Nitheesh NH

JD.com

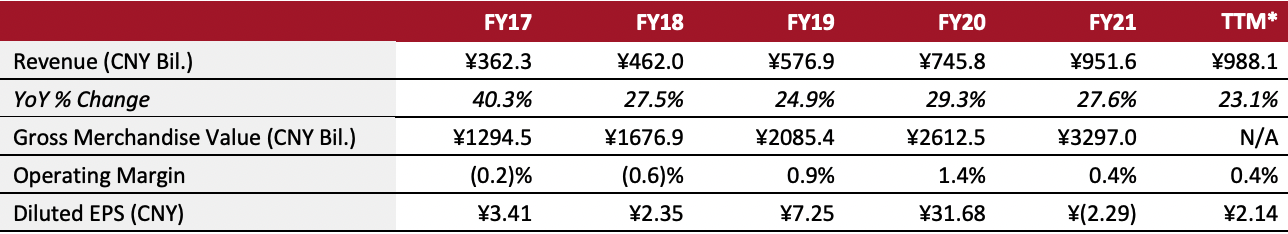

Sector: E-commerce Countries of operation: China, Indonesia, Russia and Thailand Key product categories: Beauty, electronics, fashion and home products Annual Metrics [caption id="attachment_152873" align="aligncenter" width="700"] Fiscal year ends on December 31

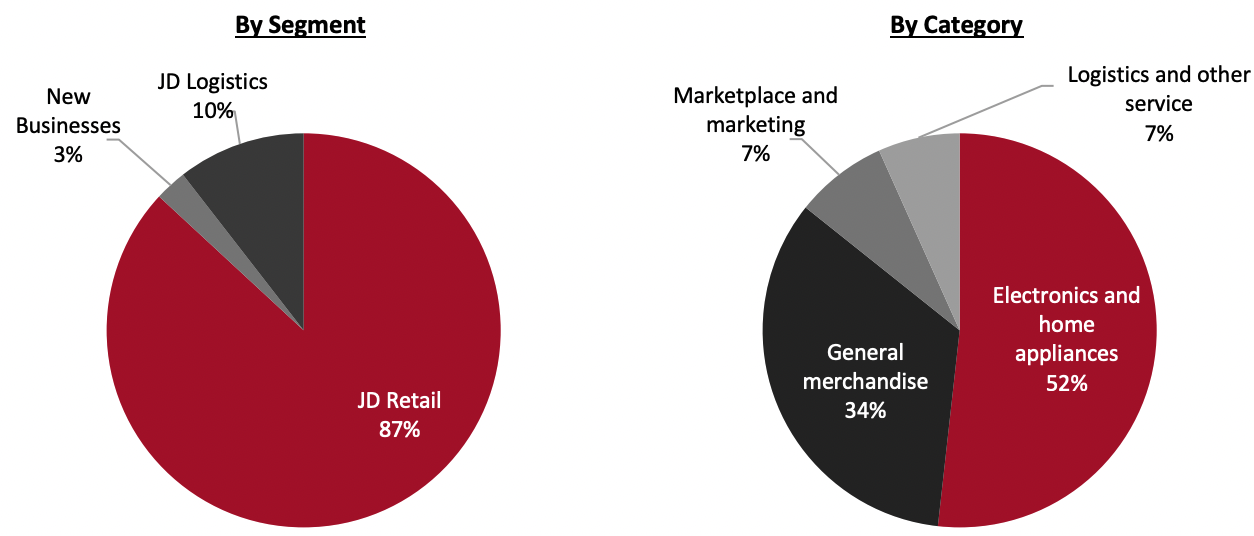

Fiscal year ends on December 31* Trailing twelve months ended March 31, 2022[/caption] Summary Founded in 1998 and headquartered in Beijing, JD.com is an e-commerce company and supply chain-based technology and service provider. The company operates in China in three segments: JD Retail, JD Logistics and New Businesses. Known primarily for being an electronics and home appliance retailer, JD.com sells a range of other products through its website and mobile apps, including apparel, fresh food and home furnishings. It also offers an online marketplace for third-party sellers. In addition, the company provides consumer financing and customer services, logistics for various industries, online marketing and supply chain financing for merchants. As of March 31, 2022, JD.com operates more than 1,400 warehouses in China, with an aggregate gross floor area of about 25 million square meters. The company has strategic cooperation agreements with Shopify, Google, Tencent and Walmart. Company Analysis Coresight Research insight: Compared to its rival Alibaba, JD.com has adopted an asset-heavy model that has self-owned inventory and a self-operated fulfilment network, making it a reputable site for authentic products and ultra-fast delivery. JD.com is China’s largest retailer by revenue, which gives it bargaining power with suppliers. Its partnership with Tencent also enables it to access the massive user base of Tencent’s social platforms, including WeChat. Like other e-commerce platforms, JD.com has been making efforts to penetrate China’s lower-tier cities. Given the competitive e-commerce landscape in China, JD.com faces stiff competition from Alibaba, Pinduoduo and other social commerce platforms. This may push JD.com to invest more aggressively to capture market share, which could weigh on near-term profitability. In fiscal 2021, JD.com incurred a net loss of ¥4.5 billion, compared to net incomes of ¥11.9 billion and ¥49.3 billion in 2019 and 2020 respectively. JD.com’s annual active customer increased by 21% to reach 569.7 million in 2021 from 471.9 million 2020. As such, the company has emphasized the importance of improving its user experience and user engagement going forward. The company witnessed gross merchandise revenue accelerate to 29.0% year-on-year and 32% two-year in the third quarter of 2022.

| Tailwinds | Headwinds |

|

|

- Widen product selection and improve personalization and other features on JD.com.

- Increase direct purchases from manufacturers to provide high-quality products.

- Extend online and offline presence and develop innovative retail channels to meet evolving consumer needs.

- Use technology to combine online and offline retail to improve user experience.

- Expand further in lower-tier cities to serve consumers there with tailor-made quality products and upgraded services.

- Strengthen key technological initiatives, including artificial intelligence, big data and cloud computing.

- Continue to invest in a holistic, smart supply chain platform and fulfilment infrastructure to improve operational efficiency.

- Look to expand the overseas customer base through organic growth, strategic collaboration, acquisitions and investments.

- Open up its infrastructure to more business partners and develop more innovative solutions.

Company Developments

Company Developments

| Date | Development |

| May 4, 2022 | SEC announces that JD.com and other Chinese companies face delisting in the US if they do not allow US regulators auditing access. |

| April 7, 2022 | Lei Xu, President of JD.com, is appointed CEO, succeeding Richard Liu, effective immediately. |

| January 18, 2022 | JD.com and Shopify Ink announce a strategic partnership to simplify cross-border e-commerce transactions. |

| November 12, 2021 | JD.com Singles’ Day achieves record high sales record of ¥349.1 billion. |

| October 22, 2021 | JD’s technology arm, JD Technology, announces that the company will offer free non-fungible token (NFT) badges to users registered for the company’s annual tech summit JD Discovery (JDD), to be held on November 22. |

| September 15, 2021 | JD inaugurates its first overseas E-Space store, JD.ID Electronic Store, in Indonesia. |

| September 2, 2021 | JD and Lagardère Travel Retail announce a partnership starting on September 2, which includes a minority equity investment from JD.com into the global leading travel retailer. |

| July 31, 2021 | JD announces a strategic investment in Li & Fung, a Hong Kong-based giant in global supply chain solutions. |

| July 9, 2021 | JD’s shares rise over 6%, bringing JD’s market cap to over US $100 billion for the first time. |

| May 28, 2021 | JD announces a strategic investment in Gome Retail, one of China’s largest electronics chains, and buys $100 million of convertible bonds in the company. |

| March 22, 2021 | JD and Seagate reassures their partnership in a signing ceremony on March 19 to create more C2M storage products and deliver them to customers through the omnichannel model. |

| March 10, 2021 | JD Property, JD.com’s infrastructure asset management and integrated property services subsidiary, receives $700 million in a Series A financing round. |

| February 16, 2021 | JD Logistics, JD.com’s logistics unit, files its initial public offering prospectus with the Hong Kong Stock Exchange. |

| December 16, 2020 | JD.com’s self-developed logistics drone JDX-500, China’s first autogyro (also known as a gyroplane or gyrocopter) logistics drone that can carry weight of up to a few hundred kilograms with airdrop capabilities, takes off from Fengming Airport in Sichuan province. |

| December 16, 2020 | JD.com sets up a joint venture with supermarket chain Better Life Commercial Chain Share to expand its 7Fresh banner in the southern Hunan province. |

| December 13, 2020 | JD.com invests $700 million in preferred shares of online group-buying platform Xinsheng Youxuan. |

| December 9, 2020 | JD.com signs a cooperation agreement to deepen its supply chain partnership with October Rice Field, a Chinese agriculture brand, providing enterprise clients with tailored and diverse procurement services. |

| December 7, 2020 | JD.com becomes the first online platform to accept digital RMB as payment for some products. |

| November 26, 2020 | JD.com launches a smart open platform that helps optimize costs, efficiency and experience across its supply chain. |

| November 12, 2020 | JD.com records $40.9 billion in GMV during its 11-day Singles’ Day promotion, representing a 34.6% year-over-year increase. |

| November 8, 2020 | JD.com and Diageo, the world’s largest international spirits producer, reach an agreement to partner on promoting responsible drinking and moderate consumption of alcohol in the Chinese market. |

| October 30, 2020 | JD Cloud & AI cooperate with BiNEi, a leading Internet of Vehicle (IoV) solution provider, to build a IoV research lab in Wuhan, China. |

| October 20, 2020 | JD.com adds two Asia No.1 fulfillment centers in Changchun, the capital of Jilin province, and Hohhot, the capital of Inner Mongolia. |

| October 12, 2020 | JD Health and Japanese electronics manufacturer Omron reach an agreement to co-create intelligent health management solutions for chronic diseases. |

| September 28, 2020 | JD.com partners with Xpeng Motors, a Chinese electric vehicle startup, to install charging piles. |

- Lei Xu—CEO and Executive Director

- Qiangdong Liu – Founder and Chairman

- Ran Xu—CFO

- Lijun Xin—CEO, JD Retail

- Yui Yu—CEO, JD Logistics

- Shengqiang Chen—CEO, JD Finance

- Chengfeng He—Chief Compliance Officer

Source: Company reports/S&P Capital IQ