Nitheesh NH

[caption id="attachment_94645" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

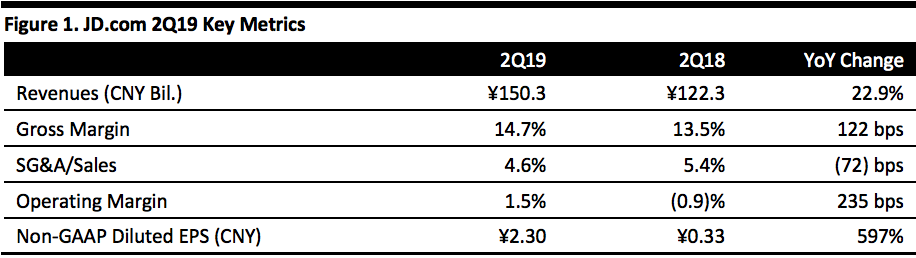

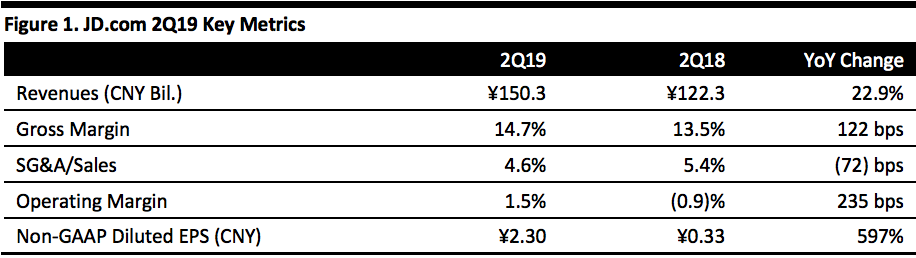

JD.com reported 2Q19 revenue of ¥150.3 billion ($21.9 billion), up 22.9% year over year and beating the consensus estimate of ¥147.4 billion. Growth was helped by the 6.18 midyear shopping festival, with double-digit growth in electronics and home appliances and 34% growth in general merchandise Service revenue, which increased 42% year over year, contributed 11.2% of company sales.

Operating income reached a record high of ¥2.3 billion ($330.2 million), compared to a loss of ¥1.0 billion in 2Q18, equating to operating-margin expansion of 235 basis points to 1.5%. The profit improvement reflected a higher margin in both JD Retail (up 76 basis points) and JD Logistics (which reached breakeven point), thanks to economies of scale, better capacity utilization and higher staff productivity.

Non-GAAP diluted EPS increased 597% to ¥2.30 (equivalent to $0.33), but came in below the consensus estimate of $0.46.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

JD.com reported 2Q19 revenue of ¥150.3 billion ($21.9 billion), up 22.9% year over year and beating the consensus estimate of ¥147.4 billion. Growth was helped by the 6.18 midyear shopping festival, with double-digit growth in electronics and home appliances and 34% growth in general merchandise Service revenue, which increased 42% year over year, contributed 11.2% of company sales.

Operating income reached a record high of ¥2.3 billion ($330.2 million), compared to a loss of ¥1.0 billion in 2Q18, equating to operating-margin expansion of 235 basis points to 1.5%. The profit improvement reflected a higher margin in both JD Retail (up 76 basis points) and JD Logistics (which reached breakeven point), thanks to economies of scale, better capacity utilization and higher staff productivity.

Non-GAAP diluted EPS increased 597% to ¥2.30 (equivalent to $0.33), but came in below the consensus estimate of $0.46.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

JD.com reported 2Q19 revenue of ¥150.3 billion ($21.9 billion), up 22.9% year over year and beating the consensus estimate of ¥147.4 billion. Growth was helped by the 6.18 midyear shopping festival, with double-digit growth in electronics and home appliances and 34% growth in general merchandise Service revenue, which increased 42% year over year, contributed 11.2% of company sales.

Operating income reached a record high of ¥2.3 billion ($330.2 million), compared to a loss of ¥1.0 billion in 2Q18, equating to operating-margin expansion of 235 basis points to 1.5%. The profit improvement reflected a higher margin in both JD Retail (up 76 basis points) and JD Logistics (which reached breakeven point), thanks to economies of scale, better capacity utilization and higher staff productivity.

Non-GAAP diluted EPS increased 597% to ¥2.30 (equivalent to $0.33), but came in below the consensus estimate of $0.46.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

JD.com reported 2Q19 revenue of ¥150.3 billion ($21.9 billion), up 22.9% year over year and beating the consensus estimate of ¥147.4 billion. Growth was helped by the 6.18 midyear shopping festival, with double-digit growth in electronics and home appliances and 34% growth in general merchandise Service revenue, which increased 42% year over year, contributed 11.2% of company sales.

Operating income reached a record high of ¥2.3 billion ($330.2 million), compared to a loss of ¥1.0 billion in 2Q18, equating to operating-margin expansion of 235 basis points to 1.5%. The profit improvement reflected a higher margin in both JD Retail (up 76 basis points) and JD Logistics (which reached breakeven point), thanks to economies of scale, better capacity utilization and higher staff productivity.

Non-GAAP diluted EPS increased 597% to ¥2.30 (equivalent to $0.33), but came in below the consensus estimate of $0.46.

- Annual active customers increased 3.5% to 321.3 million in the 12 months ended June 30, 2019.

- Total merchants on its marketplace were over 220,000 as of June 30, 2019, compared to over 170,000 as of June 30, 2018.

- Italian luxury fashion house Prada Group, French apparel brands Sandro and Maje, British fashion brand Mulberry and Italian high-end footwear brand Giuseppe Zanotti launched flagship stores on JD.com.

- TCL (China’s leading appliance manufacturer) entered into a partnership with JD.com for the launch of three customized smart appliances in the Chinese consumer market. JD also helped Nestlé optimize flavors of two of its products to meet customer needs.

- JD PLUS, JD.com’s premium membership program, announced a cooperation with 19 hotel brands including InterContinental Hotels and Resorts, The Ascott, AccorHotels, and Wanda Hotels and Resorts to provide its members with exclusive benefits at over 15,000 hotels worldwide.

- As of June 30, 2019, JD.com’s joint venture Dada-JD Daojia had established partnerships with over 300 chain retailers. Dada-JD Daojia teamed up with over 30 cosmetics brands and home retailers including Watsons, Mannings, Miniso and Nature Republic to launch a dedicated channel on its platform.

- com operated approximately 600 warehouses with a total gross floor area of over 15 million square meters in China as of June 30, 2019.

- JD Logistics started offering a new cold chain transport service in April, forming a one-stop factory-to-business-to-consumer cold chain delivery system. American food brand Dairy Queen recently adopted JD’s direct sales platform for the global debut of its ice cream tubs.