DIpil Das

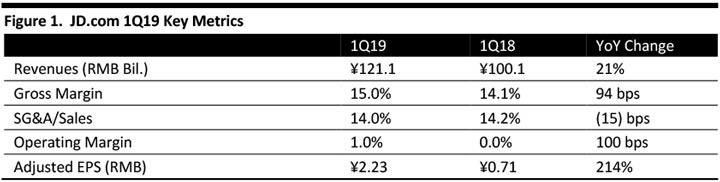

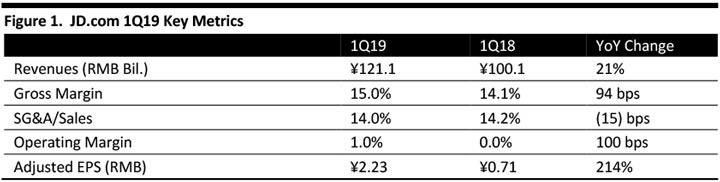

[caption id="attachment_87582" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

JD.com reported revenue of ¥121.1 billion ($18.0 billion) for the first quarter, ended March 31, 2019, up 21% year over year and ahead of the consensus estimate of ¥120.2 billion. Revenue growth in 1Q19 was the slowest on record according to Reuters. The company’s product and service revenues increased 19% and 44%, year over year, respectively.

Operating income for the quarter increased to ¥1.2 billion ($200 million) from ¥4.4 million for the same period last year, equating to an operating margin of about 1.0%, driven by the improvement of margin from JD Retail and the recovery in JD Logistics, thanks to economies of scale, better capacity utilization and technology innovation. The operating margin of the company’s core business JD Retail, formerly JD Mall, increased 0.6 percentage points year over year to 2.7% in 1Q.

Non-GAAP diluted EPS increased 214% year over year to ¥2.23, beating the consensus estimate of ¥0.83.

The company’s key performance indicators (KPIs) are as follows:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

JD.com reported revenue of ¥121.1 billion ($18.0 billion) for the first quarter, ended March 31, 2019, up 21% year over year and ahead of the consensus estimate of ¥120.2 billion. Revenue growth in 1Q19 was the slowest on record according to Reuters. The company’s product and service revenues increased 19% and 44%, year over year, respectively.

Operating income for the quarter increased to ¥1.2 billion ($200 million) from ¥4.4 million for the same period last year, equating to an operating margin of about 1.0%, driven by the improvement of margin from JD Retail and the recovery in JD Logistics, thanks to economies of scale, better capacity utilization and technology innovation. The operating margin of the company’s core business JD Retail, formerly JD Mall, increased 0.6 percentage points year over year to 2.7% in 1Q.

Non-GAAP diluted EPS increased 214% year over year to ¥2.23, beating the consensus estimate of ¥0.83.

The company’s key performance indicators (KPIs) are as follows:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

JD.com reported revenue of ¥121.1 billion ($18.0 billion) for the first quarter, ended March 31, 2019, up 21% year over year and ahead of the consensus estimate of ¥120.2 billion. Revenue growth in 1Q19 was the slowest on record according to Reuters. The company’s product and service revenues increased 19% and 44%, year over year, respectively.

Operating income for the quarter increased to ¥1.2 billion ($200 million) from ¥4.4 million for the same period last year, equating to an operating margin of about 1.0%, driven by the improvement of margin from JD Retail and the recovery in JD Logistics, thanks to economies of scale, better capacity utilization and technology innovation. The operating margin of the company’s core business JD Retail, formerly JD Mall, increased 0.6 percentage points year over year to 2.7% in 1Q.

Non-GAAP diluted EPS increased 214% year over year to ¥2.23, beating the consensus estimate of ¥0.83.

The company’s key performance indicators (KPIs) are as follows:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

JD.com reported revenue of ¥121.1 billion ($18.0 billion) for the first quarter, ended March 31, 2019, up 21% year over year and ahead of the consensus estimate of ¥120.2 billion. Revenue growth in 1Q19 was the slowest on record according to Reuters. The company’s product and service revenues increased 19% and 44%, year over year, respectively.

Operating income for the quarter increased to ¥1.2 billion ($200 million) from ¥4.4 million for the same period last year, equating to an operating margin of about 1.0%, driven by the improvement of margin from JD Retail and the recovery in JD Logistics, thanks to economies of scale, better capacity utilization and technology innovation. The operating margin of the company’s core business JD Retail, formerly JD Mall, increased 0.6 percentage points year over year to 2.7% in 1Q.

Non-GAAP diluted EPS increased 214% year over year to ¥2.23, beating the consensus estimate of ¥0.83.

The company’s key performance indicators (KPIs) are as follows:

- Annual active customers increased 2.9% year over year to 310.5 million in the 12 months ended March 31, 2019.

- Total merchants on its marketplace were over 220,000 as of March 31, 2019, compared to approximately 170,000 as of April 30, 2018.

- Swiss luxury watch brands Tissot, ORIS and TITONI, New Zealand food brands Zespri and Rockit, and Italian fashion house MOSCHINO launched flagship stores on JD.com.

- In the first quarter, AEG (a German manufacturer of design-focused premium home appliances) entered into an agreement with JD.com, for the launch of certain high-tech products exclusively on JD.

- In March, the company signed a strategic cooperation agreement with Michelin China, becoming the first direct-supply e-commerce platform for the French tire manufacturer in China.

- JD Logistics became the exclusive logistics service provider for China CITIC Bank in January. JD’s parcel delivery service had expanded services to fifty major cities across China as of March 31, since its official launch in October 2018.

- By the end of April, Dada-JD Daojia, JD.com’s joint venture with Walmart, had established partnerships with more than 270 Walmart stores, 700 Yonghui stores, 180 Carrefour and 1,000 China Resource (CR) Vanguard stores, among others, to provide delivery services through its crowd-sourcing delivery network.

- JD.com operated more than 550 warehouses with a total gross floor area of around 12 million square meters in China as of March 31, 2019.