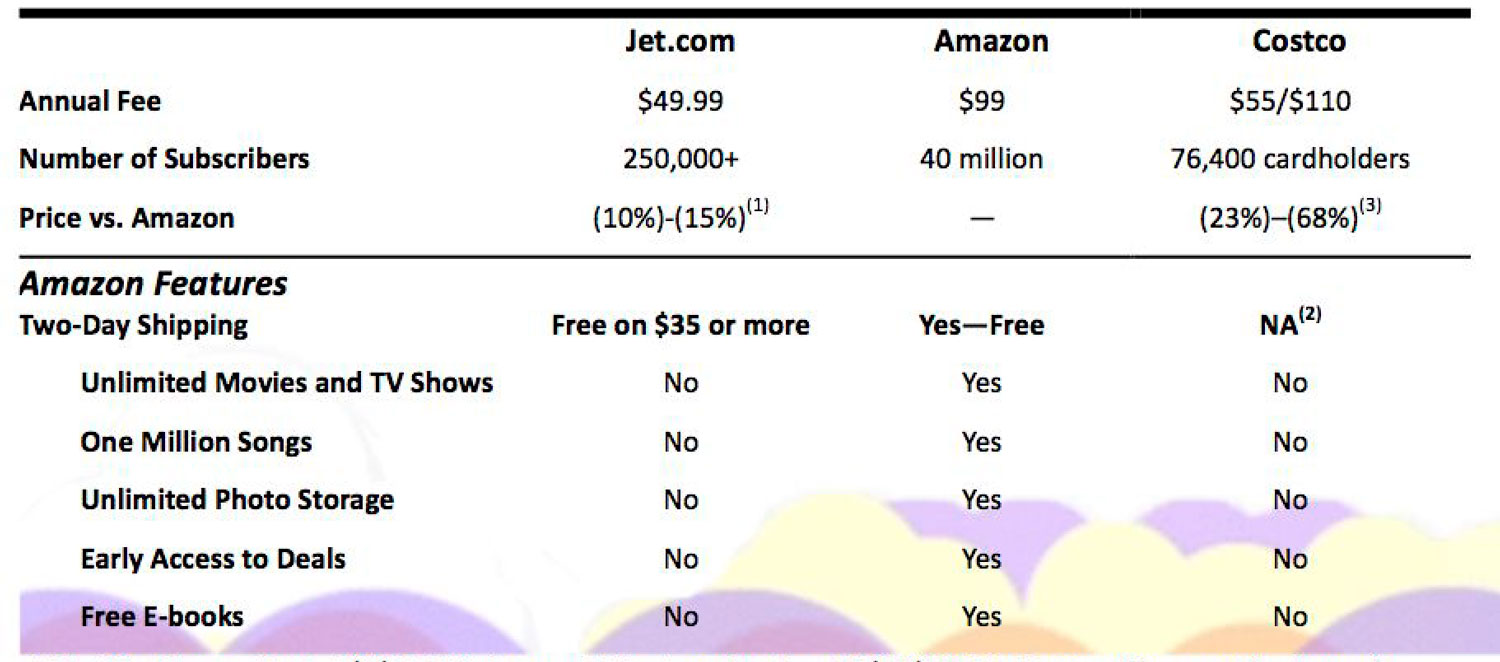

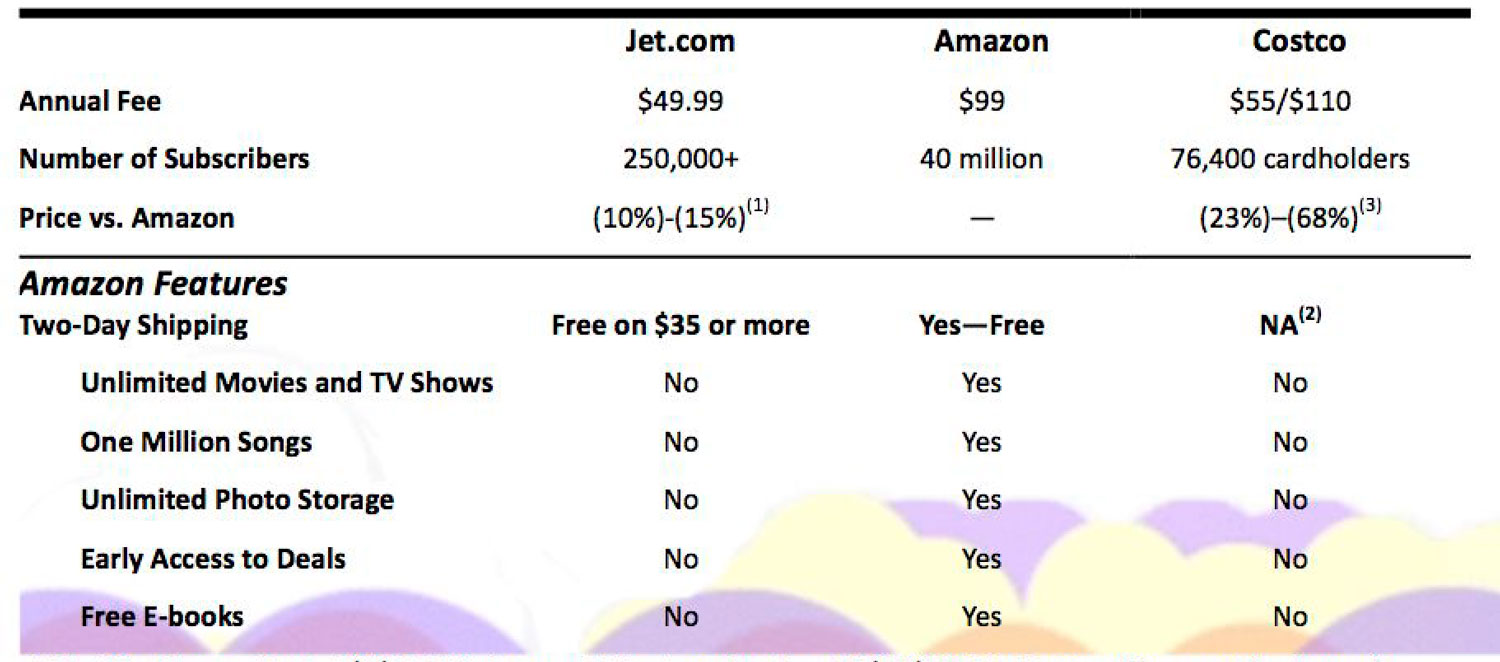

Comparisons with Amazon and Costco

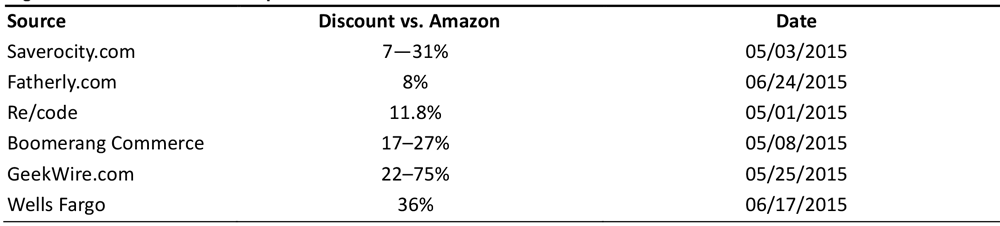

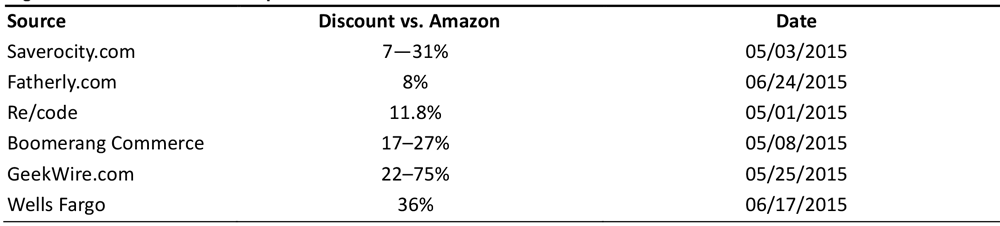

Amazon is Jet.com’s most-often mentioned competitor, and Jet.com’s website promises prices that are 10%–15% lower than Amazon’s. A Boomerang Commerce survey found that Jet.com’s household product prices were 39% cheaper than Amazon’s, that its appliance prices were 27% cheaper, and that its electronics and cellphone prices were 16% cheaper, for an average product

Selected Price Comparisons of Jet.com vs. Amazon.com

Source: Wall Street Journal, TheStreet.com, and respective websites

Costco offers two main memberships for individuals: a Gold Star Membership for $55 per year and a $110 per year Executive Membership that offers an annual reward equal to 2% of purchases. According to a recent article on

Investopedia, Costco charges membership fees for three reasons: they increase loyalty (being a member of a private club and shopping to get a return on the membership fee), they reduce shrinkage (i.e., shoplifting), and of course, provide a revenue stream for the retailer. (Costco received $2.4 billion in of its revenue from membership fees in 2014, which contributed more than 75% of its operating income.)

The table below outlines selected service offerings for, Jet, Amazon, and Costco.

1. The Washington Post, 5/1/2015 2. Jet.com 3. Business Insider, 12/17/2014 4. Costco offers next-business-day delivery of certain items for free for orders over $250 and standard delivery of pharmacy products Source: Business Insider, The Washington Post, and company websites

1. The Washington Post, 5/1/2015 2. Jet.com 3. Business Insider, 12/17/2014 4. Costco offers next-business-day delivery of certain items for free for orders over $250 and standard delivery of pharmacy products Source: Business Insider, The Washington Post, and company websites

How Does Jet.com Do It?

Jet.com is creating buzz about its upcoming launch by leveraging social media while providing the appearance of exclusivity and secrecy by awarding memberships only to the select few who are promoted from its waiting list. A recent

Inc. Magazine article distilled the strategy behind the company’s launch plan

- Go big

- Use gamification

- Make the website clean and simple

- Provide incentives to share on social media

- Be creative in giving inexpensive prizes

- Create mystery around the launch

Jet.com’s Strategy

A recent article in GeekWire.com distilled the secrets behind Jet.com’s seemingly large discounts:

- com only makes money from membership fees

- It constantly calculates the most efficient shipping methods to offer the lowest prices

- Customers can waive return privileges for even greater savings

Customers also receive bonus savings alerts on special deals.

Jet.com has hired engineers with experience creating financial-trading systems to develop its model for product and shipping pricing. The website dynamically recalculates the lowest price and shipping cost and method to the specified ZIP code after a shopper adds an item is added to his or her shopping cart, which it calls building a “Smart Cart.” This seems to be a key differentiator for the company, enabling it to offer extremely low prices.

Reviewers say that Jet.com’s selection is much narrower than Amazon’s, which could also contribute to the savings that Jet.com can offer. The GeekWire.com article further reported that Jet.com offered only 38 options for dishwasher detergent, as compared to Amazon’s 2,416 options. Still, Jet.com plans to offer 10 million items at launch.

Building a Buzz Before Its Public Launch

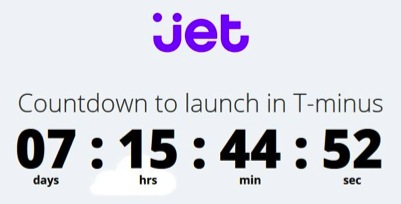

Jet.com is not currently offering subscriptions to the public, but the company has earmarked $100 million in marketing for its public launch. Nonmembers who visit the site see a home page featuring a clock that’s counting down to the public launch, scheduled for 6:00 a.m. EDT on July 21.

Visitors can enter their e-mail address to receive a free six-month membership after launch.

Yet there’s a way for social-media users to gain early access to the complete site. Visitors who “like” the company’s Facebook page can see limited-time, early-access promotions prior to the public launch.

Yet there’s a way for social-media users to gain early access to the complete site. Visitors who “like” the company’s Facebook page can see limited-time, early-access promotions prior to the public launch.

Promotions in July: A Boon for Consumers

Amazon scheduled its Prime Day of discounts on July 15, the day before the company’s 20th anniversary. Coincidentally, this date falls about a week prior to Jet’s public launch on July 21, so Prime Day could have possibly siphoned off some customers from Jet.com’s launch, as consumers are unlikely to choose to pay for two different e-commerce memberships. Other retailers, such as Walmart, offered deals to compete with Amazon Prime Day, and Best Buy and Target have been offering “Black Friday in July” sales for the past several years.

Conclusion

Jet.com appears to be taking a page out of Amazon’s playbook in the buildup to its public launch this July. The company is employing viral marketing, gamification and social media to generate buzz and create pent-up demand prior to its debut. Jet.com’s marketing strategy is not coincidental, since its founder previously spent two years at Amazon, honing his skill set. He’s adopted the best of Amazon’s practices that apply to Jet.com.

Amazon celebrated its 20

th anniversary with Prime Day, which coincidentally occurred a week ahead of Jet.com’s public launch. That event, however, seems to have disappointed consumers, which could lead many to consider switching to Jet.com. Other retailers are also offering onetime and recurring promotions,

leading to a July brimming with deals benefiting consumers and back-to-school shoppers—and potentially crowding out the

Jet.com message and its strong value proposition.

We believe

Jet.com‘s offer of a free six-month trial membership will appeal to many shoppers. However, the extent of Amazon’s merchandise assortment and services makes its Prime membership compelling as well. Amazon enjoys leading customer satisfaction scores, and benefits from having the first-mover advantage.

There’s a new e-commerce startup in town—by the name of Jet.com—that’s poised to give Amazon some competition by combining the membership approach of Costco, the broad retail category coverage of Amazon, and some innovative analytics for computing pricing and shipping. The Jet.com team is extremely familiar with Amazon’s competitive advantages as well as its weaknesses, since Jet.com‘s CEO Marc Lore worked at Amazon for a couple of years after it acquired his startup (Quidsi, the parent company of Diapers.com).

Jet.com is employing all the techniques that successful e-commerce companies use today: viral marketing, savvy use of social media and membership by invitation only so as to create scarcity and pent-up demand for access to membership. First and foremost, Jet.com plans to deliver what many consumers want most—lower prices. In a recent interview, Lore told The Washington Post, “Price is still king.” The company claims it can underprice Amazon and others by 10%–15%, and some analyses point to even greater savings.

The company is taking a page from Amazon’s playbook by going for scale at the expense of profits. The company plans to generate profits solely from membership fees and therefore offer goods and shipping services at rates very close to cost. By optimizing product selection and shipping methods, Jet.com can reduce prices even further.

Amazon, as one would expect, is not taking the competitive threat lying down. To celebrate its 20th birthday on July 15, the company launched Amazon Prime Day—which it boasted would surpass Black Friday in terms of the quality and quantity of deals offered. Prime Day was scheduled about a week before Jet.com’s public launch (July 21), and Amazon’s deals threatened to steal customers and attention from Jet.com, since consumers are unlikely to pay for two e-commerce memberships at the same time.

Unfortunately for Amazon, though, many consumers were underwhelmed by its sale offerings on Prime Day, and they vented their complaints on social media. In fact, many subscribers were so disappointed by Amazon’s offerings that they threatened to cancel their Amazon Prime memberships altogether. The figures tell a different story, though, and Amazon said that orders were 18% higher than on Black Friday 2014 and that the company had signed up hundreds of thousands of new members.

The occasion also encouraged several other large retailers to jump on the midsummer sale bandwagon, offering onetime and regular promotions of their own in order to compete with Amazon. That made mid-July sweet for consumers and possibly provided a much-needed boost to the back-to-school shopping season.

There’s a new e-commerce startup in town—by the name of Jet.com—that’s poised to give Amazon some competition by combining the membership approach of Costco, the broad retail category coverage of Amazon, and some innovative analytics for computing pricing and shipping. The Jet.com team is extremely familiar with Amazon’s competitive advantages as well as its weaknesses, since Jet.com‘s CEO Marc Lore worked at Amazon for a couple of years after it acquired his startup (Quidsi, the parent company of Diapers.com).

Jet.com is employing all the techniques that successful e-commerce companies use today: viral marketing, savvy use of social media and membership by invitation only so as to create scarcity and pent-up demand for access to membership. First and foremost, Jet.com plans to deliver what many consumers want most—lower prices. In a recent interview, Lore told The Washington Post, “Price is still king.” The company claims it can underprice Amazon and others by 10%–15%, and some analyses point to even greater savings.

The company is taking a page from Amazon’s playbook by going for scale at the expense of profits. The company plans to generate profits solely from membership fees and therefore offer goods and shipping services at rates very close to cost. By optimizing product selection and shipping methods, Jet.com can reduce prices even further.

Amazon, as one would expect, is not taking the competitive threat lying down. To celebrate its 20th birthday on July 15, the company launched Amazon Prime Day—which it boasted would surpass Black Friday in terms of the quality and quantity of deals offered. Prime Day was scheduled about a week before Jet.com’s public launch (July 21), and Amazon’s deals threatened to steal customers and attention from Jet.com, since consumers are unlikely to pay for two e-commerce memberships at the same time.

Unfortunately for Amazon, though, many consumers were underwhelmed by its sale offerings on Prime Day, and they vented their complaints on social media. In fact, many subscribers were so disappointed by Amazon’s offerings that they threatened to cancel their Amazon Prime memberships altogether. The figures tell a different story, though, and Amazon said that orders were 18% higher than on Black Friday 2014 and that the company had signed up hundreds of thousands of new members.

The occasion also encouraged several other large retailers to jump on the midsummer sale bandwagon, offering onetime and regular promotions of their own in order to compete with Amazon. That made mid-July sweet for consumers and possibly provided a much-needed boost to the back-to-school shopping season.

1. The Washington Post, 5/1/2015 2. Jet.com 3. Business Insider, 12/17/2014 4. Costco offers next-business-day delivery of certain items for free for orders over $250 and standard delivery of pharmacy products Source: Business Insider, The Washington Post, and company websites

1. The Washington Post, 5/1/2015 2. Jet.com 3. Business Insider, 12/17/2014 4. Costco offers next-business-day delivery of certain items for free for orders over $250 and standard delivery of pharmacy products Source: Business Insider, The Washington Post, and company websites Jet.com is not currently offering subscriptions to the public, but the company has earmarked $100 million in marketing for its public launch. Nonmembers who visit the site see a home page featuring a clock that’s counting down to the public launch, scheduled for 6:00 a.m. EDT on July 21.

Visitors can enter their e-mail address to receive a free six-month membership after launch.

Jet.com is not currently offering subscriptions to the public, but the company has earmarked $100 million in marketing for its public launch. Nonmembers who visit the site see a home page featuring a clock that’s counting down to the public launch, scheduled for 6:00 a.m. EDT on July 21.

Visitors can enter their e-mail address to receive a free six-month membership after launch.

Yet there’s a way for social-media users to gain early access to the complete site. Visitors who “like” the company’s Facebook page can see limited-time, early-access promotions prior to the public launch.

Yet there’s a way for social-media users to gain early access to the complete site. Visitors who “like” the company’s Facebook page can see limited-time, early-access promotions prior to the public launch.

Yet there’s a way for social-media users to gain early access to the complete site. Visitors who “like” the company’s Facebook page can see limited-time, early-access promotions prior to the public launch.

Yet there’s a way for social-media users to gain early access to the complete site. Visitors who “like” the company’s Facebook page can see limited-time, early-access promotions prior to the public launch.

Amazon scheduled its Prime Day of discounts on July 15, the day before the company’s 20th anniversary. Coincidentally, this date falls about a week prior to Jet’s public launch on July 21, so Prime Day could have possibly siphoned off some customers from Jet.com’s launch, as consumers are unlikely to choose to pay for two different e-commerce memberships. Other retailers, such as Walmart, offered deals to compete with Amazon Prime Day, and Best Buy and Target have been offering “Black Friday in July” sales for the past several years.

Amazon scheduled its Prime Day of discounts on July 15, the day before the company’s 20th anniversary. Coincidentally, this date falls about a week prior to Jet’s public launch on July 21, so Prime Day could have possibly siphoned off some customers from Jet.com’s launch, as consumers are unlikely to choose to pay for two different e-commerce memberships. Other retailers, such as Walmart, offered deals to compete with Amazon Prime Day, and Best Buy and Target have been offering “Black Friday in July” sales for the past several years.

Jet.com appears to be taking a page out of Amazon’s playbook in the buildup to its public launch this July. The company is employing viral marketing, gamification and social media to generate buzz and create pent-up demand prior to its debut. Jet.com’s marketing strategy is not coincidental, since its founder previously spent two years at Amazon, honing his skill set. He’s adopted the best of Amazon’s practices that apply to Jet.com.

Amazon celebrated its 20th anniversary with Prime Day, which coincidentally occurred a week ahead of Jet.com’s public launch. That event, however, seems to have disappointed consumers, which could lead many to consider switching to Jet.com. Other retailers are also offering onetime and recurring promotions,

leading to a July brimming with deals benefiting consumers and back-to-school shoppers—and potentially crowding out the Jet.com message and its strong value proposition.

We believe Jet.com‘s offer of a free six-month trial membership will appeal to many shoppers. However, the extent of Amazon’s merchandise assortment and services makes its Prime membership compelling as well. Amazon enjoys leading customer satisfaction scores, and benefits from having the first-mover advantage.

Jet.com appears to be taking a page out of Amazon’s playbook in the buildup to its public launch this July. The company is employing viral marketing, gamification and social media to generate buzz and create pent-up demand prior to its debut. Jet.com’s marketing strategy is not coincidental, since its founder previously spent two years at Amazon, honing his skill set. He’s adopted the best of Amazon’s practices that apply to Jet.com.

Amazon celebrated its 20th anniversary with Prime Day, which coincidentally occurred a week ahead of Jet.com’s public launch. That event, however, seems to have disappointed consumers, which could lead many to consider switching to Jet.com. Other retailers are also offering onetime and recurring promotions,

leading to a July brimming with deals benefiting consumers and back-to-school shoppers—and potentially crowding out the Jet.com message and its strong value proposition.

We believe Jet.com‘s offer of a free six-month trial membership will appeal to many shoppers. However, the extent of Amazon’s merchandise assortment and services makes its Prime membership compelling as well. Amazon enjoys leading customer satisfaction scores, and benefits from having the first-mover advantage.