Source: Company reports/Fung Global Retail & Technology

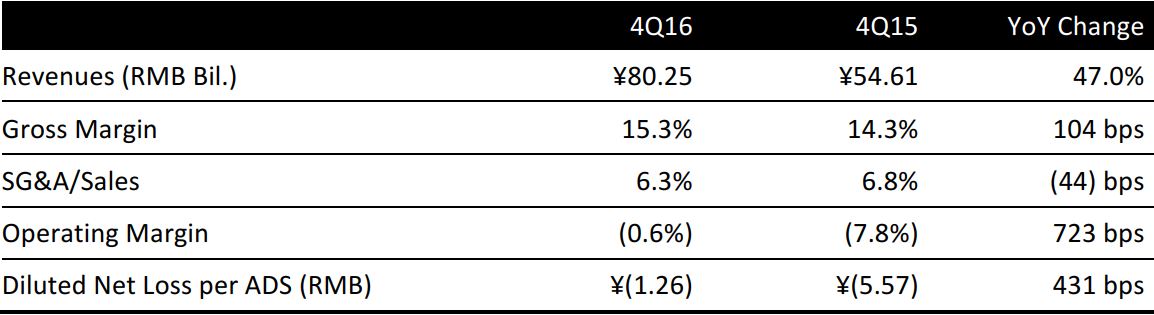

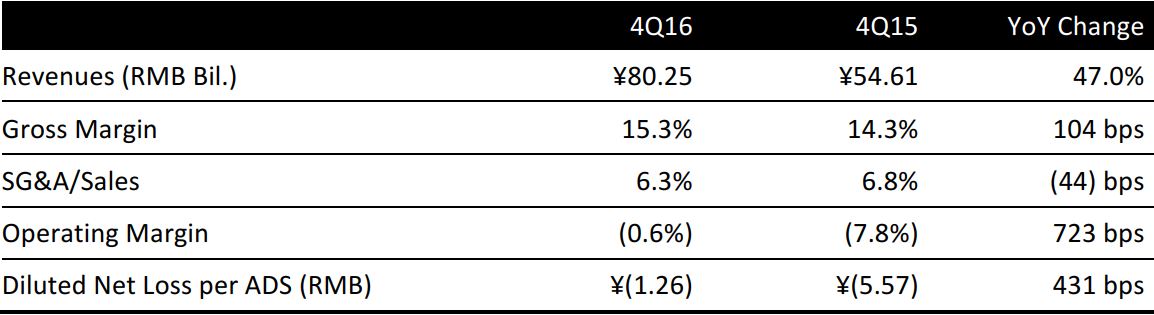

4Q16 Results Summary

JD.com reported 4Q16 revenues of ¥80.25 billion (US$11.6 billion), a 47.0% year-over-year increase, driven largely by strong GMV growth. Net loss per ADS was ¥1.26, compared to ¥5.57 for 4Q15. Non-GAAP diluted net income per ADS was ¥0.40, compared to non-GAAP net loss per ADS of ¥0.48 in 4Q15.

Business Performance

JD.com’s 4Q16 revenue grew 47.0% year over year, in tandem with total GMV growth of 50.5% over the same period.

- Online direct sales business: GMV from the online direct sales business was ¥7 billion in 4Q16, up 46% from 4Q15.

- Online marketplace business: GMV from the online marketplace business excluding virtual items totaled ¥4 billion in 4Q16, an increase of 57% from 4Q15.

- Electronics and home appliance products: GMV from electronics and home appliance products was ¥9 billion in 4Q16, an increase of 42% from 4Q15.

- General merchandise: GMV from general merchandise and others excluding virtual items was ¥3 billion in 4Q16, an increase of 59% from 4Q15. General merchandise accounted for 52% of total GMV excluding virtual items, up from 49% in 4Q15.

- Annual active customer accounts increased by 46% year over year to 226.6 million in the 12 months ended December 31, 2016.

- Fulfilled orders excluding virtual items was 505.7 million in 4Q16, representing a 43% increase from 353.1 million orders in 4Q15. Fulfilled orders placed through mobile comprised approximately 80% of total orders fulfilled.

Disposal of JD Finance

JD.com will dispose of its entire 68.6% equity stake in JD Finance, and will no longer hold legal ownership or effective control of JD Finance. JD.com will receive approximately ¥14.3 billion in cash and profit-sharing rights for 40% of the future pretax profit of JD Finance once JD Finance records a positive pretax income on a cumulative basis. The profit-sharing rights will be convertible into 40% of JD Finance’s equity interest, subject to applicable regulatory approvals.

Guidance

Management guided for net revenues of ¥72.3–¥74.3 billion for 1Q17, representing a growth rate of 34%–38% compared with 1Q16. The consensus estimate for FY17 revenue is ¥342.9 billion, implying an increase of 31.8% year over year.