Source: Company reports/FGRT

3Q17 Results

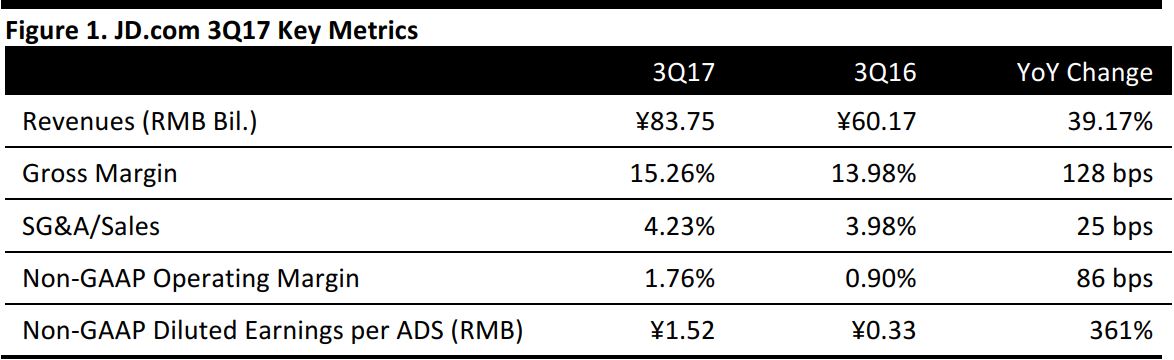

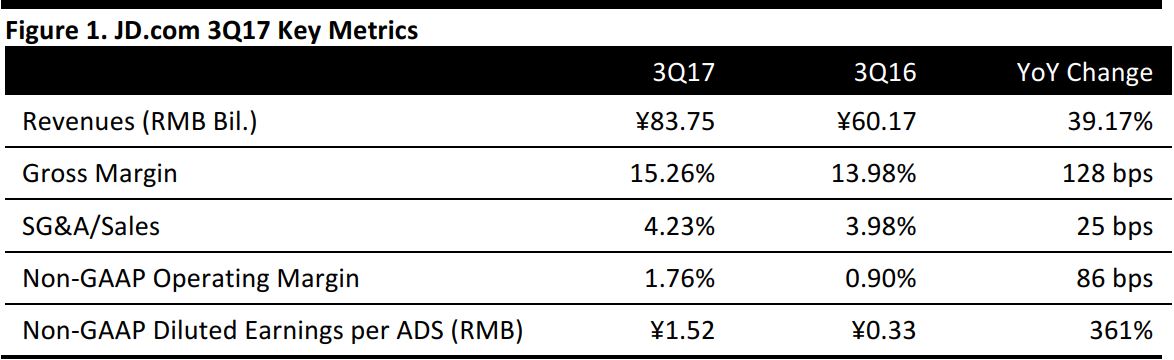

JD.com reported 3Q17 revenues of ¥83.7 billion, up 39.2% year over year and in line with the consensus estimate. Direct sales revenues reached ¥76.5 billion, up 39% year over year, driven by home appliances and fast-moving consumer goods (FMCG). Services and others revenues reached ¥7.3 billion, up 46% year over year, thanks to improved brand engagement and better monetization of the platform.

JD reported 3Q17 non-GAAP gross margin of 15.3%, up from 13.4% in 2Q17 and 14.0% in 3Q16. 3Q17 non-GAAP operating margin was 1.8%, up from 0.6% in 2Q17 and 0.9% in 3Q16. Margin improvement in 3Q17 was mainly driven by economies of scale from a consistent procurement strategy, enhanced user engagement and branding engagement through better advertising of products.

Non-GAAP diluted earnings per ADS was ¥1.52, growing by 361% year over year, beating the consensus of ¥0.59. Management highlighted that any excess return beyond expectations would be reinvested back into the business, half of which would be in different technologies.

Key Takeaways from the Conference Call

- GMV: Gross merchandise volume for 3Q17 grew 32%, compared to an increase of 46% in 2Q17. The slowdown in year-over-year growth was mainly attributed to two factors: 1) the full-year effect of integrating the Yihaodian platform, without which the GMV growth rate would have been in the mid-30s; and 2) the impact from the withdrawal of more than 100 apparel and general merchandise merchants from JD.com’s platform. According to management, the move was mainly due to the coercive tactics of the competition.

- The impact of the withdrawal of many apparel brands: Management mentioned that although 4Q17 saw stagnant growth in the apparel category, which could last for another two to three quarters, the company is still confident that growth will resume again. Management believes that as long as JD.com’s core values of being a reliable shopping platform for consumers and having sustainable partnerships with merchants are unchanged, it should see a recovery in the apparel category.

- Tencent partnership: Management mentioned that JD.com’s agreement with Tencent will not expire until 2019 and it is confident in Tencent’s support. With the extension of their partnership to include offline retail, management believes that going forward, possibly half of all products will be available in the same cities as the merchants and retailers and that a same-city delivery network will be critical.

- Logistics technology development: Management mentioned three ways it can improve its logistics network: 1) increase the number of orders to enhance order volumes and hence improve efficiency; 2) expand the business to serve third-party merchants and partners; and 3) constantly innovate its logistics capabilities.

Outlook

For 4Q17, JD.com expects revenues to be ¥107.0–¥110.0 billion, up 35%–39% year over year. Net margin guidance for full-year 2017 was maintained at 0.5%–1.5%. The success of the November 11 shopping promotions and possibly another promotion in December should help boost GMV in 4Q17.